Saudi Arabia Plastic Components Market Report by Product Type (Sheets, Film, and Plates, Tubes, Containers, Household Articles, Floor Cover and Wall Cover, Textile Fabrics, and Others), End Use Industry (Building and Construction, Consumer Goods, Life Sciences, Aerospace, Food and Beverage, and Others), and Region 2025-2033

Market Overview:

Saudi Arabia plastic components market size reached USD 4.8 Billion in 2024. Looking forward, IMARC Group expects the market to reach USD 8.8 Billion by 2033, exhibiting a growth rate (CAGR) of 6.20% during 2025-2033. The growing utilization of advanced manufacturing technologies, such as injection molding, blow molding, and extrusion, to produce high-quality components with precision and efficiency is primarily driving the market growth.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

|

Market Size in 2024

|

USD 4.8 Billion |

|

Market Forecast in 2033

|

USD 8.8 Billion |

| Market Growth Rate 2025-2033 | 6.20% |

Plastic components refer to various parts, objects, or elements made from synthetic polymers or plastics. They are created through processes such as injection molding, extrusion, or thermoforming, where raw plastic materials are melted, shaped, and solidified into specific forms. Plastic components find wide-ranging applications in numerous industries, from automotive and electronics to consumer goods and medical devices. They offer several advantages, including durability, lightweight properties, and cost-effectiveness, making them a versatile choice for manufacturing various products. Plastic components can take on diverse shapes, sizes, and colors, and they are often utilized for their resistance to corrosion, chemicals, and moisture, as well as their electrical insulation properties. Whether as intricate parts within a machine, housing for electronic devices, or everyday household items, plastic components play a fundamental role in modern manufacturing and technology.

Saudi Arabia Plastic Components Market Trends:

Expansion of Electronics and Electrical Manufacturing

The growing consumer base for electronics, combined with industrial policies encouraging local assembly and production, is creating new opportunities for plastic components in Saudi Arabia. Plastics are widely used in casings, connectors, circuit housings, and insulation materials, all of which are critical for safety and performance in electronic products. As demand for smartphones, appliances, and industrial electronics continues to rise, local manufacturers are turning to plastic parts to meet both functional and design requirements. The Kingdom’s push to attract foreign investment in technology manufacturing is expected to establish more localized supply chains, reducing reliance on imports. This trend benefits plastic component producers, who can provide high-quality, customized parts for electronics makers. The growing use of renewable energy systems and smart technologies enhances this demand, linking the plastics industry to the Kingdom's goals for technological independence and digital advancement.

Technological Advancements and Sustainability Focus

Advancements in technology for plastic production is a major factor bolstering the market growth, providing enhanced performance, lower manufacturing costs, and increased design versatility in various sectors. Improvements in processing methods, material compositions, and automation enable manufacturers to meet increasing quality standards while preserving efficiency. Furthermore, sustainability is emerging as a key focus, with higher attention on recyclable resources, minimizing waste, and adhering to international environmental criteria. National plans under Vision 2030 strongly encourage embracing sustainable production methods and community-based recycling programs, ensuring the industry progresses in accordance with global standards. For example, in 2024, SABIC, Napco, and FONTE launched Saudi Arabia’s first bread packaging made from fully recycled post-consumer plastic as part of SABIC’s TRUCIRCLE circular economy program. The packaging used certified circular polyethylene produced from advanced recycling processes, promoting sustainability in food packaging. This collaboration marked a significant step toward circular plastics and aligns with Saudi Vision 2030 goals.

Growth in Construction and Infrastructure Development

Saudi Arabia’s large-scale infrastructure projects are catalyzing the demand for plastic components owing to their durability, versatility, and cost efficiency in construction and utility applications. Vision 2030's focus on smart cities, housing, and transport is establishing ongoing needs for pipes, panels, insulation, and fittings, with plastics progressively substituting metals because of better corrosion resistance and cost-effectiveness. The focus on sustainability and energy efficiency in the construction industry enhances the significance of plastic materials, especially in modular and prefabricated systems that utilize lightweight and easily installed components. A prominent example of this demand is the Tilal Khuzam (Khuzam Hills) residential development initiated in 2024 by Citic Construction, in collaboration with the National Housing Company (NHC) and Rafal Real Estate. Covering 630,000 square meters close to King Khalid International Airport, the initiative will provide 3,500 low-rise residential units, highlighting the extent of opportunities increasing plastics use in Saudi Arabia’s infrastructure industry.

