Saudi Arabia Private Equity Market Size, Share, Trends and Forecast by Fund Type and Region, 2026-2034

Saudi Arabia Private Equity Market Summary:

The Saudi Arabia private equity market size was valued at USD 7,822.71 Million in 2025 and is projected to reach USD 14,160.67 Million by 2034, growing at a compound annual growth rate of 6.82% from 2026-2034.

The Kingdom's private equity landscape is undergoing a significant transformation driven by ambitious economic diversification programs under Vision 2030. Rising sovereign wealth fund participation, regulatory modernization, and expanding opportunities in non-oil sectors are creating a favorable investment climate. Growing entrepreneurship, technological advancements, and increased foreign capital inflows are positioning Saudi Arabia as a leading private equity destination in the Middle East and North Africa region, contributing to the Saudi Arabia private equity market share.

Key Takeaways and Insights:

- By Fund Type: Buyout dominates the market with a share of 38% in 2025, driven by government privatization initiatives under Vision 2030, family-owned conglomerates pursuing succession planning, and mature businesses seeking capital for restructuring and international expansion strategies across telecommunications and infrastructure sectors.

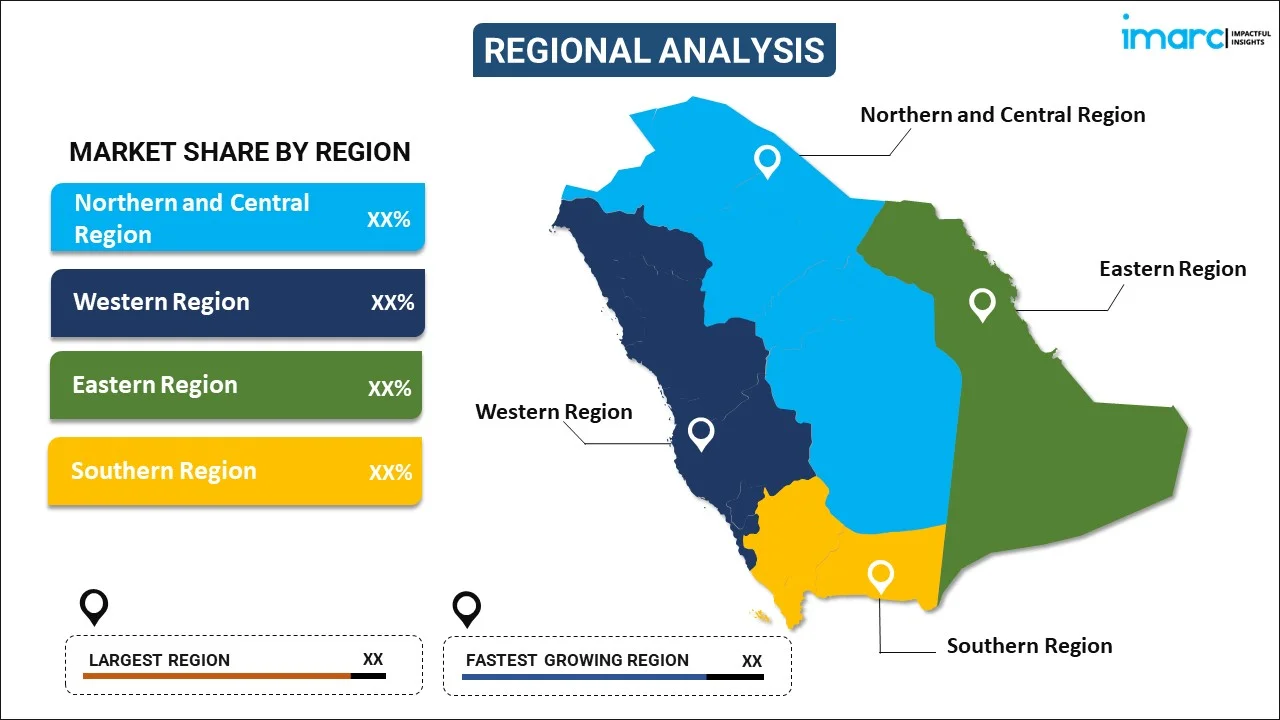

- By Region: Northern and Central Region leads the market with a share of 40% in 2025, owing to Riyadh's position as the Kingdom's economic and commercial hub, hosting the highest concentration of financial institutions, regulatory bodies, and the development of King Abdullah Financial District as a premier business destination.

