Saudi Arabia Security Market Size, Share, Trends and Forecast by Component, End User, and Region, 2026-2034

Saudi Arabia Security Market Summary:

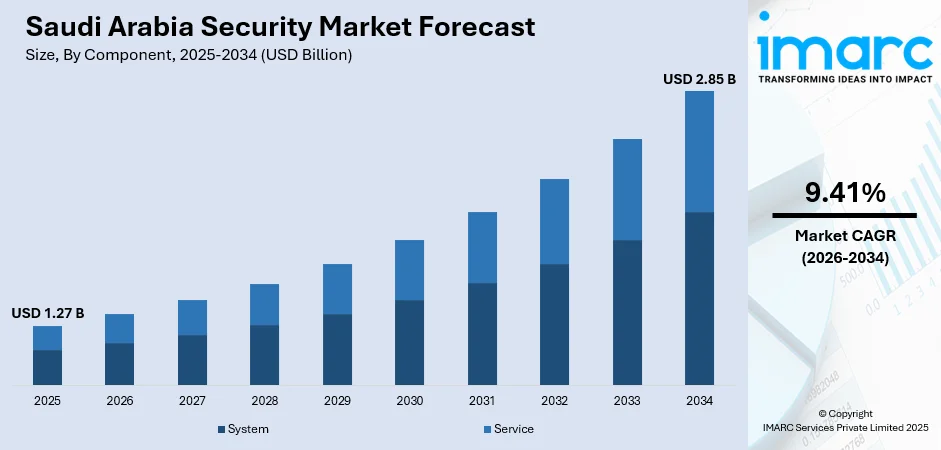

The Saudi Arabia security market size was valued at USD 1.27 Billion in 2025 and is projected to reach USD 2.85 Billion by 2034, growing at a compound annual growth rate of 9.41% from 2026-2034.

The Saudi Arabian security landscape is experiencing robust expansion driven by accelerating urbanization, heightened infrastructure development, and the Kingdom's strategic emphasis on safeguarding critical assets across public and private sectors. This growth trajectory reflects increasing investments in advanced surveillance technologies, integrated security solutions, and comprehensive protection frameworks aligned with national transformation initiatives and evolving threat perceptions, thereby expanding the Saudi Arabia security market share.

Key Takeaways and Insights:

- By Component: System dominates the market with a share of 66% in 2025, establishing itself as the largest component through widespread deployment of access control, surveillance, and intrusion detection technologies across diverse applications.

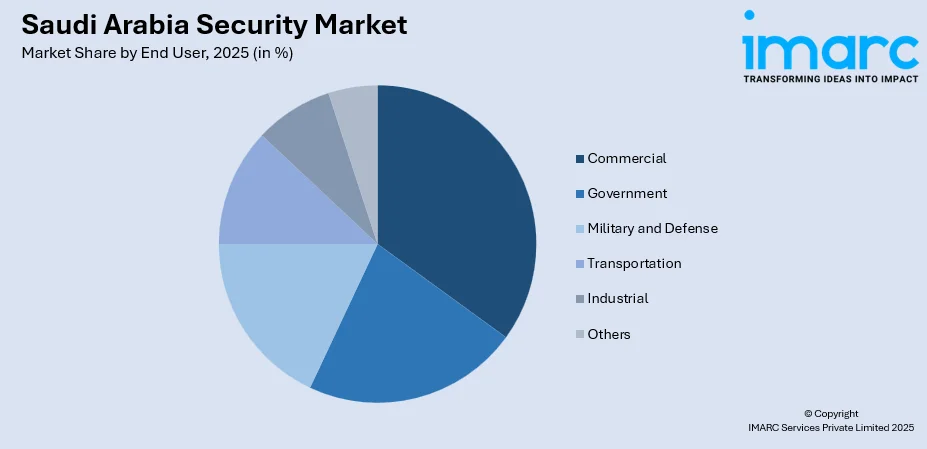

- By End User: Commercial leads the market with a share of 25% in 2025, driven by expanding retail infrastructure, hospitality developments, and corporate establishments requiring comprehensive protection solutions for assets and personnel.

- By Region: Northern and central region represents the largest segment with a market share of 40% in 2025, reflecting concentration of government institutions, economic activity centers, and strategic infrastructure requiring sophisticated security frameworks.

- Key Players: The Saudi Arabia security market exhibits a moderately fragmented competitive structure with established regional specialists competing alongside international technology providers across various security solution segments, driving innovation through localized service offerings and technological partnerships. Some of the key players include ABTSS Co., NASTECH Group, National Security Services Company, Nesma Security Company Services, SAT Microsystems, and Security Matterz.

