Saudi Arabia Sports and Fitness Goods Market Size, Share, Trends and Forecast by Product Type, Fitness Goods, Cardiovascular Training Goods, End Use, and Region, 2026-2034

Saudi Arabia Sports and Fitness Goods Market Overview:

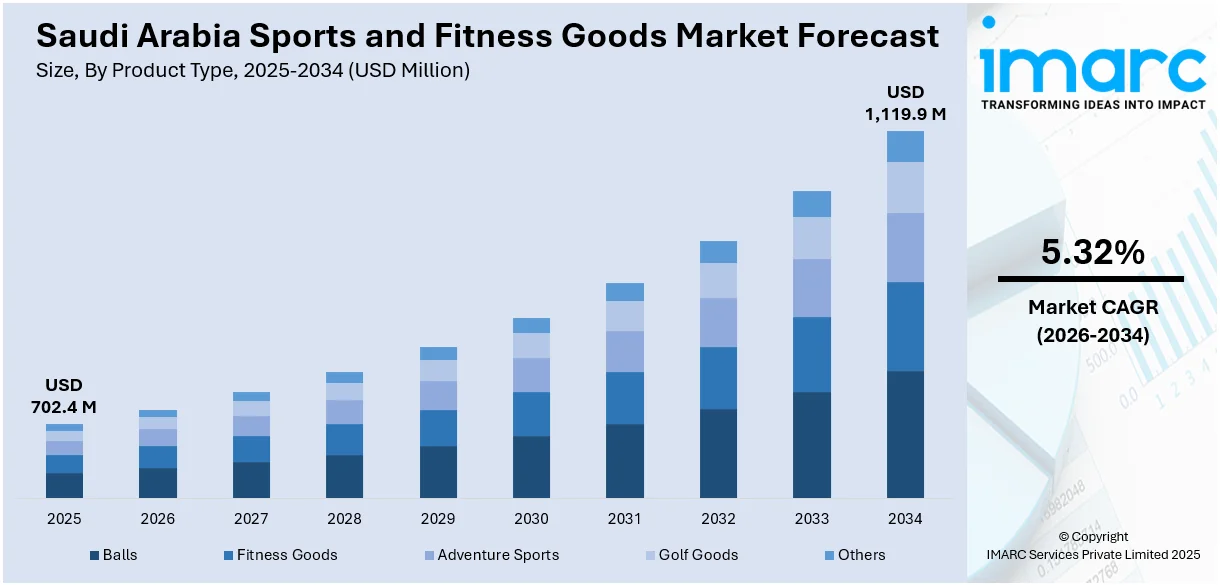

The Saudi Arabia sports and fitness goods market size reached USD 702.4 Million in 2025. Looking forward, IMARC Group expects the market to reach USD 1,119.9 Million by 2034, exhibiting a growth rate (CAGR) of 5.32% during 2026-2034. The market is mainly fueled by government programs like Vision 2030, which encourages healthy living and more engagement in sports. Other factors include escalating health consciousness, development of fitness facilities, and escalating demand for home workout equipment.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2025 |

|

Forecast Years

|

2026-2034

|

|

Historical Years

|

2020-2025

|

| Market Size in 2025 | USD 702.4 Million |

| Market Forecast in 2034 | USD 1,119.9 Million |

| Market Growth Rate 2026-2034 | 5.32% |

Saudi Arabia Sports and Fitness Goods Market Trends:

Technological Integration in Fitness Equipment

Today, advanced digital technology in fitness machines is transforming the Saudi Arabia sports and fitness goods market outlook. More fitness clubs and gymnasiums are now installing smart fitness devices, such as digital cardio and strength machines tracking exercise results, along with virtual training platforms. The government aims to increase the number of exercisers by 40% by 2030, as indicated in various industry reports. Thus, innovations offer the most personalized experiences to users through workout data, feedback on progress, and virtual coaching toward a tech-savvy consumer. While applications or online booking systems integrate the exercise journey, making appointment-scheduling and performance tracking easier, they also utilize virtual communities. The efficiency improvement by technology helps in offering efficient performance to fitness centers and it also aligns with the growing appetite among consumers in Saudi Arabia for personalized experiences and interactivity in fitness.

To get more information on this market Request Sample

Expansion of Women's Fitness Services

A notable trend influencing the Saudi Arabia Sports and Fitness Goods Market share is the expansion of services tailored specifically for women. The government's initiatives to promote women's participation in sports and physical activities have led to the establishment of women-only fitness centers and specialized programs. These facilities offer a range of services, including fitness classes, wellness programs, and health consultations, in environments that respect cultural norms. The increasing number of female members in major fitness chains reflects this shift, indicating a growing acceptance and demand for women's fitness services. For example, in 2023, Lamya Al-Nahdi, a 29-year-old hailing from Jeddah, etched her name in basketball history by becoming the first certified Saudi international basketball referee. Al-Nahdi exemplifies the changes occurring in Saudi Arabia. Alongside encouraging women's involvement in sports, the kingdom has passionately invested in enhancing its sports facilities, organizing significant events, and even attracting talents such as Cristiano Ronaldo. Hence, this trend contributes to the diversification of the fitness market and also empowers women to prioritize their health and well-being, fostering a more inclusive fitness culture in the kingdom.

Government Initiatives and Infrastructure Development

The Saudi Arabian government's commitment to enhance public health and promoting active lifestyles is a significant driver of the sports and fitness goods market. Initiatives such as the "Quality of Life" program aim to increase the number of individuals engaging in regular physical activity, thereby boosting demand for fitness-related products and services. Investments in sports infrastructure, including the construction of gyms, sports complexes, and recreational facilities, provide accessible venues for physical activities. While these developments encourage participation in sports they also stimulate the market for sports equipment and apparel. Additionally, the government's support for hosting international sporting events and partnerships with global sports organizations enhance the visibility and appeal of sports and fitness activities, further driving Saudi Arabia sports and fitness goods market growth.

