Saudi Arabia Telecom Market Report by Type (Mobile, Fixed-Line, Broadband), and Region 2025-2033

Saudi Arabia Telecom Market Size:

Saudi Arabia telecom market size reached USD 16.8 Billion in 2024. Looking forward, IMARC Group expects the market to reach USD 22.7 Billion by 2033, exhibiting a growth rate (CAGR) of 3.4% during 2025-2033. The market is witnessing robust expansion, mainly driven by heightening digital transformation, deployment of 5G technology, and government goals to enhance telecom infrastructure. Such drivers are spurring innovations in the sector and improving connectivity, further fueling the Saudi Arabia telecom market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 16.8 Billion |

| Market Forecast in 2033 | USD 22.7 Billion |

| Market Growth Rate (2025-2033) | 3.4% |

Saudi Arabia Telecom Market Analysis:

- Major Market Drivers: The market is chiefly driven by ongoing technological advancements and rapid digital transformation ventures. The government’s primary objective to augment the economy and improve the digital infrastructure is further boosting the market growth. Moreover, the escalating demand for efficient mobile data services and high-speed internet, along with the implementation of 5G technology, also significantly supports the market expansion. In addition, strategic collaboration and investments in the telecom industry spur innovation and improve service delivery across the country, which, in turn, is propelling the Saudi Arabia telecom market revenue 2023 2024 2025.

- Key Market Trends: Some of the key trends include the extensive utilization of 5G technology and the proliferation of broadband services. The market is also experiencing an inclination towards cloud-based and digital solutions, driven by rising consumer demand for seamless, superior-quality connectivity. Moreover, there is an increasing emphasis on developing smart cities, integrating artificial intelligence (AI), data analytics, and the Internet of Things (IoT) to improve urban services and management. Additionally, digital transformation across numerous industries is increasing Saudi Arabia telecom market revenue.

- Competitive Landscape: Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

- Challenges and Opportunities: The market witness challenges such as regulatory challenges and elevated operational costs, which can significantly impact profitability. However, these challenges provide opportunities for innovation, especially in developing cost-efficient and effective technologies. Moreover, heavy investments and strategic collaborations in advanced technologies provide substantial prospects for navigating these market challenges and fueling market growth. In addition, key market players can capitalize on the burgeoning demand for digital services and the government’s initiatives for digital transformation, which are contributing to an optimistic Saudi Arabia telecom market outlook.

Saudi Arabia Telecom Market Trends:

Increasing Expansion of 5G Technology

The rapid deployment of 5G technology is fueling the Saudi Arabia telecom market size 2025. This trend is chiefly driven by the government’s Vision 2030 initiative to improve digital transformation. For instance, in March 2024, Zain, a major telecom company in Saudi Arabia, announced its 2024-2026 plans of launching G-A services in major eight cities to provide IoT CCTV for public security governance applications. Telecom operators are actively investing in implementing 5G networks to offer reduced latency, fast internet speed, and enhanced connectivity. Moreover, this expansion is anticipated to bolster numerous industries, including entertainment, healthcare, and education, by enabling high-tech applications such as smart cities, IoT, and autonomous vehicles. In addition, the competitive landscape is also magnifying as key companies are striving to distinguish themselves by providing exceptional 5G coverage and services, preparing the market for significant growth.

Rapid Shift Towards Cloud-Based and Digital Solutions

The Saudi Arabia telecommunications market size 2024 revenue is substantially fueled by the intense shift towards cloud-based and digital solutions due to the escalating demand for scalable, cost-efficient, and flexible services. Various corporations across the country are rapidly adopting cloud-based systems to optimize operations, spur innovations, and improve customer experiences. This trend is further accelerated by the heightening popularity of e-learning and remote work culture, which necessitates credible digital infrastructure. Moreover, telecom operators are currently collaborating with cloud service providers to provide integrated services that address the evolving demand of customers as well as businesses. For instance, in 2024, Zoho, a well-known cloud-based business solutions provider, unveiled its two new data centers in Saudi Arabia, along with a heavy investment of USD 133.33 million for the development of digital infrastructure as well as for strategic collaborations with local government firms. In addition, this transition is projected to boost, establishing new revenue structures in the telecom industry in Saudi Arabia.

