Saudi Arabia Polypropylene Market Report by Type (Homopolymer, Copolymer), Process (Injection Molding, Blow Molding, Extrusion, and Others), Application (Film and Sheet, Fiber, Raffia, and Others), End User (Packaging, Automotive, Building and Construction, Medical, Electrical and Electronics, and Others), and Region 2026-2034

Market Overview:

Saudi Arabia polypropylene market size reached USD 1,269.1 Million in 2025. Looking forward, IMARC Group expects the market to reach USD 1,717.7 Million by 2034, exhibiting a growth rate (CAGR) of 3.42% during 2026-2034. The increasing innovations in polypropylene production technologies, such as improved catalysts or process efficiency, that can impact the cost and availability of polypropylene, are driving the market.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2025 |

|

Forecast Years

|

2026-2034

|

|

Historical Years

|

2020-2025

|

| Market Size in 2025 | USD 1,269.1 Million |

| Market Forecast in 2034 | USD 1,717.7 Million |

| Market Growth Rate (2026-2034) | 3.42% |

Polypropylene is a versatile thermoplastic polymer renowned for its wide range of applications. Comprising of propylene monomers, it possesses exceptional chemical and heat resistance, making it suitable for various industries. With a high melting point, it can withstand elevated temperatures without losing its structural integrity. This lightweight material boasts remarkable durability, stiffness, and toughness, making it ideal for manufacturing products ranging from packaging materials and textiles to automotive components and medical devices. Its resistance to moisture and chemicals enhances its utility in diverse environments. Additionally, polypropylene is easily recyclable, contributing to sustainability efforts. The polymer's affordability and ease of processing further underscore its popularity in the industrial landscape. Whether in consumer goods or industrial settings, polypropylene's inherent qualities make it a go-to material for creating an array of products that meet the demands of modern life.

Saudi Arabia Polypropylene Market Trends:

The polypropylene market in Saudi Arabia is experiencing a surge in demand, propelled by several key drivers. Firstly, the growing packaging industry is a significant force behind the rise in polypropylene demand. With increasing consumer preferences for sustainable and lightweight packaging solutions, polypropylene's favorable properties, such as high tensile strength and excellent chemical resistance, position it as a preferred choice for manufacturers. Furthermore, the automotive sector plays a pivotal role in driving the polypropylene market. The demand for lightweight materials to enhance fuel efficiency and reduce emissions has led to a substantial increase in the adoption of polypropylene in automotive components. Its durability, coupled with the ability to withstand harsh environmental conditions, makes it an ideal choice for various automotive applications. In addition to this, the construction industry's expansion contributes significantly to the polypropylene market's growth. The material's resistance to moisture, chemicals, and fatigue, along with its cost-effectiveness, positions polypropylene as a favored choice for construction materials. As the regional emphasis on infrastructure development intensifies, the demand for polypropylene-based products in construction is poised to escalate, further propelling the market forward. In essence, these interconnected factors highlight the dynamic and multifaceted nature of the polypropylene market as it continues to evolve in response to diverse industry demands.

Saudi Arabia Polypropylene Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country level for 2026-2034. Our report has categorized the market based on type, process, application, and end user.

Type Insights:

- Homopolymer

- Copolymer

The report has provided a detailed breakup and analysis of the market based on the type. This includes homopolymer and copolymer.

Process Insights:

- Injection Molding

- Blow Molding

- Extrusion

- Others

A detailed breakup and analysis of the market based on the process have also been provided in the report. This includes injection molding, blow molding, extrusion, and others.

Application Insights:

- Film and Sheet

- Fiber

- Raffia

- Others

The report has provided a detailed breakup and analysis of the market based on the application. This includes film and sheet, fiber, raffia, and others.

End User Insights:

- Packaging

- Automotive

- Building and Construction

- Medical

- Electrical and Electronics

- Others

A detailed breakup and analysis of the market based on the end user have also been provided in the report. This includes packaging, automotive, building and construction, medical, electrical and electronics, and others.

