Saudi Arabia Steel Market Size, Share, Trends and Forecast by Type, Product, Application, and Region, 2025-2033

Saudi Arabia Steel Market Size and Share:

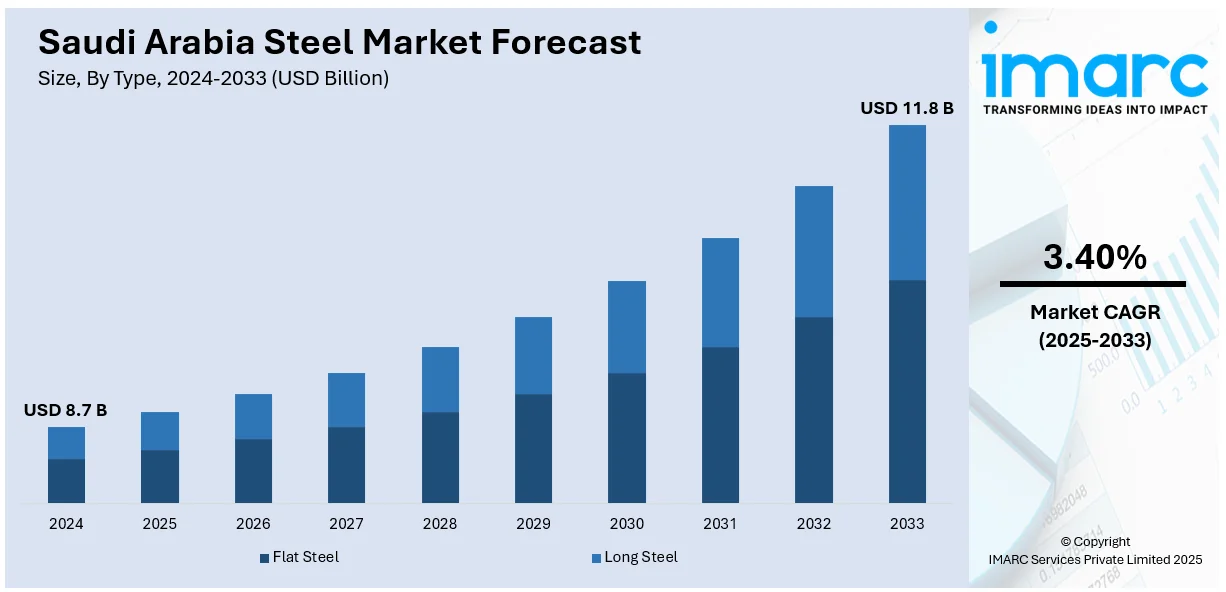

The Saudi Arabia steel market size was valued at USD 8.7 Billion in 2024. Looking forward, IMARC Group estimates the market to reach USD 11.8 Billion by 2033, exhibiting a CAGR of 3.40% from 2025-2033. The market is driven by the growing investment in large-scale infrastructure projects, where steel is a major component. Along with this, the rising demand of steel in oil refineries and pipelines in the oil and gas market due to its anti-corrosive and durable structure is stimulating market growth.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 8.7 Billion |

| Market Forecast in 2033 | USD 11.8 Billion |

| Market Growth Rate (2025-2033) | 3.40% |

As per the report published on the website of the IMARC Group, the Saudi Arabia construction market size was valued at USD 97.8 Billion in 2024. The current infrastructure development initiatives in Saudi Arabia are the key drivers of the steel sector because of massive investments associated with large-scale projects under Vision 2030. The diversification of the economy, development of smart cities, and modernization of transport network are driving the demand for steel. Mega projects like new mega cities, new future (NEOM), Red Sea development project, and Riyadh Metro lead to an increase in the utilization of steel as these megaprojects involve a lot of steel products for structural frameworks, bridges, roads, and building applications.

As the largest oil exporter in the world, Saudi Arabia makes substantial investments in expansion and modernization of energy infrastructure that includes the refineries, pipelines, drilling platforms, and storage facilities, all of which require vast quantities of steel for construction and operations. Steel is vital for the construction of strong and anti-corrosive structures that can withstand harshness during their usage for oil extraction and transportation. For the production of offshore rigs, pipelines, and oil platforms specialized steel grade is required. The persistent demand for steel is mainly driven by increased exploration in untapped oil reserves and an expanding downstream sector that includes refining and petrochemical production. IMARC Group’s report predicts that the Saudi Arabia oil and gas midstream market will exhibit a growth rate (CAGR) of 5.13% during 2024-2032.

