Saudi Arabia Workwear Market Size, Share, Trends and Forecast by Product, Application, Distribution Channel, End User and Region, 2026-2034

Saudi Arabia Workwear Market Summary:

The Saudi Arabia workwear market size was valued at USD 0.19 Billion in 2025 and is projected to reach USD 0.29 Billion by 2034, growing at a compound annual growth rate of 5.14% from 2026-2034.

The market is experiencing robust growth driven by the expansion of industrial sectors including oil and gas, construction, and chemicals, coupled with strengthened workplace safety regulations and government initiatives under Vision 2030. Large-scale infrastructure projects, such as NEOM and the Red Sea Development are generating substantial demand for specialized protective workwear that can withstand extreme environmental conditions and comply with international safety standards, thereby expanding the Saudi Arabia workwear market share.

Key Takeaways and Insights:

-

By Product: Apparel dominates the market with a share of 63% in 2025, driven by comprehensive protective clothing requirements across industrial sectors including chemical-resistant coveralls, flame-retardant garments, and high-visibility safety apparel.

-

By Application: Chemical leads the market with a share of 28% in 2025, fueled by the Kingdom's position as a global petrochemical producer with extensive operations in basic and specialty chemicals manufacturing.

-

By Distribution Channel: E-commerce represents the largest segment with a market share of 35% in 2025, reflecting the rapid digital transformation and widespread adoption of online procurement platforms for industrial supplies.

-

By End User: Men lead the market with a share of 74% in 2025, corresponding to the male-dominated workforce across Saudi Arabia's primary industries including construction, oil and gas, and heavy manufacturing.