To get more information on this market Request Sample

The Kingdom's security market is fundamentally shaped by Vision 2030 modernization objectives and accelerating investments in smart city infrastructure that are transforming the operational landscape. Riyadh's transformation into a global business hub alongside development of entertainment destinations and tourism facilities has created unprecedented demand for integrated security ecosystems capable of managing complex threat environments. The convergence of physical and cybersecurity requirements, particularly evident in megaprojects like NEOM and the Red Sea Project, demonstrates the market's evolution toward comprehensive risk management frameworks that address both traditional and emerging vulnerabilities. The Kingdom's hosting of major international events and religious pilgrimages, such as the annual Hajj welcoming millions of visitors, exemplifies the critical importance of scalable, reliable security infrastructure capable of managing massive population flows while maintaining safety standards. In 2025, Saudi Arabia has heightened the enforcement of Hajj permit rules, preventing those without official permits from accessing Makkah to guarantee that permitted pilgrims can make the most of the Kingdom's services and amenities. The Ministry of Interior stated that security personnel have been stationed at all major entry points to Makkah to stop unauthorized people from accessing the city in the days prior to Hajj. The heightened actions are a reaction to ongoing worries regarding the pressure on infrastructure and vital services caused by unapproved pilgrims.

Saudi Arabia Security Market Trends:

Integration of Artificial Intelligence and Analytics Capabilities

The Saudi security landscape is witnessing accelerated adoption of intelligent surveillance systems incorporating machine learning algorithms and behavioral analytics that transform traditional monitoring into predictive threat detection. These advanced platforms enable automated anomaly recognition, crowd management optimization, and real-time incident response coordination across distributed security networks. The shift toward AI-powered solutions reflects demand for operational efficiency improvements and enhanced decision-making capabilities that reduce human error while maximizing resource utilization in complex security environments. In 2025, the President of the General Court of Audit and Chairman of the Saudi Authority of Internal Auditors, introduced the authority's AI tool, "Sara," at the 2025 Annual Internal Audit Conference. Providing sophisticated analytical and informational features grounded in dependable sources and stringent cybersecurity protocols, Sara is fully hosted within the Kingdom to enhance internal audit operations, aid decision-making, and elevate output quality.

Expansion of Cloud-Based Security Management Platforms

Organizations across Saudi Arabia are increasingly migrating toward centralized cloud infrastructure for security system management, enabling unified oversight of geographically dispersed assets through scalable digital architectures. These platforms facilitate remote monitoring capabilities, simplified system updates, and seamless integration across multiple security components while reducing on-premise infrastructure requirements. The transition supports cost optimization objectives and operational flexibility demands particularly relevant for enterprises managing extensive facility networks requiring coordinated security protocols and standardized response procedures. In 2025, Databricks, the Data and AI firm, proclaimed the launch of its platform on Google Cloud for clients in the Kingdom of Saudi Arabia (KSA). This nearby presence enables organizations to develop and expand AI applications and agents on corporate data with improved speed, security, and oversight.

Growing Emphasis on Biometric Authentication Technologies

The Kingdom's security ecosystem is experiencing substantial uptake of biometric verification systems incorporating facial recognition, fingerprint scanning, and iris detection for enhanced access control precision. These technologies address limitations of traditional credential-based systems while supporting government initiatives promoting digital identity frameworks and contactless authentication methods. Deployment across airports, government facilities, and high-security commercial establishments reflects growing confidence in biometric reliability and acceptance of these systems as fundamental components of comprehensive security architectures. In 2025, Matrix Comsec, a top innovator in Security and Telecom solutions, revealed its strategic involvement at Intersec Saudi Arabia 2025, the country's foremost security, safety, and fire protection exhibition. The event will act as the official start for Matrix’s next-generation facial recognition technology.

How Vision 2030 is Transforming the Saudi Arabia Security Market:

Saudi Vision 2030 has reshaped the country’s security market by turning it into a priority sector rather than a support function. Mega projects like NEOM, Red Sea Global, Qiddiya, and Diriyah Gate demand advanced protection systems from the design stage itself. This has driven strong demand for integrated physical security, cybersecurity, surveillance, access control, and command-and-control solutions. Public safety upgrades across airports, metros, ports, and smart cities have expanded opportunities for private security providers and technology vendors. The government’s push for digital government services has also increased spending on data protection, threat monitoring, and critical infrastructure security. Localisation policies under Vision 2030 encourage partnerships, local manufacturing, and skills development, reducing reliance on imports. Regulatory reforms and higher compliance standards have professionalised the sector, raising service quality. Together, infrastructure expansion, digitalisation, and localisation are turning Saudi Arabia into one of the fastest-growing security markets in the Middle East.