Saudi Arabia Steel Market Trends:

Growing housing demand and urbanization

According to the report by the IMARC Group, the Saudi Arabia residential real estate market size has reached USD 71.8 Billion in 2024. Population growth, especially in major urban centers like Riyadh, Jeddah, and Dammam, is resulting in the rising need for development of residential, commercial, and mixed-use buildings. Affordable housing as one of the government's prime agendas under Vision 2030 is fast-tracking construction projects that can cater to a wide population. Urbanization will make all other infrastructural features, such as roads and bridges, schools and hospitals. All these use steel while undertaking their construction. As a result of this, the market goes on experiencing continuous growth in regard to large volumes of this required steel for structural reinforcement and framing and building material.

Development of transportation infrastructure

The developing transport infrastructure in Saudi Arabia is another force driving the market in the country. With the Vision 2030 the government is investing in expanding government infrastructures including roads, railways, airports, seaports, and hubs for logistics, which require steel in both the construction and maintenance. The increasing focus on improving road networks is also driving the demand for steel in construction highways, flyovers, and tunnels. Most of these projects strive to deliver connectivity within the region as well as internationally, these projects require steel for structural integrating, thus driving the demand for steel in developing transportation infrastructure across the globe. The IMARC Group’s report predicts that the Saudi Arabia transportation infrastructure construction market will exhibit a growth rate (CAGR) of 2.53% during 2024-2032.

Increasing application in renewable energy projects

The data published on the website of IMARC Group shows that the Saudi Arabia renewable energy market size reached 2.1 Gigawatt in 2024. An increase in the number of renewable energy projects in Saudi Arabia is significantly influencing the market. Under Vision 2030, the Government of Saudi Arabia is investing in renewable energy, particularly solar and wind sources, aiming to curtail its oil dependency and diversify its energy sources. Steel is important for these projects as it is used in creating solar power plants as well as wind turbines and energy storage systems. Steel is vital in any solar power project for constructing frames and support structure that hold and sustain stable solar panels over an extended period.

Saudi Arabia Steel Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the Saudi Arabia steel market, along with forecast at the country and regional levels from 2025-2033. The market has been categorized based on type, product, and application.

Analysis by Type:

- Flat Steel

- Long Steel

Flat steel products, like coils, sheets, and plates, find applications in industries, such as automobiles, appliances, and construction. This segment is continuously gaining importance with the growing demand in vehicles, household products, and infrastructure. Flat steel’s versatility, including its ability to be easily processed into different shapes and sizes, makes it suitable for application in the manufacturing sector.

Long steel products include bars, rods, and structural beams. These products are essential in construction and infrastructure and for industrial applications. They are primarily used to reinforce concrete or to build up frameworks or machinery. Major infrastructure projects that are taking place in Saudi Arabia, such as the New Future (NEOM) city and other Vision 2030 initiatives are driving demand for long steel.

Analysis by Product:

- Structural Steel

- Prestressing Steel

- Bright Steel

- Welding Wire and Rod

- Iron Steel Wire

- Ropes

- Braids

Structural steel is a key material in the construction of buildings, bridges, and industrial structures. The growing demand for structural steel is driven by the increasing infrastructure development in Saudi Arabia, for example the NEOM city project, as well as the urbanization under Vision 2030. The strength of this product makes it ideal for any large-scale construction projects considering its durability and versatility in carrying heavy loads.

Prestressing steel is predominantly incorporated into pre-stressed concrete for the strengthening and reinforcement of structures, such as bridges, highways, and high-rise buildings. The construction sector is expanding in Saudi Arabia, particularly long-span bridges, and large commercial buildings, which is impelling the market growth of prestressing steel.

Bright steel is a cold-finished steel with a better surface finish than normal cold-finished steel. It is primarily used for precision engineering applications like automotive, machinery, and electrical components. The continuing growth of the manufacturing and automotive industries in Saudi Arabia is increasing the demand for bright steel in the manufacture of components that are manufactured with dimensional accuracy and smooth finish.

Welding wires and rods function as very important materials for welding activities in construction, automotive, and manufacturing applications. As industrial activities and infrastructural developments increase, the demand for welding materials to join metal components undergoes an upward trend. In Saudi Arabia, expanding construction of steel frameworks, industrial plants, and pipeline construction directly lead to the demand for welding wire and rods.

Iron steel wire is manufactured into diverse uses, from reinforcing concrete to producing fences, springs, and cables. The rising construction activities in Saudi Arabia, especially the residential and commercial sectors, is catalyzing the demand for iron steel wire. The versatility, strength, and corrosion resistance providing long service life to components, such as wire ropes for lifting equipment in various sectors of the industry.

