Saudi Arabia Sun Care Products Market Size, Share, Trends and Forecast by Product Type, Product Form, Gender, Distribution Channel, and Region, 2026-2034

Saudi Arabia Sun Care Products Market Summary:

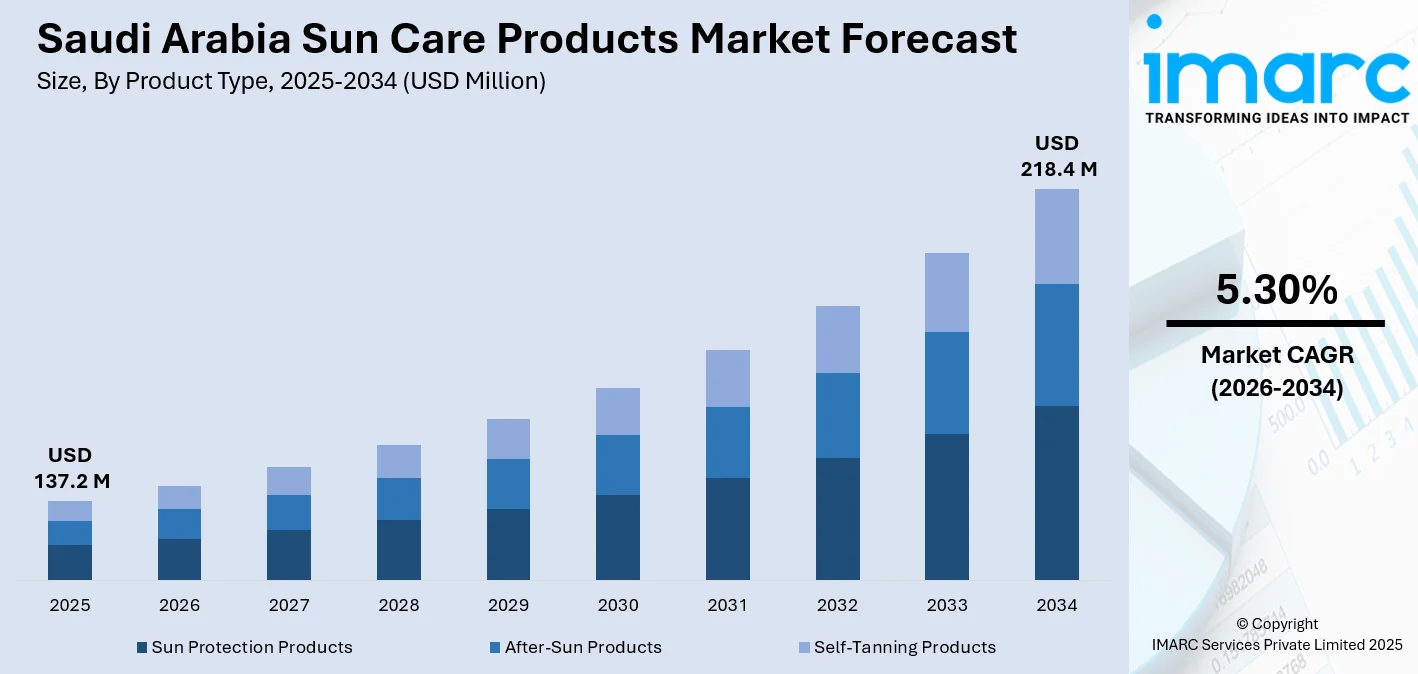

The Saudi Arabia sun care products market size was valued at USD 137.2 Million in 2025 and is projected to reach USD 218.4 Million by 2034, growing at a compound annual growth rate of 5.30% from 2026-2034.

The Saudi Arabia sun care products market is experiencing stable expansion driven by heightened awareness of UV protection and skin health among consumers. The Kingdom's extreme climatic conditions, characterized by intense solar radiation, have increased the adoption of sun protection products in daily skincare routines. Rising disposable incomes and evolving beauty standards are further accelerating the demand for premium and dermatologist-recommended sun care formulations across diverse consumer demographics.

Key Takeaways and Insights:

- By Product Type: Sun protection products dominate the market with a share of 67% in 2025, driven by the Kingdom's extreme UV exposure levels and growing consumer awareness of skin damage prevention. The increasing emphasis on daily sun protection as part of comprehensive skincare routines has positioned sun protection products as essential personal care items for both outdoor workers and urban residents.

