Saudi Arabia Prefabricated Building and Structural Steel Market Size, Share, Trends and Forecast by Component, End Use, and Region, 2026-2034

Saudi Arabia Prefabricated Building and Structural Steel Market Summary:

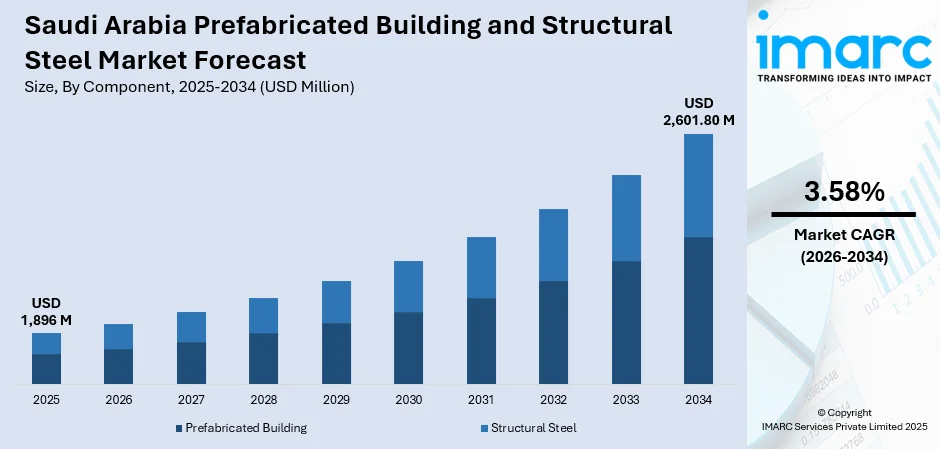

The Saudi Arabia prefabricated building and structural steel market size was valued at USD 1,896 Million in 2025 and is projected to reach USD 2,601.80 Million by 2034, growing at a compound annual growth rate of 3.58% from 2026-2034.

The Saudi Arabia prefabricated building and structural steel market is experiencing robust expansion driven by the Kingdom's transformative Vision 2030 initiative and ambitious mega-infrastructure projects. The growing urbanization, along with the influx of expatriates and the requirement to build more houses, is promoting the use of prefabricated construction solutions in residential, commercial, and industrial buildings. The initiatives undertaken by governments to invest in smart cities, logistics infrastructure, and economic diversification programs are generating a significant need for effective and economical construction approaches.

Key Takeaways and Insights:

- By Component: Structural steel dominates the market with a share of 53% in 2025, propelled by the growing requirement for resilient steel frameworks, this demand is rooted in expansive mega-projects, industrial installations, petrochemical facilities, and towering commercial developments that necessitate outstanding structural strength and versatile design adaptability.

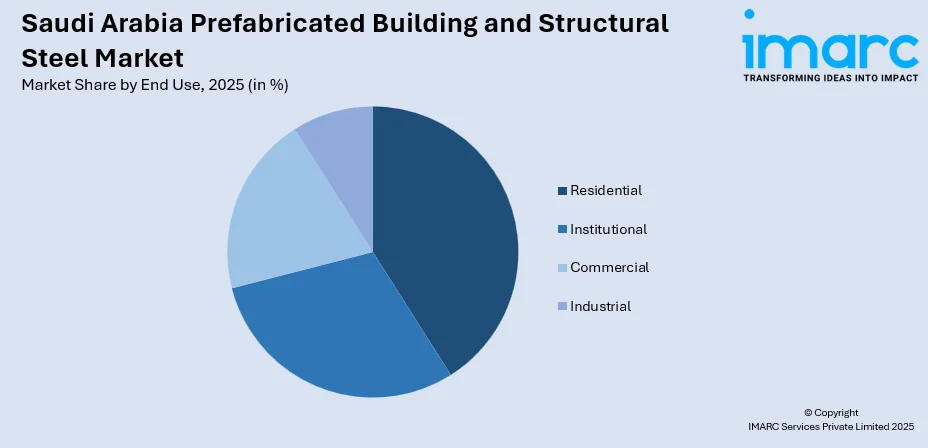

- By End Use: Residential leads the market with a share of 38% in 2025, owing to government homeownership initiatives, rapid urban expansion in major cities, increasing population density requirements, and the growing demand for affordable housing solutions aligned with national development targets.

- Key Players: The Saudi Arabia prefabricated building and structural steel market is moderately competitive, with local manufacturers and global construction technology firms leveraging advanced fabrication, broad distribution networks, and strategic partnerships to capture growth across industrial, commercial, and residential sectors. Some of the key players operating in the market include Saudi Building Systems Mfg. Co., Red Sea Housing Services, Kirby Building Systems, Zamil Steel Pre-Engineered Buildings Co. Ltd., etc.