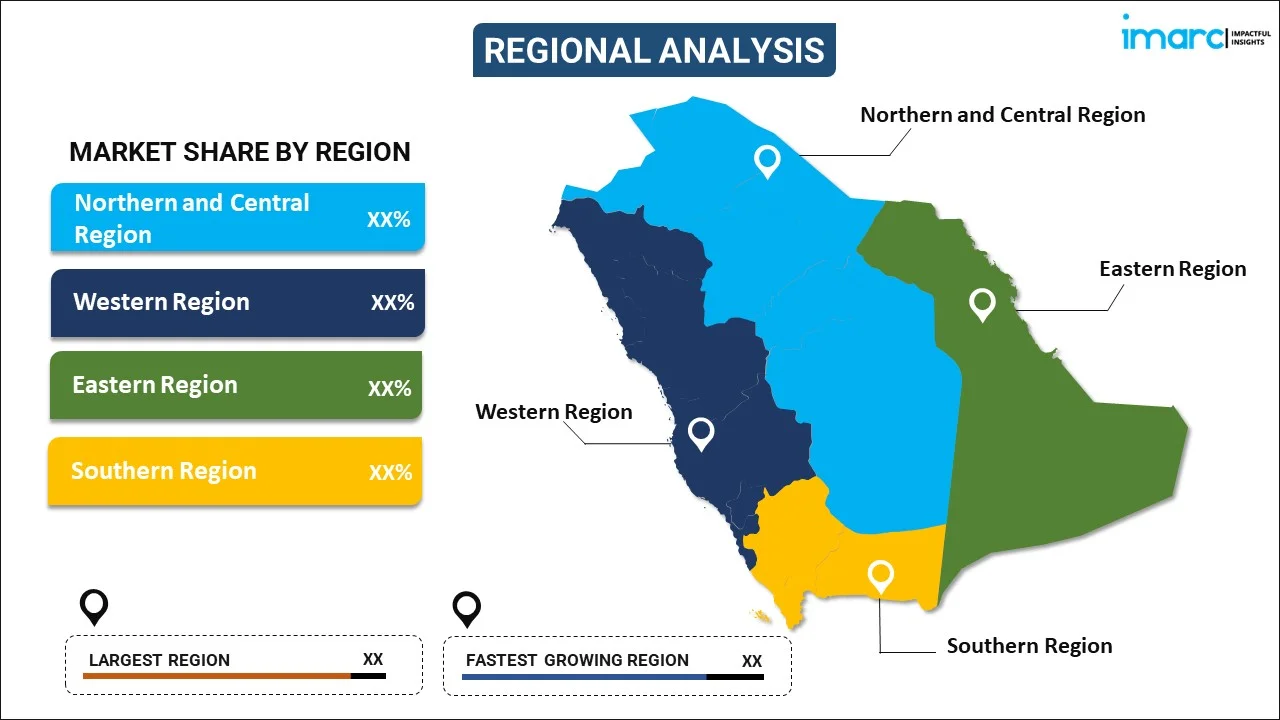

Regional Insights:

- Northern and Central Region

- Western Region

- Eastern Region

- Southern Region

The report has also provided a comprehensive analysis of all the major regional markets, which include Northern and Central Region, Western Region, Eastern Region, and Southern Region.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Saudi Arabia Polypropylene Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Million USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered | Homopolymer, Copolymer |

| Processes Covered | Injection Molding, Blow Molding, Extrusion, Others |

| Applications Covered | Film and Sheet, Fiber, Raffia, Others |

| End Users Covered | Packaging, Automotive, Building and Construction, Medical, Electrical and Electronics, Others |

| Regions Covered | Northern and Central Region, Western Region, Eastern Region, Southern Region |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Saudi Arabia polypropylene market performed so far and how will it perform in the coming years?

- What has been the impact of COVID-19 on the Saudi Arabia polypropylene market?

- What is the breakup of the Saudi Arabia polypropylene market on the basis of type?

- What is the breakup of the Saudi Arabia polypropylene market on the basis of process?

- What is the breakup of the Saudi Arabia polypropylene market on the basis of application?

- What is the breakup of the Saudi Arabia polypropylene market on the basis of end user?

- What are the various stages in the value chain of the Saudi Arabia polypropylene market?

- What are the key driving factors and challenges in the Saudi Arabia polypropylene?

- What is the structure of the Saudi Arabia polypropylene market and who are the key players?

- What is the degree of competition in the Saudi Arabia polypropylene market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Saudi Arabia polypropylene market from 2020-2034.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Saudi Arabia polypropylene market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Saudi Arabia polypropylene industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)