Increasing Emphasis on Smart City Development

The development of smart cities is a significant trend in the Saudi Arabia telecom market, convergent with the government’s 2030 goals to upgrade urban regions through cutting-edge technologies. Heavy investments in artificial intelligence, data analytics, and IoT are permitting the development of advanced, interconnected urban ecosystems. Moreover, Saudi Arabia telecom companies are playing a critical role by offering the essential connectivity and infrastructure to aid these initiatives. For instance, in April 2024, Virgin Mobile Saudi, a telecommunications company, partnered with Hiteck to formulate a strategic framework for advancing smart cities in the country. This partnership aims to develop resilient infrastructure with superior connectivity and integrate advanced technologies such as IoT and AI. and This trend is notably driving the demand for improved communication networks and bolstering innovation in segments such as transportation, energy management, and public safety. In addition, as smart city projects are progressing, they are substantially contributing to the enhancement of Saudi Arabia telecom market revenue 2024.

Key Growth Drivers of Saudi Arabia Telecom Market:

Increased private sector expenditure on digital infrastructure

Increased private sector expenditure on digital infrastructure is playing a crucial role in bolstering the market growth in Saudi Arabia. Private companies are wagering on upgrading fiber-optic networks, data centers, and 5G deployment, which supports the country’s digital transformation goals under Vision 2030. These investments are enabling telecom operators to provide faster internet speeds, lower latency, and more reliable connections, meeting the growing demand for digital services among businesses and consumers. Moreover, private sector involvement is fostering competition, innovations, and cost efficiency, which is further influencing the market positively. Overall, the rising adoption of cloud services and digital platforms by enterprises is fueling the Saudi Arabia telecommunications market size 2025.

Expansion of e-commerce portals

The rapid broadening of e-commerce portals is creating a strong growth pathway for the Saudi Arabia telecom market, as it is significantly catalyzing the demand for secure, high-speed internet and mobile data services. Online shopping platforms, mobile applications, and e-payment systems require seamless connectivity for smooth transactions, driving higher dependence on telecom infrastructure. Businesses are also employing digital marketing, mobile-first strategies, and customer support solutions, which rely on strong telecom networks. Additionally, rising user trust in digital platforms and cashless payments is further boosting data traffic and mobile usage. Telecom providers are responding by offering tailored plans for online shoppers and e-commerce businesses, ensuring uninterrupted digital engagement. This dynamic is directly strengthening the growth of Saudi Arabia telecom market size 2024 revenue subscribers.

Growing popularity of online entertainment

The rising popularity of online entertainment is a major catalyst for the market in Saudi Arabia, as people are turning to video streaming, gaming, music platforms, and live digital events. These services demand high-speed connectivity, low latency, and reliable data packages, which telecom operators are addressing through 5G expansion and broadband upgrades. The youth population, in particular, is driving higher consumption of online entertainment, encouraging service providers to innovate with bundled offers and unlimited streaming plans. Local content creation and partnerships with global platforms are also adding to the surge in data usage. As digital entertainment is becoming a central part of everyday life, it is translating directly into increased data utilization and steady growth in the Saudi Arabia telecom market revenue 2024 USD.

Saudi Arabia Telecom Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the regional and country levels for 2025-2033. Our report has categorized the market based on type.

Breakup by Type:

To get more information on this market, Request Sample

- Mobile

- Fixed-Line

- Broadband

The report has provided a detailed breakup and analysis of the market by type. This includes mobile, fixed-line, and broadband.

Mobile is one of the crucial segments in the Saudi Arabia telecom market, majorly driven by magnified smartphone penetration and heightening demand for mobile data services. As per the industry reports, around 92% of individuals in Saudi Arabia own a smartphone in 2024. With increasing young, tech-savvy population, the preference for mobile connectivity is rapidly boosting, fostered by comprehensive 4G and proliferating 5G networks. Moreover, telecom operators are currently making significant investments to enhance their mobile services, deploy innovative packages to appeal and sustain customers, and to increase their Saudi Arabia telecom market share. This segment remains pivotal for the growth of Saudi Arabia telecom market size 2024 USD.

Fixed-line is a relevant segment in Saudi Arabia telecom market regardless of a contracting global trend, chiefly due to its role in offering reliable and secure communication services. It is essential for businesses demanding exclusive data and voice lines, providing better quality as well as security. Moreover, government initiatives to improve digital infrastructure and endorse fiber optic implementations have rejuvenated consumer interest in fixed-line connections. In addition, this segment is crucial for aiding smart city and broadband initiatives, facilitating the overall telecom market development. For instance, according to a news article, Emirates Integrated Telecommunications Co., a leading telecom operator in Saudi Arabia, reported an increase of 36.8% in its net profit in 2023 due to its expanding consumer base for fixed-line and mobile services.