-

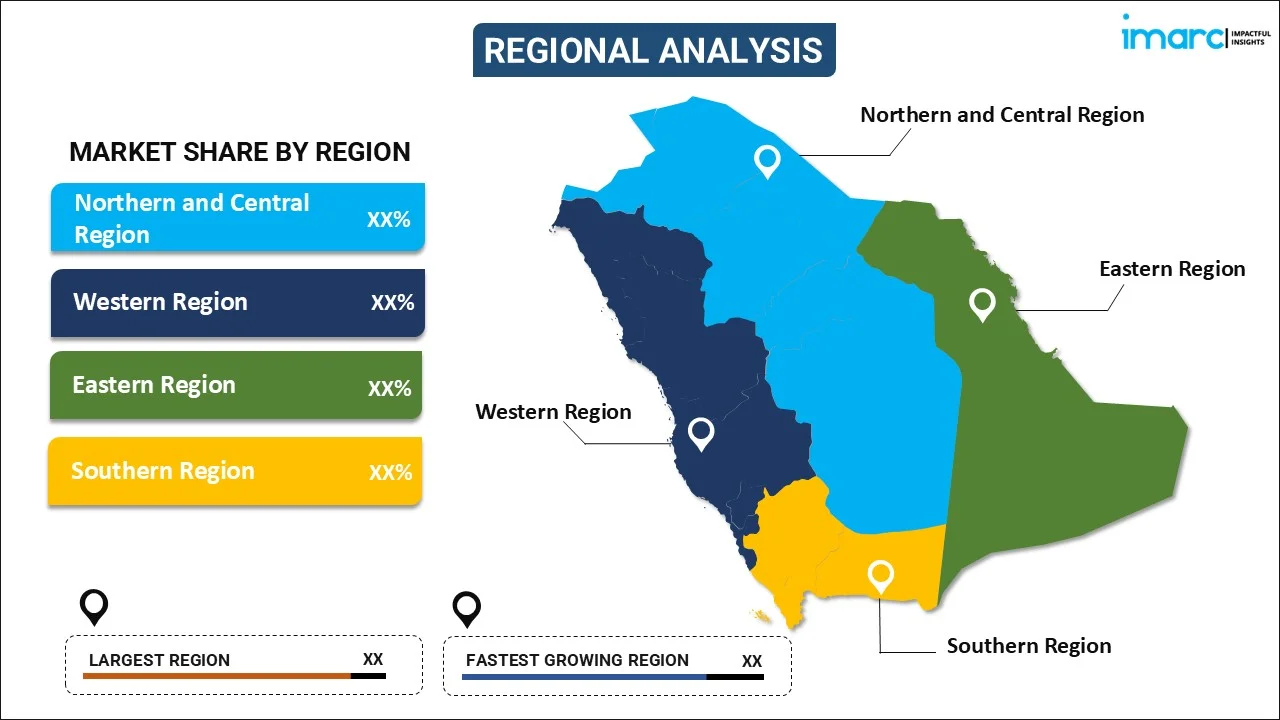

By Region: Northern and central region represents the largest segment with a market share of 36% in 2025, encompassing the industrial hubs of Riyadh and surrounding areas where major petrochemical facilities and infrastructure projects are concentrated.

-

Key Players: Key players in the Saudi Arabia workwear market boost sales by customizing durable safety apparel, expanding local production, meeting strict industry standards, targeting industrial and construction sectors, and offering branded, highvisibility and specialized protective gear to match demand growth.

The Saudi Arabian workwear market operates within a dynamic regulatory environment shaped by the Kingdom's commitment to international occupational safety standards and its ambitious Vision 2030 economic diversification program. The market serves diverse industrial sectors where protective equipment is not merely recommended but mandated by law, including the petrochemical industry where Saudi Arabia commands 17 percent of the world's proven petroleum reserves. The convergence of mandatory safety requirements and large-scale industrial expansion is creating sustained demand for both conventional workwear and next-generation protective solutions. Furthermore, the role of innovation is turning out to be increasingly important in determining market dynamics as the development of new materials such as breathable fabrics, moisture-wicking technologies, and antimicrobial treatments is being introduced by manufacturers to make the wearer more comfortable and cleaner. Another important trend emerging in the market is smart fabrics with health and safety sensors.

Saudi Arabia Workwear Market Trends:

Smart Workwear Technology Integration Enhancing Worker Safety

The Saudi Arabian workwear market is witnessing accelerated adoption of intelligent safety equipment that incorporates sensors, connectivity features, and real-time monitoring capabilities to provide enhanced protection in high-risk industrial environments. This technological evolution encompasses wearable devices that track worker location, monitor vital signs, detect hazardous gas exposure, and provide instant alerts when dangerous conditions are detected. In June 2024, Saudi Aramco announced its initiative to implement advanced helmets from WakeCap that monitor heat stress levels by alerting managers when a worker's body temperature exceeds 38 degrees Celsius, directly confronting the severe Gulf climate where outdoor temperatures frequently exceed 45 degrees in the summer months. The integration of Internet of Things capabilities into traditional personal protective equipment is transforming workwear from passive protection into active safety management systems.

Rapid E-Commerce Channel Expansion Transforming Procurement

The distribution landscape for workwear and safety equipment in Saudi Arabia is experiencing fundamental transformation as digital platforms capture an increasingly dominant share of procurement activities across industrial sectors. Saudi Arabia e-commerce market is projected to reach USD 708.7 Billion by 2033, exhibiting a growth rate (CAGR) of 12.8% during 2025-2033, according to the predictions of IMARC Group. The transition to online purchasing is driven by the convenience of 24-hour access to comprehensive product catalogs, competitive pricing through reduced distribution costs, and the ability to implement centralized procurement systems across multiple work sites. internet penetration approaching 99 percent among the Saudi population, industrial buyers have adopted digital purchasing as standard practice for routine safety equipment orders.

Sustainable and Advanced Material Development

The workwear industry is increasingly focusing on environmentally conscious practices and advanced material technologies that enhance both protection levels and comfort for extended wear in demanding industrial conditions. Manufacturers are developing flame-resistant fabrics with improved breathability, lightweight composite materials for protective footwear, and chemical-resistant coatings that provide superior protection while reducing material weight. This evolution aligns with Saudi Arabia's Circular Carbon Economy framework which emphasizes carbon capture, utilization, and storage technologies across industrial sectors. The Sadara Chemical Company, a joint venture between Dow Chemical and Saudi Aramco representing the largest integrated chemical complex ever built in a single phase, is pioneering the development of advanced polymers and specialty chemicals that enable next-generation protective materials for industrial applications. Moreover, Deputy Minister of Industry and Mineral Resources for Industrial Affairs announced in 2024 that the country is aiming to achieve a fourfold increase of production in polymer-based manufacturing industries by 2035.

