Saudi Arabia Switchgear Market Size, Share, Trends and Forecast by Voltage, Insulation, End Use Industry, and Region, 2025-2033

Saudi Arabia Switchgear Market Size and Share:

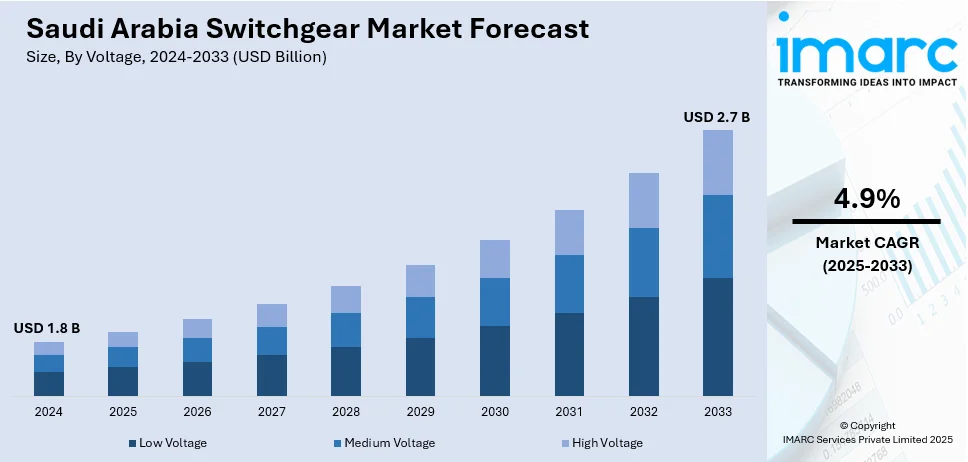

The Saudi Arabia switchgear market size was valued at USD 1.8 Billion in 2024. Looking forward, IMARC Group estimates the market to reach USD 2.7 Billion by 2033, exhibiting a CAGR of 4.9% from 2025-2033. The market is experiencing significant growth driven by industrial expansion, renewable energy adoption along with grid modernization, increasing data center investments, stricter safety regulations, and the rising demand for electric vehicle charging infrastructure, with advanced solutions offering enhanced safety, energy efficiency, and operational reliability to support evolving power distribution needs across industries.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 1.8 Billion |

| Market Forecast in 2033 | USD 2.7 Billion |

| Market Growth Rate (2025-2033) | 4.9% |

Furthermore, the expansion of the oil and gas sector is creating a positive market outlook in the market, as switchgear plays a crucial role in ensuring uninterrupted power supply and safety in critical operations. Similarly, the introduction of hydrogen and ammonia-based projects is opening new avenues for specialized switchgear solutions tailored to emerging energy technologies, thus fostering the market growth. Apart from this, the increasing emphasis on sustainability and carbon neutrality is driving the demand for eco-friendly switchgear technologies. Innovative solutions, such as dry air insulated switchgear, eliminate the use of greenhouse gases while maintaining high performance and reliability. For instance, on July 17, 2024, Mitsubishi electric corporation announced an order from Kansai Transmission and Distribution, Inc. for its 84kV dry air insulated switchgear. This environmentally friendly product eliminates greenhouse gases, aligning with carbon neutrality goals.

Saudi Arabia Switchgear Market Trends:

Growing Investment in Regional Energy Infrastructure

The development of energy infrastructure in the MENA region is driving the demand for advanced power distribution solutions in the region. For example, Lucy Electric, a leader in secondary power distribution solutions, inaugurated a new switchgear manufacturing facility in Dammam, Saudi Arabia, on December 1, 2024. The facility aims to strengthen Lucy Electric's presence in the Middle East, enhancing local manufacturing capabilities, and supporting the region's growing energy infrastructure demands. Most regional countries are upgrading their modern electrical grid, with industrial and residential energy supplies in the region propelling demand for reliable switchgear solutions manufactured domestically. This demand thus emanates from initiatives towards improvement of efficient energy use, integrating renewable energy into the grid, to even strengthening regional energy security.