- By Product Form: Cream leads the market with a share of 31% in 2025, due to its exceptional moisturizing qualities and simplicity of use, which attract customers looking for both hydration and sun protection advantages. The format's ability to deliver intensive care while providing long-lasting protection makes it particularly suitable for the Kingdom's arid climate conditions.

- By Gender: Female represents the biggest segment with a share of 54% in 2025, reflecting the strong emphasis on skincare and beauty routines among Saudi women. Increasing female workforce participation and greater engagement in outdoor recreational activities have amplified demand for comprehensive sun protection solutions tailored to female consumer preferences.

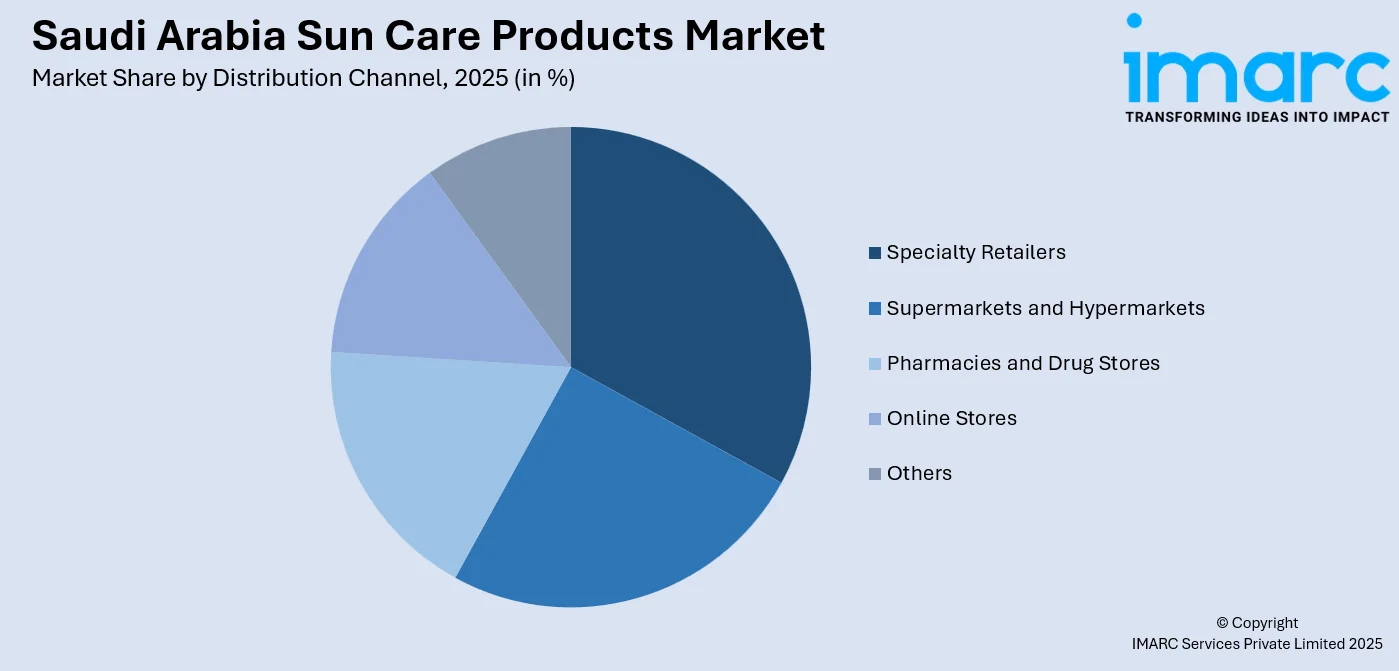

- By Distribution Channel: Specialty retailers lead the market with a share of 30% in 2025, attributed to their curated product assortments, expert consultation services, and personalized shopping experiences that help consumers navigate the extensive range of sun care products. The hands-on product testing and professional recommendations available at specialty stores drive consumer confidence in purchasing decisions.