Ropes and braids made of steel are used in heavy-duty applications like lifting, rigging, and performing industrial machinery applications. Industries in Saudi Arabia, such as oil and gas, construction, and mining make extensive use of steel rope and braids for lifting and securing heavy loads. The material’s ability to withstand high tensions is driving its demand.

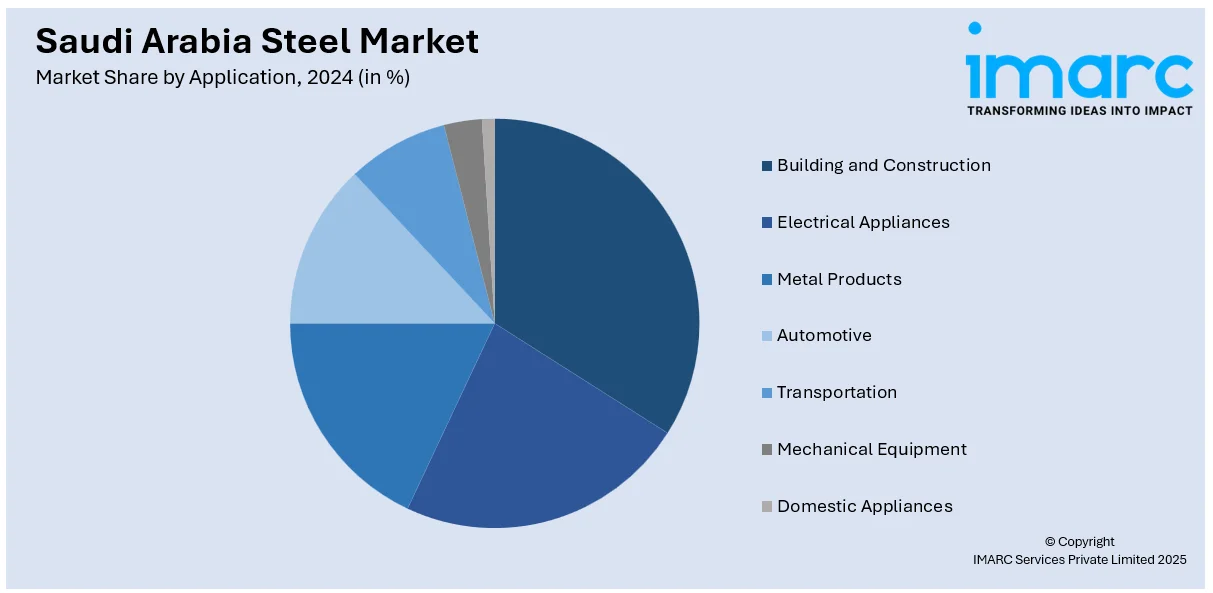

Analysis by Application:

- Building and Construction

- Electrical Appliances

- Metal Products

- Automotive

- Transportation

- Mechanical Equipment

- Domestic Appliances

The construction sector is the primary user of steel requiring varieties of steel products for structural reinforcement, beams, and frameworks. Construction and real estate related developments largely attract investments under Vision 2030 that further strengthens the growth of the market.

As a result of its strength, durability, and heat and pressure resistance steel is extensively used in electrical appliances. With the expanding consumer electronics market in Saudi Arabia, the demand for steel continues to rise, particularly in electrical applications. Steel's moldability into different shapes and resistance to corrosion are all contributing to its wide usage in appliance manufacturing.

Steel is the primary raw material in the production of numerous metal products utilized in diverse industries. In Saudi Arabia, steel production is rapidly expanding to meet steel requirement for manufacturing various metal goods.

The automotive industry is among the highest users of steel in manufacturing vehicle bodies, engines, and chassis. Steel demand is increasing with the growth of the automotive industry in Saudi Arabia, spurred by expanding production and sales of vehicles. Strength, balanced with durability, and cost-effectiveness combine to make steel the preferred material for manufacturing vehicles.

Steel plays a pivotal role in the transportation industry since it is utilized in manufacturing ships, trains, and all kinds of transport infrastructure. The expanding transport network in Saudi Arabia including railways, ports, and airports is impelling the market growth for steel in the country.

Steel is preferred for manufacturing mechanical equipment like pumps, valves, and compressors. It provides strength and toughness, along with resistance to wear and tear. In Saudi Arabia, the expansion of the industrial sectors particularly oil and gas and manufacturing leads to an increase in the demand for steel in mechanical equipment.

