Saudi Arabia Residential Real Estate Market Report by Type (Condominiums and Apartments, Villas and Landed Houses), and Region 2026-2034

Saudi Arabia Residential Real Estate Market Size:

Saudi Arabia residential real estate market size reached USD 76.8 Billion in 2025. Looking forward, IMARC Group expects the market to reach USD 141.6 Billion by 2034, exhibiting a growth rate (CAGR) of 6.69% during 2026-2034. Rapid urbanization, government initiatives including Vision 2030, growing youth population, increasing foreign investment, economic diversification, improved infrastructure, rising focus on affordable housing, and increasing disposable income are some of the major factors propelling the growth of the market.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2025 |

|

Forecast Years

|

2026-2034

|

|

Historical Years

|

2020-2025

|

| Market Size in 2025 | USD 76.8 Billion |

| Market Forecast in 2034 | USD 141.6 Billion |

| Market Growth Rate (2026-2034) | 6.69% |

Access the full market insights report Request Sample

Saudi Arabia Residential Real Estate Market Analysis:

- Major Market Drivers: Government initiatives include Vision 2030 which aims to diversify the economy and boost homeownership rates, which represents the major driver of the market. Economic diversification efforts, such as expanding tourism and entertainment sectors, further stimulate residential development across the country.

- Key Market Trends: The rise in affordable housing projects to cater to middle-income families and first-time home buyers represents the key trend of the market. The widespread adoption of smart home technologies and sustainable building practices also reflects the trends that are increasingly gaining traction in the market.

- Competitive Landscape: The Saudi Arabia residential real estate market analysis report has also provided a comprehensive analysis of the competitive landscape in the market. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

- Challenges and Opportunities: The market faces several challenges including high land costs, bureaucratic hurdles, and fluctuating oil prices, which impact economic stability and investment. However, the market also faces various opportunities such as the government’s Vision 2030 plan promoting economic diversification and increasing homeownership.

Saudi Arabia Residential Real Estate Market Trends:

Rising Government Initiatives and Vision 2030

The Saudi government's Vision 2030 aims to diversify the economy and increase homeownership, thus boosting the demand through policies supporting affordable housing and infrastructure development. For instance, in January 2024, the government unveiled plans to introduce more than half a million new housing units by 2030, following recent legal reforms aimed at restructuring the real estate sector. In the past five years, more than 15 supportive laws have been enacted to enhance transparency and improve the investment climate. The Saudi Municipal and Rural Affairs and Housing shared this information during the opening of the third edition of the Real Estate Future Forum in Riyadh. The event brings together representatives from over 85 countries, featuring 300 speakers from the public and private sectors, as well as experts in economics and investment. The event further highlighted the significant role played by banks and financial institutions, which have provided over SAR 650 bn (USD 173 bn) in real estate loans. State-supported loans have reached approximately 750,000 contracts, which is contributing to the Saudi Arabia residential real estate market growth significantly.

Growing Population and Urbanization

A young and rapidly growing population, coupled with increased urbanization, drives the demand for new residential properties, particularly in major cities. According to industry reports, at the start of 2024, 85.1 percent of Saudi Arabia’s population lived in urban centers, while 14.9 percent lived in rural areas. For instance, in July 2024, Construction began on Banan City, a sprawling new 10 sq km municipality northeast of Riyadh, as Saudi Arabia prepares for World Expo 2030. The ambitious project will feature over 20,000 smart homes for 120,000 residents within a gated community. Talaat Moustafa Group announced that construction work had commenced in the Al-Fursan suburb. Operations are ongoing around the clock, adhering to construction schedules and plans, with heavy equipment fully deployed to speed up the process and deliver the units as soon as possible.

Increasing Foreign Investment and Economic Diversification

Efforts to attract foreign investment and diversify the economy away from oil have led to increased development in the residential sector, providing more housing options and modern amenities. This, in turn, is aiding in increasing the overall Saudi Arabia residential real estate market revenue. For instance, in August 2024, Saudi Arabia’s housing sector strengthened its international partnerships by signing five key agreements on real estate development and financing with major US companies. Another MoU was signed between the Ministry of Municipalities and Housing and K. Hovnanian ME, a company with a track record of developing 500,000 housing units in the US, to build more integrated residential communities in Saudi Arabia.