- By Region: Northern and Central Region is the largest region with 35% share in 2025, driven by the concentration of Saudi Arabia's population in major metropolitan areas including Riyadh. Higher disposable incomes, extensive retail infrastructure, and greater exposure to international beauty trends contribute to the region's dominant position in sun care product consumption.

- Key Players: Key players drive the Saudi Arabia sun care products market by expanding product portfolios with innovative formulations, investing in dermatologically-tested solutions, and strengthening nationwide distribution networks. Their focus on developing climate-appropriate products and digital marketing strategies enhances brand visibility and accessibility.

To get more information on this market Request Sample

The Saudi Arabia sun care products market is witnessing significant expansion fueled by multiple converging factors that are reshaping consumer behavior across the Kingdom. The extreme climatic conditions characterized by temperatures frequently exceeding 45°C and intense UV radiation levels have necessitated the adoption of protective skincare products as daily essentials. The growing health consciousness among Saudi consumers, particularly regarding the long-term effects of sun exposure including premature aging and skin damage, has elevated the importance of sun care within personal care routines. Female workforce participation reached 36.2% in 2024, creating a substantial consumer demographic with increasing purchasing power and heightened emphasis on professional appearance and skin protection. The influence of social media and beauty influencers has accelerated awareness of sun protection benefits, with consumers increasingly seeking products that combine efficacy with cosmetic elegance. The expansion of retail infrastructure, including specialty beauty stores and e-commerce platforms, has improved product accessibility across urban and semi-urban areas.

Saudi Arabia Sun Care Products Market Trends:

Rising Demand for Lightweight and Non-Greasy Formulations

Saudi consumers are increasingly gravitating toward lightweight, non-greasy sun care formulations that provide effective protection without causing discomfort in the Kingdom's hot and humid conditions. The preference for products that absorb quickly and leave no white residue has driven manufacturers to develop innovative textures including gels, fluids, and water-based formulations. These advanced products address the specific needs of consumers who require sun protection suitable for daily wear under makeup or during outdoor activities without feeling heavy on the skin.

Growing Preference for Halal-Certified and Natural Products

The demand for halal-certified and natural sun care products is experiencing substantial growth as Saudi consumers increasingly seek formulations that align with Islamic principles and clean beauty standards. Consumers are scrutinizing ingredient lists and favoring products free from harsh chemicals, parabens, and alcohol while ensuring compliance with religious requirements. This shift reflects broader wellness trends and has prompted both local and international brands to develop transparent, ethically formulated sun care solutions that combine religious compliance with dermatological efficacy.

Integration of Anti-Aging and Skincare Benefits

Sun care products incorporating anti-aging ingredients and skincare benefits beyond basic UV protection are gaining significant traction in the Saudi market. Consumers are seeking multifunctional formulations that address photoaging, hyperpigmentation, and skin barrier repair while providing broad-spectrum protection. The convergence of sun care with cosmeceuticals reflects the sophisticated demands of Saudi consumers who view sun protection as an integral component of comprehensive skincare regimens rather than a standalone seasonal product.

How Vision 2030 is Transforming the Saudi Arabia Sun Care Products Market:

Saudi Arabia's Vision 2030 is catalyzing transformative growth in the sun care products market through economic diversification, cultural liberalization, and enhanced quality of life initiatives. The expansion of tourism through mega-projects including NEOM and The Red Sea Project is generating unprecedented demand for sun protection products as millions of visitors and residents engage in outdoor recreational activities. Rising disposable incomes fueled by non-oil sector growth are enabling consumers to invest in premium sun care formulations. The government's establishment of the Halal Products Development Company through the Public Investment Fund positions Saudi Arabia as a regional hub for halal-certified beauty products. Increased female workforce participation and greater public engagement have amplified demand for professional-grade sun care solutions tailored to active lifestyles.

Market Outlook 2026-2034:

The Saudi Arabia sun care products market is positioned for sustained expansion throughout the forecast period, driven by increasing health awareness, climate-related demand, and evolving consumer preferences for sophisticated formulations. The market generated a revenue of USD 137.2 Million in 2025 and is projected to reach a revenue of USD 218.4 Million by 2034, growing at a compound annual growth rate of 5.30% from 2026-2034. The expansion of e-commerce platforms and digital beauty retail is enhancing product accessibility, with online sales channels experiencing rapid growth. The premiumization trend continues to reshape purchasing patterns as consumers increasingly favor dermatologically-tested, high-SPF products from established international brands. Manufacturers are responding with innovative formulations addressing specific climate challenges including extreme heat resistance and long-lasting protection.