Saudi Arabia Sports and Fitness Goods Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the regional level for 2026-2034. Our report has categorized the market based on product type, fitness goods, cardiovascular training goods, and end use.

Product Type Insights:

- Balls

- Fitness Goods

- Adventure Sports

- Golf Goods

- Others

The report has provided a detailed breakup and analysis of the market based on the product type. This includes balls, fitness goods, adventure sports, golf goods, and others.

Fitness Goods Insights:

- Cardiovascular Training Goods

- Strength Training Goods

The report has provided a detailed breakup and analysis of the market based on the fitness goods. This includes cardiovascular training goods and strength training goods.

Cardiovascular Training Goods Insights:

- Treadmills

- Stationary Bikes

- Rowing Machines

- Ellipticals

- Others

A detailed breakup and analysis of the market based on the cardiovascular training goods have also been provided in the report. This includes treadmills, stationary bikes, rowing machines, ellipticals, and others.

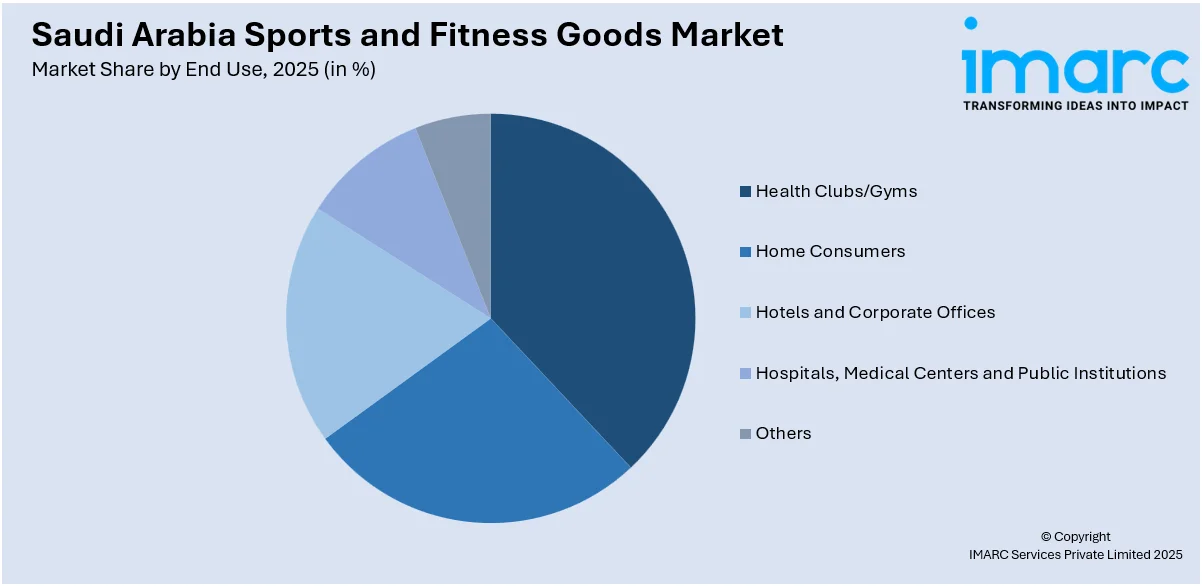

End Use Insights:

Access the comprehensive market breakdown Request Sample

- Health Clubs/Gyms

- Home Consumers

- Hotels and Corporate Offices

- Hospitals, Medical Centers and Public Institutions

- Others

The report has provided a detailed breakup and analysis of the market based on the end use. This includes health clubs/gyms, home consumers; hotels and corporate offices, hospitals, medical centers and public institutions, and others.

Regional Insights:

- Northern and Central Region

- Western Region

- Eastern Region

- Southern Region

The report has also provided a comprehensive analysis of all the major regional markets, which include Northern and Central Region, Western Region, Eastern Region, and Southern Region.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Saudi Arabia Sports and Fitness Goods Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Product Types Covered | Balls, Fitness Goods, Adventure Sports, Golf Goods, Others |

| Fitness Goods Covered | Cardiovascular Training Goods, Strength Training Goods |

| Cardiovascular Training Goods Covered | Treadmills, Stationary Bikes, Rowing Machines, Ellipticals, Others |

| End Uses Covered | Health Clubs/Gyms, Home Consumers, Hotels and Corporate Offices, Hospitals, Medical Centers and Public Institutions, Others |

| Regions Covered | Northern and Central Region, Western Region, Eastern Region, Southern Region |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Saudi Arabia sports and fitness goods market performed so far and how will it perform in the coming years?

- What is the breakup of the Saudi Arabia sports and fitness goods market on the basis of product type?

- What is the breakup of the Saudi Arabia sports and fitness goods market on the basis of fitness goods?

- What is the breakup of the Saudi Arabia sports and fitness goods market on the basis of cardiovascular training goods?

- What is the breakup of the Saudi Arabia sports and fitness goods market on the basis of end use?

- What is the breakup of the Saudi Arabia sports and fitness goods market on the basis of region?

- What are the various stages in the value chain of the Saudi Arabia sports and fitness goods market?

- What are the key driving factors and challenges in the Saudi Arabia sports and fitness goods market?

- What is the structure of the Saudi Arabia sports and fitness goods market and who are the key players?

- What is the degree of competition in the Saudi Arabia sports and fitness goods market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Saudi Arabia sports and fitness goods market from 2020-2034.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Saudi Arabia sports and fitness goods market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Saudi Arabia sports and fitness goods industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)