Saudi Arabia Smart Lighting Market Size, Share, Trends and Forecast by Offering, Communication Technology, Installation Type, Light Source, and Application, 2026-2034

Saudi Arabia Smart Lighting Market Summary:

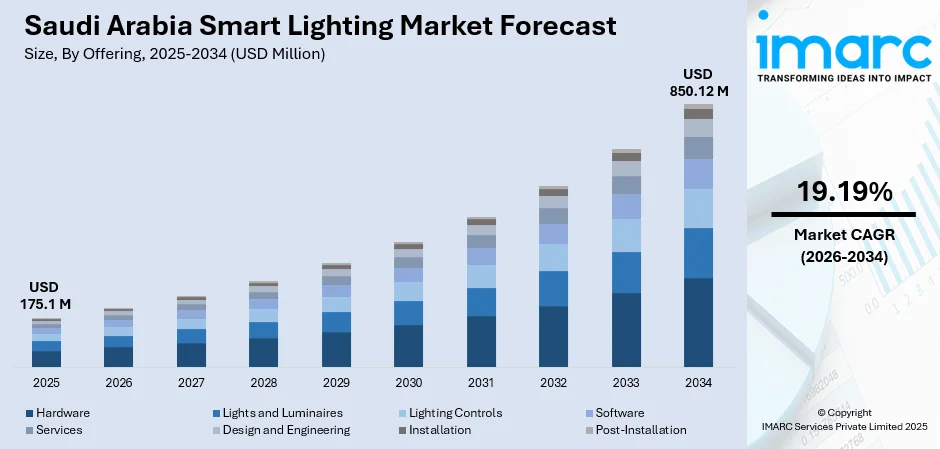

The Saudi Arabia smart lighting market size was valued at USD 175.1 Million in 2025 and is projected to reach USD 850.12 Million by 2034, growing at a compound annual growth rate of 19.19% from 2026-2034.

The Saudi Arabia smart lighting market is growing rapidly due to the increased efforts put by the country into achieving a sustainable and smart infrastructure. Initiatives by the country, such as the focus on energy efficiency, and investments made by the country in next-generation city developments, are driving the growth and use of smart lighting solutions. Increasing consumer acceptance of the benefits of smart lighting, due to rising energy costs, is leading the Saudi Arabia smart lighting market share to grow.

Key Takeaways and Insights:

-

By Offering: Hardware dominates the market with a share of 70% in 2025, driven by extensive deployment of smart luminaires, sensors, and control devices across mega-projects and urban infrastructure upgrades, supporting the Kingdom's modernization goals.

-

By Communication Technology: Wireless technology leads the market with a share of 60% in 2025, owing to its flexibility in installation, seamless IoT integration capabilities, and lower infrastructure requirements for both new developments and retrofit applications.

-

By Installation Type: Retrofit installation represents the largest segment with a market share of 55% in 2025, reflecting the nationwide initiative to upgrade existing lighting infrastructure in government buildings, streets, and commercial establishments to energy-efficient systems.

-

By Light Source: LED lamps exhibit a clear dominance with 72% share in 2025, attributed to superior energy efficiency, extended lifespan, smart compatibility features, and government mandates promoting LED adoption across public and private sectors.

