Saudi Arabia Retail Banking Market Size, Share, Trends and Forecast by Product, Application, Channel, and Region, 2026-2034

Saudi Arabia Retail Banking Market Summary:

The Saudi Arabia retail banking market size was valued at USD 20.62 Billion in 2025 and is projected to reach USD 34.98 Billion by 2034, growing at a compound annual growth rate of 6.05% from 2026-2034.

The Saudi Arabia retail banking market is undergoing substantial transformation as the Kingdom accelerates its financial modernization efforts under Vision 2030. Growing consumer demand for digital financial solutions, increasing smartphone penetration, and government-led initiatives promoting financial inclusion are strengthening market dynamics. Enhanced regulatory frameworks, expanding mortgage accessibility through housing programs, and the emergence of digital-only banking platforms are reshaping how consumers interact with financial services. The integration of advanced technologies including artificial intelligence and open banking frameworks is enabling personalized customer experiences, driving efficiency improvements, and supporting the Saudi Arabia retail banking market share.

Key Takeaways and Insights:

-

By Product: Debit cards dominate the market with a share of 20% in 2025, driven by widespread adoption of contactless payment solutions and the Kingdom's accelerating transition toward cashless transactions across retail and e-commerce sectors.

-

By Application: Services leads the market with a share of 50% in 2025, reflecting the substantial demand for comprehensive banking solutions, including account management, digital transactions, and personalized financial advisory offerings.

-

By Channel: Direct sales represent the largest segment with a market share of 58% in 2025, as banks strengthen their direct customer engagement through digital platforms, mobile applications, and enhanced branch networks.

