Saudi Arabia Perfume Market Size, Share, Trends and Forecast by Price, Gender, and Product, 2026-2034

Saudi Arabia Perfume Market Summary:

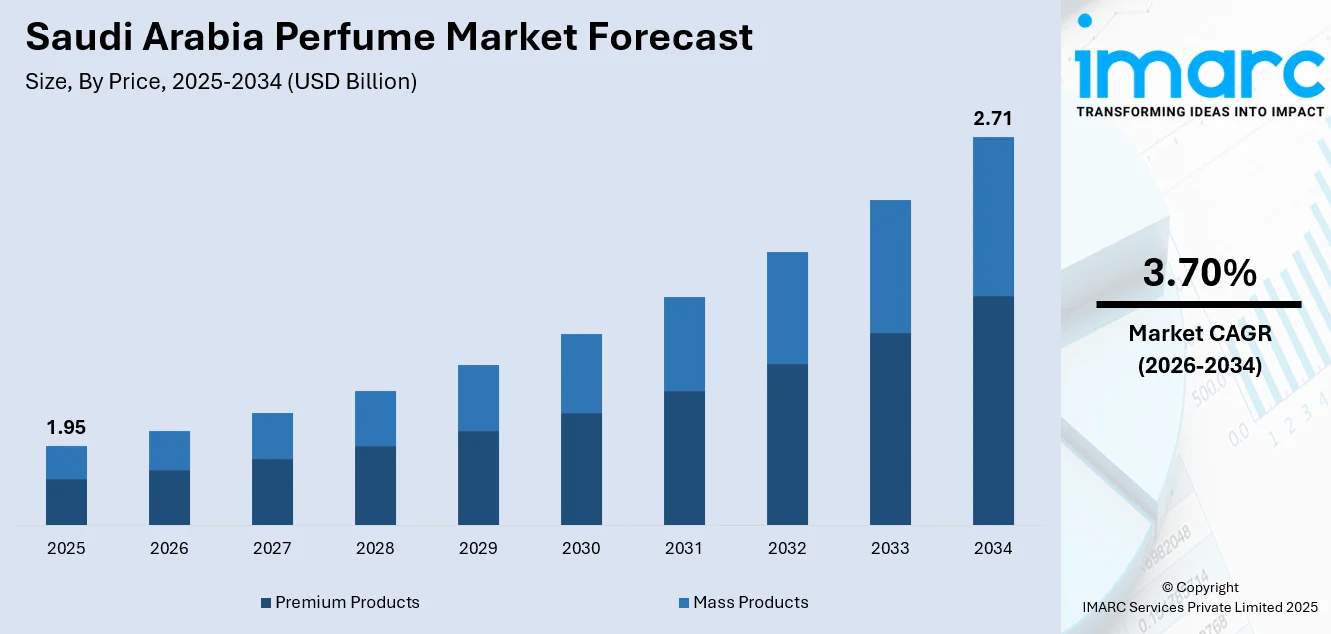

The Saudi Arabia perfume market size was valued at USD 1.95 Billion in 2025 and is projected to reach USD 2.71 Billion by 2034, growing at a compound annual growth rate of 3.70% from 2026-2034.

The Saudi Arabia perfume market is driven by deep cultural affinity for fragrances, rising disposable incomes, and growing demand for premium and luxury products. Traditional Arabic scents remain central to consumer preferences, while e-commerce expansion and increasing tourism further boost demand. Urbanization and evolving personal grooming habits among younger demographics continue to strengthen the Saudi Arabia perfume market share.

Key Takeaways and Insights:

- By Price: Premium products dominate the market with a share of 61% in 2025, owing to a strong cultural inclination towards luxury scents that represent elegance and social standing. Rising affluence among Saudi consumers and their inclination towards exclusive, long-lasting perfumes drive premium segment growth.