-

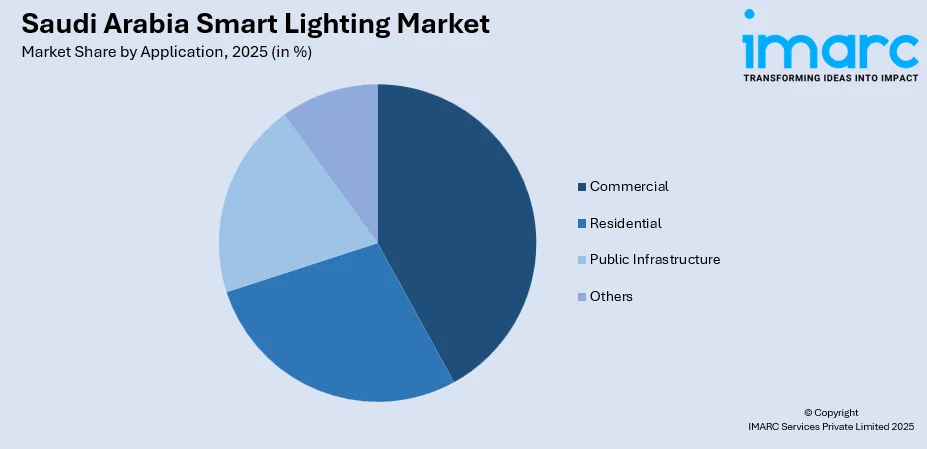

By Application: Commercial holds the largest share at 42% in 2025, propelled by the construction boom in retail complexes, hospitality venues, corporate offices, and entertainment destinations requiring advanced lighting management systems.

-

Key Players: Market participants are strengthening their positions through strategic partnerships, localized manufacturing investments, and technology transfer initiatives. Companies are expanding product portfolios with IoT-enabled solutions, enhancing after-sales support networks, and collaborating with giga-project developers to capture opportunities in Saudi Arabia's transformative urban landscape.

To get more information on this market Request Sample

The market for smart lights in Saudi Arabia is progressing at a fast pace because all concerned parties in government, business, and residential segments are accepting intelligent lighting solutions with energy efficiency along with operational benefits. Smart lights are being effectively and significantly implemented as a part of city development in Saudi Arabia as intelligent lights are already connected and implemented in most cities like Riyadh, Jeddah, and Dammam. IoT technology implemented in intelligent lights allows for energy management and monitoring from a distance. In June 2024, the National Energy Services Company (Tarshid) announced at the Global Project Management Forum in Riyadh. Saudi Arabia aims to become the first G20 nation to fully implement LED street lighting, with initiatives achieving seventy to seventy-five percent energy savings. These advancements reflect the Kingdom's commitment to sustainable infrastructure development and position the market for continued expansion.

Saudi Arabia Smart Lighting Market Trends:

Integration of IoT and Connected Lighting Ecosystems

The recent times see the adoption of Internet of Things-enabled lighting systems that are revolutionizing the way buildings and public areas manage illumination across Saudi Arabia. Smart lighting platforms integrate advanced sensors, wireless connectivity, and cloud-based analytics to support automated brightness adjustment, occupancy-based controls, and predictive maintenance capabilities in modern times. This trend is especially prominent in commercial complexes and smart city developments, where integrated building management systems demand seamless connectivity between lighting and other infrastructure components for driving growth in the Saudi Arabia smart lighting market.

Localization of Smart Lighting Manufacturing

A significant trend reshaping the market is the strategic shift toward domestic production of advanced lighting technologies. Companies are establishing manufacturing facilities within the Kingdom to enhance supply chain resilience and meet localization requirements for mega-projects. In March 2025, Asheil Versatile Lighting Technologies announced plans for a new manufacturing facility in Shaqraa Industrial City, located one hundred eighty kilometers northwest of Riyadh. The six thousand eight hundred square meter facility will produce high-performance lighting solutions for giga-projects while creating skilled employment opportunities for Saudi professionals.

Rising Demand for Human-Centric Lighting Solutions

Human-centric lighting that adjusts color temperature and intensity throughout the day to support natural circadian rhythms is gaining traction across healthcare, educational, and corporate environments. These intelligent systems enhance occupant wellbeing, productivity, and comfort by mimicking natural daylight patterns. The technology is increasingly specified for new commercial developments and office retrofits where organizations prioritize employee health and performance, creating opportunities for manufacturers offering tunable white and dynamic color-changing systems that align with wellness-focused building design principles.