-

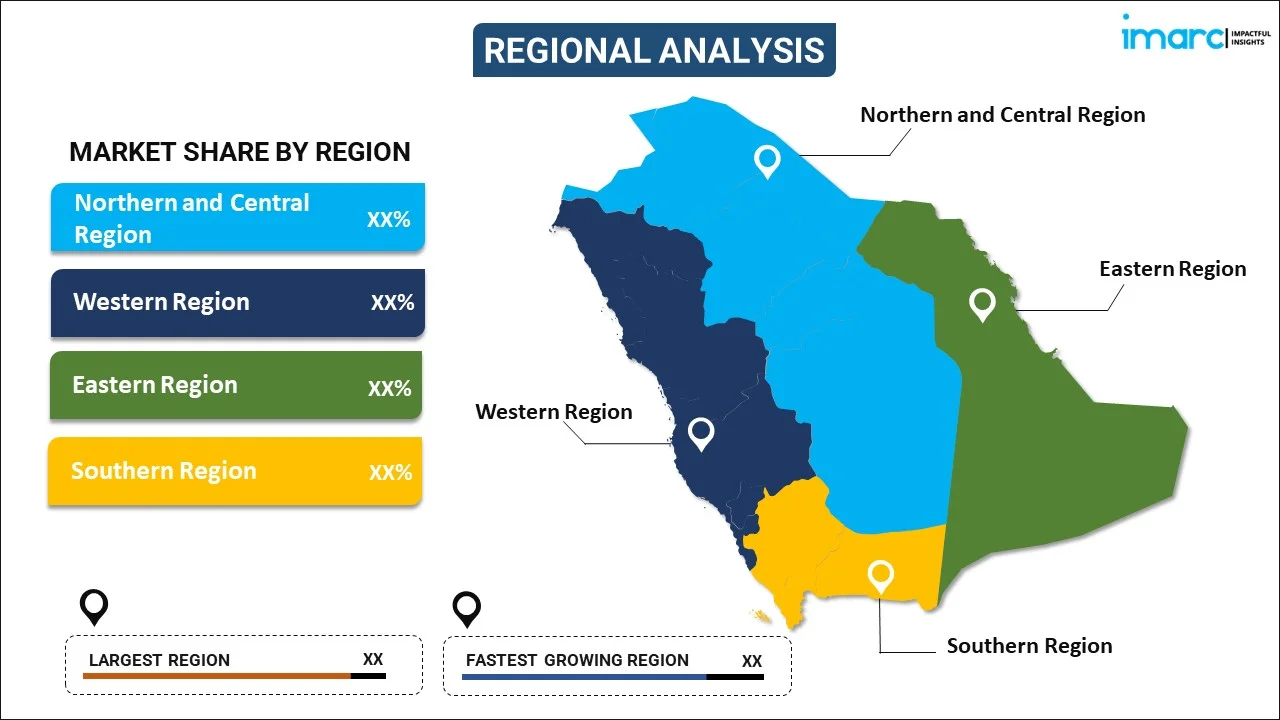

By Region: Northern and Central region dominate the market with a share of 28% in 2025, supported by Riyadh's position as the financial hub hosting major banking headquarters and the concentration of economic activity.

-

Key Players: The Saudi Arabia retail banking market features intense competition among established national banks and emerging digital challengers. Major institutions are investing heavily in digital infrastructure, customer experience enhancement, and innovative product development to maintain competitive positioning and capture growing demand for modern banking services.

The Saudi Arabia retail banking market continues to evolve as financial institutions respond to changing consumer preferences and regulatory developments. The Saudi Central Bank's licensing of digital-only banks is intensifying competition and driving innovation across the sector. In December 2024, D360 Bank became the first licensed digital bank in the Kingdom to commence operations, attracting several customers within its initial months of launch. This development exemplifies the strong consumer appetite for convenient, technology-driven banking solutions. Traditional banks are responding by upgrading mobile applications, streamlining digital onboarding processes, and expanding their range of digital services. The market is further strengthened by government-backed housing initiatives that have elevated homeownership rates while expanding mortgage lending opportunities for retail banks.

Saudi Arabia Retail Banking Market Trends:

Emergence of Digital-Only Banking Platforms

The Saudi Arabia retail banking market is seeing the rise of digital-only banks that are redefining traditional banking through streamlined, mobile-first experiences. The Saudi Arabia digital banking market size reached USD 87.60 Million in 2024. Looking forward, IMARC Group expects the market to reach USD 278.19 Million by 2033, exhibiting a growth rate (CAGR) of 12.70% during 2025-2033. These institutions utilize advanced data analytics and artificial intelligence to offer personalized financial products and seamless customer onboarding. Such digital challengers are gaining strong traction among younger, tech-savvy consumers who value convenience, transparency, and innovative banking solutions, signaling a shift in customer expectations and accelerating the Kingdom’s transition toward a more digitally focused financial ecosystem.

Acceleration of Cashless Transaction Adoption

Electronic payments have achieved remarkable penetration in Saudi Arabia, fundamentally transforming retail banking dynamics and driving the Saudi Arabia retail banking market growth. The shift toward cashless transactions is supported by robust digital infrastructure and widespread acceptance of contactless payment methods. According to the Financial Sector Development Program's annual report, electronic payments accounted for 79% of total retail transactions in 2024, demonstrating significant consumer adoption. E-commerce transactions using mada cards reached nearly SR29.86 billion in July 2025, representing a substantial increase from the previous year, reflecting growing consumer confidence in digital payment platforms.

Expansion of Open Banking Frameworks

Open banking initiatives are transforming the competitive landscape by allowing secure data sharing between financial institutions and third-party service providers. This regulatory framework is driving innovation and facilitating the creation of personalized financial products tailored to individual consumer needs. By enabling efficient and secure data exchange, banks and fintech companies can develop a wide range of innovative financial solutions. The growing number of fintech firms in the Kingdom reflects a dynamic and supportive ecosystem, highlighting the increasing adoption of technology-driven services that enhance customer experience and accelerate the advancement of financial technology in Saudi Arabia.

