Saudi Arabia Silica Sand Market Size, Share, Trends and Forecast by End Use and Region, 2026-2034

Saudi Arabia Silica Sand Market Summary:

The Saudi Arabia silica sand market size was valued at USD 249.62 Million in 2025 and is projected to reach USD 409.51 Million by 2034, growing at a compound annual growth rate of 5.65% from 2026-2034.

The silica sand market in Saudi Arabia is witnessing significant growth, propelled by the Kingdom's ambitious infrastructure initiatives under Vision 2030 and increasing industrialization in various sectors. Growing demand from the construction industry, expanding glass production capabilities, and heightened use in hydraulic fracturing for unconventional gas extraction are driving market expansion. The strategic investments made by the government in large-scale projects and water treatment facilities also boost the increasing demand for silica sand.

Key Takeaways and Insights:

-

By End Use: Glass industry dominates the market with a share of 42% in 2025, owing to the expanding production of flat glass, container glass, and specialty glass for construction and automotive applications. The rising investments in domestic glass manufacturing facilities are strengthening the segment's position in the market.

-

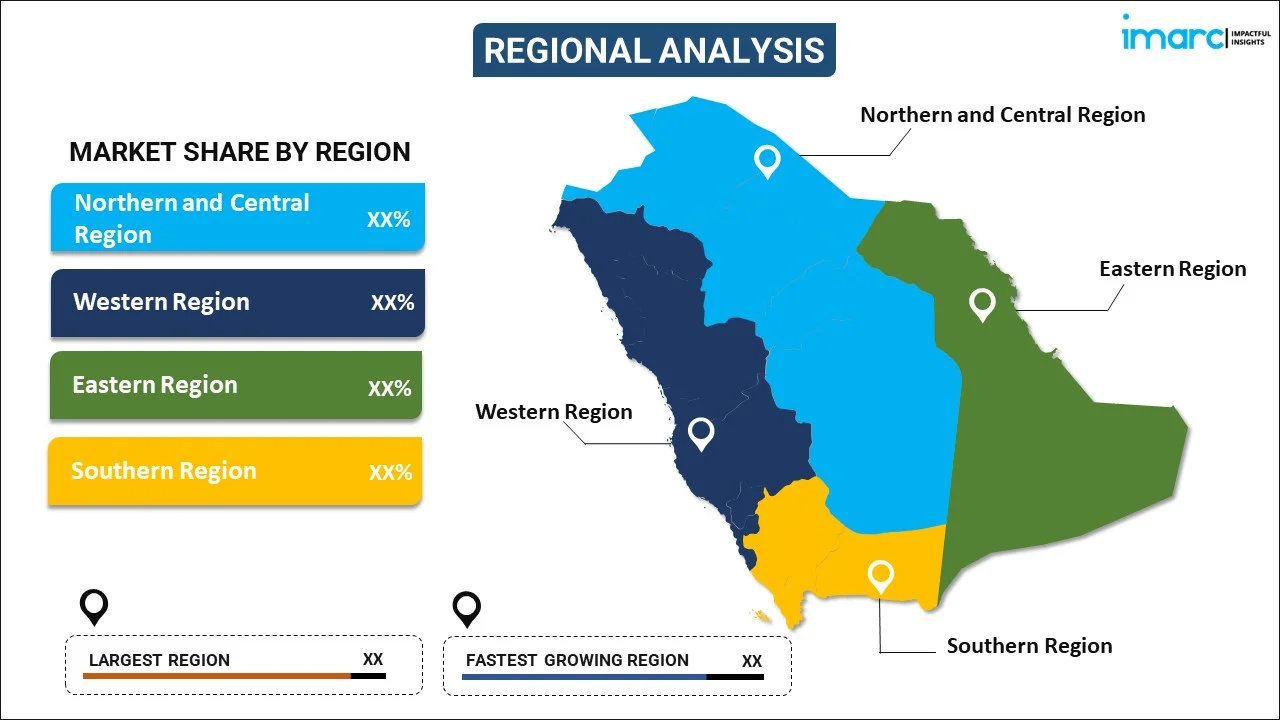

By Region: Eastern Region leads the market with a share of 48% in 2025, driven by the concentration of oil and gas exploration activities, industrial manufacturing facilities, and proximity to major silica sand deposits in the region.