According to the Saudi Arabia telecom market forecast, the broadband segment is anticipated to expand rapidly, primarily driven by escalating internet utilization and demand for excellent-speed connectivity. The government's efforts for smart city ventures and digital transformation projects under Vision 2030 has fueled the growth of broadband infrastructure, including wireless and fiber optics technologies. For instance, in March 2024, Oman Broadband signed an agreement with Dawiyat Integrated Telecommunication and Information Technology Company, a Saudi Arabia-based firm, to offer the robust infrastructure for the development of fiber optic networks between Oman and Saudi Arabia. Moreover, this segment plays a major role in promoting digital services across various industries, such as entertainment, education, and healthcare and facilitating substantial investments from telecom operators to enhance service quality as well as coverage, thus expanding the Saudi Arabia telecom market size 2024 revenue.

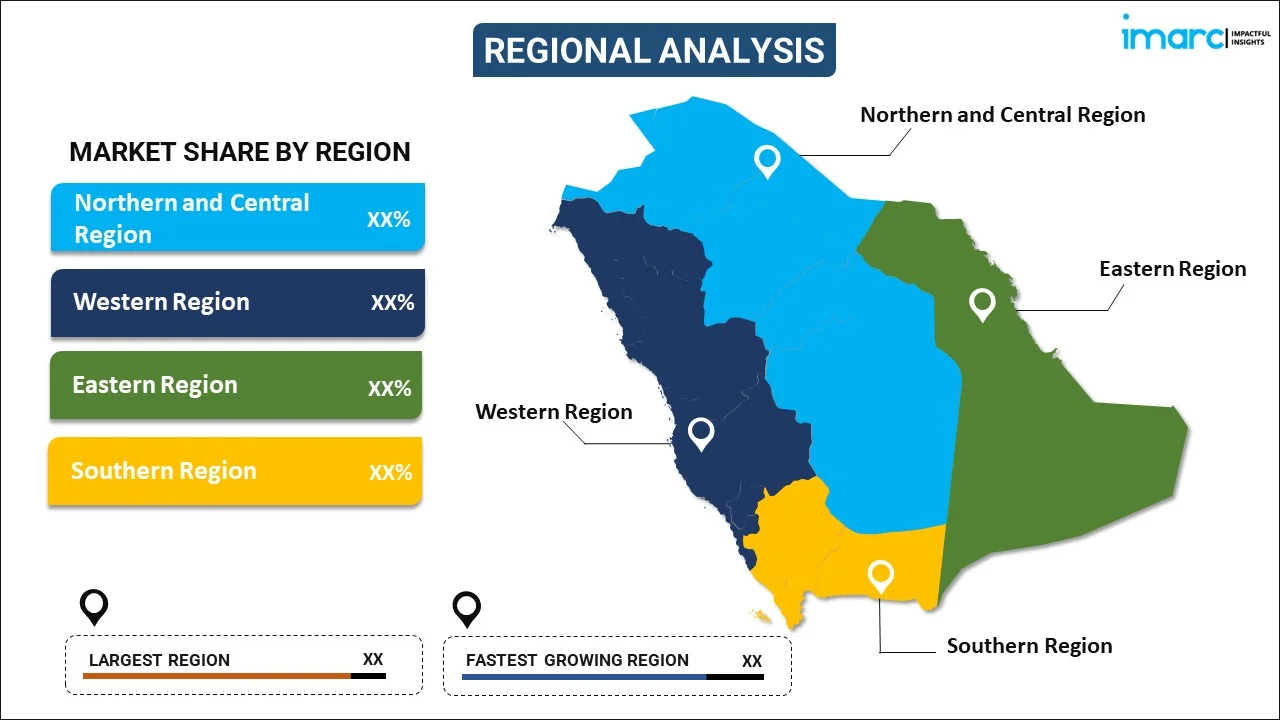

Breakup by Region:

- Northern and Central Region

- Western Region

- Eastern Region

- Southern Region

The report has also provided a comprehensive analysis of the Saudi Arabia telecom market by region, including Northern and Central Region, Western Region, Eastern Region, and Southern Region.

The Saudi Arabia telecom market size is witnessing significant growth in Northern and Central regions, driven by expanding urbanization and increasing demand for high-speed internet services. The deployment of advanced infrastructure, including 5G networks, is enhancing connectivity and supporting digital transformation across various sectors. Additionally, the government's initiatives to promote smart city developments in key cities like Riyadh are accelerating telecom investments. These efforts aim to improve service quality and accessibility, fostering a competitive environment among telecom operators.

