Saudi Arabia Potato Chips Market Size, Share, Trends and Forecast by Product Type, Distribution Channel, and Region, 2026-2034

Saudi Arabia Potato Chips Market Overview:

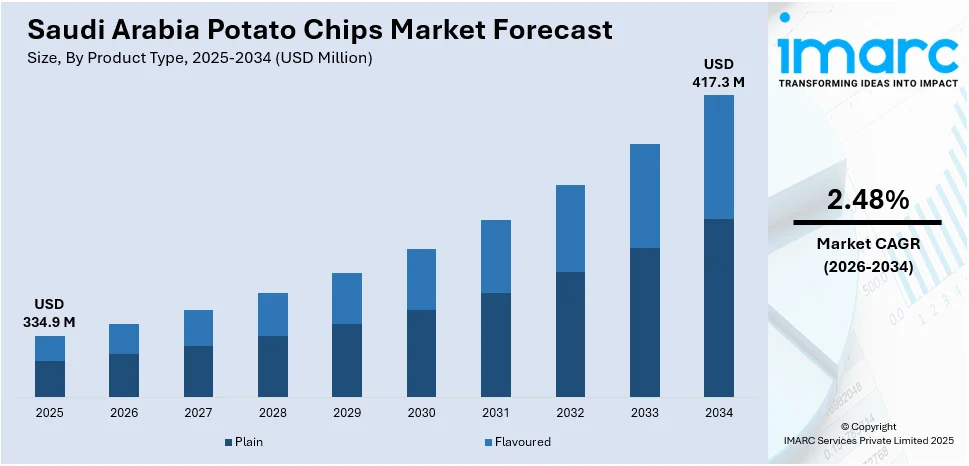

The Saudi Arabia potato chips market size reached USD 334.9 Million in 2025. Looking forward, IMARC Group expects the market to reach USD 417.3 Million by 2034, exhibiting a growth rate (CAGR) of 2.48% during 2026-2034. The market is driven by urbanization, rising disposable incomes, and a preference for convenient ready-to-eat (RTE) snacks, further supported by increasing health-consciousness, demand for locally inspired flavors, and the expansion of modern retail and e-commerce platforms.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2025 |

|

Forecast Years

|

2026-2034

|

|

Historical Years

|

2020-2025

|

| Market Size in 2025 | USD 334.9 Million |

| Market Forecast in 2034 | USD 417.3 Million |

| Market Growth Rate 2026-2034 | 2.48% |

Saudi Arabia Potato Chips Market Trends:

Rising Demand for Healthier and Premium Variants

Saudi consumers are increasingly embracing healthier lifestyles, fueling a growing demand for potato chips with reduced fat, lower sodium, and baked or air-popped alternatives. This shift reflects heightened health awareness and concerns over rising obesity rates. It aligns with a broader trend across GCC countries, where 60% of consumers are becoming more mindful of their snacking habits and portion sizes to maintain healthier diets. In response, brands are launching innovations such as sweet potato chips, organic ingredients, and fortified snacks enriched with fiber or vitamins. Gourmet flavors, unusual seasonings, and artisanal production techniques are becoming more and more popular in the premium market, which is also flourishing. Clear front-of-pack labeling and “free-from” claims—like gluten-free or non-genetically modified organisms (GMO)—are particularly appealing to health-conscious shoppers, making the balance between indulgence and nutrition vital for staying competitive in evolving Saudi Arabia’s snack market outlook.

To get more information on this market, Request Sample

Influence of Local Flavors and Cultural Preferences

Localization has become a defining trend in Saudi Arabia’s potato chips market, as consumers increasingly favor products that reflect regional tastes. Brands are capitalizing on this by introducing chips seasoned with traditional spices such as za’atar, kabsa, or chili-lime blends. These flavors cater to national pride and cultural identity, enhancing consumer loyalty. Limited-edition flavors linked to Ramadan or Saudi National Day are also gaining traction, encouraging trial and boosting seasonal sales. Local snack manufacturers often have an edge here, leveraging deep understanding of domestic flavor profiles. This trend aligns with the broader movement toward cultural authenticity in food, where local consumers seek familiarity and comfort in their snacking experiences without sacrificing convenience or novelty.

