Saudi Arabia PE Pipes Market Size, Share, Trends and Forecast by Type and Application, 2026-2034

Saudi Arabia PE Pipes Market Summary:

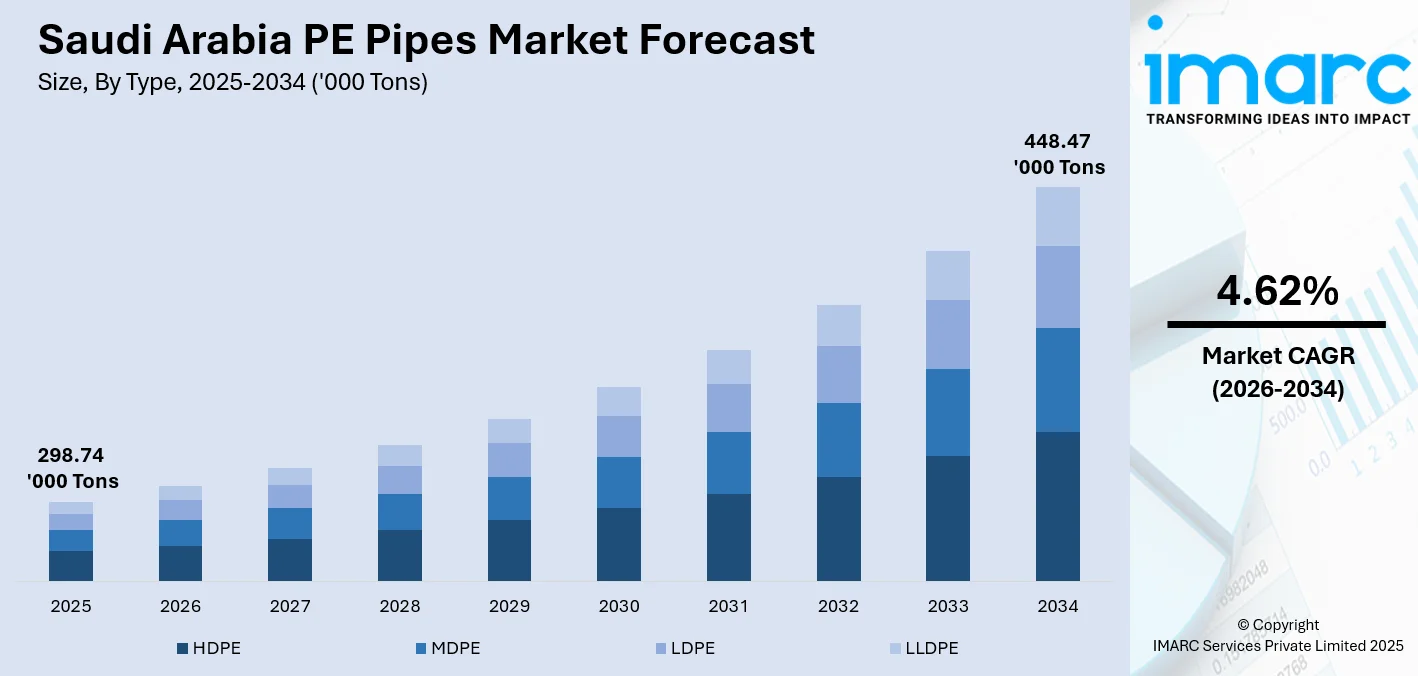

The Saudi Arabia PE pipes market size reached 298.74 Thousand Tons in 2025 and is projected to reach 448.47 Thousand Tons by 2034, growing at a compound annual growth rate of 4.62% from 2026-2034.

The Saudi Arabia PE pipes market is witnessing robust expansion driven by accelerating infrastructure development under Vision 2030 and increasing investments in water distribution networks. Growing urbanization, expanding oil and gas sector activities, and government initiatives promoting sustainable piping solutions are strengthening demand. Advancements in pipe manufacturing technologies, coupled with the material's corrosion resistance and durability in harsh desert environments, are reinforcing the Saudi Arabia PE pipes market share.

Key Takeaways and Insights:

- By Type: HDPE dominates the market with a share of 62.9% in 2025, driven by its exceptional corrosion resistance, flexibility, and suitability for demanding applications in water supply, sewage systems, and gas distribution infrastructure across the Kingdom.