How Vision 2030 is Transforming the Saudi Arabia Workwear Market:

Saudi Arabia's Vision 2030 is significantly influencing the workwear market, primarily through its focus on industrial diversification and safety standards. As the country shifts from oil dependency to more diversified sectors like construction, manufacturing, and healthcare, the demand for high-quality, durable, and safety-compliant workwear is increasing. Vision 2030 emphasizes worker safety, spurring the adoption of protective gear that meets international standards. This includes flame-resistant clothing, high-visibility uniforms, and specialized gear for various industries. Furthermore, the government's push to modernize infrastructure projects and develop smart cities drives the demand for innovative workwear solutions, such as climate-adaptive fabrics and wearable technology. Local production is also growing as part of the "Made in Saudi" initiative, reducing reliance on imports and supporting economic sustainability. These shifts are reshaping the workwear market by encouraging technological advancements, expanding local manufacturing, and ensuring that safety remains a top priority for workers across all sectors in the country.

Market Outlook 2026-2034:

The Saudi Arabia workwear market is positioned for sustained expansion throughout the forecast period, driven by the Kingdom's ambitious Vision 2030 diversification strategy which encompasses significant investment in industrial infrastructure, petrochemical expansion, and construction mega-projects. The market generated a revenue of USD 0.19 Billion in 2025 and is projected to reach a revenue of USD 0.29 Billion by 2034, growing at a compound annual growth rate of 5.14% from 2026-2034. The ongoing development of NEOM, projected to require investment, alongside the Red Sea Development Project, Qiddiya entertainment city, and Diriyah Gate cultural district, will generate continuous demand for comprehensive protective equipment across multiple work environments.

Saudi Arabia Workwear Market Report Segmentation:

|

Segment Category |

Leading Segment |

Market Share |

|

Product |

Apparel |

63% |

|

Application |

Chemical |

28% |

|

Distribution Channel |

E-Commerce |

35% |

|

End Users |

Men |

74% |

|

Region |

Northern and Central Region |

36% |

Product Insights:

To get more information on this market, Request Sample

- Apparel

- Footwear

Apparel dominates with a market share of 63% of the total Saudi Arabia workwear market in 2025.

The apparel segment's commanding position reflects the comprehensive protective clothing requirements mandated across Saudi Arabia's industrial sectors where workers face exposure to chemical hazards, extreme temperatures, and mechanical risks. The segment encompasses a diverse range of protective garments including chemical-resistant coveralls, flame-retardant jackets and pants, high-visibility vests and shirts, insulated clothing for cold storage facilities, and specialized uniforms for cleanroom environments. In the petrochemical sector where Saudi Arabia accounts for a massive global production capacity, workers require flame-resistant suits capable of withstanding flash fires and protecting against chemical splashes, with specifications often exceeding international standards set by organizations such as the National Fire Protection Association.

The ongoing expansion of Saudi Arabia's chemicals sector, which aims to eight million tons of chemicals for local manufacturing instead of exports, is generating sustained demand for advanced protective apparel. The construction boom driven by Vision 2030 megaprojects including NEOM, which represents the world's largest construction site, requires extensive use of protective coveralls, safety vests with reflective materials for visibility in low-light conditions, and weather-resistant outerwear for outdoor work environments. Healthcare facilities implementing stringent infection control protocols following global health emergencies have expanded their use of disposable protective gowns, creating additional demand within the broader apparel category.

Application Insights:

- Chemical

- Power

- Food and Beverage

- Biological

- Others

Chemical leads with a share of 28% of the total Saudi Arabia workwear market in 2025.