Increased Demand for Advanced Low-Voltage Switchgear Solutions

The rapid expansion of industrial activities and urban areas is further contributing to the growth of the market. Certain major adoption-leading features of real-time monitoring, enhanced operator protection, and conformation to international standards propel growth within the verticals of energy, infrastructural, and manufacturing industries. This growing requirement is further facilitated by the growing emphasis on smart grids and energy-efficient systems. Moreover, innovative switchgear technologies offer solutions to ensure reliable power distribution, adding to global trends towards automation and sustainability, making them imperative in modern infrastructure and industrial applications. On December 18, 2023, ABB introduced its SEN Plus low-voltage switchgear in Riyadh, Saudi Arabia. This DEKRA-certified solution, compliant with IEC-61439-1/2 standards, is designed for demanding environments, offering flexibility, modularity, and enhanced operator protection. It integrates with ABB Ability for real-time monitoring and improved safety measures.

Rising Adoption of Electric Vehicles (EVs)

The expanding electric vehicle market is significantly impelling demand for low-voltage switchgear. As EV charging stations proliferate, advanced switchgear is required to manage power distribution and ensure safety during operation. Switchgear solutions play a vital role in optimizing energy flow, protecting charging infrastructure, and enabling smart energy management. Government initiatives promoting EV adoption, along with investments in charging networks, are creating substantial opportunities for switchgear manufacturers. In addition to this, the integration of renewable energy sources into EV charging systems highlights the importance of efficient and reliable switchgear to support sustainable and scalable charging solutions.

Saudi Arabia Switchgear Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the Saudi Arabia switchgear market, along with forecasts at the country and regional levels from 2025-2033. The market has been categorized based on voltage, insulation, and end use industry.

Analysis by Voltage:

- Low Voltage

- Medium Voltage

- High Voltage

Low voltage switchgear ensures safety and efficiency in power distribution related to residential, commercial, and small-scale industrial purposes in Saudi Arabia. Its importance lies in the form of reliable power management, especially for urban development and smart city projects.

Medium voltage switchgear has become an integral element in the supply of power to industries, substations, and mega structure projects. Medium voltage solutions are preferred due to their handling higher loads and seamless power delivery, thus aligning with the focus of the country for better energy reliability and resilience of infrastructure.

High voltage switchgear forms an indispensable part of massive power transmission and renewable energy projects in Saudi Arabia. The systems play a crucial role in maintaining the stability of grids and handling the increased requirements of electricity in industrial as well as urban expansion in the Kingdom.

Analysis by Insulation:

- Gas-Insulated Switchgear

- Air-Insulated Switchgear

Gas-insulated switchgear (GIS) is highly in demand in Saudi Arabia, as its compact design makes it both reliable and suitable for the urban and industrial environment. It can be operated in rough climates, making it a highly preferred choice for projects requiring space-saving solutions. GIS ensures very high safety standards and minimal maintenance, which fits into the Kingdom's vision of modernizing infrastructure and improving energy efficiency, especially in fast-developing urban areas and industrial zones.

AIS stands among some of the most important in the power distribution network within Saudi Arabia, valued highly for its cost-effectiveness as well as simplicity in its designs. It is widely employed on outside installations and areas where ample space is not a restriction. AIS supports the Kingdom’s growing renewable energy projects and grid expansion initiatives by providing robust and flexible solutions, ensuring reliability and safety in energy transmission and distribution across diverse applications.

Analysis by End Use Industry:

.webp)

- Residential

- Commercial

- Industrial

The residential sector is also highly significant in the Saudi Arabia switchgear market due to rapid urbanization and housing development projects. Advanced switchgear systems are necessary to ensure efficient power distribution, safety, and energy management for modern housing complexes and smart city initiatives.

The commercial sector is the most significant contributor to the switchgear market in Saudi Arabia, as the development of shopping malls, office complexes, hotels, and entertainment hubs creates a demand for continuous power supply and high-performance electrical systems. Switchgear solutions in this segment are crucial for ensuring the safety and reliability of electrical networks while supporting the integration of energy-efficient technologies and smart grid capabilities.