Saudi Arabia Residential Real Estate Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional levels for 2026-2034. Our report has categorized the market based on type.

Breakup by Type:

To get detailed segment analysis of this market Request Sample

- Condominiums and Apartments

- Villas and Landed Houses

The report has provided a detailed breakup and analysis of the market based on the type. This includes condominiums and apartments and villas and landed houses.

The demand for condominiums and apartments in Saudi Arabia is driven by urbanization, a growing population of young professionals, and smaller family sizes. Additionally, these properties offer affordability, convenience, and proximity to work and amenities. Government initiatives promoting homeownership and the development of mixed-use urban areas also contribute to the increasing popularity of apartments among first-time buyers and investors. Consequently, condominiums and apartments represent one of the most popular segments, holding significant Saudi Arabia residential real estate market share.

The demand for villas and landed houses is steadily increasing in Saudi Arabia, driven by the preferences of larger families and high-income residents seeking spacious living environments. These properties offer privacy, luxury, and more room for outdoor activities, appealing to those desiring a high-quality lifestyle. Additionally, cultural preferences for traditional family living and government support for residential development boost the demand for such properties significantly.

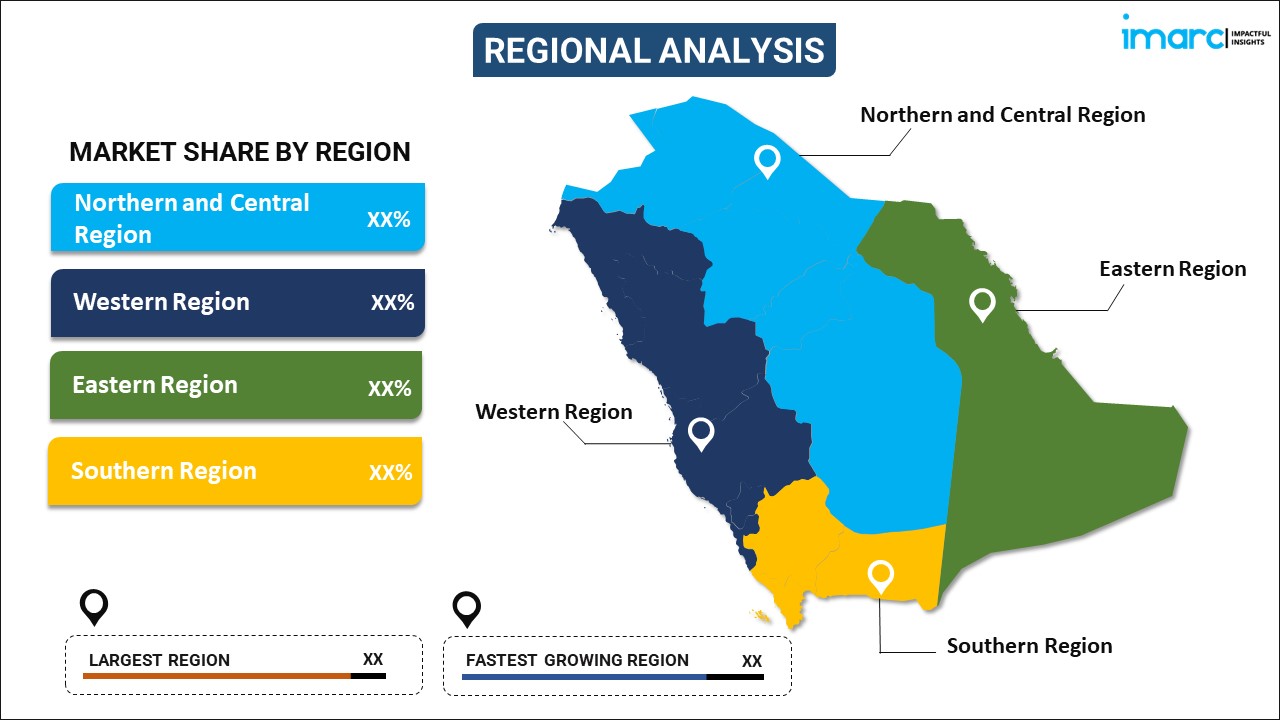

Breakup by Region:

To get detailed regional analysis of this market Request Sample

- Northern and Central Region

- Western Region

- Eastern Region

- Southern Region

The report has also provided a comprehensive analysis of all the major markets in the region, which include Northern and Central Region, Western Region, Eastern Region, and Southern Region.