- Key Players: The Saudi Arabia private equity market exhibits intensifying competition, with sovereign-backed entities and established investment firms competing alongside international asset managers. The market structure reflects strong domestic institutional participation, strategic partnerships with global private equity sponsors, and growing sophistication in deal structuring and execution capabilities.

Saudi Arabia's private equity ecosystem has emerged as a cornerstone of the Kingdom's economic transformation agenda. The market benefits from substantial sovereign wealth fund backing, with the Public Investment Fund managing assets exceeding USD 913 billion as of 2024 and deploying USD 56.8 billion across priority sectors. The Saudi Arabia private equity landscape is becoming increasingly sophisticated, with a growing focus on sector-specific funds in healthcare, technology, and infrastructure. The emergence of blind-pool and other diversified private equity vehicles highlights the market’s maturation, reflecting investors’ appetite for flexible, multi-asset strategies. These developments support the Kingdom’s broader economic diversification objectives, enabling capital to flow into high-growth sectors while fostering a more structured and resilient investment ecosystem. The trend underscores the evolving depth and professionalism of Saudi Arabia’s private equity market.

Saudi Arabia Private Equity Market Trends:

Shift Toward Growth-Stage and Mid-Market Investments

Private equity investors in Saudi Arabia are increasingly focusing on scalable domestic companies in high-growth sectors, moving away from large leveraged buyouts. This shift reflects a maturing investment ecosystem targeting opportunities in technology, healthcare, renewable energy, logistics, and advanced manufacturing. The mid-market segment has become more attractive due to its predictable cash flows, balanced risk, and steady deal flow. Investors are prioritizing substantial yet manageable opportunities that offer growth potential while maintaining portfolio stability, underscoring a strategic approach aligned with the Kingdom’s economic diversification objectives.

Integration of ESG and Sustainability Principles

Environmental, social, and governance considerations are becoming integral to investment decision-making across the Saudi private equity landscape. Investors are channeling capital toward green projects including renewable energy initiatives and carbon capture technologies that align with the Kingdom's sustainability agenda. This trend reflects growing recognition that sustainable investments generate both financial returns and positive societal impact. The Public Investment Fund achieved a 96% score on Global SWF's 2024 GSR Scoreboard, reaching 100% in 2025 and tying for first place globally among sovereign investors, demonstrating the Kingdom's commitment to responsible investment practices.

AI-Powered Due Diligence and Digital Transformation

Artificial intelligence is rapidly transforming private equity operations across the Kingdom, enhancing decision-making throughout the investment lifecycle. From AI-powered due diligence platforms that streamline financial modeling and risk assessment to predictive analytics that optimize exit strategies, technology adoption is accelerating investment efficiency. Machine learning algorithms now enable portfolio performance monitoring, helping firms identify operational inefficiencies and growth opportunities proactively. At the 2025 LEAP conference, the Public Investment Fund announced USD 14.9 billion worth of partnerships with technology leaders including Groq, Lenovo, Databricks, and Salesforce, advancing capabilities in AI, robotics, and cloud computing.

How Vision 2030 is Transforming the Saudi Arabia Private Equity Market:

Vision 2030 is reshaping Saudi Arabia’s private equity (PE) market by promoting economic diversification, strengthening regulatory frameworks, and fostering a more investor-friendly environment. Initiatives under the plan, such as the Financial Sector Development Program, encourage capital flow into high-growth sectors including technology, healthcare, renewable energy, and infrastructure. Increased government-backed investment vehicles and sovereign wealth fund participation are enhancing deal-making activity and liquidity in the market. Regulatory reforms, streamlined licensing, and improved corporate governance standards are boosting transparency and investor confidence, attracting both domestic and international PE firms. These developments position Saudi Arabia as a regional hub for private equity, driving sustainable growth and portfolio expansion.

Market Outlook 2026-2034:

The Saudi Arabia private equity market outlook remains robust, underpinned by sustained government commitment to economic diversification and private sector development. Mega-projects including NEOM and the Red Sea development continue to generate substantial investment opportunities requiring private capital participation. The Kingdom's regulatory environment is becoming increasingly investor-friendly, with streamlined registration processes replacing traditional licensing requirements. The National Centre for Privatisation and PPP is progressing with more than 200 approved projects across 17 sectors, offering long-duration opportunities with predictable returns. The market generated a revenue of USD 7,822.71 Million in 2025 and is projected to reach a revenue of USD 14,160.67 Million by 2034, growing at a compound annual growth rate of 6.82% from 2026-2034.Saudi

Arabia Private Equity Market Report Segmentation:

|

Segment Category |

Leading Segment |

Market Share |

|

Fund Type |

Buyout |

38% |

|

Region |

Northern and Central Region |

40% |

Fund Type Insights:

To get detailed segment analysis of this market, Request Sample

- Buyout

- Venture Capital (VCs)

- Real Estate

- Infrastructure

- Others

Buyout dominates with a market share of 38% of the total Saudi Arabia private equity market in 2025.

