Saudi Arabia Renewable Energy Market Size, Share, Trends and Forecast by Type and Region, 2026-2034

Saudi Arabia Renewable Energy Market Size and Share:

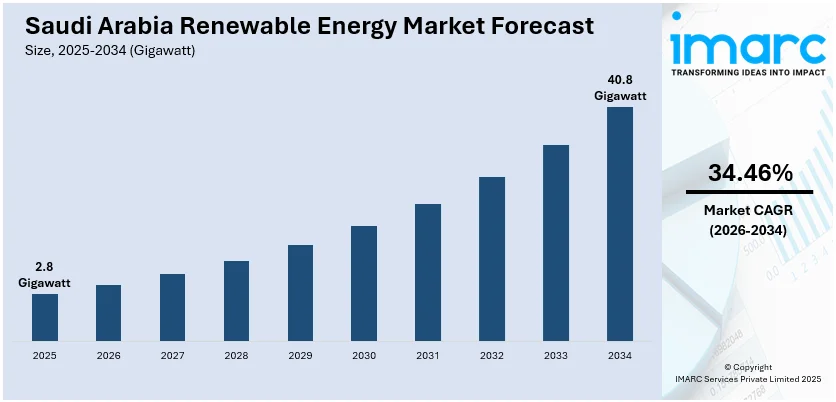

The Saudi Arabia renewable energy market size reached 2.8 Gigawatt in 2025. Looking forward, IMARC Group estimates the market to reach 40.8 Gigawatt by 2034, exhibiting a CAGR of 34.46% from 2026-2034. The region’s favorable geography including abundant sunlight and strong winds, supports large-scale solar and wind projects. Besides this, Saudi Arabia renewable energy market share is driven by increasing engagement of private sector through investments and technological innovations. Government initiatives, such as Vision 2030, provide regulatory support and financing for renewable energy development.

|

Report Attribute

|

Key Statistics |

|---|---|

|

Base Year

|

2025 |

|

Forecast Years

|

2026-2034

|

|

Historical Years

|

2020-2025

|

| Market Size in 2025 | 2.8 Gigawatt |

| Market Forecast in 2034 | 40.8 Gigawatt |

| Market Growth Rate (2026-2034) | 34.46% |

Saudi Arabia's advantageous geography significantly contributes to the growth of the renewable energy sector. The nation's extensive deserts and open terrains create a perfect environment for solar energy production. Elevated solar radiation levels, especially in the central and western areas, guarantee regular and intense sunlight throughout the year. These environmental factors contribute to the efficiency and cost-effectiveness of solar energy production, promoting expansive solar initiatives. Likewise, the coastal areas bordering the Red Sea and Arabian Gulf face powerful winds, rendering them ideal for wind energy production. These breezy regions facilitate the creation of wind farms, particularly in the northwestern areas of the nation. The close geographic location of Saudi Arabia to international shipping lanes and energy centers also creates avenues for exporting renewable energy. Saudi Arabia’s distinct geographical position, characterized by extensive unpopulated areas, facilitates the development of large-scale renewable energy systems without considerable land-use disputes, thereby aiding in enhancing market expansion.

To get more information on this market Request Sample

The Vision 2030 initiative by the government actively promotes private companies to invest in clean energy projects, catalyzing the Saudi Arabia renewable energy market demand. Numerous prominent local and global private companies are leading the way in renewable energy projects. These firms provide cutting-edge technologies, knowledge, and funding, enabling the feasibility of extensive solar and wind initiatives. The Public Investment Fund (PIF) is also essential as it collaborates with private entities on energy initiatives. Involvement of the private sector aids in minimizing government expenditures, facilitating a more effective distribution of resources. Private sector companies are gaining from beneficial regulatory measures, such as tax breaks and subsidies. Additionally, their involvement guarantees that projects are executed swiftly and effectively, influencing market expansion. Engagement in the private sector also promotes innovation via competition, propelling technological progress in energy storage and grid oversight. Furthermore, regional companies are enhancing their skills in fields like project management and operations, aiding in workforce development.