How Vision 2030 is Transforming the Saudi Arabia Smart Lighting Market:

Saudi Arabia's Vision 2030 initiative has positioned smart lighting as a cornerstone of the Kingdom's urban transformation strategy, prioritizing sustainable infrastructure, energy efficiency, and digital integration across all development sectors. The ambitious national blueprint has allocated substantial resources toward mega-projects and smart city developments, each incorporating advanced smart lighting systems from their foundational design phases. The government continues to channel significant investment into megacity and smart infrastructure projects, creating unprecedented demand for connected lighting solutions. The vision's emphasis on reducing fossil fuel dependency has accelerated the replacement of conventional lighting with energy-efficient LED systems, while stringent building codes now mandate smart lighting integration in new construction, fundamentally reshaping market dynamics and positioning Saudi Arabia as a regional leader in intelligent urban illumination.

Market Outlook 2026-2034:

The Saudi Arabia smart lighting market outlook remains exceptionally positive as the Kingdom continues executing transformative infrastructure projects aligned with Vision 2030 objectives. Sustained government investments in smart city developments, coupled with private sector participation in commercial and residential construction, are expected to drive consistent demand expansion. The market generated a revenue of USD 175.1 Million in 2025 and is projected to reach a revenue of USD 850.12 Million by 2034, growing at a compound annual growth rate of 19.19% from 2026-2034. Technological advancements in wireless connectivity, artificial intelligence integration, and solar-powered smart lighting will create additional growth avenues, while the localization of manufacturing capabilities enhances supply chain stability.

Saudi Arabia Smart Lighting Market Report Segmentation:

| Segment Category | Leading Segment | Market Share |

|---|---|---|

| Offering | Hardware | 70% |

| Communication Technology | Wireless Technology | 60% |

| Installation Type | Retrofit Installation | 55% |

| Light Source | LED Lamps | 72% |

| Application | Commercial | 42% |

Offering Insights:

- Hardware

- Lights and Luminaires

- Lighting Controls

- Software

- Services

- Design and Engineering

- Installation

- Post-Installation

Hardware dominates with a market share of 70% of the total Saudi Arabia smart lighting market in 2025.

The hardware segment encompasses smart luminaires, LED fixtures, sensors, controllers, and connected lighting components that form the physical infrastructure of intelligent illumination systems. Demand is driven by extensive deployment across mega-projects, commercial developments, and municipal infrastructure upgrades requiring advanced fixtures with integrated connectivity and sensing capabilities. The segment benefits from falling LED prices and increasing product sophistication as manufacturers incorporate occupancy detection, daylight harvesting, and wireless communication features directly into lighting hardware. These technologically advanced components enable seamless integration with building management systems and smart city platforms, enhancing operational efficiency across diverse applications.

Smart hardware installations are accelerating across key urban centers including Riyadh, Jeddah, and the Eastern Province, where construction activity remains robust. Projects like NEOM and Qiddiya require lighting systems integrating sensor networks and real-time monitoring capabilities from their foundational design phases. The hospitality, retail, and entertainment sectors are emerging as significant consumers of premium hardware solutions. In May 2024, Swan and Maclaren Group secured a twenty-eight million dollar contract to design illumination systems for the Six Flags Qiddiya theme park in Riyadh, demonstrating the substantial hardware investments flowing into entertainment and hospitality destinations across the Kingdom.

Communication Technology Insights:

- Wired Technology

- Wireless Technology

Wireless technology leads with a share of 60% of the total Saudi Arabia smart lighting market in 2025.

Wireless communication technology has emerged as the preferred connectivity solution for smart lighting deployments due to its installation flexibility, reduced infrastructure costs, and seamless integration with broader Internet of Things ecosystems. Technologies including Bluetooth, Zigbee, Wi-Fi, and cellular networks enable remote monitoring and control capabilities without extensive cabling requirements. The wireless segment is particularly advantageous for retrofit installations in existing buildings where running new wires would be disruptive or cost-prohibitive. Additionally, wireless protocols support scalable network architectures that can accommodate future expansion and integration with complementary building automation systems.