Saudi Arabia Sun Care Products Market Report Segmentation:

|

Segment Category |

Leading Segment |

Market Share |

|

Product Type |

Sun Protection Products |

67% |

|

Product Form |

Cream |

31% |

|

Gender |

Female |

54% |

|

Distribution Channel |

Specialty Retailers |

30% |

|

Region |

Northern and Central Region |

35% |

Product Type Insights:

- Sun Protection Products

- After-Sun Products

- Self-Tanning Products

Sun protection products dominate with a market share of 67% of the total Saudi Arabia sun care products market in 2025.

The dominance of sun protection products in the Saudi Arabian market reflects the fundamental consumer need for UV defense in a region characterized by extreme solar intensity. The Kingdom's geographic location and climate conditions, with temperatures regularly exceeding 45°C and consistently high UV index readings, have made sun protection an essential component of daily skincare routines. Consumers across all demographics are gradually recognizing the importance of protecting skin from harmful radiation, driving consistent demand for broad-spectrum sunscreen formulations throughout the year.

The segment's growth is further propelled by increasing awareness of skin health and the long-term consequences of unprotected sun exposure. In February 2025, L'Oréal Groupe showcased over twenty beauty tech innovations at LEAP 2025 in Riyadh, including advanced skin diagnostic tools that emphasize personalized sun protection recommendations. Saudi consumers are increasingly gravitating toward high-SPF formulations offering protection against both UVA and UVB rays, with water-resistant and sweat-proof variants gaining particular traction among active individuals and outdoor workers.

Product Form Insights:

- Cream

- Gel

- Lotion

- Wipes

- Spray

- Others

Cream leads with a share of 31% of the total Saudi Arabia sun care products market in 2025.

The cream format maintains its leading position in the Saudi sun care market due to its superior ability to deliver intensive moisturization alongside sun protection benefits. Saudi Arabia's arid climate, characterized by low humidity and high temperatures, creates significant skin hydration challenges that cream formulations effectively address. The rich texture of sun protection creams provides a protective barrier that locks in moisture while shielding skin from harmful UV radiation, making them particularly appealing to consumers with dry or sensitive skin types.

The segment's strength is reinforced by consumer preferences for products offering comprehensive skincare benefits beyond basic sun protection. In July 2024, Nivea introduced its Luminous630 Even Skin Tone range in Saudi Arabia, featuring cream-based formulations addressing hyperpigmentation concerns prevalent among regional consumers. The format's versatility in incorporating active ingredients such as vitamins, antioxidants, and anti-aging compounds enables manufacturers to develop multifunctional products that satisfy the sophisticated demands of Saudi consumers seeking value-added sun care solutions.

Gender Insights:

- Female

- Male

- Unisex

Female exhibits a clear dominance with a 54% share of the total Saudi Arabia sun care products market in 2025.

The female segment's dominance in the Saudi sun care products market reflects the strong emphasis on skincare and beauty routines among Saudi women. Cultural shifts under Vision 2030 have expanded women's public participation and workforce engagement, creating heightened demand for professional-grade sun protection solutions. Saudi women demonstrate a sophisticated approach to personal care, incorporating multiple products into their daily facial routines where sun protection serves as a foundational component of comprehensive beauty regimens. The growing visibility of women in professional and social settings has intensified the focus on skin health and appearance, driving consistent investment in high-quality sun care formulations that offer both protection and cosmetic elegance.

The segment benefits from increasing purchasing power and evolving beauty consciousness among female consumers. In November 2024, clean beauty brand Kosas officially entered the Saudi market through Sephora, offering skincare-focused makeup products that incorporate sun protection benefits, demonstrating the growing demand for products that serve multiple functions. Female consumers are particularly receptive to innovations in formulation aesthetics, favoring lightweight textures that integrate seamlessly under makeup while providing reliable UV protection throughout the day.