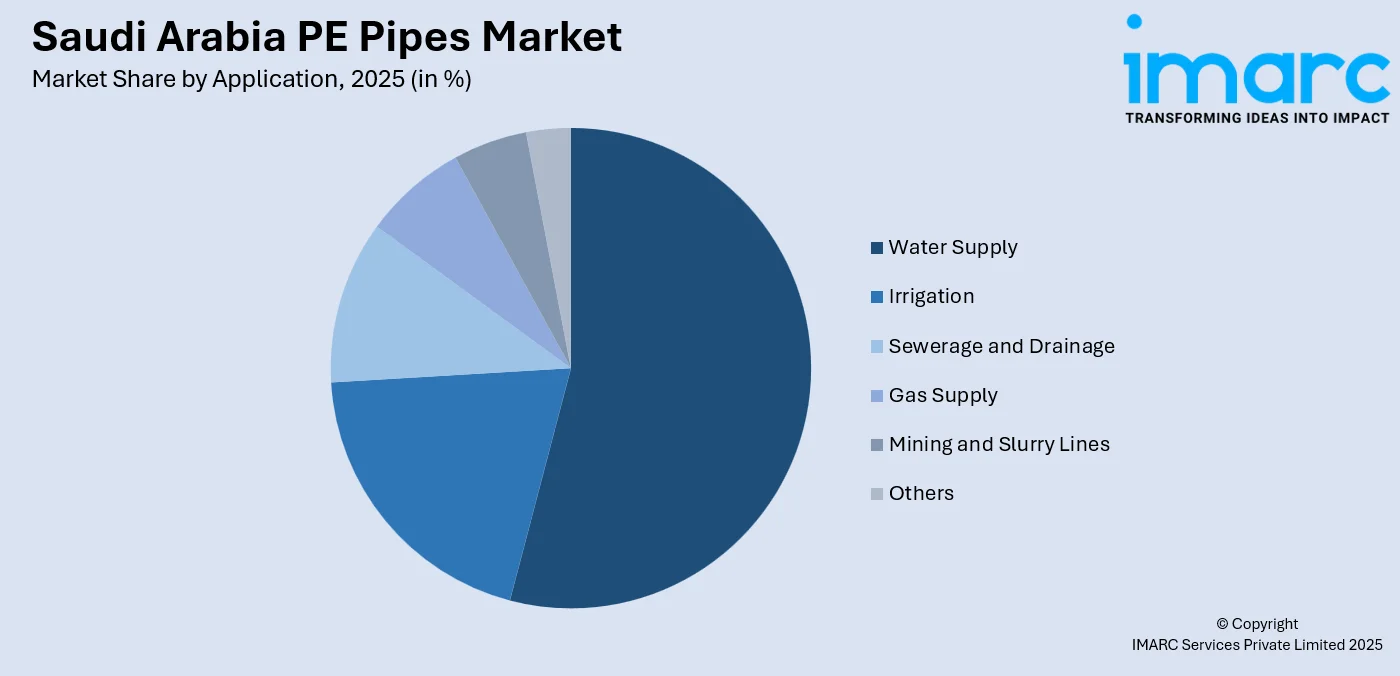

- By Application: Water supply leads the market with a share of 54.2% in 2025, owing to rising demand for efficient water distribution systems amid rapid urbanization, population growth, and government efforts to modernize aging water infrastructure nationwide.

- Key Players: The Saudi Arabia PE pipes market exhibits moderate competitive intensity, with established domestic manufacturers competing alongside regional players. Key market participants are expanding production capacities and investing in advanced manufacturing technologies to meet growing infrastructure demand. Some of the key players operating in the market include Saudi Plastic Products Company Ltd. (SAPPCO), Alwasail Industrial Company, Arabian Gulf Manufacturers Ltd., Saudi Arabian Amiantit Company, Al Jubail Sanitary Pipe Factory, and IKK Group.

To get more information on this market Request Sample

The Saudi Arabia PE pipes market is progressing steadily as infrastructure modernization gains momentum across the Kingdom. Expanding water supply and sanitation networks are increasing the need for durable and efficient polyethylene piping systems. In parallel, the development of smart cities and large-scale urban projects in major metropolitan areas is creating strong demand for new pipeline installations, supporting the sustained growth of the PE pipes market as part of broader urban and infrastructure development efforts. The oil and gas sector continues to drive consumption as exploration and production activities expand, with PE pipes preferred for their chemical resistance and long service life. For instance, in April 2025, NWC completed a SAR 400 million project delivering desalinated water to three governorates in the Riyadh region, demonstrating the scale of ongoing infrastructure investments driving Saudi Arabia PE pipes market growth.