The proliferation of smart home technologies in urban centers like Riyadh and Jeddah is accelerating wireless smart lighting adoption in residential settings, where consumers increasingly demand smartphone-controlled illumination systems. Smart street lighting projects throughout the Kingdom are utilizing wireless connectivity to enable centralized monitoring across vast municipal networks. Long-range communication technologies such as LoRaWAN are gaining traction for outdoor applications, providing reliable data transmission across extensive geographic areas while maintaining energy-efficient operation essential for sustainable urban infrastructure development.

Installation Type Insights:

- New Installation

- Retrofit Installation

Retrofit installation exhibits a clear dominance with a 55% share of the total Saudi Arabia smart lighting market in 2025.

Retrofit installations involve upgrading existing conventional lighting infrastructure to smart, energy-efficient systems without complete replacement of fixtures or building electrical systems. This approach enables organizations to realize immediate energy savings and operational benefits while minimizing capital expenditure and installation disruption. Government mandates promoting energy efficiency in public buildings have accelerated retrofit activity across municipalities, schools, hospitals, and commercial establishments throughout the Kingdom. The retrofit segment addresses the substantial inventory of legacy lighting installations requiring modernization to meet contemporary energy standards and performance expectations.

Building owners and facility managers are increasingly recognizing the favorable return on investment offered by retrofit solutions, with payback periods often achieved within several years through reduced electricity consumption and maintenance costs. The segment particularly benefits commercial and industrial properties seeking to improve operational efficiency without undergoing extensive renovation projects. Retrofit programs also support sustainability objectives by extending the useful life of existing infrastructure while incorporating advanced control capabilities, occupancy sensing, and remote management features that transform conventional lighting assets into intelligent, networked systems.

Light Source Insights:

- LED Lamps

- Fluorescent Lamps

- Compact Fluorescent Lamps

- High Intensity Discharge Lamps

- Others

LED lamps represent the leading segment with a 72% share of the total Saudi Arabia smart lighting market in 2025.

LED technology has established itself as the foundation of Saudi Arabia's smart lighting infrastructure due to its inherent compatibility with digital controls, superior energy efficiency, and extended operational lifespan. This is resulting in the growing use of LED lamps across the country. LEDs consume significantly less power compared to traditional halogen or sodium vapor lamps while offering exceptional dimming capabilities and color temperature adjustment features essential for smart lighting applications. The technology's durability and heat tolerance make it particularly suitable for the Kingdom's extreme desert climate conditions, ensuring reliable performance across challenging environmental scenarios.

Government initiatives promoting LED adoption have accelerated market penetration across all sectors. The Saudi Energy Efficiency Program targets substantial reductions in electricity consumption through LED deployment in government buildings and public infrastructure. Regulatory frameworks now mandate energy-efficient lighting standards for new building developments, creating sustained demand across residential, commercial, and industrial construction. The Saudi Industrial Development Fund provides financing for industrial facilities replacing conventional lighting with modular LED panels, further supporting the segment's expansion across manufacturing zones in Jeddah, Dammam, and Riyadh where operational efficiency remains paramount.

Application Insights:

Access the comprehensive market breakdown Request Sample

- Commercial

- Residential

- Public Infrastructure

- Others

Commercial holds the largest share at 42% of the total Saudi Arabia smart lighting market in 2025.

Commercial encompasses smart lighting deployments across retail spaces, office buildings, hospitality venues, healthcare facilities, and entertainment destinations. Commercial establishments prioritize energy management, operational efficiency, and enhanced customer experiences, driving adoption of advanced lighting control systems. The segment benefits from substantial construction activity in mixed-use developments, shopping centers, and corporate headquarters where lighting represents a significant portion of operational electricity consumption. Rising electricity tariffs are further incentivizing commercial property owners to invest in intelligent lighting solutions that optimize energy utilization.

