Saudi Arabia Snacks Market Size, Share, Trends and Forecast by Product, Packaging, Distribution Channel, and Region, 2026-2034

Saudi Arabia Snacks Market Overview:

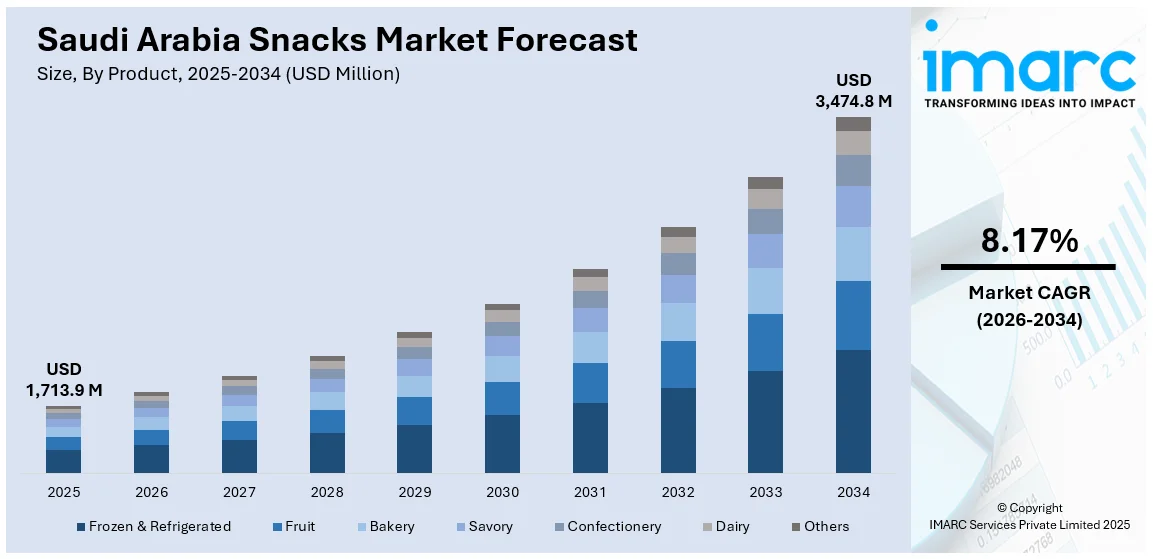

The Saudi Arabia snacks market size reached USD 1,713.9 Million in 2025. Looking forward, IMARC Group expects the market to reach USD 3,474.8 Million by 2034, exhibiting a growth rate (CAGR) of 8.17% during 2026-2034. The market includes rising health awareness, increasing disposable income, a young and urbanized population, and growing demand for convenience foods. Additionally, digital transformation, exposure to global food trends, and government initiatives promoting healthier lifestyles under Vision 2030 are fueling innovation and consumer interest in diverse snack options.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2025 |

|

Forecast Years

|

2026-2034

|

|

Historical Years

|

2020-2025

|

| Market Size in 2025 | USD 1,713.9 Million |

| Market Forecast in 2034 | USD 3,474.8 Million |

| Market Growth Rate 2026-2034 | 8.17% |

Saudi Arabia Snacks Market Trends:

Premiumization and Global Flavors

Saudi consumers are progressively seeking premium snack products and diverse global flavor profiles. With increasing global exposure and rising disposable incomes among middle-class and younger demographics, there is a growing demand for higher-quality gourmet chips, artisanal candies, and internationally-inspired nuts. Foreign-bought snacks, including those in South Korea, Japan, and the US, are becoming wider ranging in the supermarkets and even on online forums in Saudi. There is also a palpable interest in fusion flavor combinations that bring local tastes together with global influences, like za'atar-flavored popcorn or gourmet cheeses filled in dates. This trend is underpinned by the expansion of specialty food stores and luxury food aisles at top retailers as consumers pay more for distinctive, indulgent snacking experiences further contributing to the Saudi Arabia snacks market growth.

To get more information on this market Request Sample

Health and Wellness Snacking

Saudi consumers are increasingly prioritizing health, driving demand for snacks perceived as nutritious and functional. This includes low-calorie, high-protein, low-sugar, and organic options, as well as products made from natural ingredients, free from additives, and enriched with vitamins or fiber. The popularity of protein bars, roasted nuts, dried fruits, and gluten-free chips reflects a shift toward smarter snacking, influenced by rising fitness culture and concerns over obesity and diabetes further resulting in an increase in Saudi Arabia snacks market share. Many brands now offer portion-controlled packs to encourage mindful eating. This consumer behavior aligns with government initiatives like the Ministry of Health’s, Quality of Life Program, which aims to halt the rise in diabetes-related deaths by 2025 and reduce diabetes cases by 10% by 2030. Such efforts, under Saudi Vision 2030, emphasize healthier lifestyles and support a thriving health-focused snacks market.

Digitalization and E-Commerce Growth

The digital revolution in Saudi Arabia is changing the way people shop for snacks. Online sites and food delivery apps are becoming major platforms for buying snacks, especially after the pandemic. Grocery delivery services and e-commerce giants now have vast snack offerings, including online-exclusive products available only on the web. People like the convenience, variety, and personalized suggestions that digital sites provide. Social media personalities and also digital marketing campaigns are both contributing significantly to facilitating new snack trends and driving trial. Subscription boxes and direct-to-consumer (D2C) snack companies are cropping up, delivering handpicked monthly boxes. With strong smartphone penetration and a youthful, digitally connected population, digital interaction will continue to be the dominant force in the future of the Saudi Arabia snacks market outlook.

