Saudi Arabia Textile Market Size, Share, Trends and Forecast by Product, Raw Material, Application, and Region, 2025-2033

Saudi Arabia Textile Market Size, Share Analysis, and Forecast:

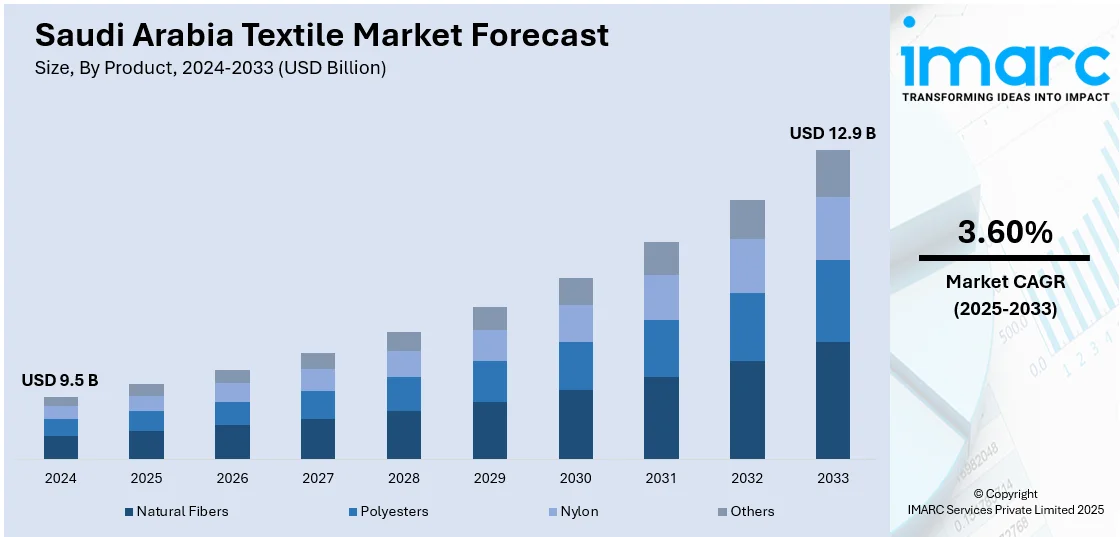

The Saudi Arabia textile market size was valued at USD 9.5 Billion in 2024. Looking forward, IMARC Group estimates the market to reach USD 12.9 Billion by 2033, exhibiting a CAGR of 3.60% from 2025-2033. The market is driven by the growing shift towards online shopping that allows individuals to purchase textile items from the comfort of their homes, along with innovations in technology to improve supply chain management and reduce wastage.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 9.5 Billion |

| Market Forecast in 2033 | USD 12.9 Billion |

| Market Growth Rate (2025-2033) | 3.60% |

The growing demand for local manufacturing in Saudi Arabia is reducing dependency on imports and enhancing domestic production capabilities. This shift is aligned with government initiatives to emphasize economic diversification, job creation, and the development of local industries. By promoting local manufacturing, the country is expanding its textile sector to make it more competitive and self-sufficient. Local manufacturing allows Saudi textile companies to produce textiles that cater specifically to domestic requirements, including traditional and culturally relevant designs that resonate with people. The ability to manufacture locally also helps to reduce lead times, which allows retailers to offer products more quickly and efficiently. Moreover, government agencies are introducing incentives and funding for businesses that focus on local textile production.

To get more information on this market, Request Sample

The rising shift toward sustainable and eco-friendly textiles with people and manufacturers becoming more environment conscious, is impelling the market growth. In the country, there is a high demand for textiles made from natural, biodegradable, and recycled materials. Saudi Arabia, with its thriving fashion industry, is adopting eco-friendly practices to meet this requirement. Manufacturers in Saudi Arabia are using sustainable raw materials like organic cotton, bamboo, and hemp, which require fewer chemicals and water for production compared to traditional fibers. Besides this, recycled polyester and other eco-friendly synthetic fibers are employed to reduce the environmental impact of textile production. This shift is aligned with worldwide sustainability initiatives that advocate for a reduction in carbon footprints and waste. In response, many fashion brands and textile manufacturers are introducing eco-conscious collections to appeal to people.