Major commercial projects across the Kingdom are incorporating smart lighting from design inception to optimize energy performance and create distinctive environments. Retail centers and hospitality venues utilize dynamic lighting scenes to enhance atmosphere and visitor engagement, differentiating their offerings in increasingly competitive markets. Corporate buildings deploy occupancy-based controls and daylight harvesting to reduce operational costs while meeting sustainability certifications and corporate environmental commitments. Healthcare facilities are adopting human-centric lighting systems that support patient wellbeing and staff productivity through circadian rhythm alignment.

Market Dynamics:

Growth Drivers:

Why is the Saudi Arabia Smart Lighting Market Growing?

Expanding Hospitality and Tourism Infrastructure

The rapid expansion of Saudi Arabia's hospitality and tourism sector is generating substantial demand for sophisticated lighting solutions across hotels, resorts, entertainment venues, and retail destinations. The Kingdom's ambitious tourism development agenda is driving unprecedented hotel construction, with new properties requiring advanced lighting systems that enhance guest experiences while optimizing energy consumption. Hospitality sector performance indicators have demonstrated robust growth, reflecting increased visitor arrivals and strengthening demand for quality accommodation across major cities and emerging tourism destinations. The continued expansion of international visitor numbers is stimulating significant investment in hospitality infrastructure throughout the Kingdom. New hotel brand debuts and luxury resort openings are incorporating smart lighting technologies that enable personalized ambiance control, automated scheduling, and integration with property management systems to deliver superior guest experiences while achieving operational cost reductions across expanding accommodation portfolios. Entertainment complexes, cultural attractions, and retail destinations are similarly adopting intelligent lighting solutions to create distinctive environments that attract visitors and enhance their overall experience.

Government Energy Efficiency Mandates

National policies promoting energy conservation are compelling organizations across public and private sectors to upgrade lighting infrastructure to smart, efficient systems. The Saudi government aims to reduce electricity consumption significantly, with initiatives targeting deployment of LED and smart lighting technologies in government buildings, educational institutions, and healthcare facilities. Regulatory frameworks now mandate energy-efficient lighting standards for new construction, while incentive programs encourage existing building owners to undertake retrofit projects. Government-backed entities implement comprehensive programs for retrofitting street lighting across the Kingdom in cooperation with municipalities and public agencies. These initiatives standardize technical specifications for locally produced LED streetlights while targeting substantial electricity savings across municipal networks. The emphasis on energy conservation extends to industrial zones where financing mechanisms support manufacturers in transitioning from conventional lighting to efficient alternatives. Building codes continue to evolve, establishing increasingly stringent requirements that position smart lighting as essential infrastructure rather than optional enhancement.

Expansion of Smart City Infrastructure

The integration of smart lighting into broader urban technology ecosystems is accelerating as municipalities and developers prioritize connected infrastructure that enhances livability, safety, and resource efficiency. Smart street lighting networks now serve as platforms for additional capabilities including environmental monitoring, public safety surveillance, and electric vehicle charging integration. Cities are deploying intelligent poles incorporating sensors, communication equipment, and LED luminaires to create multifunction infrastructure assets that maximize public investment value. Major urban centers have achieved recognition for their progress in developing connected urban systems, reflecting substantial investments in smart infrastructure across transportation, utilities, and public spaces. Urban greening initiatives incorporate smart lighting as integral components of sustainable, well-illuminated public spaces that improve quality of life for residents and visitors. The convergence of lighting with telecommunications, security, and environmental monitoring systems creates comprehensive smart city platforms that support data-driven urban management and continuous service improvement across expanding metropolitan areas.

Market Restraints:

What Challenges the Saudi Arabia Smart Lighting Market is Facing?

High Initial Investment Requirements

The upfront costs associated with smart lighting systems remain substantially higher than conventional lighting alternatives, presenting barriers for budget-constrained organizations and smaller municipalities. Advanced features including IoT connectivity, motion sensors, and solar integration increase initial capital requirements. While long-term operational savings typically justify investments, many potential adopters struggle to secure financing or demonstrate immediate returns, slowing broader market penetration particularly in secondary cities and less economically developed regions.