-

Key Players: Key players drive the Saudi Arabia silica sand market by expanding mining operations, enhancing processing capabilities, and investing in advanced purification technologies. Their focus on improving supply reliability, product quality, and regional distribution networks ensures consistent availability across diverse industrial applications.

The Saudi Arabia silica sand market is witnessing robust growth, underpinned by the Kingdom's transformative economic initiatives and expanding industrial base. The construction sector continues to serve as a primary demand driver, with the country announcing a USD 1 Trillion pipeline of infrastructure projects in 2024 to position itself as a global hub for investment and logistics in line with Vision 2030. The glass manufacturing industry is experiencing significant expansion, with major investments in float glass and container glass production facilities to reduce import dependency and strengthen domestic manufacturing capabilities. Additionally, the oil and gas sector's increased exploration and production activities, particularly in unconventional gas reserves, are generating substantial demand for high-quality silica sand used as proppant in hydraulic fracturing operations. The Kingdom's focus on water treatment infrastructure and renewable energy development further supports market expansion across filtration and solar applications.

Saudi Arabia Silica Sand Market Trends:

Rising Investments in Domestic Glass Manufacturing Capacity

The Saudi Arabia silica sand market is experiencing increased demand, driven by substantial investments in glass production facilities. Manufacturers are expanding operations to meet growing requirements from construction, automotive, and consumer goods sectors. In August 2024, the National Company for Glass Industries announced that its subsidiary Gulf Guard approved plans to build a flat and insulating glass plant in Jubail, Saudi Arabia, estimated at USD 215 Million, demonstrating the industry's commitment to expanding domestic production capacity and reducing reliance on imports.

Expansion of Unconventional Gas Exploration Activities

The Kingdom's aggressive development of unconventional gas reserves is creating significant demand for high-quality silica sand used in hydraulic fracturing operations. In June 2024, Aramco awarded USD 25 Billion in contracts to expand upstream unconventional gas production, targeting a substantial increase in the Kingdom's gas output by 2030. The contracts were associated with the second phase development of the extensive Jafurah unconventional gas field, the third phase expansion of Aramco’s Master Gas System, new gas rigs, and continuous capacity maintenance in Saudi Arabia.

Growing Emphasis on Advanced Water Treatment Infrastructure

The rising focus on sustainable water management and expanding desalination infrastructure is driving the demand for silica sand in filtration applications. The Kingdom operates multiple wastewater treatment plants and aims to achieve complete reuse of treated urban wastewater for irrigation and industrial purposes. In May 2024, Saudi Arabia's National Water Company (NWC) launched water and sanitation projects valued at approximately USD 959 Million across Riyadh, Madinah, and the Eastern Province, enhancing infrastructure coverage and supporting silica sand consumption in water purification systems.

How Vision 2030 is Transforming the Saudi Arabia Silica Sand Market:

Vision 2030 is transforming the Saudi Arabia silica sand market by driving large-scale industrial diversification and infrastructure development beyond oil. Massive investments in construction, smart cities, and mega projects are increasing the demand for high-quality silica sand used in glass manufacturing, cement, concrete, and specialty building materials. The program’s focus on expanding domestic manufacturing is encouraging local processing of silica sand for applications in foundries, ceramics, and chemicals, reducing reliance on imports. Growth in renewable energy and solar panel manufacturing under Vision 2030 is also supporting demand for high-purity silica sand used in photovoltaic glass. In parallel, mining sector reforms and private sector participation are improving exploration, extraction efficiency, and value addition across the silica sand supply chain. Logistics upgrades and industrial zones are enabling smoother distribution to end-use industries. Overall, Vision 2030 is strengthening the silica sand market by stimulating downstream industries, improving resource utilization, and positioning silica sand as a strategic industrial mineral for sustainable economic growth.

Market Outlook 2026-2034:

The Saudi Arabia silica sand market is poised for sustained expansion over the forecast period, propelled by continued infrastructure development, industrial diversification, and expanding energy sector activities. The market generated a revenue of USD 249.62 Million in 2025 and is projected to reach a revenue of USD 409.51 Million by 2034, growing at a compound annual growth rate of 5.65% from 2026-2034. The construction sector will remain a dominant consumption driver, supported by mega-projects aligned with Vision 2030 objectives. Glass manufacturing expansion, increased hydraulic fracturing activities, and growing water treatment requirements will further support market development across the Kingdom.