Saudi Arabia PE Pipes Market Trends:

Smart City Development and Vision 2030 Infrastructure Programs

Saudi Arabia's ambitious Vision 2030 initiative is transforming urban infrastructure, with smart city projects driving unprecedented demand for advanced piping systems. The integration of IoT-enabled pipeline networks and digital monitoring systems is becoming standard practice in new developments. Municipal authorities are prioritizing leak-resistant PE pipe installations to optimize water conservation efforts in the arid climate. The National Water Company piloted a fibre-optic-based leak detection project in Burayada in 2024, showcasing the transition toward intelligent pipeline infrastructure.

Rising Investments in Insulated Piping Solutions

The uptake of insulated polyethylene piping systems is accelerating across urban and industrial zones in Saudi Arabia. These systems are favored for their thermal efficiency, corrosion resistance, and suitability for extreme desert environments. Applications are expanding in district cooling, water transmission, and industrial utilities where long service life and minimal maintenance are essential. In July 2024, Perma-Pipe International Holdings secured USD 10 million in contracts for infrastructure projects in Riyadh, Madinah, and Mekkah utilizing advanced XTRU-THERM insulation technology.

Adoption of Advanced Non-Metallic Piping Technologies

The Kingdom is witnessing growing adoption of thermoplastic composite pipes and reinforced polymer piping solutions for specialized applications. These advanced materials offer superior corrosion resistance, lightweight properties, and extended operational lifespans compared to traditional alternatives. Oil and gas operators are increasingly specifying non-metallic solutions for flowlines and process piping. In January 2025, Strohm secured a contract to supply 33 kilometers of thermoplastic composite pipes for Aramco's Fadhili gas plant expansion project.

How Vision 2030 is Transforming the Saudi Arabia PE Pipes Market:

Saudi Arabia’s Vision 2030 is driving significant growth in the PE pipes market by promoting large-scale infrastructure development, urban expansion, and water and wastewater management projects. Mega-projects, including smart cities, industrial zones, and residential communities, are increasing demand for durable, corrosion-resistant, and cost-efficient piping solutions. Sustainability and efficiency goals under Vision 2030 are encouraging the adoption of advanced PE materials that reduce leakage and energy losses. Additionally, regulatory reforms, localization initiatives, and private-sector participation are strengthening domestic manufacturing capabilities, fostering technology transfer, and positioning the PE pipes sector as a key enabler of the Kingdom’s long-term infrastructure and economic transformation.

Market Outlook 2026-2034:

The Saudi Arabia PE pipes market is positioned for sustained growth through 2033, supported by continued government investment in water infrastructure, expanding urban development projects, and robust oil and gas sector activities. The transition toward sustainable construction practices and the emphasis on reducing water losses through modern piping networks will drive adoption. Local manufacturing capabilities are strengthening as companies invest in advanced production facilities to meet rising demand and reduce import dependence. The market generated a revenue of 298.74 Thousand Tons in 2025 and is projected to reach a revenue of 448.47 Thousand Tons by 2034, growing at a compound annual growth rate of 4.62% from 2026-2034.

Saudi Arabia PE Pipes Market Report Segmentation:

| Segment Category | Leading Segment | Market Share |

|---|---|---|

| Type | HDPE | 62.9% |

| Application | Water Supply | 54.2% |

Type Insights:

- HDPE

- MDPE

- LDPE

- LLDPE

HDPE dominates the market with a share of 62.9% of the total Saudi Arabia PE pipes market in 2025.

HDPE dominates the Saudi Arabia PE pipes market due to its superior mechanical strength, durability, and resistance to harsh environmental conditions. The material performs well under high temperatures, pressure fluctuations, and corrosive soil conditions commonly found across the Kingdom. Its long service life, low maintenance requirements, and resistance to chemical degradation make HDPE highly suitable for water supply, wastewater, and industrial piping applications, where reliability and operational efficiency are critical for long-term infrastructure performance.