The prominence of the buyout segment in Saudi Arabia is closely linked to the government’s privatization agenda under Vision 2030, which encourages greater private sector participation and reduced state ownership. This environment has created attractive opportunities in mature industries such as telecommunications and infrastructure. Investors are drawn to established businesses that require capital for transformation, operational efficiency, and long-term expansion. As a result, buyout investments play a central role in the private equity market, reflecting strong institutional interest in scalable assets with clear value-creation potential.

Family-owned conglomerates represent another significant driver of buyout activity as prominent business groups pursue succession planning and international expansion strategies. These established enterprises increasingly seek private equity partnerships to professionalize management, implement best practices, and access growth capital. The segment benefits from predictable cash flows, established market positions, and opportunities for operational value creation through enterprise resource planning systems, professional management structures, and strategic repositioning initiatives.

Regional Insights:

To get detailed segment analysis of this market, Request Sample

- Northern and Central Region

- Western Region

- Eastern Region

- Southern Region

Northern and Central Region leads with a share of 40% of the total Saudi Arabia private equity market in 2025.

The Northern and Central Region's dominance is anchored by Riyadh's position as the Kingdom's economic and commercial hub, contributing a significant portion of Saudi Arabia's non-oil GDP. The region hosts the highest concentration of industries including manufacturing, logistics, financial services, and technology sectors, providing diverse investment opportunities. The development of King Abdullah Financial District as a premier business destination has attracted major financial institutions, regulatory bodies, and the Saudi Stock Exchange, creating a thriving financial ecosystem.

Economic diversification initiatives and the region's designation as a financial hub under Vision 2030 continue to attract both domestic and international private equity investment. For instance, in May 2025, KAFD now spans over 1.6 million square meters and hosts the Public Investment Fund, Capital Market Authority, and Tadawul alongside global firms including Goldman Sachs, Deloitte, and ExxonMobil. The region's infrastructure development, industrial expansion, and technology sector growth create substantial opportunities for private equity firms seeking strategic exposure to the Kingdom's evolving economic landscape.

Market Dynamics:

Growth Drivers:

Why is the Saudi Arabia Private Equity Market Growing?

Vision 2030 Economic Diversification Initiative

Saudi Arabia's Vision 2030 initiative represents the primary catalyst driving private equity market expansion by systematically reducing the economy's reliance on oil revenues. This comprehensive transformation plan encourages private sector growth, welcomes foreign investments, and supports the development of new industries including technology, tourism, healthcare, and renewable energy. The initiative has created numerous opportunities for private equity firms to invest in emerging sectors aligned with national development priorities. The government's National Investment Strategy aims to increase private sector contributions to 65% of total GDP and attract USD 103 billion in annual foreign direct investment by 2030, generating substantial deal-flow opportunities for both domestic and international investors.

Regulatory Reforms and Improved Investment Framework

The Saudi government has implemented comprehensive regulatory reforms to create a more investor-friendly environment that enhances market confidence and accessibility. For instance, in February 2025, the updated Investment Law came into force, introducing a unified investment framework applicable to both foreign and domestic investors. This landmark legislation replaced traditional licensing requirements with a streamlined registration process, ensuring equal treatment for all investors and providing robust protections against expropriation. The reforms include guarantees of fair and equitable treatment, safeguards for intellectual property, and freedom to manage investments and transfer funds. These measures have significantly reduced barriers to entry and operational risks, making Saudi Arabia increasingly attractive for private equity capital deployment.

Rising Entrepreneurship and Startup Ecosystem Development

A thriving entrepreneurial ecosystem supported by government initiatives, startup incubators, and accelerators presents expanding opportunities for private equity investors. The General Authority for Small and Medium Enterprises, known as Monsha'at, continues to spearhead initiatives designed to propel private sector growth, including enhanced financing programs for small and medium enterprises and programs strengthening entrepreneurship culture among Saudi citizens. This growing ecosystem offers lucrative opportunities to fund early-stage companies with high growth potential, particularly in technology, fintech, and consumer goods sectors that cater to the Kingdom's young, tech-savvy population. Saudi Arabia recorded 114 venture capital deals in H1 2025, representing a 31% increase from the same period in 2024, demonstrating the ecosystem's expanding dynamism.