Distribution Channel Insights:

Access the comprehensive market breakdown Request Sample

- Supermarkets and Hypermarkets

- Specialty Retailers

- Pharmacies and Drug Stores

- Online Stores

- Others

Specialty retailers represent the leading segment with a 30% share of the total Saudi Arabia sun care products market in 2025.

Specialty retailers maintain their leadership position in the Saudi sun care products market through their distinctive ability to offer curated product assortments, expert consultation services, and immersive shopping experiences that build consumer confidence. Retailers including Sephora, Paris Gallery, and Faces (Wojooh) provide trained beauty advisors who guide customers through complex product choices, offer personalized recommendations based on skin type and lifestyle, and enable hands-on product testing before purchase. These stores create environments where consumers can explore premium formulations, receive professional skincare consultations, and access exclusive product launches unavailable through other channels.

The channel's strength is reinforced by its role as the preferred destination for premium and prestige sun care brands seeking brand-appropriate retail environments. In November 2025, e.l.f. Beauty launched exclusively across seventy Sephora stores in the Gulf Cooperation Council region, including Saudi Arabia, highlighting the channel's continued importance for brand introductions. Specialty retailers' ability to create educational experiences around sun protection, demonstrate product efficacy, and offer loyalty rewards programs generates customer engagement that mass-market channels cannot replicate.

Regional Insights:

- Northern and Central Region

- Western Region

- Eastern Region

- Southern Region

Northern and Central Region dominates the market with a 35% share of the total Saudi Arabia sun care products market in 2025.

The Northern and Central Region's market leadership stems from the concentration of Saudi Arabia's population and economic activity in major metropolitan centers, particularly Riyadh. The capital city serves as the Kingdom's primary hub for retail infrastructure, featuring the highest density of specialty beauty stores, shopping malls, and e-commerce fulfillment centers. Residents of this region demonstrate higher per-capita spending on personal care products, reflecting above-average disposable incomes and sophisticated consumer preferences. The urban lifestyle and professional work environments prevalent in this region drive consistent demand for premium sun care solutions suitable for daily use.

The region's dominance is further reinforced by its role as the epicenter of Vision 2030 implementation and economic transformation. The presence of government institutions, multinational corporations, and a substantial expatriate population creates diverse demand patterns that drive innovation and product variety in the sun care category. International beauty brands prioritize this region for new product launches and flagship store openings, ensuring residents have early access to the latest sun care innovations. The well-developed logistics infrastructure also facilitates efficient distribution of products across the region's extensive retail network.

Market Dynamics:

Growth Drivers:

Why is the Saudi Arabia Sun Care Products Market Growing?

Increasing Consumer Awareness of UV Protection and Skin Health

The growing understanding of the detrimental effects of prolonged UV exposure on skin health is driving significant demand for sun care products in Saudi Arabia. Consumers are increasingly educated about the risks of photoaging, hyperpigmentation, and skin cancer, prompting proactive adoption of sun protection as part of daily skincare routines. The influence of social media platforms and beauty influencers has accelerated this awareness, with skincare education content reaching millions of digitally-connected Saudi consumers who now prioritize UV protection regardless of season or outdoor activity level. The beauty industry in the GCC region experienced twelve percent growth in 2024, with skincare leading at seventeen percent according to the Chalhoub Group's GCC Personal Luxury report, reflecting the heightened emphasis on skin health. This shift from reactive to preventive skincare behavior has expanded the consumer base beyond traditional sunscreen users to include indoor workers and young adults seeking long-term skin preservation benefits.

Rising Female Workforce Participation and Changing Lifestyles

The substantial increase in female workforce participation under Vision 2030 is fundamentally reshaping demand patterns in the Saudi sun care products market. Working women with higher disposable incomes are investing in comprehensive skincare routines that include high-quality sun protection products suitable for professional environments. The growing presence of women in the workforce has created a substantial consumer demographic with sophisticated beauty preferences and increased purchasing power. Women entering professional careers in healthcare, finance, technology, and other sectors require products that provide all-day protection while maintaining an elegant appearance under makeup. This lifestyle transformation has driven demand for premium, multifunctional sun care formulations that address the needs of active, career-focused consumers seeking convenience without compromising on protection or aesthetic appeal. The shift toward professional lifestyles has also elevated expectations for product performance, with working women seeking formulations that withstand long hours in air-conditioned offices and outdoor commutes while delivering visible skincare benefits.