Saudi Arabia Textile Market Trends:

Expansion of e-commerce platforms

The expansion of e-commerce platforms is fueling the market growth. As online shopping becomes popular, people have easier access to a wider range of textile products, ranging from fashion and clothing to home textiles. This digital shift offers convenience to allow individuals to shop from anywhere and anytime, which is particularly appealing in the fast-paced lifestyles of urban Saudi Arabia. E-commerce platforms provide a marketplace for both local and international textile brands to broaden their customer base. People can browse a variety of products, compare prices, read reviews, and make informed purchasing decisions from the comfort of their homes. This is particularly important for niche textile markets, such as luxury or eco-friendly fabrics, where users may have limited access to traditional retail stores. Besides this, local businesses can sell to customers across the country without the need for a physical storefront, which lowers overhead costs and increases profit margins. With payment options, such as cash on delivery, online transactions are more accessible to a wider range of people. According to the IMARC Group’s report, the Saudi Arabia e-commerce market is projected to exhibit a growth rate (CAGR) of 13.70% during 2024-2032.

Rising adoption of smart manufacturing

The increasing adoption of smart manufacturing is improving production efficiency, reducing costs, and enhancing the quality of products. With the help of technologies such as the Internet of Things (IoT), artificial intelligence (AI), and automation, textile manufacturers in Saudi Arabia are streamlining their operations to meet the growing demand for high-quality products. IoT allows real-time monitoring of production lines, which enables manufacturers to optimize machine performance and minimize downtime. This will ensure that production cycles are accelerated, and operational efficiency improves. The application of AI and ML enables textile manufacturers to predict trends of demand for adjustment of production schedules and the required inventory. It thus offers technologies to operate more accurately and in a timely manner in improving supply chain management while minimizing wastage. According to IMARC Group's report, the Saudi Arabia smart manufacturing market is likely to grow with a growth rate of CAGR at 14.78% during 2024-2032.

Increasing demand for luxury textiles

The rising demand for luxury textiles is bolstering the market growth across the region. The growing affluence of the Saudi population, coupled with the cultural appreciation for luxury goods, is catalyzing the demand for premium textiles in various segments, including fashion, interior design, and home decor. Saudi Arabia’s wealthy people choose to invest in high-end fabrics, such as silk, high-thread-count cotton, and cashmere, which are often used in upscale clothing and luxurious home textiles. This increasing trend is particularly noticeable in fashion, where premium textile brands cater to the need for unique and customized designs that reflect status and sophistication. Since there is an increased emphasis on luxurious and high-quality materials, local and international textile manufacturers are being encouraged to supply premium fabrics. Moreover, luxury textiles are gaining popularity among people who seek exquisite textiles for their home interiors. High-end curtains, upholstery, and luxury bedding made from fine materials are being favored by homeowners who want to create opulent living spaces. The data published on the website of the IMARC Group shows that the Saudi Arabia luxury market is expected to reach USD 22.5 Billion by 2032.

Saudi Arabia Textile Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the Saudi Arabia textile market, along with forecasts at the country and regional levels from 2025-2033. The market has been categorized based on product, raw material, and application.

Analysis by Product:

- Natural Fibers

- Polyesters

- Nylon

- Others

Natural fibers like cotton, wool, silk, and linen are preferred due to their breathability, softness, and comfort and thus are commonly used in clothing, especially in the hot desert climate. They are often used in daily wear, household textiles, and local attires. In addition, the demand for environment-friendly and sustainable products leads people to opt for natural fibers.

Polyester is a man-made fiber and is used extensively owing to its durability, flexibility, and economical price. It is employed in many products, such as clothes, couches, and industrial fabrics. It has good moisture-wicking capability and, hence, it is a suitable choice in activewear and sportswear. It also resists wrinkles and shrinking and fits those garments well that are easy to maintain.

Nylon is employed in Saudi Arabia’s textile industries, as it is strong, elastic, and resistant to wear and tear. It is found in outerwear, activewear, and performance gear to offer flexibility and durability. It is also used in products like hosiery, carpets, and upholstery fabrics to provide resilience.

