Saudi Arabia Surgical Robots Market Size, Share, Trends and Forecast by Product, Application, End User, and Region, 2025-2033

Saudi Arabia Surgical Robots Market:

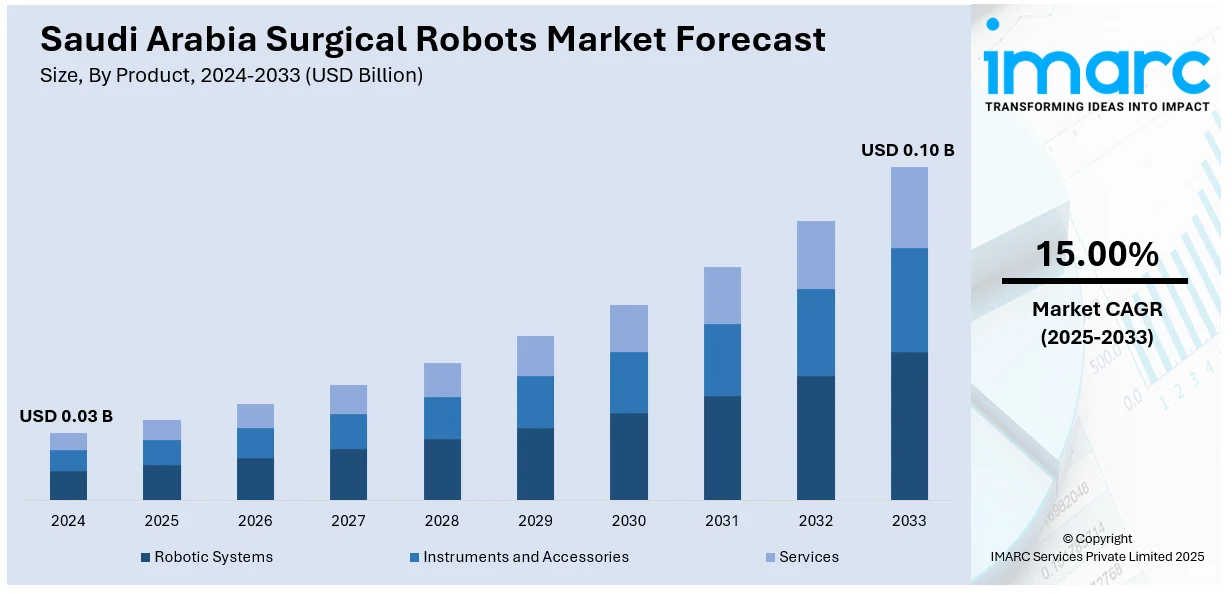

The Saudi Arabia surgical robots market size reached USD 0.03 Billion in 2024. Looking forward, IMARC Group expects the market to reach USD 0.10 Billion by 2033 exhibiting a growth rate (CAGR) of 15.00% during 2025-2033 The Saudi Arabia surgical robots market share is driven by increasing government investments in healthcare modernization, rising adoption of minimally invasive surgeries, and growing adoption of AI-driven robotic systems.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 0.03 Billion |

| Market Forecast in 2033 | USD 0.10 Billion |

| Market Growth Rate (2025-2033) | 15.00% |

Saudi Arabia Surgical Robots Market Trends:

Rising Prevalence of Chronic Diseases

Saudi Arabia is witnessing a significant rise in chronic diseases such as obesity, diabetes, and cardiovascular disorders, driving the demand for minimally invasive surgical interventions. As per the research published by Frontiers, various chronic diseases were present in 49.4% of the people covered in a survey conducted in Riyadh, Saudi Arabia in 2023. According to the ADL and Barthel index, the prevalence of impairments was 33.6 and 49.7%, respectively, and among participants with MLTCs, these rates rose by 42.5 and 58.1%. The country has a high obesity rate, leading to increased cases of bariatric surgeries, where robotic-assisted procedures enhance precision and reduce complications. Similarly, the growing prevalence of cancer, particularly prostate and colorectal cancers, is fueling the demand for robotic-assisted oncological surgeries, which offer superior precision compared to traditional methods. The increasing geriatric population also contributes to the demand for robotic-assisted orthopedic and neurological surgeries to manage age-related conditions. Healthcare providers are increasingly relying on robotic surgery for reduced hospital stays, lower infection rates, and faster recovery, improving overall patient outcomes. This trend is pushing both public and private hospitals to invest in advanced robotic surgical systems to cater to the rising volume of complex procedures.

Government Investments in Healthcare Modernization

The Saudi Arabian government is diligently investing in healthcare modernization as part of its Vision 2030 strategy, aiming to enhance medical structure and ameliorate patient issues. As per US Saudi Arabian Business Council, Saudi Arabia has the largest healthcare sector in the Middle East. The government prioritizes healthcare services and training, allocating 13.5% of its budget to this area. The Health Sector Transformation Program focuses on expanding robotic- supported surgeries to reduce reliance on foreign medical expertise and encourage medical tourism. The Saudi Ministry of Health (MoH) and private hospital networks are embracing robotic surgical systems to give minimally invasive procedures that enhance perfection and reduce recovery times. Government- backed initiatives, including partnerships with global medical technology enterprises, are accelerating the acceptance of robotic- supported surgery. The National Unified Procurement Company (NUPCO) facilitates large- scale procurement of surgical robots, increasing wide availability in public hospitals. Also, investments in medical education and robotic surgery training for surgeons are strengthening domestic expertise, ensuring a skilled workforce able to use robotic-supported procedures across various surgical disciplines.