Market Outlook 2026-2034:

The Saudi Arabia security market demonstrates compelling expansion potential underpinned by sustained infrastructure investments, regulatory emphasis on comprehensive protection frameworks, and technological evolution enabling sophisticated threat mitigation capabilities. The confluence of megaproject developments, expanding commercial real estate portfolios, and heightened security consciousness across public and private sectors creates sustained demand momentum. The market generated a revenue of USD 1.27 Billion in 2025 and is projected to reach a revenue of USD 2.85 Billion by 2034, growing at a compound annual growth rate of 9.41% from 2026-2034. Government prioritization of citizen safety alongside protection of strategic economic assets ensures continued capital allocation toward advanced security solutions throughout the forecast horizon.

Saudi Arabia Security Market Report Segmentation:

| Segment Category | Leading Segment | Market Share |

|---|---|---|

| Component | System | 66% |

| End User | Commercial | 25% |

| Region | Northern and Central Region | 40% |

Component Insights:

- System

- Access Control Systems

- Alarms and Notification Systems

- Intrusion Detection Systems

- Video Surveillance Systems

- Barrier Systems

- Others

- Service

- System Integration and Consulting

- Risk Assessment and Analysis

- Managed Services

- Maintenance and Support

System dominates with a market share of 66% of the total Saudi Arabia security market in 2025.

System-based security solutions maintain commanding market presence through their fundamental role in establishing comprehensive protection frameworks across diverse operational environments. The segment encompasses integrated platforms combining surveillance infrastructure, access management technologies, intrusion detection capabilities, and physical barriers that collectively form the foundation of modern security architectures. Video surveillance systems represent particularly significant components, with organizations deploying advanced camera networks featuring high-resolution imaging, night vision capabilities, and wide-area coverage supporting both real-time monitoring and forensic analysis requirements.

The dominance of system solutions reflects their tangible security enhancement capabilities and alignment with regulatory compliance mandates across government and commercial applications. Access control systems incorporating card readers, biometric scanners, and automated entry management have become essential for facilities requiring granular permission management and audit trail documentation. Intrusion detection technologies, ranging from perimeter sensors to motion-activated alerts, provide critical early warning capabilities that enable proactive threat response. The segment's leadership position is reinforced by ongoing technological advancement introducing intelligent features, connectivity enhancements, and integration capabilities that expand system functionality while addressing evolving security challenges across the Kingdom's expanding infrastructure landscape.

End User Insights:

Access the comprehensive market breakdown Request Sample

- Government

- Military and Defense

- Transportation

- Commercial

- Industrial

- Others

Commercial leads with a share of 25% of the total Saudi Arabia security market in 2025.

Commercial applications represent the largest end-user category driven by explosive growth in retail infrastructure, hospitality establishments, mixed-use developments, and corporate facilities requiring sophisticated protection for assets, personnel, and customer environments. The Kingdom's retail sector transformation, characterized by development of expansive shopping complexes, entertainment venues, and dining destinations, necessitates comprehensive security ecosystems managing crowd flows, preventing theft, and ensuring visitor safety. Hotels and hospitality developments implementing luxury service standards require unobtrusive yet effective security measures protecting guest privacy while maintaining secure operational environments.

Corporate office developments and business districts emerging across major Saudi cities demand integrated security solutions supporting access management for thousands of daily occupants, visitor screening protocols, and parking facility monitoring. The commercial segment's leadership reflects both the sheer scale of development activity and the sector's willingness to invest in premium security technologies that enhance operational efficiency and protect brand reputation. Financial institutions, healthcare facilities, and educational establishments within the commercial category implement specialized security requirements including vault protection, pharmaceutical storage monitoring, and campus safety systems. This diverse application landscape creates sustained demand for customized security solutions addressing sector-specific challenges while maintaining integration capabilities across broader organizational security frameworks.

Regional Insights:

- Northern and Central Region

- Western Region

- Eastern Region

- Southern Region

Northern and central region exhibits a clear dominance with a 40% share of the total Saudi Arabia security market in 2025.

The Northern and Central Region commands market leadership through concentration of government institutions, diplomatic facilities, financial centers, and strategic infrastructure requiring the highest levels of security sophistication. Riyadh's position as the political and administrative capital creates exceptional demand for comprehensive protection frameworks safeguarding ministerial complexes, royal facilities, and international embassy compounds. The region hosts the Kingdom's primary financial district with banking headquarters, investment firms, and stock exchange facilities implementing stringent security protocols protecting sensitive financial data and high-value assets from physical and digital threats.

