Saudi Arabia PoS Terminal Market Size, Share, Trends and Forecast by Type, End Use Industry, and Region, 2026-2034

Saudi Arabia POS Terminal Market Summary:

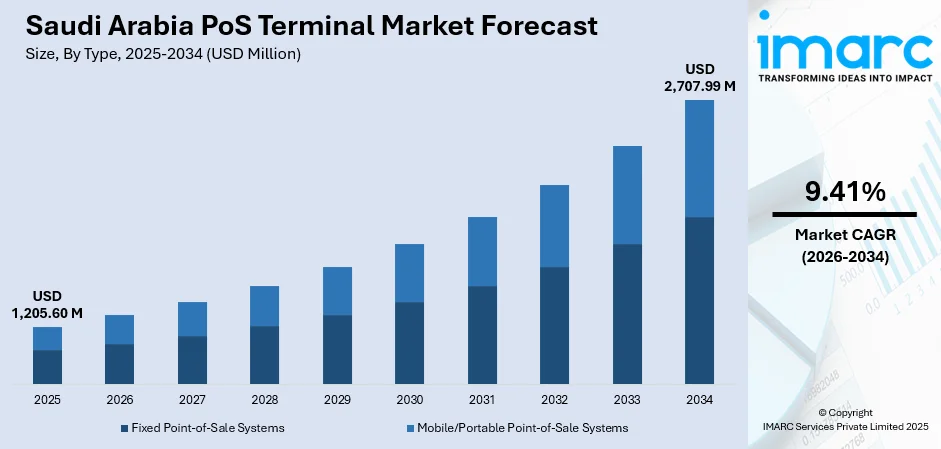

The Saudi Arabia POS terminal market size was valued at USD 1,205.60 Million in 2025 and is projected to reach USD 2,707.99 Million by 2034, growing at a compound annual growth rate of 9.41% from 2026-2034.

The Saudi Arabia POS terminal market is witnessing robust expansion driven by the Kingdom's accelerated transition towards a cashless economy under Vision 2030 strategic objectives. Rising smartphone penetration, widespread adoption of contactless payment technologies, and regulatory mandates requiring electronic payment acceptance across commercial establishments are propelling the market growth. The expansion of retail infrastructure, hospitality sector development, and increasing e-commerce activities are creating sustained demand for advanced payment processing solutions across the Kingdom.

Key Takeaways and Insights:

-

By Type: Fixed point-of-sale systems dominate the market with a share of 63% in 2025, due to their extensive use in high-transaction-volume retail and hospitality settings that demand stable, dependable, and thorough payment processing capabilities. Their connection with enterprise resource planning systems enables efficient operations.

-

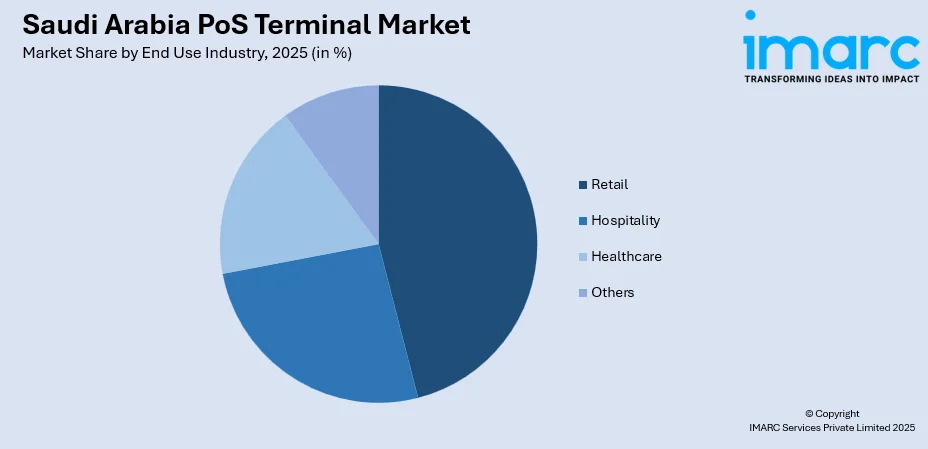

By End Use Industry: Retail leads the market with a share of 46% in 2025. This supremacy is fueled by the growth of shopping mall infrastructure, increasing consumer spending habits, and the surge of modern trade outlets needing comprehensive payment solutions.

-

By Region: Northern and Central Region represent the largest region with 39% share in 2025, influenced by Riyadh's accumulation of businesses, financial entities, and governmental agencies requiring the implementation of digital payment systems.

-

Key Players: Key players propel the Saudi Arabia POS terminal market by broadening product offerings, implementing cutting-edge contactless technologies, and enhancing countrywide service networks. Investments in biometric verification, AI-driven analytics, and cloud management systems improve merchant functions and speed up the adoption of digital payments.