Analysis by Raw Material:

- Cotton

- Chemical

- Wool

- Silk

- Others

Cotton is chosen for being soft, lightweight, and very comfortable. It is used in many products, including casual wear, household textiles, and traditional attires like thobes and abayas. It soaks water and is very light in weight and thus suitable for a hot and humid climate. It remains popular for many textile products including apparel, furnishings, and accessories, as it is eco-friendly.

The chemical fibers including polyester, nylon, and acrylic are used because of their flexibility and strength. They are often employed in everyday clothes, sportswear, and technical fabrics. They are usually selected for their capacity to retain shape because they do not wrinkle and give a lasting appearance.

Wool is known for having features of being soft and warm and is used in the textile industries for the production of quality apparel, which includes suits, scarves, and sweaters among others. It is most utilized in weather conditions that are colder. It is also employed in producing household textiles, such as rugs and blankets because it is a good insulator of heat.

Silk is a high-end product used in the production of high-end clothing items including dresses, scarves, and formal wear. In Saudi Arabia, silk is utilized due to its smooth surface, glossy appearance, and elegant design, which makes it suitable for special events and high-end fashion. It is also employed in accessories including ties, handkerchiefs, and high-end home textiles including linens and curtains.

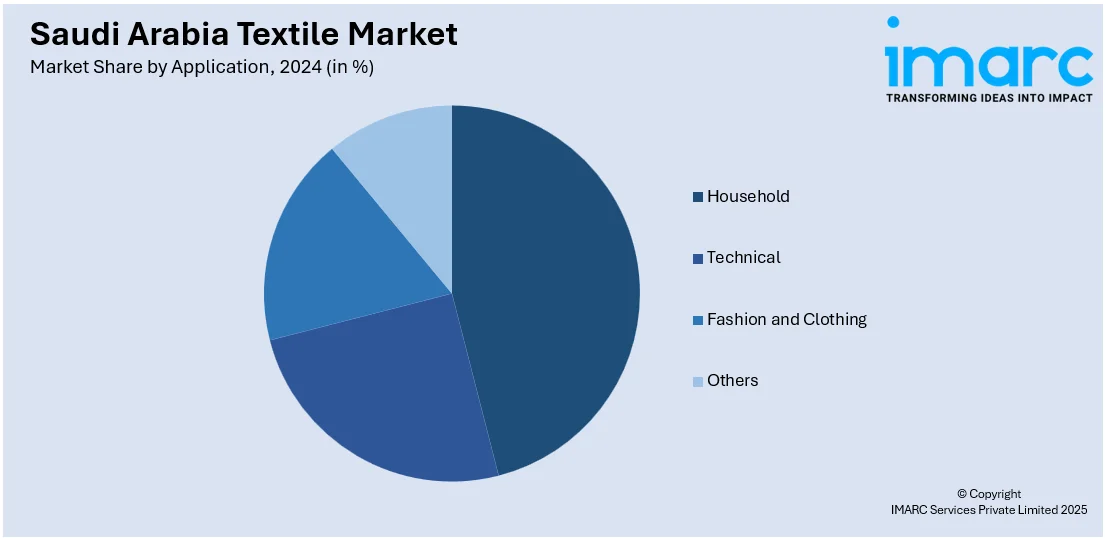

Analysis by Application:

- Household

- Technical

- Fashion and Clothing

- Others

The household textiles segment benefits from a consistent demand for items like bed linens, curtains, towels, and upholstery. The country emphasizes home décor and textile products that are made from fabrics including cotton, polyester, and other materials. Most households are inclined towards using quality fabrics for furnishings to improve the appearance as well as the comfort of homes.

The technical textile products include industrial fabrics, geotextiles, and protective clothing. Polyester and nylon are used here due to their strength and durability. In the country, there is a high demand for specialized textiles that serve functional purposes like protecting workers and providing medical solutions.

The fashion and clothing segment caters to the high demand for both traditional and modern attire. This leads to an increase in the production of textiles like cotton, wool, and synthetic fabrics. Fabrics are used in everyday wear as well as high-end fashion pieces, including thobes, abayas, dresses, and suits. Moreover, Saudi Arabian people prefer luxury brands and premium textile products.

