Saudi Arabia Solar Energy Storage Market Size, Share, Trends and Forecast by Type, Installation, and Region, 2025-2033

Saudi Arabia Solar Energy Storage Market Overview:

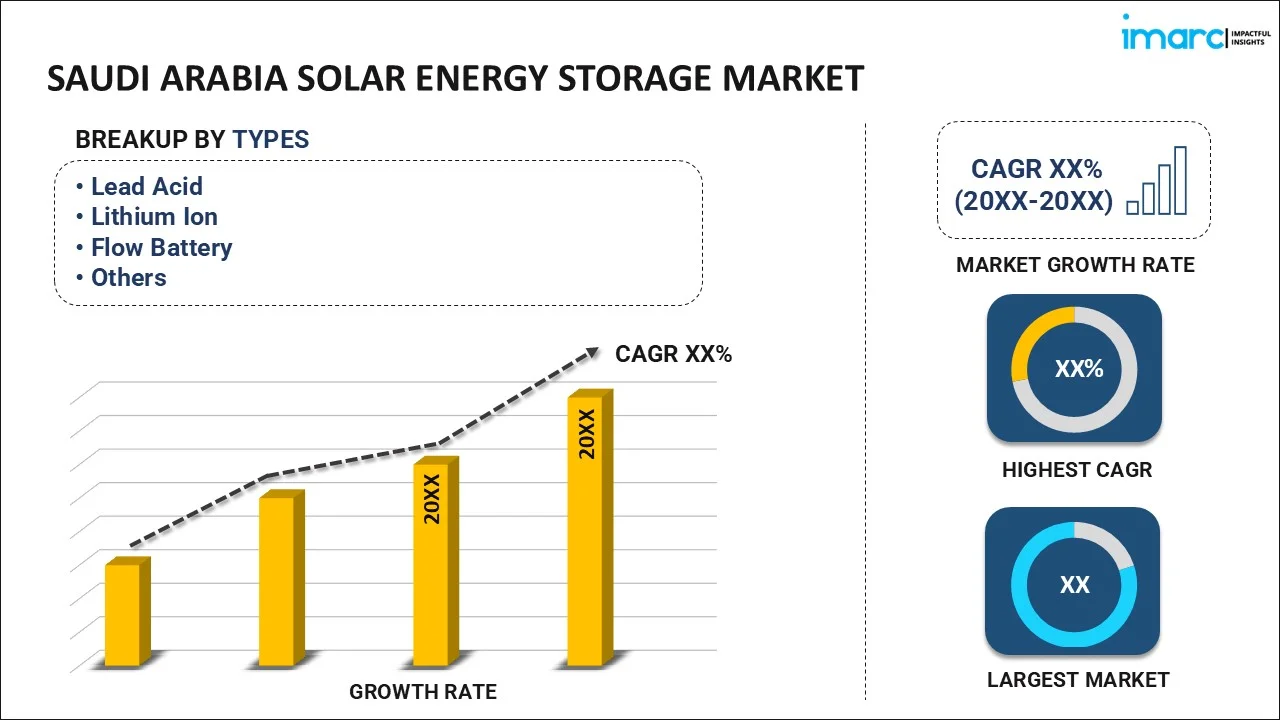

The Saudi Arabia solar energy storage market size reached USD 160.43 Million in 2024. Looking forward, IMARC Group expects the market to reach USD 728.01 Million by 2033, exhibiting a growth rate (CAGR) of 17.10% during 2025-2033. The supportive government initiatives, rising renewable energy investments, rapid technological advancements, cost reductions, environmental sustainability goals, and the increasing demand for reliable, efficient energy storage solutions are some of the key factors impelling the market growth.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 160.43 Million |

| Market Forecast in 2033 | USD 728.01 Million |

| Market Growth Rate (2025-2033) | 17.10% |

Saudi Arabia Solar Energy Storage Market Trends:

Government Support and Policy Initiatives

The heightened focus on renewable energy growth under its Vision 2030 initiative aimed at diversifying the energy mix and lowering fossil fuel dependency is reinforcing the market growth. The government's focus on increasing the solar energy capacity, especially under its National Renewable Energy Program (NREP), has brought focus to energy storage solutions for achieving stability and reliability in power supply. For promoting the integration of solar power in the national grid, the government has also introduced several policies and incentives, including subsidies for solar power projects and public-private partnership. This favorable policy environment supports the use of solar energy storage and international investments in the sector. Additionally, growth in large solar farms, such as the King Salman Energy Park, is also boosting the energy storage solutions' demand to buffer excess solar power during peak usage hours, hence supporting market growth.

Technological advancements

Technological evolution is another industry-driving factor for the Saudi Arabia solar energy storage market. Robust evolution of energy storage technologies, particularly battery systems like lithium-ion batteries that have become cost-effective, more efficient, and more durable, are driving the market growth. The speedy advancement in energy storage capacity, charge/discharge cycle, and energy density has intensely made solar energy storage economically competitive and viable. For instance, in November 2024, GlassPoint and MISA unveiled the next phase of the GlassPoint Ma'aden Technology Showcase (GMTS), which featured direct solar-to-heat technology with advanced thermal storage to decarbonize Ma'aden’s aluminum supply chain, reducing carbon emissions and supporting Saudi Arabia’s Vision 2030 goals. Additionally, the emergence of hybrid energy systems integrating solar energy with energy storage solutions provides for more efficient energy output management and energy distribution flexibility. Further driving market growth, with increasing research and development (R&D) in energy storage technologies, newer, more efficient technologies are likely to appear on the market.

Increasing demand for reliable and sustainable energy solutions:

The accelerating need for green energy alternatives is another important trend fueling the market growth. With the nation looking to minimize its carbon footprint and tackle environmental issues, there is a growing move toward renewable energy options, such as solar power. Solar energy storage is a major factor in such a shift, as it makes sure that any surplus energy produced during the day can be saved and used on cloudy days or peak demand hours, lowering the reliance on conventional fossil fuel-powered grid systems. It is vital in places where there is high energy demand and varying energy consumption, as storage technologies offer a more reliable, cheaper substitute for traditional power sources. Moreover, companies and consumers are growingly realizing the long-term economic and environmental advantages of embracing solar energy storage, and thus a wider movement to cleaner, more stable energy systems.

Saudi Arabia Solar Energy Storage Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the region level for 2025-2033. Our report has categorized the market based on type and installation.

Type Insights:

- Lead Acid

- Lithium Ion

- Flow Battery

- Others

The report has provided a detailed breakup and analysis of the market based on the type. This includes lead acid, lithium ion, flow battery, and others.

Installation Insights:

- On grid

- Off grid

A detailed breakup and analysis of the market based on the installation have also been provided in the report. This includes on grid, and off grid.