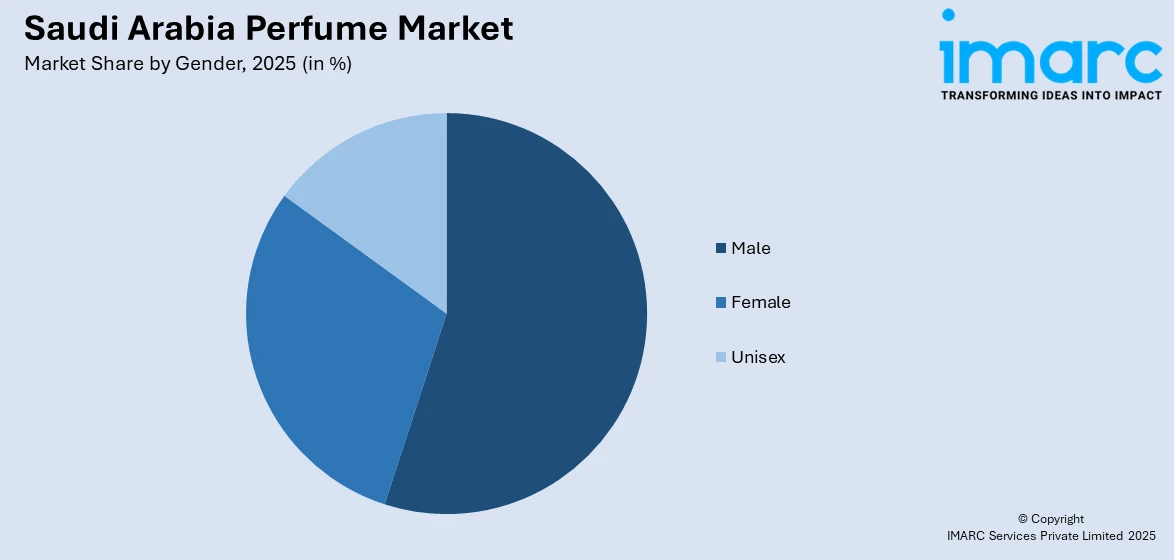

- By Gender: Male leads the market with a share of 45% in 2025, reflecting entrenched grooming habits and cultural traditions where men apply fragrances multiple times daily. The popularity of oud, sandalwood, and musk-based scents among male consumers fuels this segment.

- By Product: Arabic prevails the market with a share of 51% in 2025, driven by deep-rooted cultural heritage and consumer preference for traditional oriental compositions. Rich ingredients like oud, amber, rose, and musk remain highly valued for their depth and longevity.

- Key Players: Key players drive the Saudi Arabia perfume market by expanding retail networks, investing in product innovations, and strengthening e-commerce presence. Their focus on premium oud-based collections, personalized fragrances, and strategic partnerships with international distributors enhances market penetration and consumer engagement. Some of the key players operating in the market include Abdul Samad Al Qurashi, Ahmed Al Maghribi Perfumes, Ajmal Perfumes, Arabian Oud, Rasasi Perfume Industry LLC, Rashat, and Swiss Arabian Perfumes Group.

To get more information on this market Request Sample

The Saudi Arabia perfume market exhibits robust growth, driven by the Kingdom's unique cultural landscape where fragrances serve as essential expressions of personal identity, hospitality, and social etiquette. The market benefits significantly from increasing urbanization and a young, digitally connected population that embraces both traditional Arabic scents and contemporary international brands. The expansion of e-commerce platforms has fundamentally transformed fragrance distribution, creating unprecedented market accessibility beyond traditional retail limitations. As per IMARC Group, the Saudi Arabia e-commerce market size reached USD 222.9 Billion in 2024. Rising tourism, particularly religious pilgrimage to Mecca and Medina, further stimulates demand, as visitors purchase perfumes as authentic cultural souvenirs. The interplay between classic attars and modern eau de parfums continues to reshape local preferences in exciting ways.

Saudi Arabia Perfume Market Trends:

Rise of Niche and Artisanal Fragrances

Saudi consumers increasingly gravitate towards niche and artisanal fragrances offering unique compositions and limited availability, departing from mainstream designer brands. This trend reflects sophisticated consumer tastes and desire for exclusivity within the Kingdom's affluent demographics. Artisanal brands emphasize rare raw materials, handcrafted production methods, and complex scent layering to differentiate offerings. Limited-edition releases and bespoke fragrance services enhance personalization and luxury appeal. Growing exposure to global niche perfumery through travel and digital platforms further accelerates this premiumization trend.