Regional Analysis:

- Northern and Central Region

- Western Region

- Eastern Region

- Southern Region

The Northern and Central region of Saudi Arabia has well-setup urban centers, which require textiles for fashion needs. In this area, people prefer both local and international textile products, which promotes large-scale textile manufacturing. Moreover, regional retail channels, including malls and local boutiques, are utilizing textiles to cater to modern fashion choices.

The Western region, including cities like Jeddah and Mecca, has a strategic location for textile production and holds importance as a commercial hub. Jeddah’s proximity to key ports facilitates easy access to global textile imports. Here, the high number of retail channels creates the need for textiles, such as clothing, accessories, and fabric.

The Eastern region inculcates oil-rich cities like Dammam and Khobar. In this region, individuals buy premium and high-quality textiles, which promotes their manufacturing. Apart from this, people prefer both casual and formal wear to focus on stylish and high-performance fabrics. The region is also close to international ports to support textile imports.

The Southern region of Saudi Arabia, including cities like Abha and Jizan, produces textiles influenced by its local culture and traditional clothing preferences. People like wearing locally made textiles and garments, particularly those catering to cultural and religious practices. Moreover, the region benefits from the large number of retail shops that sell textiles.

Competitive Landscape:

Key players in Saudi Arabia are concentrating on creativity, sustainability, and broadening their product range. Leading textile producers in the area are investing in new technologies, including smart fabrics, sustainable materials, and automation. They are also wagering on fulfilling the increasing demand for personalized and premium products, especially in the luxury and fashion sectors. Besides this, they are expanding local manufacturing facilities and partnering with international brands. They are also making efforts to introduce new products, such as functional textiles for health, sports, and smart wearables and cater to different needs, contributing to the overall development of the textile industry in Saudi Arabia. For instance, in July 2024, Business Plus Fairs, a UAE-based regional exhibition organizer specializing in B2B textile trading, announced its collaboration with Vision Fairs, a leading event planning company, to unveil a new textile brand, Stitch & Tex in Saudi Arabia, Morocco, and Egypt and expand their regional industry capabilities.

The report provides a comprehensive analysis of the competitive landscape in the Saudi Arabia textile market with detailed profiles of all major companies.

Latest News and Developments:

- August 2024: The Saudi Fashiontex Expo, a well-known international trade fair for fashion, textiles, and leather goods, announced to offer participation opportunities to more than 500 exhibitors and brands in Riyadh Exhibition & Convention Center. This platform gives a chance to the experts and new talents to present new trends and items in the field of fashion.

- November 2024: India and Saudi Arabia announced their participation in the Future Investment Initiative (FII) in Riyadh. This collaborative agreement will provide benefits to the textile sectors of both nations by enabling efficient developments in textile manufacturing, export, innovations in textile technologies, and supply chain optimization.

Saudi Arabia Textile Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Products Covered | Natural Fibers, Polyesters, Nylon, Others |

| Raw Materials Covered | Cotton, Chemical, Wool, Silk, Others |

| Applications Covered | Household, Technical, Fashion and Clothing, Others |

| Regions Covered | Northern and Central Region, Western Region, Eastern Region, Southern Region |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Saudi Arabia textile market from 2019-2033.

- The research study provides the latest information on the market drivers, challenges, and opportunities in the Saudi Arabia textile market.

- Porter's Five Forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Saudi Arabia textile industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

Textile refers to any material made from fibers or yarns, woven, knitted, or processed into fabrics. It is used to make clothing, upholstery, bed linens, curtains, industrial fabrics, geotextiles, and protective wear. It plays a significant role in various industries including fashion, home decor, medical, automotive, and technical applications due to its versatility and adaptability.

The Saudi Arabia textile market was valued at USD 9.5 Billion in 2024.

IMARC estimates the Saudi Arabia textile market to exhibit a CAGR of 3.60% during 2025-2033.

In Saudi Arabia, people are seeking personalized and customized textile products, such as monogrammed fabrics and custom-made garments, which is encouraging innovation in textiles. Besides this, the growing trend of modernizing textile items with contemporary fabrics and designs is impelling the market growth. Moreover, the rapid expansion of retail outlets and e-commerce platforms is increasing textile availability and sales, making products more accessible to users.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)