The chemical application segment's market leadership directly corresponds to Saudi Arabia's position as a global petrochemical powerhouse, with the Kingdom hosting some of the world's largest integrated petrochemical complexes including the Sadara facility in Jubail which features world-scale manufacturing units. Workers in petrochemical facilities face exposure to hazardous substances including corrosive acids, toxic gases, flammable liquids, and reactive chemicals that require specialized protective equipment meeting stringent safety specifications. Saudi Basic Industries Corporation, majority owned by Saudi Aramco and operating as the largest chemical company in the Kingdom, enforces comprehensive personal protective equipment protocols across its facilities to protect workers from chemical burns, inhalation hazards, and skin contamination.

The Eastern Region of Saudi Arabia, which serves as the heart of the Kingdom's petrochemical and oil and gas industries, generates intensive demand for specialized workwear suitable for hydrocarbon processing, chemical manufacturing, and supporting industrial activities. The ongoing expansion of downstream petrochemical capacity, with the Kingdom planning to invest into the sector by 2030, is creating sustained growth in chemical application workwear requirements. The development of specialty chemicals production including catalysts, additives, and performance polymers requires workers to handle increasingly sophisticated chemical compounds that demand advanced protective equipment with enhanced resistance properties and longer service life under harsh operating conditions.

Distribution Channel Insights:

- Supermarkets and Hypermarkets

- Specialty Stores

- E- commerce

- Others

E-commerce exhibits a clear dominance with a 35% share of the total Saudi Arabia workwear market in 2025.

The e-commerce distribution channel has achieved market leadership with 35 percent share, reflecting the rapid digital transformation of Saudi Arabia's business procurement processes and the growing preference for online purchasing platforms among industrial buyers. The Saudi Arabian e-commerce market is driven by high internet penetration approaching 99 percent and smartphone adoption. Industrial purchasers increasingly favor digital platforms that provide comprehensive product catalogs, detailed technical specifications, customer reviews, and competitive pricing comparisons, eliminating the time and cost associated with visiting physical retail locations.

Major e-commerce operators including Amazon, Noon, and specialized industrial suppliers have developed dedicated sections for safety equipment and workwear, offering features such as bulk ordering, corporate account management, and scheduled delivery services that align with industrial procurement requirements. The transition to digital purchasing as companies adopted remote procurement procedures and discovered the efficiency advantages of centralized online ordering systems. The growth of local e-commerce platforms and specialized industrial suppliers offering online ordering capabilities is expanding access to workwear products across all regions of the Kingdom.

End User Insights:

- Men

- Women

Men lead with a share of 74% of the total Saudi Arabia workwear market in 2025.

The male workforce's dominant position in the Saudi Arabian workwear market reflects the demographic composition of the Kingdom's primary industrial sectors where men constitute the overwhelming majority of employees in construction, oil and gas extraction, petrochemical manufacturing, and heavy industry. Moreover, Saudi Arabia's labor force participation demonstrates significant gender disparities across industrial sectors, with male workers predominating in physically demanding and high-risk occupations that require extensive personal protective equipment. The construction industry, experiencing unprecedented expansion through Vision 2030 megaprojects including NEOM which encompasses the world's largest construction site, employs a predominantly male workforce that requires comprehensive protective equipment including safety harnesses, protective footwear, hard hats, and high-visibility apparel.

The oil and gas sector, which forms the backbone of Saudi Arabia's economy with the Kingdom controlling a major percent of the world's proven petroleum reserves, maintains a male-dominated workforce across drilling operations, refinery work, and maintenance activities. These positions require specialized protective equipment including flame-resistant coveralls, chemical-resistant gloves, respiratory protection, and safety eyewear designed to withstand extreme temperatures and hazardous substance exposure. Moreover, international companies are partnering with various companies to create customized workwear specially for the company’s employees to enhance their work efficiency.

Regional Insights:

To get more information on this market, Request Sample

- Northern and Central Region

- Western Region

- Eastern Region

- Southern Region

Northern and central region exhibits a clear dominance with a 36% share of the total Saudi Arabia workwear market in 2025.