Expansion of E-commerce and Digital Beauty Retail Channels

The rapid expansion of e-commerce platforms and digital retail channels is transforming how Saudi consumers discover and purchase sun care products. The Kingdom's exceptional internet penetration rate of ninety-nine percent and social media usage rate of 94.3% among the population create unprecedented opportunities for online beauty retail. E-commerce platforms offer consumers expanded product selection, competitive pricing, convenient home delivery, and access to international brands not available in physical retail locations. The integration of virtual try-on tools, AI-powered skin analysis, and personalized product recommendations is enhancing the online shopping experience for sun care products.

Market Restraints:

What Challenges the Saudi Arabia Sun Care Products Market is Facing?

Stringent Regulatory Requirements and Compliance Costs

The Saudi Food and Drug Authority enforces rigorous regulatory requirements for cosmetic products that create barriers to market entry and increase compliance costs. Manufacturers and importers must navigate complex registration procedures through the GHAD system, maintain detailed product information files, and obtain certificates of conformity before market distribution. The evolving regulatory landscape requires continuous monitoring as the SFDA periodically updates restricted and prohibited ingredient lists, necessitating reformulation efforts and documentation updates.

Price Sensitivity Among Mass-Market Consumers

Despite rising disposable incomes among certain demographics, price sensitivity remains a significant factor limiting sun care product adoption among mass-market consumers. Economic fluctuations linked to oil price volatility can impact consumer spending on non-essential personal care products, prompting shifts toward lower-priced alternatives during periods of uncertainty. The mass category accounts for approximately sixty-one percent of the beauty and personal care market, underscoring the importance of affordability in purchasing decisions.

Climate-Related Formulation Stability Challenges

Saudi Arabia's extreme climatic conditions pose unique challenges for sun care product formulation stability and shelf life. The combination of high temperatures, low humidity, and intense UV radiation can degrade active ingredients and compromise product efficacy. Manufacturers must invest in advanced stabilization technologies and temperature-controlled supply chain logistics to maintain product integrity, increasing production and distribution costs that may ultimately impact consumer pricing.

Competitive Landscape:

The Saudi Arabia sun care products market features a dynamic competitive landscape with international giants and regional specialists vying for consumer attention. Leading multinational corporations leverage established brand equity, extensive research capabilities, and global distribution networks to capture premium market segments. These players continuously invest in product innovation, developing climate-appropriate formulations with advanced UV filtering technologies tailored to Saudi consumer needs. Local and regional companies compete by offering halal-certified products and culturally resonant brand positioning. The competitive intensity is driving premiumization, with brands differentiating through dermatological credentials, clean beauty certifications, and multifunctional formulations. Strategic partnerships with specialty retailers and aggressive digital marketing campaigns on social media platforms are key competitive tactics.

Saudi Arabia Sun Care Products Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Product Types Covered | Sun Protection Products, After-Sun Products, Self-Tanning Products |

| Product Forms Covered | Cream, Gel, Lotion, Wipes, Spray, Others |

| Genders Covered | Female, Male, Unisex |

| Distribution Channels Covered | Supermarkets and Hypermarkets, Specialty Retailers, Pharmacies and Drug Stores, Online Stores, Others |

| Regions Covered | Northern and Central Region, Western Region, Eastern Region, Southern Region |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report

The Saudi Arabia sun care products market size was valued at USD 137.2 Million in 2025.

The Saudi Arabia sun care products market is expected to grow at a compound annual growth rate of 5.30% from 2026-2034 to reach USD 218.4 Million by 2034.

Sun protection products dominated the market with a share of 67%, driven by the Kingdom's extreme UV exposure levels, growing consumer awareness of skin damage prevention, and the integration of sun protection into daily skincare routines.

Key factors driving the Saudi Arabia sun care products market include increasing consumer awareness of UV protection and skin health, rising female workforce participation and changing lifestyles, expansion of e-commerce and digital beauty retail channels, and the growing preference for halal-certified and premium formulations.

Major challenges include stringent regulatory requirements and compliance costs imposed by the Saudi Food and Drug Authority, price sensitivity among mass-market consumers, climate-related formulation stability challenges, and competition from counterfeit products in unregulated channels.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)