Saudi Arabia Silica Sand Market Report Segmentation:

| Segment Category | Leading Segment | Market Share |

|---|---|---|

| End Use | Glass Industry | 42% |

| Region | Eastern Region | 48% |

End Use Insights:

To get detailed segment analysis of this market Request Sample

- Glass Industry

- Foundry

- Hydraulic Fracturing

- Filtration

- Abrasives

- Others

Glass industry dominates with a market share of 42% of the total Saudi Arabia silica sand market in 2025.

The glass industry represents the largest end use segment in the Saudi Arabia silica sand market, driven by expanding production of flat glass, container glass, and specialty glass for construction and automotive applications. Silica sand serves as the primary source of silicon dioxide in glass manufacturing, accounting for a significant portion of total batch costs. The segment benefits from rising demand for architectural glass in mega-projects and growing automotive glass requirements as the Kingdom expands domestic vehicle manufacturing capacity.

The expansion of glass manufacturing facilities across the Kingdom is strengthening demand for high-purity silica sand meeting precise specifications. In November 2023, Zoujaj Glass received board approval to establish a sixth production line for glass containers at its Riyadh facility, projected to increase annual capacity by approximately 25,000 Metric Tons. Major glass manufacturing companies continue to drive consumption growth through capacity additions and product diversification initiatives.

Regional Insights:

To get detailed regional analysis of this marketRequest Sample

- Northern and Central Region

- Western Region

- Eastern Region

- Southern Region

Eastern Region leads with a market share of 48% of the total Saudi Arabia silica sand market in 2025.

The Eastern Region dominates the Saudi Arabia silica sand market, driven by the concentration of oil and gas exploration activities, industrial manufacturing clusters, and proximity to major mineral deposits. The region benefits from substantial investments in unconventional gas development projects and hosts the largest concentration of foundries supporting the Kingdom's industrial sector. The Eastern Province's established petrochemical and energy infrastructure creates consistent demand for silica sand across hydraulic fracturing and industrial applications.

The Eastern Region’s leadership is reinforced by superior logistics and export connectivity. Proximity to major ports along the Arabian Gulf enables efficient transportation of bulk silica sand to domestic consumers and international markets. The region also benefits from advanced processing facilities and established supplier networks, ensuring consistent quality and reliable supply. Strong industrial demand from glass manufacturing, construction materials, and water treatment applications further supports higher consumption levels, sustaining the Eastern Region’s dominant position in the Saudi Arabia silica sand market.

Market Dynamics:

Growth Drivers:

Why is the Saudi Arabia Silica Sand Market Growing?

Expansion of Construction and Infrastructure Development

Expansion of construction and infrastructure development is a key driver of the Saudi Arabia silica sand market, as large-scale building activities continue across residential, commercial, and industrial segments. As per IMARC Group, the Saudi Arabia construction market size was valued at USD 101.4 Billion in 2025. Silica sand is a core raw material for concrete, mortar, plaster, and glass, making it essential for modern construction projects. Rapid urban development, housing expansion, and the construction of commercial complexes are increasing demand for construction-grade and processed silica sand. Infrastructure projects, such as roads, ports, airports, and utilities, also rely heavily on silica-based materials. Demand is further supported by the preference for durable, high-quality building materials that improve structural performance and aesthetics. Local availability of silica sand helps reduce material costs and supports domestic sourcing strategies. As construction remains a long-term pillar of economic development, sustained building activity continues to generate consistent and growing demand for silica sand across Saudi Arabia.

Growth of Oil, Gas, and Unconventional Energy Activities

The growth of oil, gas, and unconventional energy activities is fueling the market expansion in Saudi Arabia. Silica sand is widely used as a proppant in hydraulic fracturing to enhance oil and gas well productivity. Increasing focus on unconventional gas development and improved recovery techniques is raising the volume of silica sand required per well. Domestic energy projects demand reliable, large-scale supply of high-strength silica sand, encouraging investment in local mining and processing operations. Energy companies prioritize consistent quality and logistical efficiency, which supports long-term supply contracts with domestic producers. Innovations in drilling and completion techniques are also increasing sand intensity in extraction processes. As Saudi Arabia continues to optimize hydrocarbon production and strengthen energy security, the oil and gas sector remains a stable and significant source of silica sand demand.