Digital Transformation and E-commerce Expansion

The explosive growth of e-commerce platforms has fundamentally transformed luxury perfume distribution in Saudi Arabia, creating unprecedented market accessibility and consumer reach beyond traditional retail limitations. Online channels enable fragrance brands to implement direct-to-consumer (D2C) strategies, personalized marketing campaigns, and comprehensive product information delivery. By the end of 2024, Saudi Arabia reached 33.6 Million internet users engaged in e-commerce activities, representing a remarkable 42% increase from 2019 levels.

Growing Preferences for Natural and Sustainable Fragrances

Saudi consumers increasingly favor natural and eco-friendly perfumes, driven by health and environmental concerns. Brands respond by incorporating organic ingredients like musk, sandalwood, and jasmine while avoiding synthetic allergens. This trend supports sustainability, with companies adopting eco-friendly packaging, biodegradable plastics, and ethical sourcing practices. Growing environmental awareness among younger consumers accelerates the shift towards sustainable packaging in the perfume segment. Local brands are also highlighting transparency and clean-label claims to strengthen trust and differentiate offerings in the market.

How Vision 2030 is Transforming the Saudi Arabia Perfume Market:

Vision 2030 is transforming the Saudi Arabia perfume market by elevating local manufacturing, branding, and cultural heritage while expanding consumer access and retail innovation. The program encourages domestic production of fragrances and ingredients, supporting Saudi perfumers and reducing reliance on imports. Rising disposable incomes, lifestyle upgrades, and a growing young population are strengthening demand for premium and niche perfumes. Tourism development and the expansion of luxury retail in malls, airports, and entertainment zones are increasing exposure to global and regional fragrance brands. Vision 2030 also promotes entrepreneurship, enabling small and artisanal perfume houses to scale through digital platforms and modern distribution channels. Greater female workforce participation and evolving social norms are broadening the consumer base. Sustainability initiatives further influence product development, encouraging natural ingredients, eco-friendly packaging, and ethical sourcing practices across the Saudi Arabia perfume industry.

Market Outlook 2026-2034:

The Saudi Arabia perfume market outlook remains positive, supported by strong cultural affinity for fragrances, rising disposable incomes, and expanding retail infrastructure. The market is expected to witness sustained demand for premium and luxury perfumes as consumers continue to seek distinctive scents that reflect personal identity and social status. The market generated a revenue of USD 1.95 Billion in 2025 and is projected to reach a revenue of USD 2.71 Billion by 2034, growing at a compound annual growth rate of 3.70% from 2026-2034. Vision 2030 initiatives promoting domestic luxury goods production, combined with expanding e-commerce platforms and growing tourism, will continue to drive market expansion. The increasing adoption of digital marketing strategies and influencer collaborations further enhances consumer engagement and brand awareness.

Saudi Arabia Perfume Market Report Segmentation:

|

Segment Category |

Leading Segment |

Market Share |

|

Price |

Premium Products |

61% |

|

Gender |

Male |

45% |

|

Product |

Arabic |

51% |

Price Insights:

- Premium Products

- Mass Products

Premium products dominate with a market share of 61% of the total Saudi Arabia perfume market in 2025.

Premium products hold the largest share of the Saudi Arabia perfume market because there is a strong cultural focus on luxury and high-quality perfumes. Saudi Arabian consumers tend to link premium perfumes with sophistication, wealth, and social status, making them extremely sought after. The market is also driven by a long-standing tradition of using rich, long-lasting fragrances, such as oud, amber, and musk, which are usually contained in premium products.

Global high-end brands and domestic artisanal perfumers satisfy these tastes with exclusive, personalized perfumes that resonate with cultural values. In Saudi Arabia, the premium segment benefits from strategic partnerships enhancing distribution capabilities, exemplified by collaborations between regional distributors and international luxury houses. Saudi consumers in this segment demonstrate strong preference for original, long-lasting fragrances with distinctive character, frequently selecting niche brands that convey exclusivity and tailor-made craftsmanship. Premium gifting culture during festivals and social occasions further reinforces the segment’s growth.

Gender Insights:

Access the comprehensive market breakdown Request Sample

- Male

- Female

- Unisex

Male leads with a share of 45% of the total Saudi Arabia perfume market in 2025.