Saudi Arabia Plastic Components Market Growth Drivers:

Rising Demand from Water Desalination Projects

Saudi Arabia’s increasing reliance on desalination to secure freshwater supplies is catalyzing the demand for copper pipes and tubes. Pipes, tanks, membranes, and protective casings made from high-performance plastics are critical in handling high salinity and corrosive environments. The Kingdom continues to build large-scale desalination plants to secure drinking water for its growing population and industries. For instance, in 2025, Lantania and MGC announced they will build a $544 million seawater reverse osmosis desalination plant in Jubail, Saudi Arabia, with a capacity of 600,000 m³/day. The project supports Saudi Arabia’s Vision 2030 by enhancing sustainable water resources. The resistance of plastics to corrosion and chemicals makes them more suitable than metals in such projects, reducing operational costs and extending equipment lifespans.

Increasing Focus on Renewable Energy and Utilities

The growth of renewable energy initiatives and utility services in Saudi Arabia is driving the demand for plastic components, as these materials are essential for contemporary energy and water systems. Major solar and wind initiatives guided by Vision 2030 depend on plastic-based wiring, connectors, enclosures, and protective components engineered to endure severe weather conditions. Additionally, water management systems, such as desalination facilities, pipelines, and irrigation systems, rely on plastics for their resistance to corrosion, chemical durability, and affordability, especially in a nation with scarce freshwater supplies. The government's enduring dedication to clean energy and water safety guarantees a strong flow of initiatives where plastics are essential. In 2025, a significant milestone was achieved when SIG and Yellow Door Energy inaugurated a 2-megawatt solar power facility in Riyadh, comprising over 3,200 panels and decreasing carbon emissions by 1,300 metric tons each year, highlighting the growing need for plastics for lightweight, durable, and weather-resistant components in renewable energy infrastructure.

Growth of Packaging and Logistics Sector

The swift growth of retail, food distribution, and logistics systems in Saudi Arabia is driving the need for plastic components that ensure safe packaging, efficient storage, and reliable transportation solutions. Lightweight, sturdy plastics are vital for pallets, crates, containers, and storage options that enable secure and effective movement of products. The increase in online shopping is catalyzing the demand for durable, protective packaging and handling systems that utilize plastic for both cost-effectiveness and weight benefits. As the Kingdom aims to establish itself as a regional logistics center through Vision 2030, significant investments are being made in warehouses, cold chain facilities, and transportation infrastructure. These segments require a continuous provision of containers made from plastic, shelving units, and insulation materials. The combination of packaging and logistics with broader economic diversification guarantees a continuous demand for plastic component manufacturers, broadening their influence from local usage to facilitating regional trade activities.

Saudi Arabia Plastic Components Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the saudi arabia plastic components market report, along with forecasts at the country level for 2025-2033. Our report has categorized the market based on product type and end use industry.

Product Type Insights:

To get more information on this market, Request Sample

- Sheets, Film, and Plates

- Tubes

- Containers

- Household Articles

- Floor Cover and Wall Cover

- Textile Fabrics

- Others

The report has provided a detailed breakup and analysis of the market based on the product type. This includes sheets, film, and plates, tubes, containers, household articles, floor cover and wall cover, textile fabrics, and others.

End Use Industry Insights:

- Building and Construction

- Consumer Goods

- Life Sciences

- Aerospace

- Food and Beverage

- Others

A detailed breakup and analysis of the market based on the end use industry have also been provided in the report. This includes building and construction, consumer goods, life sciences, aerospace, food and beverage, and others.