Technical Integration Complexities

Deploying smart lighting systems requires seamless integration with existing building management platforms, network infrastructure, and control systems, presenting technical challenges for many organizations. Interoperability between different manufacturers' products and communication protocols remains inconsistent, complicating system design and limiting flexibility. The shortage of specialized technical expertise for installation, commissioning, and maintenance of smart lighting networks creates operational hurdles, particularly for organizations without established facilities management capabilities.

Cybersecurity and Data Privacy Concerns

As smart lighting systems become increasingly connected and data-intensive, concerns regarding cybersecurity vulnerabilities and data privacy are emerging as restraining factors. Connected lighting networks collect operational data and may integrate with surveillance and access control systems, creating potential security risks if not properly protected. Organizations must invest in robust cybersecurity frameworks to protect critical infrastructure, adding complexity and cost to smart lighting deployments while requiring ongoing vigilance against evolving threats.

Competitive Landscape:

The Saudi Arabia smart lighting market exhibits a dynamic competitive environment characterized by the presence of established multinational corporations, regional manufacturers, and emerging local players. International companies including Signify, Osram, Panasonic, and Samsung leverage global technology capabilities while expanding local partnerships and distribution networks. Domestic manufacturers are strengthening their positions through localization initiatives aligned with Vision 2030 requirements, establishing manufacturing facilities within the Kingdom. Strategic partnerships between international technology providers and local companies are enabling knowledge transfer while meeting content localization mandates for mega-projects. Competition intensifies around product innovation, service capabilities, and project execution experience, with participants differentiating through IoT integration, after-sales support, and customization capabilities for climate-specific applications.

Recent Developments:

-

In February 2025, SM C2R (Singapore), a subsidiary of Swan and Maclaren Group, and Advanced Lighting Company (ALC), a leading Saudi-based lighting manufacturer, announced the strengthening of their strategic partnership through joint ownership of SM C2R Arabia at the Public Investment Fund Private Sector Forum. The collaboration aims to deliver comprehensive lighting and design solutions while manufacturing high-quality lighting products aligned with Saudi Arabia's Vision 2030 localization goals.

Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Million USD |

| Scope of the Report | Exploration of Historical and Forecast Trends, Industry Catalysts and Challenges, Segment-Wise Historical and Predictive Market Assessment:

|

| Offering Covered | Hardware, Lights and Luminaires, Lighting Controls, Software, Services, Design and Engineering, Installation, Post-Installation |

| Communication Technology Covered | Wired Technology, Wireless Technology |

| Installation Type Covered | New Installation, Retrofit Installation |

| Light Source Covered | LED Lamps, Fluorescent Lamps, Compact Fluorescent Lamps, High Intensity Discharge Lamps, Others |

| Application Covered | Commercial, Residential, Public Infrastructure, Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report

The Saudi Arabia smart lighting market size was valued at USD 175.1 Million in 2025

The Saudi Arabia smart lighting market is expected to grow at a compound annual growth rate of 19.19% from 2026-2034 to reach USD 850.12 Million by 2034.

Hardware, holding the largest revenue share of 70%, dominates the Saudi Arabia smart lighting market, driven by extensive deployment of smart luminaires, sensors, and control devices across mega-projects and urban infrastructure upgrades supporting the Kingdom's modernization goals.

Key factors driving the Saudi Arabia smart lighting market include Vision 2030 mega-project developments, government energy efficiency mandates, expansion of smart city infrastructure, growing adoption of IoT-enabled lighting systems, rising demand for retrofit installations, and increasing investments in localized manufacturing capabilities.

Major challenges include high initial investment requirements for advanced smart lighting systems, technical integration complexities with existing infrastructure, cybersecurity and data privacy concerns, shortage of specialized technical expertise, and interoperability issues between different manufacturers' products and communication protocols.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)