Major infrastructure projects transforming the capital region, including extensive metro systems, airport expansions, and integrated transport networks, require sophisticated surveillance and access control installations managing millions of passenger movements while maintaining security vigilance. The region's industrial clusters, including manufacturing zones and logistics facilities serving the central Kingdom, implement perimeter protection, cargo monitoring, and facility access management systems. Government prioritization of Riyadh's development as a global business destination drives continued investment in smart city security infrastructure incorporating intelligent surveillance networks, emergency response coordination systems, and integrated command centers. This concentration of critical assets, administrative functions, and economic activity ensures the Northern and Central Region maintains its leadership position throughout the forecast period as security requirements evolve alongside expanding urban infrastructure.

Market Dynamics:

Growth Drivers:

Why is the Saudi Arabia Security Market Growing?

Accelerating Vision 2030 Infrastructure Development Initiatives

The Kingdom's ambitious transformation agenda drives unprecedented investment in megaprojects, entertainment destinations, transportation networks, and urban development requiring comprehensive security frameworks from project inception through operational phases. NEOM's futuristic city concept, Red Sea tourism developments, and Qiddiya entertainment complexes necessitate integration of cutting-edge security technologies including perimeter monitoring systems, intelligent surveillance networks, and sophisticated access management platforms protecting infrastructure investments valued in billions of dollars. These landmark projects establish new benchmarks for security system sophistication, incorporating artificial intelligence, automation capabilities, and predictive analytics that influence security standards across the broader market. Government emphasis on world-class infrastructure quality ensures security considerations receive priority attention during planning and implementation phases, creating sustained demand for advanced protection solutions. Saudi Arabia has initiated a CAD 1.04 trillion initiative to expand the City of Riyadh's size over the next ten years, aiming to establish it as an economic, social, and cultural center for the region. This will generate significant prospects for city infrastructure, including water and transport, and will feature the largest urban park globally, along with diverse sports and cultural amenities.

Heightened Focus on Critical Infrastructure Protection

Saudi Arabia's strategic emphasis on safeguarding energy facilities, transportation networks, government installations, and telecommunications infrastructure drives substantial investment in specialized security solutions addressing unique vulnerabilities of critical assets. The Kingdom's position as a global energy leader creates imperative for robust protection of oil production facilities, refineries, pipeline networks, and export terminals against potential threats ranging from unauthorized access to sophisticated attacks. Transportation infrastructure including airports, seaports, railway networks, and metro systems require multilayered security architectures incorporating passenger screening, cargo inspection, perimeter monitoring, and emergency response coordination capabilities. In 2024, Saudi Arabia participated for the first time in the Defense and Security Eurosatory 2024 (June 17-21), a premier global defense and security exhibition in Paris, unveiling its pavilion that highlights the newest advancements and accomplishments in its military industries sector.

Expanding Regulatory Framework and Compliance Requirements

The Saudi government's progressive implementation of comprehensive security standards, mandatory protection protocols, and enforcement mechanisms across public and private sectors creates structured demand for compliant security solutions meeting defined specifications. In 2024, Prince Khalid bin Salman, the Saudi Defense Minister, opened the second World Defense Show in Riyadh representing Crown Prince Mohammed bin Salman.Organized by the General Authority for Military Industries, the event took place under the patronage of King Salman. The exhibition, set to continue until February 8, highlights the Kingdom's dedication to establishing itself as a worldwide center for the defense sector. Regulatory authorities establish minimum security requirements for facility categories including commercial buildings, industrial sites, educational institutions, and healthcare facilities, mandating deployment of specific surveillance coverage, access control capabilities, and emergency alert systems. Building codes increasingly incorporate security considerations alongside traditional structural and fire safety requirements, embedding protection measures into development approval processes.

Market Restraints:

What Challenges the Saudi Arabia Security Market is Facing?

High Initial Capital Investment Requirements

Comprehensive security system deployment necessitates substantial upfront expenditure encompassing hardware procurement, installation labor, infrastructure modifications, and integration services that create financial barriers particularly challenging for small and medium enterprises. Advanced surveillance technologies, biometric access systems, and intelligent monitoring platforms command premium pricing reflecting sophisticated components and specialized capabilities. Organizations face additional costs for network infrastructure upgrades, power supply enhancements, and environmental conditioning supporting security equipment operations. The capital intensity becomes particularly pronounced for facilities requiring extensive coverage across large areas or multiple locations, where equipment quantities and installation complexity multiply project costs substantially beyond initial budgets.