To get more information on this market Request Sample

The Saudi Arabia prefabricated building and structural steel market is characterized by substantial government-led infrastructure investments and private sector participation in large-scale construction activities. The Kingdom's strategic focus on economic diversification beyond oil dependency has positioned the construction sector as a primary growth engine, with prefabricated solutions gaining prominence due to their inherent advantages in construction speed, cost efficiency, and quality control. The market benefits from advanced manufacturing technologies, including automated production systems, robotics integration, and building information modeling capabilities that enhance precision and reduce project timelines. A notable illustration of market expansion is the establishment of the modular production facility in Riyadh by China Harbour Engineering Company, featuring advanced robotics and digital production management systems to support large-scale housing developments, demonstrating the increasing adoption of sophisticated prefabrication technologies in the Kingdom.

Saudi Arabia Prefabricated Building and Structural Steel Market Trends:

Integration of Advanced Manufacturing Technologies

The adoption of sophisticated manufacturing technologies is transforming prefabricated construction capabilities across Saudi Arabia. The Saudi Arabia prefabricated buildings market size reached USD 1.4 Billion in 2025. Looking forward, IMARC Group expects the market to reach USD 2.3 Billion by 2034, exhibiting a growth rate (CAGR) of 5.80% during 2026-2034. Manufacturers are increasingly implementing automated production lines, computer numerical control fabrication equipment, and laser-guided welding systems to enhance precision and production efficiency. Building information modeling integration enables seamless coordination between design and manufacturing processes, reducing errors and optimizing material utilization throughout the construction value chain.

Growing Emphasis on Sustainable Construction Practices

Environmental sustainability considerations are increasingly influencing construction methodologies and material selection across the Kingdom. The Saudi Arabia green building materials market size reached USD 239.40 Million in 2024. Looking forward, IMARC Group expects the market to reach USD 711.01 Million by 2033, exhibiting a growth rate (CAGR) of 11.50% during 2025-2033. Prefabricated structures inherently offer reduced on-site waste generation, enhanced energy efficiency, and lower carbon footprints compared to conventional construction approaches. The introduction of sustainability certification frameworks and green building standards is encouraging developers to adopt prefabricated solutions that align with national environmental objectives and international sustainability benchmarks.

Expansion of Smart City and Mixed-Use Development Projects

The proliferation of integrated smart city developments is creating substantial demand for innovative prefabricated construction solutions capable of meeting complex architectural requirements and accelerated delivery schedules. The Saudi Arabia smart cities market size reached USD 13,209.6 Million in 2024. The market is projected to reach USD 29,228.7 Million by 2033, exhibiting a growth rate (CAGR) of 9.2% during 2025-2033. Mixed-use developments combining residential, commercial, hospitality, and entertainment facilities necessitate flexible structural frameworks and modular components that enable efficient construction coordination and future expansion capabilities.

How Vision 2030 is Transforming the Saudi Arabia Prefabricated Building and Structural Steel Market:

Vision 2030 is significantly reshaping Saudi Arabia’s prefabricated building and structural steel market by accelerating infrastructure development, industrial diversification, and sustainable construction initiatives. Large-scale mega-projects, including NEOM, The Red Sea development, and Qiddiya, are driving demand for modular, high-quality prefabricated structures and advanced steel solutions that enable faster construction timelines and enhanced efficiency. Government-backed industrial zones and urban development projects are further boosting the adoption of structural steel for commercial, residential, and industrial applications. Sustainability targets and energy efficiency mandates are encouraging the use of innovative, environmentally friendly materials, while localization programs are strengthening domestic manufacturing capabilities, reducing import dependency, and supporting long-term market growth.

Market Outlook 2026-2034:

The Saudi Arabia prefabricated building and structural steel market is positioned for sustained expansion throughout the forecast period, supported by ongoing infrastructure investments and industrial development initiatives. The government's continued commitment to mega-project execution, housing development programs, and economic diversification strategies creates a favorable demand environment for prefabricated construction solutions. Technological advancements in manufacturing processes, coupled with growing industry expertise in modular construction methodologies, are enhancing market competitiveness and delivery capabilities. The market generated a revenue of USD 1,896 Million in 2025 and is projected to reach a revenue of USD 2,601.80 Million by 2034, growing at a compound annual growth rate of 3.58% from 2026-2034.

