Saudi Arabia Solar Energy Market Report by Type (Solar Photovoltaic (PV), Concentrated Solar Power (CSP)), and Region 2026-2034

Saudi Arabia Solar Energy Market Overview:

Saudi Arabia solar energy market size reached USD 8.3 Billion in 2025. Looking forward, IMARC Group expects the market to reach USD 145.4 Billion by 2034, exhibiting a growth rate (CAGR) of 37.39% during 2026-2034. There are various factors that are driving the market, which include the rising need to reduce carbon emissions and maintain environmental sustainability, increasing focus on energy security, declining cost of solar technology, and favorable government initiatives.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2025 |

|

Forecast Years

|

2026-2034

|

|

Historical Years

|

2020-2025

|

| Market Size in 2025 | USD 8.3 Billion |

| Market Forecast in 2034 | USD 145.4 Billion |

| Market Growth Rate (2026-2034) | 37.39% |

Saudi Arabia Solar Energy Market Analysis:

- Major Market Drivers: The market is experiencing robust growth as Saudi Arabia has one of the highest solar irradiance levels in the world. This, along with continuous improvements in energy storage systems, is stimulating the market growth.

- Key Market Trends: The increasing focus on energy security and the declining cost of solar technology are main trends in the market.

- Competitive Landscape: Some of the major market players in the Saudi Arabia solar energy industry are provided in the report.

- Challenges and Opportunities: High initial costs represent a key market challenge. Nonetheless, the rising development of utility-scale solar farms, coupled with the several partnerships among key players, is projected to overcome these challenges and offer recent market opportunities.

Saudi Arabia Solar Energy Market Trends:

Favorable Government Initiatives

Governing agencies in Saudi Arabia are focusing on reducing the country's reliance on oil and diversifying its economy. Solar energy is one of the main sources of renewable energy in the Vision 2030 plan. The plan comprises investment and capacity targets for renewable energy. Furthermore, governing authorities are setting standards for solar technology, ensuring efficacy and quality, and providing detailed guidelines for project development. Governing agencies are also providing incentives like tax breaks, financial subsidies, and advantageous tariffs, which is offering a favorable Saudi Arabia solar energy market outlook. Furthermore, various agreements are promoting renewable energy adoption in the country. For example, the Public Investment Fund (PIF) announced the signing of 3 new agreements to localize the manufacturing and assembly of solar and wind generating equipment and components in Saudi Arabia on July 16, 2024. The Renewable Energy Localization subsidiary (RELC), a completely owned PIF subsidiary, entered into these agreements. They are consistent with the efforts of the Saudi Ministry of Energy to localize the production of renewable energy components.

Rising Need to Reduce Carbon Emissions and Maintain Sustainability

Increasing environmental concerns among individuals are impelling the market growth. Saudi Arabia is reducing its carbon footprint in compliance with international agreements like the Paris Agreement. One clean, renewable energy source that lowers greenhouse gas (GHG) emissions is solar energy. Furthermore, Saudi Arabia's heavy reliance on oil for energy generation contributes to its significant carbon emissions. By investing in solar energy, the country is trying to diversify its energy mix. A sustainable substitute that lessens the need for fossil fuels and overall carbon emissions is solar power. In addition, companies operating in the region are focusing on initiating solar projects as to sustain enhanced competitiveness and increase their Saudi Arabia solar energy market share. For example, ACWA Power Company was successful in obtaining a US$ 2.30 billion loan on February 14, 2024, for 3 solar power projects. The funds will help the solar power projects in central and northern Saudi Arabia including Ar Raas 2, Saad 2, and Al Kahfah.

Increasing Focus on Energy Security

The nation is investing on advanced solar technologies as to save expenses and increase efficiency. By guaranteeing a dependable energy source, Saudi Arabia can attain energy security via its focus on innovation. In addition, Saudi Arabia is making investments in solar projects and establishing strategic alliances with foreign companies. This not only benefit the regional solar business but also guarantees access to various cutting-edge technologies. Solar energy contributes to long-term energy stability and has no fuel costs, which offer a positive Saudi Arabia solar energy market scope. Apart from this, various organization and governing authorities in the country are undertaking several measures to promote solar energy. For example, on June 28, 2024, Saudi Arabia's Ministry of Energy began a geographic survey to determine the optimal locations for the development of renewable energy projects. 1,200 stations will be installed by Saudi enterprises as part of the project to measure metrics related to solar and wind energy in all locations. More than 850,000 square kilometers in all of Saudi Arabia's regions will be covered by the survey.