How Vision 2030 is Transforming the Saudi Arabia Retail Banking Market:

Vision 2030 is profoundly reshaping the Saudi Arabia retail banking market by driving digital transformation, financial inclusion, and diversification of services. Government initiatives aimed at modernizing the financial sector are encouraging banks to adopt advanced technologies, including mobile banking, AI-driven solutions, and fintech collaborations, enhancing customer convenience and operational efficiency. Regulatory reforms, such as open banking frameworks, are fostering innovation and enabling personalized financial products tailored to individual needs. Additionally, the focus on financial literacy and inclusion is expanding access to banking services across underserved segments. Together, these reforms are creating a more competitive, technology-enabled, and customer-centric retail banking landscape aligned with the Kingdom’s long-term economic diversification goals.

Market Outlook 2026-2034:

The Saudi Arabia retail banking market is positioned for sustained expansion as Vision 2030 initiatives continue driving economic diversification and financial sector modernization. Digital transformation investments, enhanced regulatory frameworks, and growing consumer sophistication are expected to accelerate market development. The continued rollout of mega-projects and infrastructure development will generate substantial financing opportunities while the expansion of housing programs will sustain mortgage demand. The market generated a revenue of USD 20.62 Billion in 2025 and is projected to reach a revenue of USD 34.98 Billion by 2034, growing at a compound annual growth rate of 6.05% from 2026-2034.

Saudi Arabia Retail Banking Market Report Segmentation:

| Segment Category | Leading Segment | Market Share |

|---|---|---|

| Product | Debit Cards | 20% |

| Application | Services | 50% |

| Channel | Direct Sales | 58% |

| Region | Northern and Central Region | 28% |

Product Insights:

To get detailed segment analysis of this market Request Sample

- Transactional Accounts

- Savings Accounts

- Debit Cards

- Credit Cards

- Loans

- Others

The debit cards dominates with a market share of 20% of the total Saudi Arabia retail banking market in 2025.

Debit cards have emerged as the preferred payment instrument among Saudi consumers, driven by the Kingdom's strategic push toward a cashless economy and the widespread deployment of point-of-sale infrastructure. The convenience of instant transactions, enhanced security features, and seamless integration with mobile wallets have strengthened consumer preference for debit card usage. Financial institutions are responding by introducing premium debit card offerings with expanded benefits, rewards programs, and international acceptance capabilities.

The rapid expansion of e-commerce platforms has further accelerated debit card adoption as consumers increasingly utilize cards for online purchases. The mada payment network, Saudi Arabia's national payment system, has played a pivotal role in facilitating secure and efficient debit card transactions across retail and digital commerce channels. Banks are continuously enhancing their card management features through mobile applications, enabling customers to control spending limits, receive real-time transaction alerts, and manage multiple cards from unified digital platforms.

Application Insights:

- Hardware

- Software

- Services

The services leads with a share of 50% of the total Saudi Arabia retail banking market in 2025.

Services encompass the comprehensive range of financial solutions delivered to retail customers, including account management, payment processing, lending facilities, and wealth advisory offerings. The dominance of services reflects the fundamental nature of retail banking as a service-oriented industry where customer relationships and transaction processing form the core value proposition. Banks are investing substantially in enhancing service delivery through digital channels, enabling customers to access comprehensive banking capabilities through mobile applications and online platforms.

The evolution of service offerings in the Saudi retail banking sector is marked by greater personalization and the integration of artificial intelligence capabilities. Recent mobile application upgrades exemplify this trend, allowing customers to open accounts, apply for loans, and make investment deposits entirely through digital channels without visiting branches. This shift reflects the successful digital transformation of service delivery models, with a growing number of consumers regularly relying on mobile banking solutions for convenient, seamless, and efficient financial management.

Channel Insights:

- Direct Sales

- Distributor

The direct sales represent the largest share at 58% of the total Saudi Arabia retail banking market in 2025.

Direct sales channels encompass the various touchpoints through which banks engage directly with customers, including physical branch networks, digital banking platforms, mobile applications, and dedicated relationship managers. The predominance of direct sales reflects the strategic importance banks place on maintaining close customer relationships and controlling the customer experience throughout the banking journey. Digital channels have become increasingly central to direct sales strategies, with banks achieving significant growth in accounts opened and products sold through online platforms.