Saudi Arabia Renewable Energy Market Trends:

Government Initiatives

The Saudi Arabian Government is significantly influencing the growth of the renewable energy sector. Vision 2030 seeks to broaden energy sources and lessen the nation's reliance on oil. According to the IEA, Saudi Arabia’s National Renewable Energy Program (NREP), financed by the Public Investment Fund (PIF), seeks to deploy 11.8 GW of renewable capacity by 2025, in collaboration with ACWA Power. This initiative plays a crucial role in the government’s wider plan to attain 50% renewable electricity production by 2030, with the balance sourced from natural gas. Major initiatives like the Red Sea Project and NEOM are crucial for reaching these objectives. Government funding in solar, wind, and green hydrogen infrastructure is promoting industry expansion. The government fosters both local and foreign investments through incentives, subsidies, and regulatory backing. Saudi Arabia's goals for renewable energy are included in wider international efforts to combat climate change. Moreover, the government is advocating for research and development (R&D) in clean technologies to improve efficiency and lower costs. Collaborations with global organizations and corporations also enhance the nation’s renewable energy potential. Saudi Arabia's initiatives to enhance renewable energy are drawing international interest and funding. The government is advocating for a cleaner energy future that can generate new employment opportunities in the renewable industry. In alignment with Vision 2030, the government aims to cultivate a strong green energy workforce. These strategic efforts are not only reshaping the energy sector but also establishing Saudi Arabia as a frontrunner in worldwide renewable energy markets.

Technological advancements

Innovations of larger generation scale, low-cost solar panels are increasing the viability to generate solar power. Technological advancements in wind turbines will heighten energy generation potential, especially in coastal areas with strong winds. Energy storage technologies such as lithium-ion batteries are improving the grid's ability to manage and incorporate more renewable energy. Breakthroughs in energy efficiency and power electronics reduce operational costs and improve performance. Advanced grid infrastructure, through the use of digital tools and AI, enhances energy distribution and reduces waste. For example, in February 2025, ACWA Power and Saudi Aramco signed two major agreements that will spur renewable energy and innovation in Saudi Arabia. The first agreement deals with the development of an advanced photovoltaic energy forecasting system through big data analytics and machine learning to enhance predictions in the generation of solar power. The project aims to enhance grid stability, optimize energy distribution, and improve microgrid management. Besides, smart metering and demand response technologies optimize electricity consumption and improve system stability. Carbon capture and storage technologies are also gaining traction, helping accelerate the integration of renewable energy into the overall energy system. Solar-powered innovations in desalination are helping solve water scarcity problems while producing clean power.

Rising investments in clean energy

The government's strategic emphasis on clean energy draws in both domestic and foreign investors. Significant renewable initiatives, including solar and wind energy projects, are attracting greater investment from international companies. The International Energy Agency states that clean energy investments in the Middle East account for roughly 15% of the overall investments in the energy sector. Out of all the Middle Eastern nations, Saudi Arabia aims for 130 GW of renewable capacity by 2030, a notable rise than the presents 5 GW production capacity. Significant developments, such as the Al Shuaibah solar facility in Saudi Arabia and the Mohammed bin Rashid Al Maktoum solar park in the UAE are in progress. Funding from government-affiliated organizations like the Public Investment Fund (PIF) bolsters these initiatives. Additionally, the clean energy initiatives in Saudi Arabia enjoy decreased financing risks due to substantial institutional backing. Growing investments are hastening the advancement of cutting-edge energy storage and management technologies. The growth of green hydrogen and carbon capture technologies also drawing considerable investment. Collaborations with global energy firms offer cutting-edge technologies and specialized knowledge. These investments are enhancing the nation's renewable energy infrastructure, resulting in more effective energy generation. With the ongoing decline in renewable energy costs, investors consider these projects to be lucrative opportunities.

Saudi Arabia Renewable Energy Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the Saudi Arabia renewable energy market, along with forecasts at the country and regional levels from 2026-2034. The market has been categorized based on type.