Saudi Arabia Surgical Robots Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the region/country level for 2025-2033. Our report has categorized the market based on product, application, and end user.

Product Insights:

- Robotic Systems

- Instruments and Accessories

- Services

The report has provided a detailed breakup and analysis of the market based on the product. This includes robotic systems, instruments and accessories, and services.

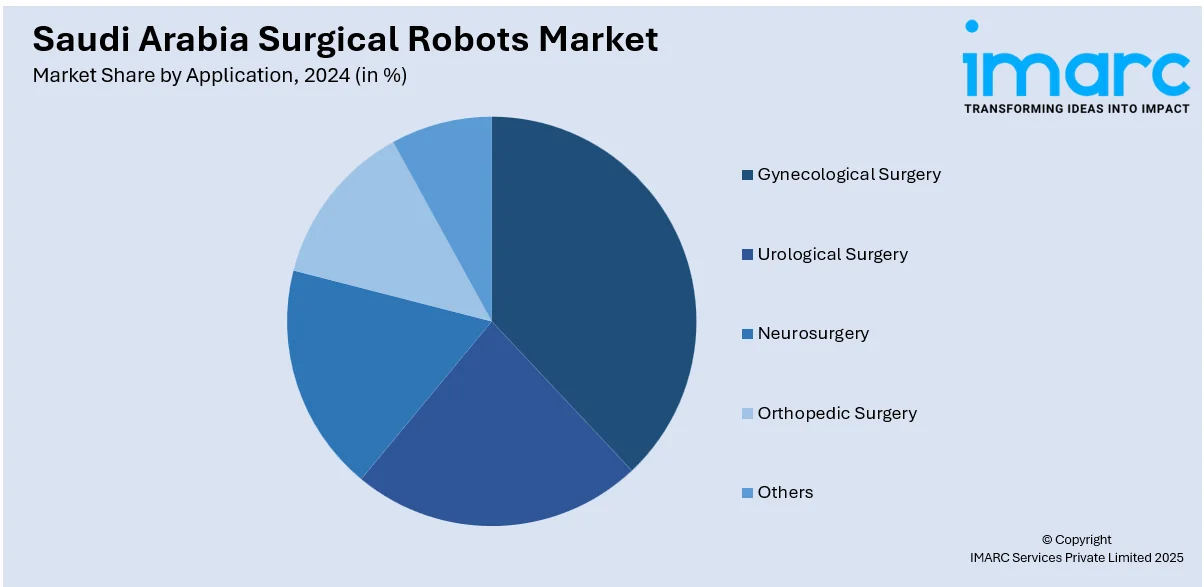

Application Insights:

- Gynecological Surgery

- Urological Surgery

- Neurosurgery

- Orthopedic Surgery

- Others

A detailed breakup and analysis of the market based on the application have also been provided in the report. This includes gynecological surgery, urological surgery, neurosurgery, orthopedic surgery, and others.

End User Insights:

- Hospitals

- Ambulatory Surgical Centers

- Others

The report has provided a detailed breakup and analysis of the market based on the end user. This includes hospitals, ambulatory surgical centers, and others.

Regional Insights:

- Northern and Central Region

- Western Region

- Eastern Region

- Southern Region

The report has also provided a comprehensive analysis of all the major regional markets, which include Northern and Central Region, Western Region, Eastern Region, and Southern Region.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Saudi Arabia Surgical Robots Market News:

- In September 2024, the King Faisal Specialist Hospital & Research Centre (KFSHRC) in Riyadh, executed the world's first entirely robotic heart transplant of a 16-year-old patient with last-stage heart failure.

- In October 2023, Royal Philips (NYSE: PHG, AEX: PHIA), a global pioneer in health technology, showcased breakthrough healthcare innovations at the Global Health Exhibition held at the Riyadh Front Exhibition & Conference Centre (RFECC) from October 29 to 31, 2023. The Image Guided Therapy Philips Zenition 10 C-arm, an addition to the company's Zenition mobile C-arm series was intended to increase patient access to surgical care and minimally invasive procedures. The usage of a C-arm has various advantages in surgical settings.

Saudi Arabia Surgical Robots Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Products Covered | Robotic Systems, Instruments and Accessories, Services |

| Applications Covered | Gynecological Surgery, Urological Surgery, Neurosurgery, Orthopedic Surgery, Others. |

| End Users Covered | Hospitals, Ambulatory Surgical Centers, Others |

| Regions Covered | Northern and Central Region, Western Region, Eastern Region, Southern Region |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Saudi Arabia surgical robots market performed so far and how will it perform in the coming years?

- What is the breakup of the Saudi Arabia surgical robots market on the basis of product?

- What is the breakup of the Saudi Arabia surgical robots market on the basis of application?

- What is the breakup of the Saudi Arabia surgical robots market on the basis of end user?

- What are the various stages in the value chain of the Saudi Arabia surgical robots market?

- What are the key driving factors and challenges in the Saudi Arabia surgical robots market?

- What is the structure of the Saudi Arabia surgical robots market and who are the key players?

- What is the degree of competition in the Saudi Arabia surgical robots market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Saudi Arabia surgical robots market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Saudi Arabia surgical robots market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Saudi Arabia surgical robots industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)