The industrial sector is one of the key drivers of the switchgear market in Saudi Arabia, as the Kingdom continues to expand its manufacturing, mining, and oil and gas operations. Industries require high-end switchgear for sophisticated power distribution networks, safe operations, and energy efficiency. Robust switchgear solutions are necessary to support various energy requirements of industrial processes, especially in demanding locations such as refineries and heavy manufacturing facilities.

Regional Analysis:

- Northern and Central Region

- Western Region

- Eastern Region

- Southern Region

The Northern and Central regions have become very significant in the Saudi Arabian switchgear market due to large infrastructure projects and urbanization, where large-scale government establishments and industries have been established along with an increasing commercial or residential base.

The Western region is of significant importance in the switchgear market, as it is the gateway for international trade and a strong tourism sector. Projects, such as NEOM and the Red Sea development are transforming the region into a hub for luxury and sustainable infrastructure. Such development requires state-of-the-art switchgear systems to support energy-intensive operations while aligning with the sustainability goals driving the region's rapid development.

The Eastern region drives the massive demand for heavy-duty switchgear solutions tailored to critical energy operations. This region requires reliable systems for power distribution in industrial complexes and refineries. Additionally, the emergence of renewable energy projects in this region underscores the importance of advanced switchgear technologies in ensuring safe and efficient energy integration into the grid.

The Southern region’s contribution to the switchgear market is supported by its growing mining activities and expanding infrastructure. With a focus on harnessing natural resources, this region demands durable and efficient switchgear systems to handle challenging environmental conditions. Additionally, ongoing investments in residential and commercial developments emphasize the need for reliable power distribution networks, further solidifying the importance of switchgear in meeting the region's evolving energy requirements.

Competitive Landscape:

In the Saudi Arabia market, key players are forming partnerships and joint ventures with local bodies to improve their operational base and respond to the national focus on localization. Companies are heavily investing in research and development (R&D) to initiate innovations, thereby creating switchgear products that are not only more advanced and efficient but also eco-friendly. Companies are also aiming for product portfolio expansion to handle diverse industry needs. In addition to renewable energy integration and the application to smart grids, the companies are putting emphasis on comprehensive after-sales services and support to build long-term customer relationships and ensure operational reliability.

The report provides a comprehensive analysis of the competitive landscape in the Saudi Arabia switchgear market with detailed profiles of all major companies.

Latest News and Developments:

- On March 28, 2024, JERA and TAQA entered into a Power and steam purchase agreement with SATORP to develop a cogeneration plant for the Amiral petrochemical complex in Jubail, Saudi Arabia. The facility will include gas-insulated switchgear interconnections and provisions for future carbon capture and hydrogen co-firing capabilities.

- On November 30, 2024, Linxon secured a 400-million-Saudi-riyal EPC contract for a 380 kV turnkey substation at Taibah Power Plant in Madinah, Saudi Arabia. The project includes the installation of advanced switchgear and is part of Saudi Arabia's efforts to enhance grid reliability and meet growing energy demands.

Saudi Arabia Switchgear Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Voltages Covered | Low Voltage, Medium Voltage, High Voltage |

| Insulations Covered | Gas-Insulated Switchgear, Air-Insulated Switchgear |

| End Use Industries Covered | Residential, Commercial, Industrial |

| Regions Covered | Northern and Central Region, Western Region, Eastern Region, Southern Region |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Saudi Arabia switchgear market from 2019-2033.

- The research study provides the latest information on the market drivers, challenges, and opportunities in the Saudi Arabia switchgear market.

- Porter's Five Forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Saudi Arabia switchgear industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The Saudi Arabia switchgear market was valued at USD 1.8 Billion in 2024.

The market is driven by infrastructure projects like NEOM, grid modernization, renewable energy adoption, industrial diversification, rising EV infrastructure, and increased focus on sustainability through eco-friendly switchgear solutions.

IMARC estimates the Saudi Arabia switchgear market to exhibit a CAGR of 4.9% during 2025-2033.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)