The transformation of branch networks from mere transaction points to advisory hubs signifies a major shift in direct sales strategies. Banks are redesigning physical locations to emphasize complex financial consultations, wealth management, and relationship-building, while routine transactions are increasingly handled through digital channels. This approach highlights the successful integration of digital capabilities within traditional banking, enabling institutions to enhance customer engagement, streamline operations, and offer personalized advisory services without relying solely on branch visits.

Regional Insights:

To get detailed regional analysis of this marketRequest Sample

- Northern and Central Region

- Western Region

- Eastern Region

- Southern Region

The Northern and Central region dominates with a market share of 28% of the total Saudi Arabia retail banking market in 2025.

The Northern and Central Region's market leadership is anchored by Riyadh's position as the Kingdom's capital and principal financial center. The concentration of major banking headquarters, corporate entities, and government institutions in Riyadh generates substantial demand for retail banking services. The region's growing population, elevated disposable incomes, and extensive urban development projects create favorable conditions for retail banking expansion. Urban centers within this region serve as innovation hubs where banks deploy flagship digital branches that showcase advanced banking technologies.

The Western Region, encompassing Jeddah and the holy cities of Mecca and Medina, represents a significant market driven by commercial activity, tourism, and religious pilgrimage. The Eastern Region's importance stems from its role as the center of the petroleum industry and its substantial expatriate population. The Southern Region, while representing a smaller market share, is experiencing growth through government development programs aimed at enhancing economic activity and infrastructure across the Kingdom's diverse geography.

Market Dynamics:

Growth Drivers:

Why is the Saudi Arabia Retail Banking Market Growing?

Vision 2030 Financial Sector Development Initiatives

The Financial Sector Development Program, a cornerstone initiative under Saudi Vision 2030, is fundamentally reshaping the retail banking landscape by promoting financial inclusion, fostering innovation, and enhancing the sector's contribution to economic diversification. The program's comprehensive reforms have attracted significant investment into the financial sector while creating a supportive regulatory environment for banking innovation. The share of bank credit to the private sector relative to GDP increased from 61% in 2023 to 69% in 2024, reaching a value of SAR 2,752 billion and recording annual growth of 13%. Government-backed housing initiatives under the Sakani program have elevated homeownership rates to 65.4% in 2024, surpassing the original 2025 target and generating sustained demand for mortgage products.

Rapid Digital Transformation and Technology Adoption

The accelerating adoption of digital banking technologies is fundamentally transforming how retail banking services are delivered and consumed in Saudi Arabia. Widespread smartphone penetration, high-speed internet availability, and consumer preference for digital convenience are driving banks to invest substantially in technology infrastructure and digital capabilities. The SARIE instant payment system processed billions of real-time transactions in recent years, pushing digital transactions to represent a significant majority of retail activity. In July 2024, Riyad Bank announced the establishment of the Center of Intelligence, the first specialized artificial intelligence hub in the Kingdom's banking sector, designed to improve operational performance and elevate customer experience by leveraging cutting-edge artificial intelligence and machine learning capabilities

Expanding Personal Lending and Mortgage Demand

Growing consumer aspirations for homeownership, education financing, and lifestyle improvements are driving sustained demand for personal lending products across the Saudi Arabia retail banking market. Government support mechanisms, affordable housing schemes, and competitive interest rates have made financing more accessible to broader population segments. Saudi banks' total loans and advances to customers grew by 13.6% year-on-year in 2024, reaching SAR 4.21 trillion. Al Rajhi Bank led in loan issuance, providing SAR 693.4 billion, representing a 16.8% increase from the previous year. The Saudi Real Estate Refinance Company's completion of a USD 2 billion international sukuk in May 2025 injected fresh liquidity into the mortgage market, supporting continued expansion of residential financing activities.

Market Restraints:

What Challenges the Saudi Arabia Retail Banking Market is Facing?

Escalating Cybersecurity Threats and Compliance Requirements

As digital banking adoption accelerates, financial institutions face mounting cybersecurity challenges including sophisticated phishing attacks, ransomware threats, and data breach risks. The regulatory environment requires compliance with multiple overlapping frameworks, creating operational complexity for banks seeking to maintain robust security postures while delivering seamless digital experiences. Banks must invest substantially in security infrastructure, employee training, and incident response capabilities to protect customer data and maintain regulatory compliance.