The Western region of Saudi Arabia, including major cities like Jeddah and Mecca, is experiencing rapid advancements in its telecom market. The region benefits from a high concentration of commercial and economic activities, driving demand for reliable, high-speed connectivity. Moreover, efforts to improve digital services for tourism, particularly during the Hajj season, have led to substantial investments in network expansion and upgrades. In addition, the deployment of 5G and enhanced broadband services further supports the region's robust growth trajectory in telecommunications.

The Eastern region, a vital economic hub due to its oil industry, is experiencing a robust expansion in the telecom market, driven by industrial digitalization and smart technology adoption. The region's strategic importance has spurred substantial investment in advanced telecommunications infrastructure, including 5G networks and IoT solutions. Furthermore, enhanced connectivity is supporting various sectors, such as energy, logistics, and manufacturing, contributing to economic diversification. In addition, the focus on integrating advanced digital services is positioning the Eastern region as a leader in Saudi Arabia's telecom market.

In Saudi Arabia’s Southern region, the telecom market is evolving with ongoing efforts to improve network coverage and digital accessibility in more remote and mountainous areas. Initiatives to enhance broadband services and introduce advanced technologies like 5G are crucial for supporting local communities and businesses. Moreover, the government's investment in expanding digital infrastructure is aimed at bridging the digital divide and fostering economic growth. Furthermore, these developments are creating new opportunities for telecom operators to expand their market presence in this region.

Competitive Landscape:

- The market research report has also provided a comprehensive analysis of the competitive landscape in the market. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

- The Saudi Arabia telecom market is witnessing intense competition among well-established enterprises and new operators. Leading companies are actively investing in cutting-edge technologies, such as fiber optics and 5G services, to improve quality or their services and proliferate their consumer base. In addition, strategic partnerships between domestic as well international firms with the country’s research facilities or governmental firms are rapidly becoming prevalent as companies strive to fortify their positions and attain a competitive edge. For instance, in 2024, Ericsson, one of the well-known telecommunications and networking company, announced the extension of its research and development partnership with Saudi Arabia’s King Abdullah University of Science and Technology (KAUST), which will focus on research associated with 5G and 6G technologies. This partnership corresponds to Saudi Arabia’s Vision 2030 initiative. Moreover, regulatory policies and government ventures under Vision 2030 further fuel competition, fostering market growth and innovation.

Saudi Arabia Telecom Market News:

- August 2025: Rebellion, a startup focused on AI semiconductors, announced the creation of a subsidiary in Riyadh, the capital of Saudi Arabia, as part of a strategic effort to penetrate the Middle Eastern market and strengthen its footprint in advanced AI technologies. The firm aimed to enhance its cooperation with Aramco and establish strategic alliances with key Saudi telecom firms, while also creating opportunities for collaboration with small and medium-sized technology and telecommunications companies.

- May 2025: The Saudi Minister of Communications and Information Technology, Abdullah Al-Swaha, assessed arrangements for delivering telecommunications services to pilgrims for the coming Hajj season. These initiatives would improve the pilgrim experience and demonstrate the Kingdom’s dedication to offering dependable and effective services.

- November 2024: China Telecom Global commenced operations in Saudi Arabia by introducing its new subsidiary, China Telecom Gulf, which secured initial cooperation agreements with local telecommunications companies STC and state-owned BTC Networks. The firm would utilize its expertise in 5G, cloud technology, AI, and other areas to deliver digital solutions and services to enterprises, institutions, and users in Saudi Arabia.

Saudi Arabia Telecom Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered | Mobile, Fixed-Line, Broadband |

| Regions Covered | Northern and Central Region, Western Region, Eastern Region, Southern Region |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Saudi Arabia telecom market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Saudi Arabia telecom market.

- Porter's five forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Saudi Arabia telecom industry and its attractiveness.

- The competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The telecom market in Saudi Arabia was valued at USD 16.8 Billion in 2024.

The Saudi Arabia telecom market is projected to exhibit a CAGR of 3.4% during 2025-2033, reaching a value of USD 22.7 Billion by 2033.

The expansion of 5G infrastructure is a major growth catalyst, enabling faster connectivity and supporting emerging technologies such as cloud services. Rising smartphone adoption and high demand for high-speed data are fueling revenue streams for telecom operators. Increased private and public sector investments in digital infrastructure, along with partnerships with global technology providers, are further strengthening the market growth.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)