To get more information on this market Request Sample

The POS terminal market in Saudi Arabia is undergoing significant growth as the Kingdom progresses towards achieving its Vision 2030 cashless economy goals. Government measures requiring the acceptance of digital payments in commercial and government institutions have spurred extensive terminal implementation nationwide. The Saudi Central Bank and Saudi Payments led an impressive digital payment transformation, with electronic payments rising to 79% of total retail transactions in 2024, an increase from 70% in 2023. The growth of fintech firms, increasing smartphone usage, and the adoption of advanced technologies such as near-field communication (NFC) contactless payments and biometric identification are driving an unparalleled need for advanced payment terminal solutions in the retail, hospitality, and healthcare industries. The assimilation of AI-powered analytics is further offering a favorable market outlook in Saudi Arabia.

Saudi Arabia POS Terminal Market Trends:

Thriving hospitality Industry

The thriving hospitality industry is strengthening the Saudi Arabia POS terminal market by increasing demand for efficient, high-volume transaction management across hotels, restaurants, cafes, and entertainment venues. Growing tourist arrivals and expanding food service outlets require fast, reliable, and contactless payment solutions to enhance guest experiences. According to the Ministry of Tourism’s latest annual statistical report, Saudi Arabia attracted 116 Million visitors in 2024, surpassing its yearly tourist goal for the second consecutive year. Hospitality operators are adopting advanced POS systems to manage orders, billing, inventory, and customer data in real time. Integration with digital wallets and loyalty programs further supports seamless service, boosting POS adoption.

Rising Adoption of Soft POS and Mobile Payment Solutions

The Saudi Arabia POS terminal market is witnessing significant transformation through the increasing adoption of software-based point-of-sale solutions. Businesses are transitioning from traditional hardware-based systems to smartphone-enabled payment applications, allowing merchants to accept digital transactions using mobile devices. This trend is particularly advantageous for small businesses, street vendors, and e-commerce delivery services, substantially reducing hardware investment requirements while improving payment flexibility. The integration of tap-to-phone technology is enabling merchants to transform smartphones into secure payment terminals, expanding acceptance capabilities across the Kingdom.

Integration of Biometric Authentication and Enhanced Security Features

Advanced biometric authentication technologies are becoming integral components of POS terminal systems across Saudi Arabia. The integration of fingerprint scanning, facial recognition, and voice authentication is significantly improving transaction security while enhancing customer experiences. Banks and payment service providers are deploying biometric-enabled terminals to comply with stringent anti-fraud regulations and know-your-customer requirements. This technology adoption is gaining particular traction in high-value transactions and financial institutions, effectively reducing dependency on traditional personal identification numbers (PINs) and passwords while strengthening overall payment ecosystem security.

How Vision 2030 is Transforming the Saudi Arabia POS Terminal Market:

Vision 2030 is significantly transforming the Saudi Arabia POS terminal market by accelerating the shift towards a cashless, digitally connected economy. The national agenda emphasizes financial inclusion, digital payments, and smart infrastructure, encouraging businesses across retail, hospitality, healthcare, and transportation to adopt modern POS systems. Government-backed initiatives promoting electronic transactions and fintech innovation are expanding POS penetration among small and medium enterprises (SMEs) that previously relied on cash. Rapid growth of organized retail, tourism projects, and entertainment hubs under Vision 2030 is further increasing demand for advanced POS terminals capable of handling high transaction volumes and multiple payment methods. Integration with e-wallets, contactless payments, and mobile banking platforms aligns with the country’s push for seamless consumer experiences. Additionally, regulatory support and investments in cloud computing and data security are enabling smarter POS solutions with analytics and inventory management features.

Market Outlook 2026-2034:

The Saudi Arabia POS terminal market is poised for sustained expansion throughout the forecast period, driven by comprehensive government digitalization initiatives and evolving consumer payment preferences. The Kingdom's commitment to achieving a cashless economy is creating substantial opportunities for terminal manufacturers and payment solution providers. The market generated a revenue of USD 1,205.60 Million in 2025 and is projected to reach a revenue of USD 2,707.99 Million by 2034, growing at a compound annual growth rate of 9.41% from 2026-2034. Continued infrastructure development across giga-projects, expanding tourism sector, and mandatory e-invoicing compliance are expected to sustain robust demand for advanced payment terminal solutions.

Saudi Arabia POS Terminal Market Report Segmentation:

|

Segment Category |

Leading Segment |

Market Share |

|

Type |

Fixed Point-of-Sale Systems |

63% |

|

End Use Industry |

Retail |

46% |

|

Region |

Northern and Central Region |

39% |

Type Insights:

- Fixed Point-of-Sale Systems

- Mobile/Portable Point-of-Sale Systems

Fixed point-of-sale systems dominate with a market share of 63% of the total Saudi Arabia POS terminal market in 2025.