Saudi Arabia Solar Energy Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional levels for 2026-2034. Our report has categorized the market based on type.

Breakup by Type:

- Solar Photovoltaic (PV)

- Concentrated Solar Power (CSP)

The report has provided a detailed breakup and analysis of the market based on the type. This includes solar photovoltaic (PV) and concentrated solar power (CSP).

Solar photovoltaic (PV) uses semiconductor materials to directly convert sunlight into power. It works well on a variety of sizes, ranging from huge utility-scale solar farms to residential rooftops. It’s deployment in different sizes enables flexible use according to energy requirements. According to the Saudi Arabia solar energy market forecast, the solar PV segment is expected to experience significant expansion as a result of advancements in PV technology such as higher panel efficiency and lower installation costs.

Through the use of mirrors or lenses, concentrated solar power (CSP) technology focuses sunlight onto a tiny area, creating high temperatures that power a steam turbine that is connected to a generator. Large-scale power generation in locations with lots of direct sunshine is best suited for CSP. The ability of CSP systems to provide power even in the absence of sunlight using thermal energy storage improves grid stability and dependability.

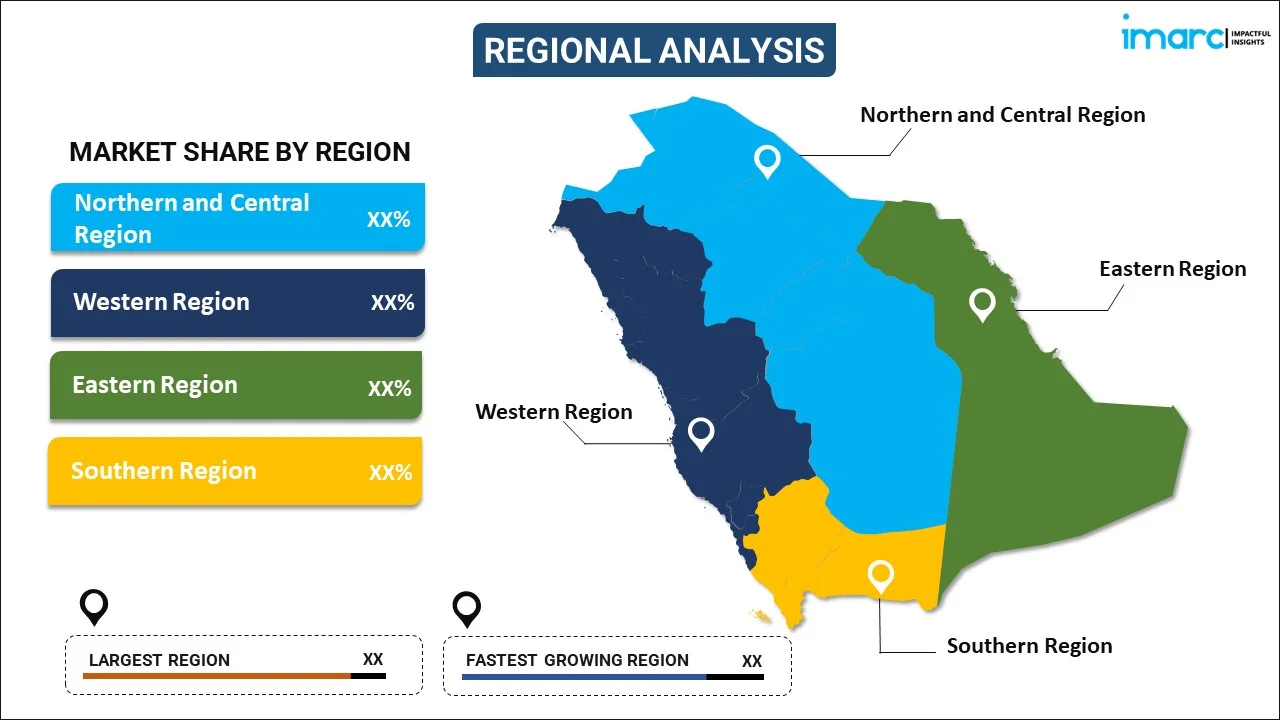

Breakup by Region:

- Northern and Central Region

- Western Region

- Eastern Region

- Southern Region

The report has also provided a comprehensive analysis of all the major markets in the Saudi Arabia, which include Northern and Central Region, Western Region, Eastern Region, and Southern Region.

Northern and central regions have high levels of solar irradiance, which makes them suitable for solar energy projects. The Central region, especially Riyadh, has better infrastructure and accessibility. This supports the deployment of large-scale solar projects and PV installations.

The Western region has high solar irradiance levels, suitable for both PV and CSP technologies. Additionally, the presence of major cities and religious tourism sites is creating opportunities for solar energy projects. Furthermore, the region has seen several high-profile solar projects including those aimed at supporting the large energy demands of cities and religious sites.

The Eastern region benefits from high solar irradiance, making it favorable for solar energy projects. The rising demand for solar energy as a supplementary or alternative energy source in various sectors is bolstering the Saudi Arabia solar energy market growth.

The Southern region has favorable conditions for solar energy. In addition, governing agencies in the region are promoting renewable energy to ensure balanced energy development, which is impelling the market growth.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape in the market. Detailed profiles of all major companies have also been provided. Some of the key players in the market include:

- ACWA Power Company

- Alfanar Group

- EDF Renewables

- ENGIE Solutions

- Masdar (Abu Dhabi Future Energy Company)

- Saudi Electricity Company

Top market players are investing in solar energy projects to diversify their energy portfolio. They are engaging in joint ventures and partnerships to create massive solar farms. Additionally, they are working on energy storage and advanced solar technologies via research and development (R&D) activities. Besides this, they are inking memorandums of understanding (MoUs) to increase solar power output. For instance, SPPC finished power purchase agreements with ACWA Power Company, Water and Electricity Holding Co., also known as Badeel, and Aramco Power on July 1, 2024, for 3 photovoltaic projects totaling US$ 3.3 billion. Each of the three power purchase agreements (PPAs) has a 25-year contract term.

Saudi Arabia Solar Energy Market News:

- 1 September 2024: ACWA Power contracted financing agreements at US$ 2.58 Billion with a consortium of banks to develop 3 large-scale solar projects in the country. These projects are in Haden, Muwyah, and Al-Khushaybi in the Makkah and Qassim provinces that will have capacities of 2,000 megawatts, 2,000MW, and 1,500MW, respectively.

- 14 November 2023: Under the national renewable energy program (NREP), the Saudi Power Procurement Company (SPCC), a government-owned organization under the Kingdom's Ministry of Energy, released a request for qualification (RFQ) for the fourth round of solar projects with a total capacity of 3,700 MW.

Saudi Arabia Solar Energy Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Billion USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered | Solar Photovoltaic (PV), Concentrated Solar Power (CSP) |

| Regions Covered | Northern and Central Region, Western Region, Eastern Region, Southern Region |

| Companies Covered | ACWA Power Company, Alfanar Group, EDF Renewables, ENGIE Solutions, Masdar (Abu Dhabi Future Energy Company), Saudi Electricity Company |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Saudi Arabia solar energy market performed so far, and how will it perform in the coming years?

- What has been the impact of COVID-19 on the market?

- What is the breakup of the Saudi Arabia solar energy market on the basis of type?

- What are the various stages in the value chain of the Saudi Arabia solar energy market?

- What are the key driving factors and challenges in the Saudi Arabia solar energy?

- What is the structure of the Saudi Arabia solar energy market, and who are the key players?

- What is the degree of competition in the Saudi Arabia solar energy market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Saudi Arabia solar energy market from 2020-2034.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Saudi Arabia solar energy market.

- Porter's five forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Saudi Arabia solar energy industry and its attractiveness.

- The competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)