Expansion of Glass, Ceramics, and Industrial Manufacturing

Expansion of glass, ceramics, and broader industrial manufacturing is driving steady growth in the Saudi Arabia silica sand market. High-purity silica sand is a critical input for manufacturing flat glass, container glass, fiberglass, and specialty glass used in construction, automotive, and industrial applications. The ceramics industry also relies on silica sand for tiles, sanitaryware, and technical ceramics. As domestic manufacturing capacity increases, producers are demanding consistent-quality raw materials to meet performance and durability standards. Industrial diversification efforts are supporting local production of value-added goods, reducing dependence on imports. Reliable access to silica sand enables manufacturers to control costs and improve supply chain resilience. Growth in industrial zones and manufacturing clusters further supports higher consumption. This expanding industrial base reinforces silica sand’s role as a strategic material supporting long-term manufacturing growth.

Market Restraints:

What Challenges is the Saudi Arabia Silica Sand Market Facing?

Environmental and Health Concerns Related to Mining Operations

Silica sand mining and processing operations generate fine silica dust known as respirable crystalline silica, posing inhalation risks to workers and nearby communities. Prolonged exposure can lead to severe respiratory conditions, including silicosis and other occupational health issues. Mining activities can also result in environmental degradation, air pollution, and water contamination, requiring operators to implement stringent mitigation measures that increase operational costs.

Stringent Quality Requirements for Specialized Applications

High-purity applications, such as solar glass, electronics, and specialty glass manufacturing, require silica sand meeting stringent material specifications for chemical composition and particle size distribution. These requirements increase production complexity and processing costs for suppliers targeting high-value market segments. Maintaining consistent quality across large production volumes presents ongoing operational challenges for domestic producers.

Competition from International Suppliers

Competition from international suppliers is affecting the growth of the Saudi Arabia silica sand market by putting pressure on pricing and profit margins for domestic producers. Imported silica sand with consistent quality and specialized grades challenges local suppliers, especially in high-purity applications. This competition can slow local capacity expansion, while also encouraging domestic players to improve processing capabilities, quality standards, and cost efficiency to remain competitive.

Competitive Landscape:

The Saudi Arabia silica sand market features a competitive landscape characterized by both established domestic producers and regional suppliers serving diverse industrial applications. Key players are focused on improving supply reliability, processing quality, and customer relationships to strengthen market positions. Industry participants are investing in advanced purification technologies and expanding processing capabilities to produce high-purity silica sand meeting international quality standards. Regional expansion strategies and partnerships with end-use industries, including glass manufacturers, construction companies, and oil and gas operators, remain priority focus areas. The government's supportive policies for mining sector development and economic diversification continue to attract new investments in silica sand production and processing infrastructure across the Kingdom.

Recent Developments:

-

In January 2025, United Mining Industries Co. secured a minor mine license to investigate high-quality silica sand mineral resources in the silica sand ore complex No. 1, Tayma Governate, Tabuk, Saudi Arabia. The license was intended to aid the company's future and growth objectives in the mining industry and to explore various new products to improve the company's operational efficiency.

Saudi Arabia Silica Sand Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Million USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| End Uses Covered | Glass Industry, Foundry, Hydraulic Fracturing, Filtration, Abrasives, Others |

| Regions Covered | Northern and Central Region, Western Region, Eastern Region, Southern Region |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report

The Saudi Arabia silica sand market size was valued at USD 249.62 Million in 2025.

The Saudi Arabia silica sand market is expected to grow at a compound annual growth rate of 5.65% from 2026-2034 to reach USD 409.51 Million by 2034.

Glass industry dominated the market with a share of 42%, driven by expanding production of flat glass, container glass, and specialty glass for construction and automotive applications across the Kingdom.

Key factors driving the Saudi Arabia silica sand market include accelerating infrastructure development under Vision 2030, expansion of oil and gas exploration activities, growing investments in glass manufacturing capacity, and increasing demand for water treatment applications.

Major challenges include environmental and health concerns related to mining operations, stringent quality requirements for specialized applications, competition from international suppliers, and logistical constraints in transporting bulky materials across the Kingdom.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)