Saudi Arabia Snacks Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the region level for 2026-2034. Our report has categorized the market based on product, packaging, and distribution channel.

Product Insights:

- Frozen & Refrigerated

- Fruit

- Bakery

- Savory

- Confectionery

- Dairy

- Others

The report has provided a detailed breakup and analysis of the market based on the product. This includes frozen & refrigerated, fruit, bakery, savory, confectionery, dairy, and others.

Packaging Insights:

- Bag and Pouches

- Boxes

- Cans

- Jars

- Others

A detailed breakup and analysis of the market based on the packaging have also been provided in the report. This includes bag and pouches, boxes, cans, jars, and others.

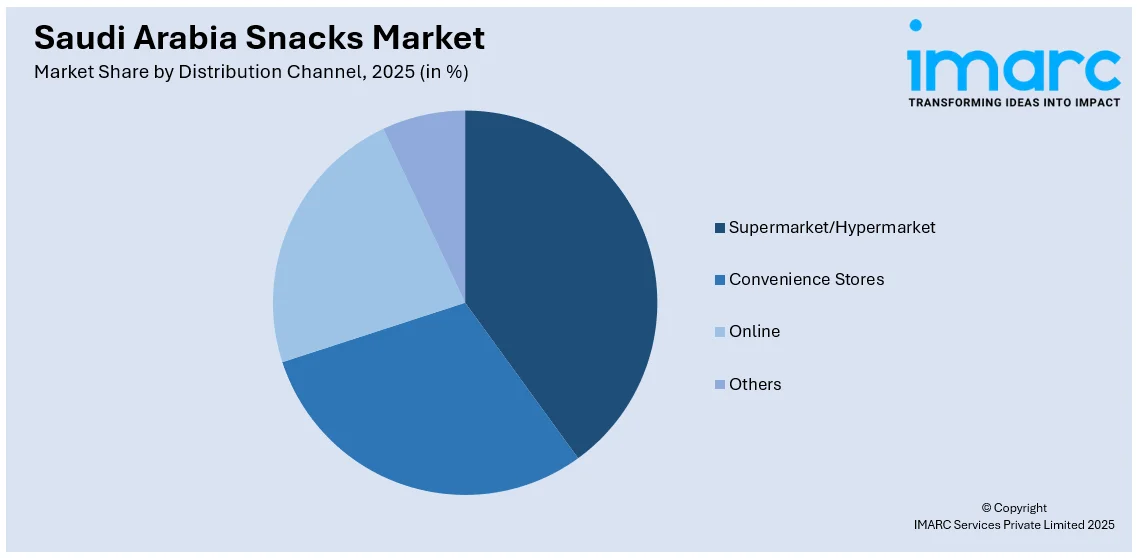

Distribution Channel Insights:

Access the comprehensive market breakdown Request Sample

- Supermarket/Hypermarket

- Convenience Stores

- Online

- Others

The report has provided a detailed breakup and analysis of the market based on the distribution channel. This includes supermarket/hypermarket, convenience stores, online, and others.

Regional Insights:

- Northern and Central Region

- Western Region

- Eastern Region

- Southern Region

The report has also provided a comprehensive analysis of all the major regional markets, which include Northern and Central, Western, Eastern, and Southern Region.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Saudi Arabia Snacks Market News:

- In August 2024, Heinz unveiled the "Hum Hum," a robotic snack dipper, at the Esports World Cup in Saudi Arabia. Designed to cater to gamers who struggle with snacking while playing, this device uses a mechanical hand to dip snacks into sauces, controlled by foot pedals. With future versions set to include voice and face recognition, the Hum Hum aims to enhance the gaming experience by allowing uninterrupted snacking during intense gaming sessions.

Saudi Arabia Snacks Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Products Covered | Frozen & Refrigerated, Fruit, Bakery, Savory, Confectionery, Dairy, Others |

| Packagings Covered | Bag and Pouches, Boxes, Cans, Jars, Others |

| Distribution Channels Covered | Supermarket/Hypermarket, Convenience Stores, Online, Others |

| Regions Covered | Northern and Central Region, Western Region, Eastern Region, Southern Region |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Saudi Arabia snacks market performed so far and how will it perform in the coming years?

- What is the breakup of the Saudi Arabia snacks market on the basis of product?

- What is the breakup of the Saudi Arabia snacks market on the basis of packaging?

- What is the breakup of the Saudi Arabia snacks market on the basis of distribution channel?

- What is the breakup of the Saudi Arabia snacks market on the basis of region?

- What are the various stages in the value chain of the Saudi Arabia snacks market?

- What are the key driving factors and challenges in the Saudi Arabia snacks market?

- What is the structure of the Saudi Arabia snacks market and who are the key players?

- What is the degree of competition in the Saudi Arabia snacks market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Saudi Arabia snacks market from 2020-2034.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Saudi Arabia snacks market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Saudi Arabia snacks industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)