In household domestic appliances like kitchen tools, washing machines and refrigerators steel provides strength and durability. Growth in the consumer goods sector in Saudi Arabia, increasing population and better living standards are strengthening the growth of the market.

Regional Analysis:

- Northern and Central Region

- Western Region

- Eastern Region

- Southern Region

Steel demand is rising in the northern and central regions of Saudi Arabia owing to the rising construction activities. Major infrastructure and residential projects are continuously being developed in this area, which includes the capital city of Riyadh. These involve new urban infrastructure and commercial areas-all of which require huge quantities of steel.

The Western part of the country, particularly Jeddah and Mecca, plays a very vital role in the market. Construction activities are concentrated in this area, especially in the real estate, tourism, and religious sectors that is driving the demand for steel. Many mega projects like ports and hotels, alongside commercial buildings, are being developed all of which require huge quantities of steel.

The Eastern region houses the major industrial cities of Dammam and Khobar and consequently considered a hub of oil and gas industry in Saudi Arabia. The large petrochemical refineries and steel mills-in the region require huge amounts of steel for construction and manufacturing as well as for developing machinery and infrastructure.

The demand for steel in the region is largely driven by government projects directed towards improving the transportation system, urbanization, and public infrastructures. Steel demand in the area is influenced by the growing focus on infrastructure improvement within the region for residential housing combined with expansion of travel and tourism sector.

Competitive Landscape:

Key players in the Saudi Arabia play are offering quality steel products for infrastructure projects. Prominent steel producing enterprises are also leading the market in providing a wide range of steel products in the automotive, construction, and industrial sectors. They are focusing on production capacities as well as advanced technologies to maximize the availability of strong and cost-effective steel. Their active participation in Vision 2030 initiatives, such as constructing mega infrastructure projects and diversifying the economy from oil dependence further strengthens their market positions. These companies also provide the local job opportunities, research, and technology advancement of steel manufacturing that improve the process's efficiency. In 2024 Tosyali Holding announced a $5 billion investment to build a sustainable steel plant in Saudi Arabia, focusing on carbon-neutral technologies.

The report provides a comprehensive analysis of the competitive landscape in the Saudi Arabia steel market with detailed profiles of all major companies, including:

- Aasia Steel Factory Company Ltd.

- Al Ittefaq Steel Products Co.

- Al Sadd Steel Industrial Company

- Al-Gaswa Steel Industries Co.

- Al-Rajhi Steel

- Modern Factory For Steel Industries Co. Ltd.

- Shaaban Steel

- Solb Steel

- Zamil Structural Steel Company Limited

(Please note that this is only a partial list of the key players, and the complete list is provided in the report.)

Latest News and Developments:

-

August 2024: Bena Steel announced its plans to build a $6.6 million plant in Riyadh, aiming to boost Saudi Arabia's steel production.

Saudi Arabia Steel Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered | Flat Steel, Long Steel |

| Products Covered | Structural Steel, Prestressing Steel, Bright Steel, Welding Wire and Rod, Iron Steel Wire, Ropes, Braids |

| Applications Covered | Building and Construction, Electrical Appliances, Metal Products, Automotive, Transportation, Mechanical Equipment, Domestic Appliances |

| Regions Covered | Northern and Central Region, Western Region, Eastern Region, Southern Region |

| Companies Covered | Aasia Steel Factory Company Ltd., Al Ittefaq Steel Products Co., Al Sadd Steel Industrial Company, Al-Gaswa Steel Industries Co., Al-Rajhi Steel, Modern Factory For Steel Industries Co. Ltd., Shaaban Steel, Solb Steel, Zamil Structural Steel Company Limited, etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Saudi Arabia steel market from 2019-2033.

- The research study provides the latest information on the market drivers, challenges, and opportunities in the Saudi Arabia steel market.

- Porter's Five Forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Saudi Arabia steel industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

Steel is an alloy made by smelting iron and carbon with other alloying elements like manganese, chromium, and nickel to amplify its properties. It is known for its strength and durability coupled with its versatility. This makes it ideal for using in construction, automotive, and manufacturing industries. It is used in all kinds of products from infrastructure to tools and machinery.

The Saudi Arabia steel market was valued at USD 8.7 Billion in 2024.

IMARC estimates the Saudi Arabia steel market to exhibit a CAGR of 3.40% during 2025-2033.

The development of infrastructure under Vision 2030 is a key factor driving the Saudi Arabia steel market where mega projects including NEOM and Riyadh Metro are revamping steel demand. The expansion of the oil and gas sector also requires specialized alloys in pipelines and refinery constructions, while urbanization and housing demands fuel the construction and structural steel market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)