The Northern and Central Region's market leadership stems from its position as the political and economic center of Saudi Arabia, encompassing the capital city Riyadh where major government institutions, corporate headquarters, and industrial development zones are concentrated. Riyadh serves as the hub for numerous Vision 2030 initiatives including the King Salman Energy Park which has allocated substantial space for chemical industries with estimated infrastructure investment exceeding 1.6 billion dollars, generating significant demand for industrial safety equipment and protective workwear. The region hosts manufacturing facilities, logistics centers, and construction projects that require comprehensive worker protection programs complying with both national regulations and international safety standards.

The concentration of mega-projects in the Northern and Central Region, including extensive infrastructure development, commercial real estate construction, and industrial park expansion, creates sustained demand for protective equipment across multiple work environments. The region's industrial development aligns with the National Industrial Development and Logistics Program which prioritizes investments in chemical diversification and downstream integration, supporting the growth of specialty chemicals production and conversion facilities that require advanced protective workwear. The presence of major industrial safety equipment suppliers including Modern Eastern Services, one of the leading providers serving the oil and gas, construction, and manufacturing sectors, ensures efficient distribution networks that support rapid equipment deployment across multiple work sites.

Market Dynamics:

Growth Drivers:

Why is the Saudi Arabia Workwear Market Growing?

Large-Scale Vision 2030 Infrastructure Development

The Saudi Arabian workwear market's expansion is fundamentally driven by the Kingdom's ambitious Vision 2030 economic diversification program which encompasses transformative infrastructure projects requiring massive deployment of construction workers and industrial personnel. NEOM, the flagship development representing the world's largest construction site with projected investment exceeding 500 billion dollars, exemplifies the scale of ongoing projects that necessitate comprehensive protective equipment for tens of thousands of workers operating across diverse environments from coastal areas to desert regions. These mega-projects are transforming Saudi Arabia into one of the world's most active construction markets, creating unprecedented requirements for safety harnesses, protective footwear, high-visibility clothing, and weather-resistant outerwear that protect workers from falls, debris, extreme temperatures, and other construction-related hazards.

Enhanced Occupational Safety and Health Regulatory Framework

The strengthening of Saudi Arabia's occupational safety and health regulations represents a critical growth driver as government authorities implement more stringent workplace protection requirements aligned with international standards. In June 2024, Saudi Arabia officially ratified the International Labour Organization's Convention No. 187 concerning the Promotional Framework for Occupational Safety and Health, marking a significant commitment to implementing systematic approaches to workplace safety that emphasize employer responsibilities, comprehensive risk assessments, and preventive strategies designed to minimize occupational accidents and diseases. This ratification positions Saudi Arabia among nations actively working to align their occupational health and safety frameworks with global best practices established by the International Labour Organization. The regulatory evolution extends beyond basic compliance requirements to encompass proactive safety management systems that require regular equipment inspections, mandatory training programs, and documented safety procedures, compelling companies across all industrial sectors to invest in high-quality protective workwear that meets or exceeds specified performance standards.

Rapid Expansion of Petrochemical and Chemical Industries

Saudi Arabia's petrochemical sector expansion serves as a fundamental driver for specialized workwear demand as the Kingdom pursues its strategy to become a global leader in specialty chemicals, plastics conversion, and inorganic chemicals production. The Kingdom’s petrochemical capacity is anticipated to "increase twofold in the upcoming five years, rising from around 75 million tonnes annually to over 140 million tonnes per year. Workers in petrochemical facilities face exposure to corrosive chemicals, toxic gases, flammable substances, and extreme process temperatures that mandate the use of flame-resistant coveralls, chemical-resistant gloves, respiratory protection equipment, and safety eyewear specifically designed for chemical processing environments where minor equipment failures or procedural lapses can result in catastrophic consequences.

Market Restraints:

What Challenges the Saudi Arabia Workwear Market is Facing?

