Saudi Arabia Wind Turbine Components Market Size, Share, Trends and Forecast by Component, Wind Turbine Type, Wind Farm Type, and Region, 2025-2033

Saudi Arabia Wind Turbine Components Market Overview:

The Saudi Arabia wind turbine components market size reached USD 1.3 Billion in 2024. Looking forward, IMARC Group expects the market to reach USD 2.1 Billion by 2033, exhibiting a growth rate (CAGR) of 6.10% during 2025-2033. The wind turbine components market is gaining momentum in Saudi Arabia through Vision 2030-driven government initiatives, favorable regulations, and strategic investment, combined with the geographic suitability and strong wind resources, which together catalyze the demand for wind energy infrastructure and reinforce the shift toward a diversified renewable energy mix.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 1.3 Billion |

| Market Forecast in 2033 | USD 2.1 Billion |

| Market Growth Rate 2025-2033 | 6.10% |

Saudi Arabia Wind Turbine Components Market Trends:

Government Initiatives and Renewable Energy Vision

Saudi Arabia's Vision 2030 initiative significantly influences the market for wind turbine components, emphasizing the need to diversify energy sources and reduce dependence on oil. The governing body is committed to boosting the proportion of renewable energy in the national grid, establishing ambitious goals for wind energy owing to the advantageous geographic factors. Consistent with this vision, considerable funds are being allocated to extensive renewable energy initiatives, which directly boost the need for wind turbines and their parts. The policies, incentives, and regulations set by the governing body create a conducive atmosphere for the advancement of wind energy, promoting expansion in the market for wind turbine components. In 2024, Marubeni Corporation and Ajlan & Bros signed a Power Purchase Agreement with the Saudi Power Procurement Company to develop two onshore wind projects in Saudi Arabia. The projects, Al-Ghat (600MW) and Waad Al-Shamal (500MW), were set to contribute to Saudi Arabia's renewable energy goals. The Al-Ghat and Waad Al-Shamal projects showcase Saudi Arabia’s commitment to fulfilling its renewable energy goals and illustrate the tangible effects of government-supported programs. As these projects progress, they create a demand for wind turbine components, such as nacelles, blades, and towers, directly supporting the objectives of Vision 2030 to enhance the clean energy framework.

Strategic Geographical Location and Wind Resources

Saudi Arabia’s strategic geographical location, with its vast desert areas and coastal regions, provides an ideal environment for wind energy generation. The region benefits from high wind potential, particularly in areas like the Red Sea and the Arabian Gulf, where consistent and favorable wind speeds make these regions perfect for turbine operations. In 2024, Saudi Arabia took significant steps to capitalize on this natural advantage by launching the world’s largest renewable energy geographic survey, covering over 850,000 sq. km. This survey was designed to identify optimal locations for solar and wind energy projects, with the goal of helping Saudi Arabia achieve its target of 50% renewable energy by 2030. The findings from the survey will expedite the development of wind and solar projects in areas with the highest wind potential, further reinforcing the commitment to diversifying the energy mix. As the wind resources in these identified areas are harnessed more efficiently, the demand for wind turbine components, such as rotor blades, towers, and generators, will continue to grow. This geographical advantage, combined with the survey's data, is a driving force behind the expansion of Saudi Arabia wind energy sector and the rising need for turbine components, positioning Saudi Arabia as a major player in the global renewable energy market.

Saudi Arabia Wind Turbine Components Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the regional level for 2025-2033. Our report has categorized the market based on component, wind turbine type, and wind farm type.

Component Insights:

- Rotator Blade

- Gearbox

- Generator

- Nacelle

- Tower

- Others

The report has provided a detailed breakup and analysis of the market based on the component. This includes rotator blade, gearbox, generator, nacelle, tower, and others.