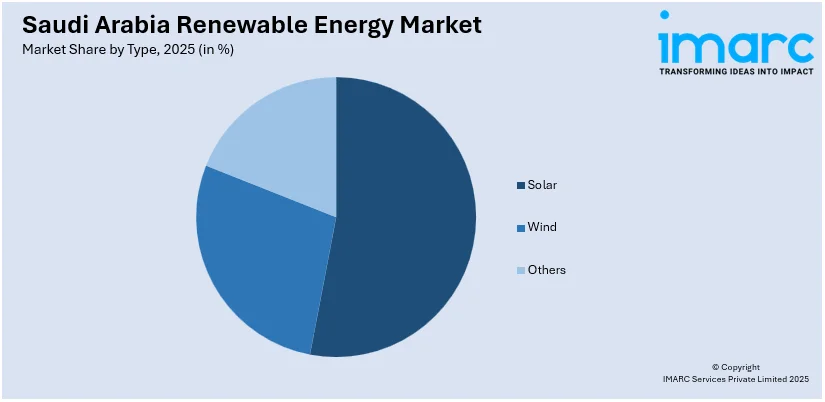

Analysis by Type:

Access the comprehensive market breakdown Request Sample

- Solar

- Wind

- Others

According to the Saudi Arabia renewable energy market analysis, solar energy holds the largest market share. The country has some of the highest solar radiation in the world, providing the perfect environmental conditions for the generation of solar energy. With large desert areas and open land, Saudi Arabia is an ideal location to install large-scale solar farms. The government is focusing on increasing solar capacity to improve the energy mix and reduce oil dependency under the Vision 2030. Solar projects like the Sakaka PV Solar Power Plant and Mohammed bin Rashid Al Maktoum Solar Park are huge investments in large-scale solar. Technological development is reducing the cost of producing solar panels sharply, thus increasingly making solar energy affordable. Newer, highly efficient photovoltaic (PV) technologies, as well as concentrated solar power (CSP), are optimizing energy output at lower costs. The Saudi Arabian government continues to offer subsidy, incentive, and favorable regulatory environments for solar energy projects, thus encouraging investment in the industry. Private sector participation in developing solar energy has been growing due to high return-on-investment potential, thereby offering competitive growth opportunities to industry investors.

Regional Analysis:

- Western Region

- Northern and Central Region

- Eastern Region

- Southern Region

The Western Region of Saudi Arabia has significant renewable energy potential due to its geographical advantages. The region’s coastal areas, particularly along the Red Sea, experience high levels of sunlight and wind. This makes it ideal for both solar and wind energy generation. Key projects, like the Red Sea Project and Neom, are being developed here, focusing on large-scale solar power and green hydrogen. The government’s support for infrastructure development and clean energy investment further accelerates growth in this region. Additionally, its proximity to major industrial hubs increases the demand for sustainable energy solutions.

The Northern and Central Region of Saudi Arabia has considerable solar energy potential due to expansive desert land. Solar radiation is abundant in this area, making it ideal for large-scale solar farms. Government initiatives including Vision 2030, prioritize energy diversification, and these regions are central to that strategy. Wind energy potential, particularly in areas like the Tabuk region, is also being explored for long-term sustainable energy solutions.

The Eastern Region is the hub for Saudi Arabia’s oil and gas industry, but it is also seeing renewable energy growth. The region’s geographical location, with high solar radiation and coastal winds, offers great potential for solar and wind energy projects. The Eastern Province’s proximity to international shipping routes along the Arabian Gulf supports green energy export opportunities. The region's strong infrastructure and industrial base make it an ideal location for renewable energy projects focused on energy transition. Government-backed initiatives and incentives are further driving investment in renewables, especially solar energy.

The Southern Region of Saudi Arabia benefits from moderate solar radiation, making it suitable for solar projects. The region, while less prominent in large-scale renewable energy development compared to others, is seeing gradual progress. Its mountainous terrain and proximity to Yemen create both challenges and opportunities in energy infrastructure. Solar energy potential is being realized through small and medium-scale projects, supported by local government incentives. The region is also exploring the use of renewable energy in agricultural and water desalination projects. As energy demand grows in southern provinces, the government is likely to increase investments in renewable energy infrastructure.