Men dominate the market, as they wear perfumes multiple times throughout a day, particularly at social gatherings or religious activities. Oud, sandalwood, musk, and amber-based fragrances are extremely popular among male consumers. The presence of Western-style designer colognes as well as traditional attar-based perfumes caters to varying tastes across age groups. Fragrance layering is a common practice among Saudi men, encouraging higher usage volumes and product variety. Strong cultural emphasis on personal grooming further supports frequent perfume application as part of daily routines.

The gifting culture, high spending power, and social status associated with personal fragrance are major growth drivers in the male segment. Premium men's fragrances, many of which feature oud, are expected to be the fastest-growing category, aligning with a regional shift towards greater male investment in personal care. Saudi Arabia's growing population with 62.2% males, by the end of 2024, offers a strong consumer base for luxury perfumes, ensuring that the market for high-end, culturally meaningful fragrances continues to expand. Woody and citrus scents remain popular choices among Saudi men seeking sophisticated daily wear options.

Product Insights:

- Arabic

- French

- Others

Arabic exhibits a clear dominance with a 51% share of the total Saudi Arabia perfume market in 2025.

Arabic is highly valued in Saudi Arabia and continues to be a mainstay of the perfume industry. The rich and enduring components of perfumes like oud, rose, amber, and musk are prized for their depth and richness, representing the customs and cultural legacy of the region. These fragrances generate a feeling of history and identity, making them appropriate for both special events and everyday wear. In May 2024, the Saudi National Museum in Riyadh, under the patronage of Prince Badr bin Farhan, opened the 'Perfumes of the East' exhibition featuring over 200 archaeological artifacts.

The persistence of these scents' popularity highlights the region's pride in ancient perfume-making methods and the wish to honor and maintain regional traditions through aroma. Traditional Arabic scents are used in religious ceremonies and daily life, symbolizing hospitality and elegance. They are also increasingly blended with modern accords to appeal to younger consumers. Local perfumers leverage heritage storytelling to strengthen brand authenticity. This fusion supports sustained relevance in a rapidly evolving luxury fragrance industry.

Market Dynamics:

Growth Drivers:

Why is the Saudi Arabia Perfume Market Growing?

Cultural Heritage and Personal Grooming Traditions

Perfumes hold immense cultural and religious significance in Saudi Arabian society, where wearing fragrances is considered a sign of cleanliness, beauty, and social etiquette. The art of perfume making has been passed down through generations, with traditional methods and natural ingredients used to create exquisite scents reflecting rich heritage. Fragrances are essential to everyday life, representing hospitality, personal hygiene, and social decorum across all demographics. The strong preference for richly layered scents drives consistent demand for both traditional Arabic and contemporary Western perfumes. This deep cultural connection ensures the market maintains strong foundations even as consumer preferences evolve with changing trends and international influences. Personal grooming awareness continues to rise among younger demographics, further strengthening market demand across the country.

Expansion of E-commerce and Digital Retail Channels

The rapid growth of retail and e-commerce platforms is a crucial factor propelling the Saudi Arabia perfume market. With high internet penetration and a digitally savvy youth population, online retail is becoming a dominant channel for personal care purchases. At the beginning of 2025, Saudi Arabia had 33.9 Million internet users. E-commerce platforms enable fragrance brands to implement D2C strategies, personalized marketing campaigns, and comprehensive product information delivery, previously impossible through physical retail alone. Major international platforms have entered the Saudi Arabia market, intensifying competition and driving service quality improvements across the ecosystem. Social media influence and celebrity endorsements shape consumer preferences, making online platforms popular destinations for fragrance shopping. These developments enhance product reach, offer greater variety, and improve customer convenience, serving as key drivers for sustained market growth and brand engagement.

Increasing Tourism Activities

Rising tourism activities are significantly bolstering the Saudi Arabia perfume market by expanding exposure to the Kingdom’s rich fragrance culture and increasing demand from international visitors. In 2024, tourism in Saudi Arabia reached 116 Million tourists, comprising 29.7 Million international visitors and 86.2 Million domestic travelers. Tourists visiting religious, cultural, entertainment, and luxury destinations frequently purchase perfumes as premium souvenirs that reflect Saudi heritage, particularly oud, amber, and musk-based fragrances. The growth of shopping districts, airport duty-free outlets, and luxury malls enhances perfume accessibility and encourages impulse and gift purchases. Hospitality experiences, including hotels and cultural festivals, often showcase local scents, strengthening visitor engagement with traditional and niche fragrances. Increased tourist footfall also attracts global luxury perfume brands to expand retail presence, intensifying market competitiveness and innovation. Moreover, experiential retail concepts, such as perfume customization and artisanal boutiques, appeal strongly to tourists seeking exclusive products.