Intensifying Competition from Fintech and Digital Banks

The entry of agile fintech companies and digital-only banks is intensifying competitive pressures on traditional retail banking institutions. These challengers often offer superior digital experiences, transparent fee structures, and innovative products that attract younger demographics. Traditional banks must continuously invest in technology modernization and service innovation to maintain market positioning while managing the associated cost implications.

Limited Credit Information Infrastructure

Credit information coverage in Saudi Arabia remains below global averages, constraining lenders' ability to make fully informed lending decisions. This information gap creates challenges in accurately assessing borrower creditworthiness, potentially elevating default risks and limiting the extension of credit to underserved consumer segments. Enhanced credit information sharing mechanisms are needed to support responsible lending expansion.

Competitive Landscape:

The Saudi Arabia retail banking market features a competitive landscape where well-established national banks hold leading positions while facing growing pressure from digital-only banks and fintech innovators. Traditional institutions leverage extensive branch networks, long-standing customer relationships, and robust financial resources to maintain market dominance. To remain competitive, these banks are heavily investing in digital transformation initiatives, enhancing online and mobile banking services, and developing innovative financial solutions. Competition is intensifying as technology-driven entrants attract younger, tech-savvy customers with flexible and convenient offerings. Collaborations and strategic partnerships with fintech and technology providers are increasingly being adopted to accelerate digital capabilities while sustaining operational efficiency.

Recent Developments:

-

March 2025: Mozn collaborated with D360 Bank, the leading digital bank in Saudi Arabia, to foster innovations in digital banking security by utilizing artificial intelligence-based AML compliance solutions. This partnership aligned with D360 Bank's dedication to providing improved, customer-focused digital banking services while maintaining regulatory compliance.

-

February 2025: Al Rajhi Bank partnered with RATL Technology to roll out the MUHIDE fintech platform for SME trade-finance governance, enhancing digital capabilities for business banking customers.

-

February 2025: Telr, a prominent provider of payment gateways, formed a strategic alliance with Bank AlJazira to advance Saudi Arabia's Vision 2030 project toward a cashless economy, providing quicker payments, enhanced fraud prevention, and seamless checkout processes for merchants.

-

September 2024: Saudi National Bank introduced 'NEO' Digital Banking, offering a unique digital banking experience encompassing personal expense tracking, savings, currency conversion, financial services, and an online retail store featuring diverse digital offerings.

Saudi Arabia Retail Banking Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Billion USD |

| Scope of the Report | Exploration of Historical and Forecast Trends, Industry Catalysts and Challenges, Segment-Wise Historical and Predictive Market Assessment:

|

| Products Covered | Transactional Accounts, Savings Accounts, Debit Cards, Credit Cards, Loans, Others |

| Applications Covered | Hardware, Software, Services |

| Channels Covered | Direct Sales, Distributor |

| Regions Covered | Northern and Central Region, Western Region, Eastern Region, Southern Region |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report

The Saudi Arabia retail banking market size was valued at USD 20.62 Billion in 2025.

The Saudi Arabia retail banking market is expected to grow at a compound annual growth rate of 6.05% from 2026-2034 to reach USD 34.98 Billion by 2034.

Debit cards represents the largest product share at 20% in 2025, driven by the Kingdom's accelerating transition toward cashless transactions, widespread contactless payment adoption, and the seamless integration of debit cards with digital banking platforms.

Key factors driving the Saudi Arabia retail banking market include Vision 2030 financial sector development initiatives, rapid digital transformation and technology adoption, expanding personal lending and mortgage demand, government-backed housing programs, and the emergence of innovative digital banking platforms.

Major challenges include escalating cybersecurity threats and complex compliance requirements, intensifying competition from fintech companies and digital-only banks, limited credit information infrastructure, and the need for continuous technology investments to meet evolving customer expectations.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)