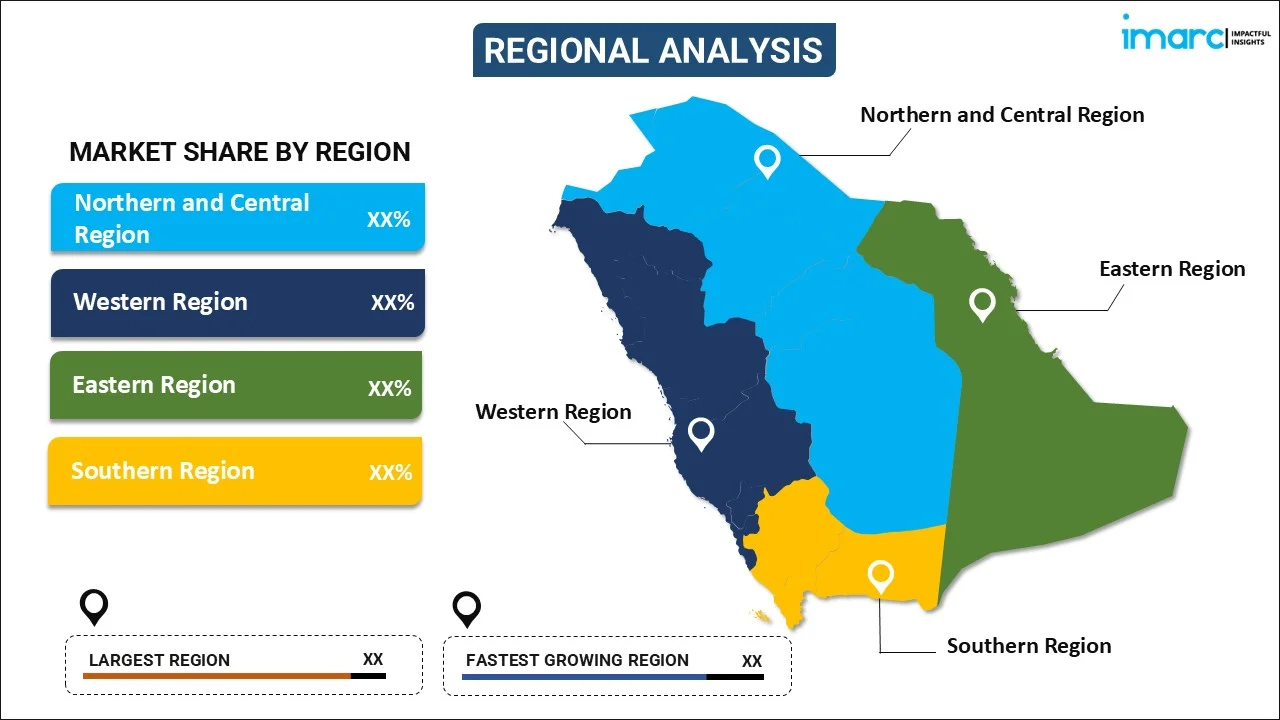

Regional Insights:

- Northern and Central Region

- Western Region

- Eastern Region

- Southern Region

The report has also provided a comprehensive analysis of all the major regional markets, which include Northern and Central, Western, Eastern, and Southern region.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Saudi Arabia Solar Energy Storage Market News:

- In November 2024, Saudi Arabia launched an 8 GWh battery storage tender to boost renewable energy. The tender, initiated by the Saudi Power Procurement Company (SPPC), will include four battery energy storage system (BESS) projects, each with a combined capacity of 2,000 MW (8,000 MWh). The projects will be developed under a build-own-operate model, with each winning developer gaining full ownership of their project.

- In October 2024, China’s Hithium partnered with Saudi firm MANAT to launch Hithium MANAT, aiming to establish a 5 GWh battery storage manufacturing plant in Saudi Arabia. The company also introduced desert-focused energy storage solutions, enhancing performance in extreme climates and supporting the Kingdom’s renewable energy goals.

Saudi Arabia Solar Energy Storage Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered | Lead Acid, Lithium Ion, Flow Battery, Others |

| Installations Covered | On grid, Off grid |

| Regions Covered | Northern and Central Region, Western Region, Eastern Region, Southern Region |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Saudi Arabia solar energy storage market performed so far and how will it perform in the coming years?

- What is the breakup of the Saudi Arabia solar energy storage market on the basis of type?

- What is the breakup of the Saudi Arabia solar energy storage market on the basis of installation?

- What is the breakup of the Saudi Arabia solar energy storage market on the basis of region?

- What are the various stages in the value chain of the Saudi Arabia solar energy storage market?

- What are the key driving factors and challenges in the Saudi Arabia solar energy storage?

- What is the structure of the Saudi Arabia solar energy storage market and who are the key players?

- What is the degree of competition in the Saudi Arabia solar energy storage market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Saudi Arabia solar energy storage market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Saudi Arabia solar energy storage market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Saudi Arabia solar energy storage industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)