Saudi Arabia Prefabricated Building and Structural Steel Market Report Segmentation:

|

Segment Category |

Leading Segment |

Market Share |

|

Component |

Structural Steel |

53% |

|

End Use |

Residential |

38% |

Component Insights:

- Prefabricated Building

- Floors and Roof

- Walls

- Staircase

- Panels and Lintels

- Others

- Structural Steel

- H-Type Beam

- I-Type Beam

- Columns

- Angles

- Others

The structural steel dominates with a market share of 53% of the total Saudi Arabia prefabricated building and structural steel market in 2025.

Structural steel dominates the Saudi Arabia prefabricated building and structural steel market due to its superior strength, durability, and versatility across diverse construction applications. Its high load-bearing capacity and resistance to environmental stress make it ideal for commercial, industrial, and large-scale infrastructure projects. Structural steel enables faster assembly and modular construction, which aligns with the kingdom’s demand for rapid project execution under Vision 2030 initiatives. Additionally, its recyclability and long service life appeal to developers seeking sustainable, cost-effective, and low-maintenance building solutions.

The extensive use of structural steel is further reinforced by ongoing mega-projects, urban development, and industrial expansion across the kingdom. Its compatibility with prefabricated construction methods allows for off-site fabrication, reduced on-site labor, and minimized construction timelines. Industries such as oil and gas, logistics, hospitality, and commercial real estate increasingly rely on steel frameworks to meet structural and regulatory requirements. Combined with growing local manufacturing capabilities, structural steel remains the preferred material, driving its dominant share in the prefabricated building and structural steel market.

End Use Insights:

Access the comprehensive market breakdown Request Sample

- Residential

- Institutional

- Commercial

- Industrial

The residential leads with a share of 38% of the total Saudi Arabia prefabricated building and structural steel market in 2025.

The residential segment's leadership reflects the Kingdom's strategic focus on addressing housing requirements for its growing population and expatriate workforce. Government homeownership initiatives and affordable housing programs are driving substantial demand for efficient construction solutions capable of delivering quality residential units within accelerated timelines. Prefabricated residential structures offer advantages in construction speed, cost predictability, and quality consistency that align with national housing development objectives.

Urban expansion in major metropolitan areas, including Riyadh, Jeddah, and Dammam, is creating concentrated demand for high-density residential developments utilizing modular construction approaches. The establishment of dedicated modular production facilities supporting large-scale housing projects demonstrates the residential sector's increasing adoption of industrialized construction methodologies. Customization capabilities enabling diverse architectural expressions while maintaining production efficiency are expanding prefabricated solutions' applicability across various residential market segments.

Market Dynamics:

Growth Drivers

Why is the Saudi Arabia Prefabricated Building and Structural Steel Market Growing?

Government-Led Mega-Project Investments and Vision 2030 Implementation

The Saudi Arabian government's unprecedented infrastructure investment program is fundamentally transforming the construction landscape and creating substantial demand for prefabricated building solutions and structural steel products. Vision 2030 initiatives encompassing smart city developments, tourism destinations, entertainment complexes, and industrial zones require construction methodologies capable of delivering complex projects within ambitious timelines. Mega-developments including futuristic urban projects, coastal resort destinations, and entertainment cities necessitate innovative construction approaches combining precision engineering with rapid execution capabilities. The government's establishment of new logistics zones and industrial cities further amplifies demand for efficient construction solutions optimizing material utilization and minimizing on-site construction duration.

Accelerating Urbanization and Housing Development Requirements

Rapid urbanization across Saudi Arabia is generating substantial housing demand that conventional construction approaches cannot adequately address within required timelines and cost parameters. Urbanization is expected to continue accelerating, with the urban share of the population forecast to reach nearly 97.6% by 2030. Based on current urban growth trends, Riyadh’s population is expected to climb to 8.2 million, with Saudi nationals accounting for around 75% of residents. The Kingdom's growing population, coupled with increasing expatriate workforce requirements, necessitates efficient housing delivery mechanisms capable of producing quality residential units at scale. Government homeownership initiatives and affordable housing programs prioritize construction methodologies offering cost predictability, quality consistency, and accelerated delivery schedules. Urban densification requirements in metropolitan areas favor modular construction approaches, enabling high-rise residential developments with reduced on-site construction activities and minimized disruption to surrounding communities.