Growth of Modern Retail and Online Sales Channels

The expansion of modern grocery retail formats and e-commerce platforms is s reshaping consumer purchasing behavior in Saudi Arabia, significantly boosting the Saudi Arabia potato chips market share. Hypermarkets, convenience stores, and online grocery apps are offering a wide variety of brands, promotional deals, and targeted discounts, leading to increased snack food consumption. This aligns with data from the U.S. Department of Agriculture's Foreign Agricultural Service, which reported that Saudi Arabia’s food retail sales reached over $51 billion in 2023, with projected annual growth above 5%, driven by population growth, urbanization, and changing consumer behaviors. Online platforms, especially post-COVID-19, have enhanced product accessibility through doorstep delivery, supporting demand for niche and imported chips. Additionally, personalized marketing, influencer campaigns, and digital loyalty programs are engaging younger consumers, contributing to both volume and value growth in the potato chips segment.

Saudi Arabia Potato Chips Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the region level for 2026-2034. Our report has categorized the market based on product type and distribution channel.

Product Type Insights:

- Plain

- Flavoured

The report has provided a detailed breakup and analysis of the market based on the product type. This includes plain and flavoured.

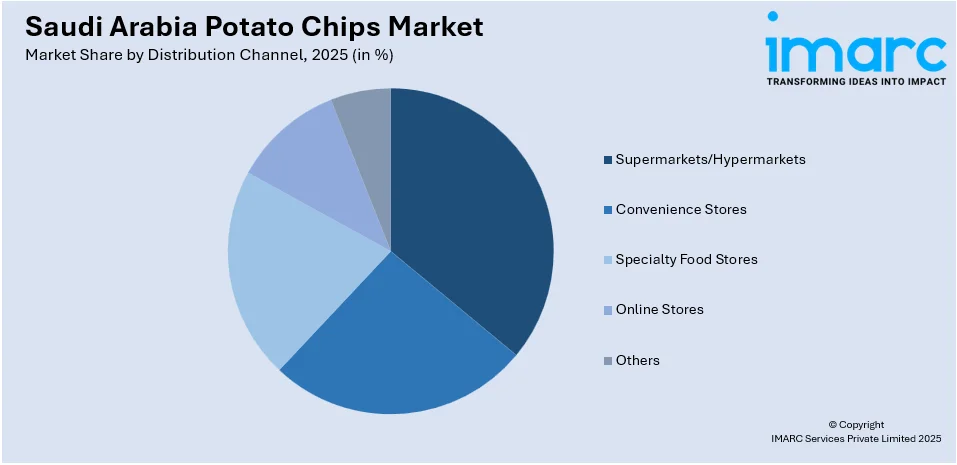

Distribution Channel Insights:

Access the Comprehensive Market Breakdown, Request Sample

- Supermarkets/Hypermarkets

- Convenience Stores

- Specialty Food Stores

- Online Stores

- Others

A detailed breakup and analysis of the market based on the distribution channel have also been provided in the report. This includes supermarkets/hypermarkets, convenience stores, specialty food stores, online stores, and others.

Regional Insights:

- Northern and Central Region

- Western Region

- Eastern Region

- Southern Region

The report has also provided a comprehensive analysis of all the major regional markets, which include Northern and Central, Western, Eastern, and Southern Region.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Saudi Arabia Potato Chips Market News:

- In July 2024, Beirut Erbil Company (B.E.P.P Co.) celebrated its first export of natural potato chips to Saudi Arabia and Jordan, marking a major milestone for Iraq’s agro-industrial sector. Held under the patronage of Erbil's Governor and key officials, the event honored the company’s pioneering role in establishing a local industrial potato market and professional chip production. This achievement follows its earlier success as Iraq’s first potato exporter.

Saudi Arabia Potato Chips Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Products Covered | Pots and Pan, Cooking Racks, Cooking Tools, Microwave Cookware, Pressure Cookers |

| Distribution Channels Covered | Hypermarkets and Supermarkets, Speciality Store, Online, Others |

| Regions Covered | North India, South India, East India, West India |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Saudi Arabia potato chips market performed so far and how will it perform in the coming years?

- What is the breakup of the Saudi Arabia potato chips market on the basis of product type?

- What is the breakup of the Saudi Arabia potato chips market on the basis of distribution channel?

- What is the breakup of the Saudi Arabia potato chips market on the basis of region?

- What are the various stages in the value chain of the Saudi Arabia potato chips market?

- What are the key driving factors and challenges in the Saudi Arabia potato chips market?

- What is the structure of the Saudi Arabia potato chips market and who are the key players?

- What is the degree of competition in the Saudi Arabia potato chips market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Saudi Arabia potato chips market from 2020-2034.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Saudi Arabia potato chips market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Saudi Arabia potato chips industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)