Additionally, HDPE’s flexibility and lightweight nature enable faster installation and lower overall project costs compared to traditional piping materials. Its ability to accommodate ground movement and reduce joint failures is particularly advantageous in large-scale infrastructure and urban development projects. The compatibility of HDPE pipes with modern construction techniques, trenchless installation methods, and sustainability objectives further strengthens their preference among contractors and project developers, reinforcing HDPE’s dominant position in the Saudi Arabia PE pipes market. For instance, in October 2024, the National Water Company announced plans to award a USD 40 million contract for the Riyadh sewage system expansion, specifying 18.5 kilometers of HDPE pipes with diameters ranging from 200mm to 500mm.

Application Insights:

Access the comprehensive market breakdown Request Sample

- Water Supply

- Irrigation

- Sewerage and Drainage

- Gas Supply

- Mining and Slurry Lines

- Others

Water supply leads the market with a share of 54.2% of the total Saudi Arabia PE pipes market in 2025.

Water supply dominates the Saudi Arabia PE pipes market due to the Kingdom’s arid climate and heavy reliance on efficient water distribution networks. Ensuring reliable access to potable water requires extensive pipeline infrastructure capable of minimizing leakage and withstanding harsh environmental conditions. PE pipes are widely preferred for water supply applications because of their corrosion resistance, flexibility, long service life, and low maintenance requirements, making them suitable for large-scale transmission and urban distribution systems across diverse terrains.

Additionally, ongoing urban expansion and population growth are driving continuous investment in water infrastructure. New residential developments, industrial zones, and smart cities require modern water networks that can be installed quickly and operate efficiently over long periods. PE pipes support these needs through ease of installation, joint integrity, and adaptability to network upgrades. Their compatibility with sustainable water management practices further reinforces their dominance in water supply applications within the Saudi Arabia PE pipes market. For instance, in April 2025, NWC commenced 16 water and wastewater projects in the Qassim region valued at SAR 1.1 billion (USD 293 million), including water pipelines extending over 579 kilometers.

Market Dynamics:

Growth Drivers:

Why is the Saudi Arabia PE Pipes Market Growing?

Government Investment in Water Infrastructure Modernization

Government commitment to strengthening water infrastructure is a key growth driver for the PE pipes market in Saudi Arabia. Ongoing initiatives to expand and modernize water distribution networks are addressing the challenges of efficient water management in an arid environment that relies heavily on desalination. These efforts focus on both new network development and the replacement of aging pipelines to minimize losses and improve reliability. Long-term public investment in water and sanitation infrastructure is creating sustained demand for durable, high-quality polyethylene piping solutions across the Kingdom.

Oil and Gas Sector Expansion and Pipeline Network Development

Saudi Arabia's robust oil and gas industry continues to generate significant demand for PE pipes across upstream and midstream operations. The sector requires corrosion-resistant piping solutions for hydrocarbon transport, water injection systems, and associated gas gathering networks. PE pipes offer advantages including chemical resistance, long service life, and reduced maintenance requirements in demanding oilfield environments. Strategic investments in natural gas infrastructure are accelerating as the Kingdom diversifies its energy mix and expands domestic gas utilization. For instance, Aramco's Master Gas System Phase 3 expansion involves 4,153 kilometers of pipeline network at an estimated cost of USD 18 billion, while the Jafurah unconventional gas development program is expected to exceed USD 110 billion in lifecycle investment, substantially boosting pipeline material demand.

Rapid Urbanization and Real Estate Development Boom

The accelerating pace of urbanization and residential development in Saudi Arabia is amplifying the need for efficient water and utility networks. Polyethylene pipes are gaining wider adoption in building infrastructure as they offer long service life, superior flexibility, and economical installation and maintenance advantages. Their ability to withstand pressure surges and temperature fluctuations makes them ideal for water distribution in newly built communities and high-density developments. The ongoing infrastructure upgrades aligned with Vision 2030 are reinforcing their relevance across real estate and utility projects. Large-scale developments including smart city initiatives, entertainment districts, and integrated housing communities, are creating substantial pipeline requirements. The Saudi Arabia real estate market size was valued at USD 77.2 Billion in 2025. Looking forward, IMARC Group estimates the market to reach USD 137.8 Billion by 2034, exhibiting a CAGR of 6.70% during 2026-2034, reflecting the scale of construction activity driving PE pipe demand.

Market Restraints:

What Challenges the Saudi Arabia PE Pipes Market is Facing?