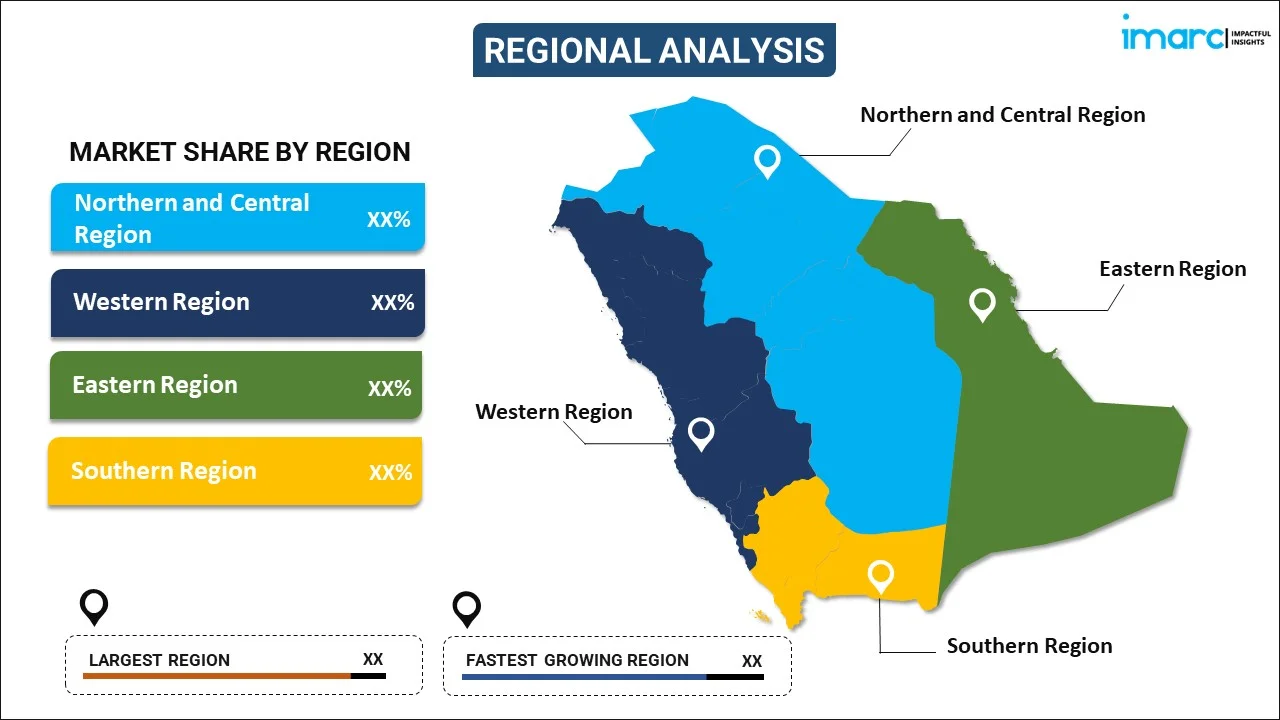

Regional Insights:

- Northern and Central Region

- Western Region

- Eastern Region

- Southern Region

The report has also provided a comprehensive analysis of all the major regional markets, which include Northern and Central Region, Western Region, Eastern Region, and Southern Region.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape in the market. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Latest News and Developments:

- In July 2025, Sabic launched LNP Thermotuf WF0087N, the first flame-retardant PBT material for nano molding, designed for metal-plastic hybrid components in smartphones and electronics. It offers 60% stronger metal bonding, thin-wall flame resistance, and high impact durability.

- In May 2025, Saudi Plastics and Petrochem 2025 will be held from May 12–15, at the Riyadh International Convention & Exhibition Center, Saudi Arabia. This 20th edition is part of Riyadh International Industry Week and focuses on innovations in plastics and petrochemicals. It brings together global exhibitors, industry leaders, and decision-makers for networking and business opportunities.

- In April 2025, the Gulf 4P Dammam 2025 expo, scheduled for December 1–4, 2025, is a major B2B event in Saudi Arabia showcasing innovations in plastics, packaging, printing, and petrochemicals. Held at Dhahran Expo, Dammam, it offers networking, product launches, and market entry opportunities for global industry players.

- In February 2025, Saudi EV maker Ceer signed $1.4 billion in deals, including agreements with Zamil Plastic Industrial Co. and Arabian Plastic Industrial Co. for plastic injection and blow parts. These efforts support Ceer’s 45% localization target ahead of its 2026 vehicle launch. The KAEC-based facility aims for an annual capacity of 240,000 units by 2034.

- In January 2025, Time Technoplast announced a new production facility in the MODON Industrial Area, Saudi Arabia, through its subsidiary Gulf Powerbeat. The plant will produce 1,000-litre Intermediate Bulk Containers (IBCs) and plastic drums using advanced automation. Operations are expected to begin by Q2 2025, serving Saudi Arabia, Kuwait, and Qatar.

- In January 2025, SABIC introduced SABIC VESTOLEN P9421, a green-colored random polypropylene solution designed for hot and cold water pipe applications. The material offers high thermal stability, pressure resistance, and long service life. Developed in collaboration with local partners, it addresses Saudi Arabia's domestic piping needs.

Saudi Arabia Plastic Components Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Predictive Market Assessment:

|

| Product Types Covered | Sheets, Film, and Plates, Tubes, Containers, Household Articles, Floor Cover and Wall Cover, Textile Fabrics, Others |

| End Use Industries Covered | Building and Construction, Consumer Goods, Life Sciences, Aerospace, Food and Beverage, Others |

| Regions Covered | Northern and Central Region, Western Region, Eastern Region, Southern Region |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Saudi Arabia plastic components market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Saudi Arabia plastic components market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Saudi Arabia plastic components industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The plastic components market in Saudi Arabia was valued at USD 4.8 Billion in 2024.

The Saudi Arabia plastic components market is projected to exhibit a CAGR of 6.20% during 2025-2033, reaching a value of USD 8.8 Billion by 2033.

The Saudi Arabia plastic components market is supported by the growing demand from construction, automotive, and packaging sectors, reinforced by Vision 2030 initiatives and large-scale infrastructure projects. The rising consumer goods usage, technological innovation in plastic processing, and the shift toward lightweight, durable, and cost-effective materials that enhance performance across multiple end-use applications is further bolstering the market growth.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)