Market Restraints:

What Challenges the Saudi Arabia Perfume Market is Facing?

Prevalence of Counterfeit Products

The presence of counterfeit perfumes poses a serious challenge for both consumers and legitimate manufacturers in Saudi Arabia. Fake products undermine brand reputation while exposing consumers to substandard or unsafe formulations. The circulation of grey-market fragrances weakens consumer trust and dilutes brand equity, particularly for premium labels. Addressing this issue requires stronger enforcement of intellectual property laws, improved traceability across supply chains, and closer collaboration with physical retailers and digital commerce platforms to curb illicit sales.

Stringent Regulatory Compliance Requirements

The Saudi Arabia perfume market operates under strict regulatory oversight, creating entry challenges for both local and international brands. Mandatory testing, certification, and product registration processes increase compliance costs and extend time-to-market. Brands must align formulations, ingredient disclosures, and labeling with local safety standards, which often differ from global norms. These regulatory complexities demand careful planning, regulatory expertise, and localized strategies to ensure smooth market entry and sustained commercial operations.

Supply Chain Inefficiencies and Logistics Challenges

Supply chain inefficiencies continue to affect perfume distribution across Saudi Arabia, particularly outside major urban centers. Limited warehousing capacity, complex import procedures, and customs clearance requirements can delay product availability and raise operational costs. Logistics challenges also impact inventory planning and retail replenishment cycles. To mitigate these issues, companies are investing in local distribution partnerships, regional warehousing solutions, and supply chain optimization to ensure consistent market coverage and timely product delivery.

Competitive Landscape:

The Saudi Arabia perfume market is highly competitive with both domestic and international companies vying for consumer attention. Global luxury brands provide international prestige and superior products, while established local brands maintain devoted followings and strong cultural connections. Key players focus on expanding retail networks, opening specialized concept stores in major cities, and strengthening e-commerce presence to enhance market penetration. Companies invest in product innovation, developing customized fragrances and exclusive collections to differentiate offerings. Marketing efforts emphasize cultural resonance, highlighting traditional notes that connect with local festivities and celebrations. Strategic partnerships with distributors and collaborations with international fragrance houses enhance brand positioning and distribution capabilities across the Kingdom.

Some of the key players include:

- Abdul Samad Al Qurashi

- Ahmed Al Maghribi Perfumes

- Ajmal Perfumes

- Arabian Oud

- Rasasi Perfume Industry LLC

- Rashat

- Swiss Arabian Perfumes Group

Recent Developments:

- In February 2025, V Perfumes, a GCC fragrance retailer, inaugurated its 51st store at Jeddah's Mall of Arabia. The store offers exclusive and international perfume collections, expanding the brand's presence in the Saudi Arabia market and providing consumers with diverse fragrance options.

Saudi Arabia Perfume Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Prices Covered | Premium Products, Mass Products |

| Genders Covered | Male, Female, Unisex |

| Products Covered | Arabic, French, Others |

| Companies Covered | Abdul Samad Al Qurashi, Ahmed Al Maghribi Perfumes, Ajmal Perfumes, Arabian Oud, Rasasi Perfume Industry LLC, Rashat, Swiss Arabian Perfumes Group. etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report

The Saudi Arabia perfume market size was valued at USD 1.95 Billion in 2025.

The Saudi Arabia perfume market is expected to grow at a compound annual growth rate of 3.70% from 2026-2034 to reach USD 2.71 Billion by 2034.

Premium products dominated the market with a share of 61%, driven by strong cultural preference for luxury fragrances that symbolize sophistication, wealth, and social status among Saudi consumers.

Key factors driving the Saudi Arabia perfume market include deep cultural affinity for fragrances, rising disposable incomes, expanding retail channels and e-commerce platforms, growing tourism, and increasing male grooming trends.

Major challenges include prevalence of counterfeit products, stringent regulatory compliance requirements, supply chain inefficiencies across the country, warehousing shortages in major cities, and high import costs affecting market efficiency.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)