Raw Material Price Volatility

Volatility in polyethylene resin prices introduces uncertainty for pipe manufacturers and complicates project cost forecasting. Global petrochemical market trends, crude oil price movements, and supply chain disruptions significantly influence raw material costs. These fluctuations can reduce profit margins, affect pricing strategies, and challenge manufacturers’ competitiveness in the domestic market, particularly for long-term infrastructure projects where cost stability is critical.

Competition from Alternative Piping Materials

Polyethylene (PE) pipes are competing with steel, ductile iron, and concrete substitutes, particularly those in large-diameter or high-pressure uses. The use of traditional materials is still popular in some infrastructure projects because of the set standards in the engineering field, installation procedures, and their durability. Such dependency on traditional solutions can inhibit the use of PE pipes in certain areas and this inhibits market penetration of the material in spite of the flexibility, corrosion protection and handling ease it provides.

Technical Standards and Certification Requirements

The infrastructure projects are also associated with the high standards of quality and certification process, which presuppose substantial expenditures on testing, compliance, and documentation. The government bodies and large contractors may impose these strict requirements, and smaller manufacturers may not be able to comply with them. These requirements may serve as entry barriers, reducing the level of supplier activity and reducing the choice of project developers in favor of well-established enterprises with certified procedures and developed quality management systems.

Competitive Landscape:

The Saudi Arabia PE pipes market features a mix of established domestic manufacturers and regional players competing across product segments. Leading companies are focusing on expanding production capacities and enhancing product quality to meet growing infrastructure demand. Investments in advanced manufacturing technologies and the adoption of international standards are improving durability and performance specifications. Collaborations with construction and utility sectors are being strengthened to secure large-scale project contracts, with emphasis on sustainability and cost efficiency. Manufacturers are exploring export opportunities within the Gulf region to leverage regional infrastructure growth. Innovation in pipe materials and customization options is gaining traction, enabling suppliers to cater to diverse applications including water supply, sewage, and oil and gas pipelines.

Some of the major players are:

- Saudi Plastic Products Company Ltd. (SAPPCO)

- Alwasail Industrial Company

- Arabian Gulf Manufacturers Ltd.

- Saudi Arabian Amiantit Company

- Al Jubail Sanitary Pipe Factory

- IKK Group

Recent Developments:

- January 2025: SABIC unveiled its new polypropylene pipe solution, SABIC VESTOLEN P9421, manufactured with a random copolymer. The material offers high thermal stability, durability, and resistance to high pressures and temperatures. It is designed for cold and hot water pipe applications, ensuring safe drinking water transport.

- October 2024: Saudi Vitrified Clay Pipe Co. (SVCP) and Qatar's Laffan Pipes Factory signed an agreement to establish a joint venture focused on producing and trading durable pipes and related components. The alliance aims to enhance production capabilities and meet growing regional demand for infrastructure piping solutions.

Saudi Arabia PE Pipes Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Million USD, Thousand Tons |

| Scope of the Report |

Exploration of Historical and Forecast Trends, Industry Catalysts and Challenges, Segment-Wise Historical and Predictive Market Assessment:

|

| Types Covered | HDPE, MDPE, LDPE, LLDPE |

| Applications Covered | Water Supply, Irrigation, Sewerage and Drainage, Gas Supply, Mining and Slurry Lines, Others |

| Companies Covered | Saudi Plastic Products Company Ltd. (SAPPCO), Alwasail Industrial Company, Arabian Gulf Manufacturers Ltd., Saudi Arabian Amiantit Company, Al Jubail Sanitary Pipe Factory, and IKK Group |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report

The Saudi Arabia PE pipes market size reached 298.74 Thousand Tons in 2025.

The Saudi Arabia PE pipes market is expected to grow at a compound annual growth rate of 4.62% from 2026-2034 to reach 448.47 Thousand Tons by 2034.

HDPE represents the largest market share at 62.9% in 2025, driven by its superior strength, corrosion resistance, and extensive use in water supply, sewage systems, and gas distribution applications across the Kingdom.

Key factors driving the Saudi Arabia PE pipes market include government investments in water infrastructure modernization, expanding oil and gas sector activities, rapid urbanization and real estate development, and Vision 2030 initiatives promoting sustainable construction.

Major challenges include raw material price volatility affecting manufacturing costs, competition from alternative piping materials in specific applications, stringent technical standards and certification requirements, and supply chain dependencies for specialty polymer grades.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)