Complexity of Legacy System Integration

Many Saudi organizations operate existing security infrastructure with limited interoperability capabilities, creating technical challenges when attempting to incorporate modern solutions into established frameworks. Disparate systems utilizing incompatible communication protocols, proprietary software platforms, and divergent data formats resist seamless integration, necessitating expensive middleware solutions or complete system replacements. The technical complexity extends to coordinating equipment from multiple vendors, managing firmware updates across diverse components, and maintaining operational reliability during transition periods. Organizations struggle to balance desires for cutting-edge capabilities against practical limitations of existing infrastructure and operational disruption concerns associated with comprehensive system overhauls.

Shortage of Specialized Technical Expertise

The Kingdom faces workforce constraints in security technology specialization, with limited availability of professionals possessing expertise in advanced system design, installation techniques, cybersecurity integration, and ongoing maintenance requirements. Rapid technological evolution outpaces training program development, creating knowledge gaps between available workforce capabilities and sophisticated system requirements. Organizations encounter difficulties recruiting qualified personnel for security operations centers, system administration roles, and technical support functions essential for maximizing security investment effectiveness. The expertise shortage affects both implementation quality during deployment phases and long-term operational performance as organizations struggle to fully utilize advanced system capabilities or address technical issues promptly.

Competitive Landscape:

The Saudi Arabia security market demonstrates a moderately consolidated competitive structure characterized by coexistence of established international technology providers and specialized regional integrators serving diverse customer requirements across market segments. Large multinational corporations leverage global research and development capabilities, extensive product portfolios, and brand recognition to capture premium market segments while regional specialists compete through localized service delivery, customized solutions, and intimate understanding of Saudi regulatory requirements and operational contexts. The competitive dynamics reflect differentiation strategies spanning technology innovation, service quality, pricing flexibility, and vertical market specialization with participants targeting specific end-user categories or geographic concentrations. Market players increasingly emphasize comprehensive solution offerings combining hardware provision, software platforms, installation services, and long-term maintenance contracts that create recurring revenue streams and strengthen customer relationships. Strategic partnerships between technology manufacturers and local implementation specialists enable market access combining global innovation with regional expertise, while consolidation activity periodically reshapes the competitive landscape as companies pursue scale advantages and capability expansion through mergers and acquisitions. Some of the key market players include:

- ABTSS Co.

- NASTECH Group

- National Security Services Company

- Nesma Security Company Services

- SAT Microsystems

- Security Matterz

Recent Developments:

- In December 2025, Saudi Arabia’s Ministry of Investment has announced more than SR500 million ($133 million) in new cybersecurity funding, strengthening the Kingdom's favorable investment environment, startup development, and digital objectives. The ministry, serving as the strategic sponsor and investment partner for the fourth edition of Black Hat Middle East and Africa 2025, revealed a number of significant investments during the event organized by the Saudi Federation for Cybersecurity, Programming and Drones at the Riyadh Exhibition and Convention Center in Malham from December 2 to 4.

- In October 2025, IDEMIA Public Security, a top provider of reliable and secure biometric solutions, has entered into a strategic partnership with SAMI Advanced Electronics, a principal player in Saudi Arabia's electronics sector, to foster innovative advancements in travel, transportation, and smart mobility throughout the Kingdom.

Saudi Arabia Security Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Components Covered |

|

| End Users Covered | Government, Military and Defense, Transportation, Commercial, Industrial, Others |

| Regions Covered | Northern and Central Region, Western Region, Eastern Region, Southern Region |

| Companies Covered | ABTSS Co., NASTECH Group, National Security Services Company, Nesma Security Company Services, SAT Microsystems, Security Matterz, etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report

The Saudi Arabia security market size was valued at USD 1.27 Billion in 2025.

The Saudi Arabia security market is expected to grow at a compound annual growth rate of 9.41% from 2026-2034 to reach USD 2.85 Billion by 2034.

System dominated the market with a 66% share in 2025, driven by fundamental requirements for surveillance infrastructure, access control technologies, and intrusion detection capabilities forming the foundation of comprehensive security frameworks across government, commercial, and industrial applications throughout the Kingdom.

Key factors driving the Saudi Arabia security market include accelerating Vision 2030 infrastructure development creating demand for sophisticated protection systems, heightened focus on critical infrastructure security across energy and transportation sectors, and expanding regulatory frameworks mandating comprehensive security compliance across facility categories.

Major challenges include high initial capital investment requirements creating barriers for comprehensive system deployment, complexity of integrating modern solutions with legacy infrastructure possessing limited interoperability, technical expertise shortages constraining implementation quality and operational effectiveness, and rapid technological evolution requiring continuous system upgrades and workforce skill development.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)