Fixed point-of-sale systems are extensively deployed across the thriving retail and hospitality sectors of Saudi Arabia, providing stable and efficient solutions for high-transaction-volume businesses. As per IMARC Group, the Saudi Arabia hospitality market size was valued at USD 53.2 Billion in 2025. These hardware systems, comprising barcode scanners, registers, and receipt printers, are utilized in supermarkets, malls, and large restaurants for their reliability and comprehensive functionality. As the Saudi government pursues a cashless economy through Vision 2030, fixed POS solutions have increasingly been adopted to enhance transaction efficiency and improve inventory management capabilities.

Retailers and hospitality operators favor fixed POS systems for their ability to integrate with enterprise software, accounting platforms, and supply chain systems. These systems support centralized data tracking, real-time sales analytics, and automated stock replenishment, improving operational control. Fixed POS terminals also offer enhanced security features, which are critical for handling large transaction values. As store formats grow larger and more sophisticated, demand for robust fixed POS infrastructure continues to rise, reinforcing its strong market presence.

End Use Industry Insights:

Access the comprehensive market breakdown Request Sample

- Retail

- Hospitality

- Healthcare

- Others

Retail leads with a share of 46% of the total Saudi Arabia POS terminal market in 2025.

The retail sector continues to dominate POS terminal deployment across Saudi Arabia, supported by the Kingdom's expanding shopping mall infrastructure and rising consumer spending patterns. Modern trade outlets, supermarket chains, and department stores require sophisticated payment systems with centralized management capabilities. Consumer spending rose to a record SAR 1.41 Trillion in 2024, representing a 7% increase from 2023, driving sustained investments in advanced payment processing infrastructure across retail establishments.

The retail segment's growth is accelerated by regulatory mandates requiring electronic payment acceptance and the proliferation of contactless payment technologies. Major retail chains have completed nationwide NFC terminal upgrades, enabling seamless tap-to-pay experiences for consumers. The expansion of integrated lifestyle destinations and experience-led retail developments, particularly across giga-projects, is creating premium demand for advanced terminals featuring multi-currency support, loyalty program integration, and real-time analytics capabilities.

Regional Insights:

- Northern and Central Region

- Western Region

- Eastern Region

- Southern Region

Northern and Central Region exhibit a clear dominance with a 39% share of the total Saudi Arabia POS terminal market in 2025.

The Northern and Central Region maintains commanding leadership in the Saudi Arabia POS terminal market, driven by Riyadh's concentration of commercial establishments, financial institutions, and government offices. The capital city's vibrant retail sector, marked by extensive shopping mall infrastructure and diverse commercial outlets, fuels substantial demand for payment terminal solutions. Advanced technological infrastructure, including high-speed internet connectivity and far-reaching mobile networks, enables seamless adoption of modern POS systems across the region.

The region's dominance is reinforced by government mandates requiring digital payment acceptance across public sector entities and the concentration of headquarters for major banks and fintech companies. Riyadh accounted for 34% of total POS transactions in the Kingdom in 2024, reflecting the city's pivotal role in driving digital payment adoption. Landmark retail developments, including the Avenues Riyadh and Diriyah Square, will deliver substantial new retail space requiring advanced payment terminal deployment across premium shopping destinations.

Market Dynamics:

Growth Drivers:

Why is the Saudi Arabia POS Terminal Market Growing?

Government Push Toward a Cashless Economy and Digital Payments

In Saudi Arabia, the market for POS terminals is mostly driven by government push towards a cashless economy. In order to improve transparency, lower the cost of managing currency, and increase financial inclusion across industries, Vision 2030 encourages electronic payments. POS terminal implementation in retail, healthcare, transportation, and government-related services is rising due to regulatory incentives for card and digital wallet acceptance. Small businesses and service providers are using POS systems more frequently as a result of many economic operations requiring the receipt of electronic payments. Transaction reliability is further strengthened by the integration of national payment networks with POS infrastructure, which is backed by improved internet connectivity. Saudi Arabia has 36.84 Million internet users in the start of 2024, with a 99.0% internet penetration rate. Higher transaction volumes through POS systems are being driven by consumers' growing comfort with cashless transactions. Banks and fintech players are also supporting merchants with subsidized terminals and value-added services. Together, policy support, regulatory mandates, and rising consumer adoption are creating a stable demand environment. This government-led transition positions POS terminals as essential infrastructure for modern commerce and long-term digital payment growth across Saudi Arabia’s evolving economic landscape.