Extreme Climate Conditions Affecting Equipment Performance

The Saudi Arabian workwear market confronts significant challenges related to the Kingdom's extreme climate conditions where summer temperatures routinely exceed 45 degrees Celsius, creating severe heat stress risks for outdoor workers and imposing demanding performance requirements on protective equipment. Traditional protective workwear designed for moderate climates often proves inadequate in Gulf conditions where the combination of high ambient temperatures, direct solar radiation, and low humidity creates physiological stress that can lead to heat exhaustion, heat stroke, and reduced cognitive function affecting worker safety judgment. Heavy protective garments required in construction and industrial settings, particularly those incorporating flame-resistant materials or chemical-resistant coatings, can exacerbate heat stress by restricting airflow and preventing natural body cooling through perspiration evaporation. The challenge of balancing adequate protection against occupational hazards with the necessity of preventing heat-related illnesses requires ongoing innovation in material science, garment design, and work practice modifications.

Import Dependency for Specialized Safety Equipment

The Saudi Arabian workwear market operates with substantial reliance on imported products for specialized safety equipment and advanced protective materials that exceed local manufacturing capabilities. While the Kingdom maintains production facilities for basic protective garments and standard safety equipment, highly specialized items including advanced respiratory protection devices, sophisticated chemical-resistant materials, smart safety equipment incorporating sensor technologies, and certified high-performance protective systems often require sourcing from international suppliers in North America, Europe, and Asia. This import dependency creates vulnerability to global supply chain disruptions delayed equipment deliveries and complicated procurement planning for industrial projects.

Skills Gap in Local Workforce for Safety Management

The effective implementation of comprehensive workplace safety programs and the proper utilization of protective equipment face challenges related to workforce skill levels and safety culture development across diverse industrial sectors. While Saudi Arabia has made significant progress in technical education and vocational training through institutions aligned with Vision 2030 objectives, gaps persist in specialized safety management competencies, equipment maintenance procedures, and the practical application of risk assessment methodologies. Many construction and industrial workers, particularly those in entry-level positions or migrant workers from diverse cultural backgrounds, may have limited familiarity with advanced safety systems, proper equipment usage protocols, and the importance of consistent compliance with protective equipment requirements.

Competitive Landscape:

The Saudi Arabia workwear market demonstrates a moderately concentrated competitive structure characterized by the presence of established international safety equipment manufacturers alongside regional distributors and specialized suppliers serving specific industrial sectors. Leading global players maintain significant market positions through their comprehensive product portfolios, technical expertise, and established relationships with major industrial clients in the oil and gas, petrochemical, and construction sectors. These international corporations leverage their global research and development capabilities to introduce advanced protective technologies and maintain certifications from international safety standards organizations. Regional distributors serve critical roles in the market by maintaining extensive local inventories, providing rapid delivery capabilities, and offering technical support services tailored to Saudi Arabian industrial requirements.

Saudi Arabia Workwear Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Products Covered | Apparel, Footwear |

| Applications Covered | Chemical, Power, Food and Beverage, Biological, Others |

| Distribution Channels Covered | Supermarkets and Hypermarkets, Specialty Stores, E- Commerce, Others |

| End Users Covered | Men, Women |

| Regions Covered | Northern and Central Region, Western Region, Eastern Region, and Southern Region |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report

The Saudi Arabia workwear market size was valued at USD 0.19 Billion in 2025.

The Saudi Arabia workwear market is expected to grow at a compound annual growth rate of 5.14% from 2026-2034 to reach USD 0.29 Billion by 2034.

Apparel dominates with 63% market share, encompassing protective coveralls, flame-resistant garments, chemical-resistant suits, high-visibility clothing, and specialized uniforms required across oil and gas, construction, and chemical industries where comprehensive body protection is mandated by safety regulations.

Key factors driving the Saudi Arabia workwear market include Vision 2030 mega-projects like NEOM requiring extensive protective equipment, strengthened occupational safety regulations following ILO Convention No. 187 ratification in June 2024, and rapid petrochemical sector expansion with Saudi Arabia controlling major portions of global production capacity.

Major challenges include extreme climate conditions with temperatures exceeding causing heat stress in protective equipment, heavy import dependency for specialized safety gear creating supply chain vulnerabilities, and workforce skill gaps in safety management and proper equipment utilization protocols.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)