Economic Diversification and Industrial Sector Expansion

Saudi Arabia's strategic economic diversification beyond oil dependency is stimulating industrial sector growth and creating new demand sources for prefabricated construction solutions and structural steel products. Manufacturing sector development, including automotive, defense, pharmaceutical, and consumer goods production facilities, requires specialized industrial structures with demanding specifications and accelerated delivery requirements. Petrochemical sector expansion and refinery upgrade projects generate substantial structural steel demand for process equipment supports, pipe racks, and industrial buildings. The emergence of technology sector facilities, data centers, and logistics infrastructure supporting e-commerce growth creates diverse application opportunities for prefabricated construction solutions across the industrial landscape.

Market Restraints

What Challenges the Saudi Arabia Prefabricated Building and Structural Steel Market is Facing?

Limited Financing Options and Capital Intensity

The capital-intensive nature of establishing prefabricated manufacturing facilities and maintaining structural steel inventory creates financial barriers limiting market participation and expansion capabilities. Smaller construction companies may face challenges accessing financing for prefabricated component procurement, particularly for large-scale projects requiring substantial upfront material investments before project completion and payment receipt.

Perception Challenges and Design Flexibility Concerns

Traditional perceptions regarding prefabricated construction limitations in architectural expression and customization capabilities may restrict adoption in premium residential and commercial segments, prioritizing distinctive design elements. Some stakeholders maintain preferences for conventional construction approaches perceived as offering greater design flexibility and material selection options despite evidence of advancing prefabricated solution capabilities.

Supply Chain Dependencies and Raw Material Price Volatility

Dependence on imported raw materials and specialized components exposes the market to supply chain disruptions, currency fluctuations, and international commodity price volatility, affecting project cost predictability. Steel price variations, transportation costs, and trade policy changes can impact prefabricated construction economics and project feasibility assessments, particularly for projects with fixed-price contractual arrangements.

Competitive Landscape:

The Saudi Arabia prefabricated building and structural steel market features a competitive environment comprising established domestic manufacturers with extensive local expertise alongside international construction technology providers offering advanced solutions. Leading domestic players leverage their understanding of local market requirements, regulatory frameworks, and customer relationships to maintain strong market positions across residential, commercial, and industrial segments. Manufacturing facility investments, technology upgrades, and capacity expansions by major competitors are intensifying competitive dynamics while enhancing overall industry capabilities. Strategic partnerships between domestic contractors and international technology providers are facilitating knowledge transfer and advanced manufacturing practice adoption, elevating industry standards and expanding solution offerings across market segments.

Some of the key players include:

- Saudi Building Systems Mfg. Co.

- Red Sea Housing Services

- Kirby Building Systems

- Zamil Steel Pre-Engineered Buildings Co. Ltd.

Recent Developments:

- In February 2025, Alghanim Industries broke ground on a new Kirby Building Systems pre-engineered building and structural steel manufacturing facility in Sudair Industrial City, Saudi Arabia. Spanning 256,000 square meters, the facility is designed to produce 200,000 metric tons annually, positioning Saudi Arabia as a global steel export hub aligned with Vision 2030 objectives.

- In January 2025, NMDC Energy officially opened a new fabrication facility worth AED 200 million in the Ras Al Khair Special Economic Zone, Saudi Arabia. Spanning 400,000 square meters with a 40,000-ton annual capacity, the facility supports offshore and modular construction projects using sustainable technologies.

Saudi Arabia Prefabricated Building and Structural Steel Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Million USD, ‘000 Units, Million Tons |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Component Covered |

|

| End Use Covered | Residential, Institutional, Commercial, Industrial |

| Companies Covered | Saudi Building Systems Mfg. Co., Red Sea Housing Services, Kirby Building Systems and Zamil Steel Pre-Engineered Buildings Co. Ltd. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report

The Saudi Arabia prefabricated building and structural steel market size was valued at USD 1,896 Million in 2025.

The Saudi Arabia prefabricated building and structural steel market is expected to grow at a compound annual growth rate of 3.58% from 2026-2034 to reach USD 2,601.80 Million by 2034.

The structural steel dominated the market with a 53% share in 2025, driven by extensive demand from mega-infrastructure projects, industrial facilities, petrochemical plants, and high-rise commercial developments requiring superior load-bearing capacity and design flexibility.

Key factors driving the Saudi Arabia prefabricated building and structural steel market include government-led mega-project investments under Vision 2030, accelerating urbanization and housing development requirements, economic diversification initiatives expanding industrial sectors, and the adoption of advanced manufacturing technologies enhancing construction efficiency.

Major challenges include limited financing options for capital-intensive manufacturing investments, perception challenges regarding design flexibility in premium segments, supply chain dependencies on imported raw materials, and steel price volatility affecting project cost predictability.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)