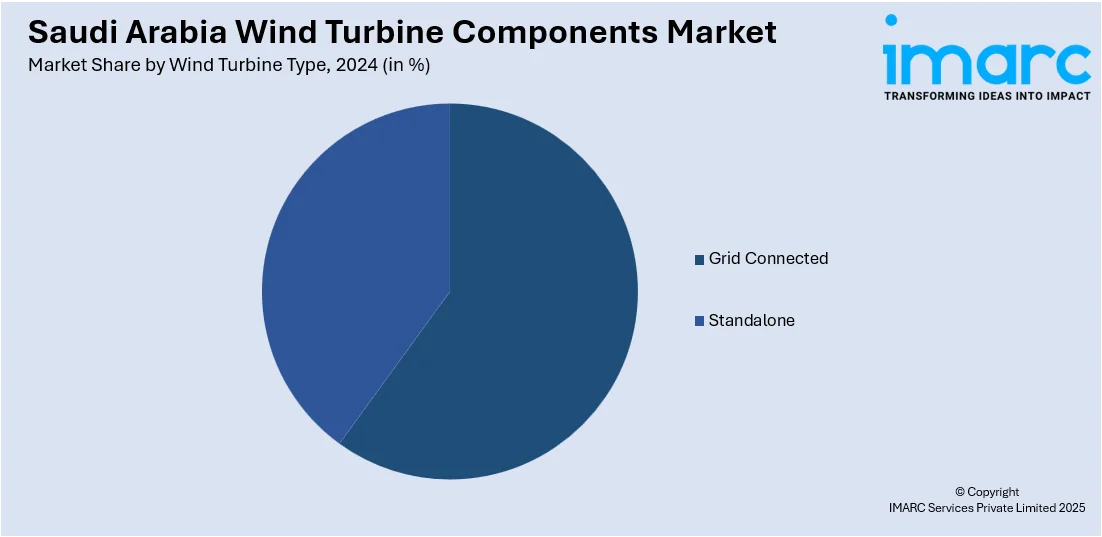

Wind Turbine Type Insights:

- Grid Connected

- Standalone

A detailed breakup and analysis of the market based on the wind turbine type have also been provided in the report. This includes grid connected and standalone.

Wind Farm Type Insights:

- Onshore

- Offshore

The report has provided a detailed breakup and analysis of the market based on the wind farm type. This includes onshore and offshore.

Regional Insights:

- Northern and Central Region

- Western Region

- Eastern Region

- Southern Region

The report has also provided a comprehensive analysis of all the major regional markets, which include Northern and Central Region, Western Region, Eastern Region, and Southern Region.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Saudi Arabia Wind Turbine Components Market News:

- In October 2024, Saudi Arabia announced agreements with Al-Yamamah Steel Industries and Arabian International Co. to locally manufacture steel towers for wind energy systems. This initiative was part of Saudi Arabia's Vision 2030, aimed at boosting renewable energy production and creating local jobs. The agreements focused on local content development and knowledge transfer to enhance the wind energy sector.

- In July 2024, Envision Energy launched a joint venture with Saudi Arabia's Public Investment Fund (PIF) and Vision Industries. The venture focused on manufacturing and assembling wind turbines and components to support Saudi Arabia's renewable energy goals. This collaboration aimed to advance the country's Vision 2030 and promote a sustainable future through clean energy initiatives.

Saudi Arabia Wind Turbine Components Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Components Covered | Rotator Blade, Gearbox, Generator, Nacelle, Tower, Others |

| Wind Turbine Types Covered | Grid Connected, Standalone |

| Wind Farm Types Covered | Onshore, Offshore |

| Regions Covered | Northern and Central Region, Western Region, Eastern Region, Southern Region |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Saudi Arabia wind turbine components market performed so far and how will it perform in the coming years?

- What is the breakup of the Saudi Arabia wind turbine components market on the basis of component?

- What is the breakup of the Saudi Arabia wind turbine components market on the basis of wind turbine type?

- What is the breakup of the Saudi Arabia wind turbine components market on the basis of wind farm type?

- What is the breakup of the Saudi Arabia wind turbine components market on the basis of region?

- What are the various stages in the value chain of the Saudi Arabia wind turbine components market?

- What are the key driving factors and challenges in the Saudi Arabia wind turbine components market?

- What is the structure of the Saudi Arabia wind turbine components market and who are the key players?

- What is the degree of competition in the Saudi Arabia wind turbine components market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Saudi Arabia wind turbine components market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Saudi Arabia wind turbine components market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Saudi Arabia wind turbine components industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)