The demand for residential real estate in the Northern and Central regions, including Riyadh, is driven by government infrastructure projects, economic diversification efforts, and Vision 2030 initiatives. The capital city’s status as a commercial hub attracts businesses and expatriates, boosting residential demand. Additionally, Riyadh's expanding job market and the development of mixed-use projects contribute to the region’s growing real estate market.

The Western region, including Jeddah and Mecca, is marked by religious tourism and the development of hospitality and residential infrastructure. The increasing number of pilgrims and tourism activities stimulate demand for residential properties. Additionally, according to the Saudi Arabia residential real estate market forecast, the area's economic diversification initiatives, focusing on logistics, retail, and entertainment sectors, will continue to support urban development and attract both domestic and international investors in the upcoming years.

The demand for residential real estate in the Eastern region, particularly in Dammam and Al Khobar, is fueled by its strategic location near the oil industry and proximity to Bahrain. The presence of oil and petrochemical industries attracts professionals, boosting demand for residential properties. Government investments in infrastructure, including transportation links and urban development projects, further enhance the region's attractiveness to residents and investors.

The Southern region's real estate market is driven by growing industrial activities and government efforts to boost local economies through infrastructure development. Improved transportation links and urbanization attract investment in residential projects. Additionally, tourism initiatives in areas like the Abha and Asir Mountains, promoting nature and cultural tourism, contribute to the increasing demand for both temporary and permanent housing options.

Competitive Landscape:

The Saudi Arabia residential real estate market is highly competitive, with both local and international developers actively participating. Major Saudi Arabia residential real estate market companies are focusing on various segments from affordable to luxury housing. New entrants are attracted by government initiatives and economic reforms promoting real estate development. Additionally, international firms have entered the market, bringing expertise in large-scale, mixed-use developments. The report has provided a comprehensive analysis of the competitive landscape in the market. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major have been provided, including:

- Jabal Omar Development Company

- Al sedan Holding Company

- Emaar Properties PJSC

- Sedco Development

- Abdul Latif Jameel Property Company Limited

- Christie's International Real Estate

- Coldwell Banker

- Al Habtoor Group L.L.C

Saudi Arabia Residential Real Estate Market News:

- In June 2024, Saudi Arabia’s multi-billion dollar project NEOM announced that its newly renamed fifth cluster, Magna, will compromise 120km along the coastline of the Gulf of Aqaba. Magna will have 15 luxury hotels, 1,600 rooms and suites, over 2,500 premium residences, and facilities such as marinas, yacht clubs, beach clubs, equestrian centers, and water sports centers.

- In September 2023, Dubai’s largest developer Emaar Properties announced its plans to build large mixed-use developments in the kingdom with Saudi Arabia’s housing ministry. The developer will likely start working on a 4,000-unit housing project as and when an agreement is reached with the ministry. The kingdom announced plans to build 660,000 homes and 289,000 hotel rooms, 6 million sq. meters of office space, and 5.3 million sq. meters of retail space.

Saudi Arabia Residential Real Estate Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Billion USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered | Condominiums and Apartments, Villas and Landed Houses |

| Regions Covered | Northern and Central Region, Western Region, Eastern Region, Southern Region |

| Companies Covered | Jabal Omar Development Company, Al sedan Holding Company, Emaar Properties PJSC, Sedco Development, Abdul Latif Jameel Property Company Limited, Christie's International Real Estate, Coldwell Banker, Al Habtoor Group L.L.C, etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Saudi Arabia residential real estate market performed so far, and how will it perform in the coming years?

- What has been the impact of COVID-19 on the Saudi Arabia residential real estate market?

- What is the breakup of the Saudi Arabia residential real estate market on the basis of type?

- What are the various stages in the value chain of the Saudi Arabia residential real estate market?

- What are the key driving factors and challenges in the Saudi Arabia residential real estate market?

- What is the structure of the Saudi Arabia residential real estate market, and who are the key players?

- What is the degree of competition in the Saudi Arabia residential real estate market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Saudi Arabia residential real estate market from 2020-2034.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Saudi Arabia residential real estate market.

- Porter's five forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Saudi Arabia residential real estate industry and its attractiveness.

- The competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)