Market Restraints:

What Challenges the Saudi Arabia Private Equity Market is Facing?

Evolving Regulatory Framework

Despite significant improvements, the regulatory landscape continues to evolve, creating uncertainty for some potential investors. The ongoing implementation of new investment laws and compliance requirements demands careful navigation. Investors must adapt to changing beneficial-ownership disclosures and ESG reporting standards that raise transaction costs while enhancing governance transparency. Full implementation of the 2025 Investment Law and its regulations remain in progress, requiring investors to monitor developments closely.

Limited Exit Opportunities and Liquidity Constraints

Exit liquidity remains the gating constraint for private equity investments in the Kingdom, with exit strategies facing challenges related to developing capital markets. The absence of a fully robust IPO environment and limited acquisition opportunities can restrict liquidity for investors seeking timely exits. Consequently, general partners increasingly favor structured exits with drag-along and tag-along rights to ensure flexibility. Secondary transactions and trade sales are emerging as alternative pathways, though the market continues to mature.

Global Market Volatility and Economic Uncertainty

Macroeconomic factors and global market conditions present ongoing challenges to private equity deal flow and investment performance. Fluctuating oil prices impact government revenues and spending on Vision 2030 projects, affecting the broader investment climate. Additionally, geopolitical tensions in the region and global economic uncertainty influence investor sentiment and capital allocation decisions. These external factors require investors to maintain flexible strategies and careful risk assessment when deploying capital in the Kingdom.

Competitive Landscape:

The Saudi Arabia private equity market exhibits increasing competitive intensity as the Kingdom's economic transformation attracts both regional and international investors. The market structure is characterized by significant sovereign wealth fund participation, with government-backed entities playing central roles in anchoring investments and facilitating strategic partnerships. Local investment firms with deep market knowledge compete alongside global asset managers expanding their presence to capitalize on growth opportunities across technology, healthcare, renewable energy, and infrastructure sectors. The competitive dynamics reflect a maturing investment environment where success depends on the ability to offer value through strategic partnerships, operational expertise, and strong local networks. Deal activity increasingly involves collaboration between domestic and international sponsors, combining local market insights with global best practices and institutional capabilities.

Recent Developments:

- June 2025: Jadwa Investment led a USD 50 million investment round in PetroApp, Saudi Arabia's leading fuel management platform, through its flagship Jadwa GCC Diversified Private Equity Fund. The transaction marked Jadwa's fifth investment under the fund launched in late 2024 and follows the fund's acquisition of a majority stake in Makhazen Alenaya, a leader in Saudi Arabia's beauty and personal care retail sector.

- March 2025: The Public Investment Fund and Goldman Sachs Asset Management signed a non-binding memorandum of understanding to act as anchor investors for new funds targeting Saudi Arabia and the broader Gulf Cooperation Council. This partnership marks a strengthening of international institutional capital in Saudi Arabia's private equity and credit-equity opportunities.

- December 2024: Jada Fund of Funds committed capital to Jadwa GCC Private Equity Fund I, which is managed by Jadwa Investment. The fund targets SAR 1.5 billion (USD 400 million) with a hard cap of SAR 2 billion and represents Jadwa's first regional blind-pool private equity fund following a track record of 16 single-asset funds since 2007.

Saudi Arabia Private Equity Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Million USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Fund Types Covered | Buyout, Venture Capital (VCs), Real Estate, Infrastructure, Others |

| Regions Covered | Northern and Central Region, Western Region, Eastern Region, Southern Region |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report

The Saudi Arabia private equity market size was valued at USD 7,822.71 Million in 2025.

The Saudi Arabia private equity market is expected to grow at a compound annual growth rate of 6.82% from 2026-2034 to reach USD 14,160.67 Million by 2034.

Buyout dominated the market with a 38% share in 2025, driven by the government's privatization program under Vision 2030, family-owned conglomerates pursuing succession planning, and mature businesses seeking capital for transformation and international expansion.

Key factors driving the Saudi Arabia private equity market include Vision 2030 economic diversification initiatives, regulatory reforms including the February 2025 Investment Law, rising entrepreneurship and startup ecosystem development, sovereign wealth fund participation, and growing opportunities in non-oil sectors.

Major challenges include an evolving regulatory framework requiring ongoing adaptation, limited exit opportunities and liquidity constraints in developing capital markets, and exposure to global market volatility and geopolitical uncertainties affecting investment sentiment and capital allocation decisions.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)