Rapid Growth of Retail, Hospitality, and Entertainment Sectors

Rapid growth of the retail, hospitality, and entertainment sectors is significantly propelling the market expansion in Saudi Arabia. The broadening of shopping malls, restaurants, hotels, cafes, cinemas, and entertainment venues is increasing demand for efficient transaction processing systems. High footfall environments require POS solutions capable of handling peak transaction volumes quickly and accurately. Hospitality operators rely on POS systems to integrate payments with order management, reservations, and inventory control. Entertainment destinations increasingly use POS terminals for ticketing, concessions, and cashless visitor experiences. As consumer expectations for speed and convenience rise, businesses are upgrading POS infrastructure to reduce waiting times and enhance service quality. Retail chains also depend on POS data to manage pricing, promotions, and multi-store operations. Continued sector expansion, supported by rising tourism and lifestyle spending, ensures sustained POS adoption, reinforcing market growth across service-oriented industries nationwide. Tourism expenditure in Saudi Arabia jumped by 27.25% in the quarter ending September 2024, compared to the same period in 2023, totaling SAR 25.05 Billion (USD 6.68 Billion).

Technological Advancements and POS System Integration Capabilities

Technological advancements and enhanced integration capabilities are strengthening the market. Modern POS systems extend beyond payment processing to include inventory management, accounting integration, customer analytics, and cloud-based reporting. These features enable businesses to gain real-time insights into sales performance and customer behavior. Cloud connectivity allows centralized control across multiple locations, appealing to expanding retail chains and franchises. Improved cybersecurity features, encryption, and compliance support increase confidence in digital transactions. POS integration with e-commerce platforms also supports omnichannel retail strategies. Automation and data-driven decision-making are becoming priorities for businesses seeking operational efficiency. As technology continues to evolve, merchants regularly upgrade POS hardware and software to remain competitive. This continuous innovation cycle sustains long-term demand, positioning advanced POS systems as essential tools for modern business operations in Saudi Arabia.

Market Restraints:

High Initial Investment and Operational Costs

The substantial upfront investment required for POS terminal deployment, including hardware acquisition, software licensing, and integration expenses, presents significant barriers for SMEs operating on constrained budgets. Ongoing operational costs, including transaction fees, maintenance requirements, and periodic system upgrades, further challenge merchant adoption, particularly among traditional retailers transitioning from cash-based operations.

Cybersecurity Concerns and Data Protection Challenges

Growing cybersecurity threats targeting payment infrastructure present persistent challenges for POS terminal operators across Saudi Arabia. The handling of sensitive customer financial information requires stringent security protocols and continuous system monitoring to prevent data breaches and fraudulent activities. Merchants face increasing complexity in maintaining compliance with evolving data protection standards while ensuring robust defense against sophisticated cyber attacks.

Infrastructure Gaps in Remote and Rural Areas

Uneven connectivity infrastructure across remote and rural regions of Saudi Arabia constrains full-scale POS terminal deployment beyond major urban centers. Limited 4G and 5G network coverage in peripheral areas, combined with shortages of certified field technicians for installation and maintenance support, creates adoption barriers for merchants operating outside Tier-1 cities. These infrastructure gaps result in uneven digital payment accessibility across the Kingdom.

Competitive Landscape:

The Saudi Arabia POS terminal market exhibits moderate concentration with a balanced mix of global manufacturers and domestic solution providers. Leading international vendors leverage established brand recognition, comprehensive product portfolios, and local compliance expertise to maintain competitive positioning. Technology differentiation increasingly centers on contactless acceptance capabilities, AI-driven analytics integration, and cloud-hosted management platforms. In Saudi Arabia, strategic partnerships between terminal manufacturers, banks, and fintech companies are extending value propositions through embedded services, including inventory finance, loyalty programs, and business intelligence solutions.

Saudi Arabia PoS Terminal Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered | Fixed Point-of-Sale Systems, Mobile/Portable Point-of-Sale Systems |

| End Use Industries Covered | Retail, Hospitality, Healthcare, Others |

| Regions Covered | Northern and Central Region, Western Region, Eastern Region, Southern Region |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email |

Key Questions Answered in This Report

The Saudi Arabia POS terminal market size was valued at USD 1,205.60 Million in 2025.

The Saudi Arabia POS terminal market is expected to grow at a compound annual growth rate of 9.41% from 2026-2034 to reach USD 2,707.99 Million by 2034.

Fixed point-of-sale systems dominated the market with a share of 63%, driven by their widespread deployment in high-transaction-volume retail and hospitality environments requiring stable and comprehensive payment processing functionality.

Key factors driving the Saudi Arabia POS terminal market include government Vision 2030 cashless economy initiatives, expanding retail and hospitality sector infrastructure, rising e-commerce and digital payment adoption, integration of contactless payment technologies, and regulatory mandates requiring electronic payment acceptance across commercial establishments.

Major challenges include high initial investment and operational costs for small businesses, cybersecurity concerns related to payment data protection, infrastructure gaps in remote and rural areas, shortage of certified field technicians, and complexity of maintaining compliance with evolving regulatory requirements.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)