Renewable Energy Companies in Saudi Arabia:

The Government entities include Ministry of Energy and provide strategic directions and policy frameworks. Public Investment Fund provides critical financing to major renewable energy projects. The domestic companies play the most crucial role in the renewable projects. Local companies strengthen market growth, as international companies introduce advanced technologies and expertise in the market. All these players are very active in big solar and wind farms projects for the execution of projects and innovations. Saudi Arabia could potentially benefit from global players, especially for improving technological capabilities and efficiency in renewable energy production. For instance, Saudi Arabia in November 2024 gave the 2 GW Al Sadawi solar project to a consortium led by Masdar, a UAE-based company, in a major leap towards renewable energy production efforts in the country. Additionally, state-owned companies are considering green hydrogen and other environmentally friendly solutions. With local firms offering services in project management, construction, and operations, and financial institutions offering funding solutions for renewable energy projects, local regulatory bodies ensure market standards are properly adhered to, thereby encouraging investment while ensuring sustainability. Successful research and development (R&D) activities by both the private and public sectors play a significant role in improving renewable energy technologies.

The report provides a comprehensive analysis of the competitive landscape in the Saudi Arabia renewable energy market with detailed profiles of all major companies, including:

- ACWA Power

- Alfanar Group

- EDF Renewables

- ENGIE Middle East

- Masdar

Latest News and Developments:

- October 2024: Antaisolar, a global leader in photovoltaic mounting solutions, partnered with Bahra Electric to create a solar manufacturing plant in Jeddah, Saudi Arabia. This collaboration is designed to strengthen the Kingdom's renewable energy infrastructure by producing solar photovoltaic (PV) mounting systems specifically for utility-scale projects.

- October 2024: Arctech, a prominent provider of solar tracking and racking solutions, reached a major agreement to deliver 2.3 GW of its SkyLine II solar trackers for the PIF4-Haden project in Saudi Arabia.

- August 2024: China Energy Engineering won a $972 million EPC contract for the 2-GW Haden solar PV plant in western Saudi Arabia. Situated around 70 km northeast of Taif City in Mecca Province, the project is expected to be completed within 31 months. Upon completion, the Haden solar plant is anticipated to generate approximately 6,355,382 MWh of electricity annually for the Saudi power grid.

- July 2024: JinkoSolar revealed plans to build the world’s largest N-type solar cell manufacturing facility in Saudi Arabia, with operations set to begin by early 2026. The project, valued at approximately USD 1 billion, aims to reach an annual production capacity of 10 gigawatts (GW).

- May 2024: Marubeni Corporation, in collaboration with Ajlan & Bros, obtained a Power Purchase Agreement (PPA) with the Saudi Power Procurement Company (SPPC) for two major wind energy projects in Saudi Arabia.

Saudi Arabia Renewable Energy Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Gigawatt |

| Scope of the Report |

Exploration of Historical and Forecast Trends, Industry Catalysts and Challenges, Segment-Wise Historical and Predictive Market Assessment:

|

| Types Covered | Solar, Wind, Others |

| Regions Covered | Western Region, Northern and Central Region, Eastern Region, Southern Region |

| Companies Covered | ACWA Power, Alfanar Group, EDF Renewables, ENGIE Middle East, Masdar, etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, renewable energy market outlook in Saudi Arabia, and dynamics of the market from 2020-2034.

- The research study provides the latest information on the market drivers, challenges, and opportunities in the Saudi Arabia renewable energy market.

- Porter's Five Forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Saudi Arabia renewable energy industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The Saudi Arabia renewable energy market reached a volume of 2.8 Gigawatt in 2025.

The Saudi Arabia renewable energy market is expected to grow at a compound annual growth rate of 34.46% from 2026-2034 to reach 40.8 Gigawatt by 2034.

Solar holds the largest market share at 93% in 2025, driven by exceptional solar irradiance levels, competitive auction-driven tariffs, strong government policy support, and strategic investments in utility-scale photovoltaic installations across the Kingdom.

Key factors driving the Saudi Arabia renewable energy market include the increasing investment in large-scale solar projects. For instance, in 2025, ACWA Power, Badeel, and SAPCO announced an $8.3 billion investment to develop 15,000 MW of renewable capacity, including five solar plants and two wind farms, supporting Vision 2030’s goal of 70% renewable energy by 2030.

Major challenges include grid infrastructure constraints requiring transmission upgrades, workforce development needs to meet localization requirements, water resource management in arid conditions, supply chain dependencies for equipment, and integration complexities associated with variable renewable generation.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)