Saudi Arabia Online Food Delivery Platforms Market Size, Share, Trends and Forecast by Demographics, Behavioral Segmentation, Psychographic Division, and Region, 2026-2034

Saudi Arabia Online Food Delivery Platforms Market Size and Share:

The Saudi Arabia online food delivery platforms market size reached USD 1.9 Billion in 2025. Looking forward, IMARC Group expects the market to reach USD 5.9 Billion by 2034, exhibiting a growth rate (CAGR) of 13.54% during 2026-2034. Rising smartphone penetration, increasing internet usage, changing consumer preferences, growing urbanization, strong logistics networks, expanding cloud kitchens, digital payment adoption, aggressive promotions by food aggregators, government support for e-commerce, and the demand for convenience are driving Saudi Arabia’s online food delivery platforms market growth.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2025

|

|

Forecast Years

|

2026-2034

|

|

Historical Years

|

2020-2025

|

| Market Size in 2025 | USD 1.9 Billion |

| Market Forecast in 2034 | USD 5.9 Billion |

| Market Growth Rate (2026-2034) | 13.54% |

Saudi Arabia Online Food Delivery Platforms Market Trends:

Strategic Partnerships and Market Competition

The competitive landscape of Saudi Arabia's online food delivery market is intensifying, with both local and international players striving for market share. This competition has led to strategic partnerships and investments aimed at enhancing service offerings and expanding reach. The online food delivery market is projected to generate USD 12.94 billion in revenue by 2025. With an expected compound annual growth rate (CAGR) of 3.99% from 2025 to 2029, the market is forecasted to reach USD 15.13 billion by 2029. In line with this, strong collaboration, including international partnerships, is driving market expansion. For example, Rebel Foods, the world's largest cloud-kitchen operator, entered Saudi Arabia in 2023 by launching its first two cloud kitchens in Riyadh. The company plans to open 60 internet restaurants throughout the city within the next year and expand its operations to other cities, including Jeddah, Dammam, and Khobar. Moreover, increasing IPO activities are also contributing to the market growth. For example, Delivery Hero announced plans in November 2024 to sell a 15% stake in its Middle East and North Africa subsidiary, Talabat, through an IPO in Dubai. Talabat reported revenues of USD 2.3 billion and a net income of USD 257 million in the previous year. These developments indicate a dynamic and rapidly evolving market, with companies leveraging strategic partnerships and financial maneuvers to strengthen their positions.

Technological Advancements and Digital Platforms

Technology is changing the game for online food delivery in Saudi Arabia. Companies are putting money into new tools to make things easier for users and to run their operations better. The number of smartphone users shot up from 14.31 million in 2013 to 33.55 million in 2024. Plus, with fast internet, it's easier than ever to use mobile apps to order food. A report says that Saudi Arabia has a 99% internet reach and mobile speeds at 215 Mbps, which is almost double the world average. All of this is helping the online food delivery market grow. Moreover, these platforms are using AI and data to tailor their services. They can predict what customers want and find the best routes for delivery. This not only helps with efficiency but also makes customers happier. Overall, these tech upgrades aligns with the tech-savvy preferences of the Saudi population, driving sustained growth in the sector.

Saudi Arabia Online Food Delivery Platforms Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the region/country level for 2026-2034. Our report has categorized the market based on demographics, behavioral segmentation, and psychographic division.

Demographics Insights:

- Age

- Gender

- Income

- Occupation

The report has provided a detailed breakup and analysis of the market based on the demographics. This includes age, gender, income, and occupation.

Behavioral Segmentation Insights:

- Usage Patterns Order

- Frequency Order Size

- Loyalty

A detailed breakup and analysis of the market based on the behavioral segmentation have also been provided in the report. This includes usage patterns order, frequency order size, and loyalty.

Psychographic Division Insights:

- Lifestyle

- Attitudes

- Values

The report has provided a detailed breakup and analysis of the market based on the psychographic division. This includes lifestyle, attitudes, and values.

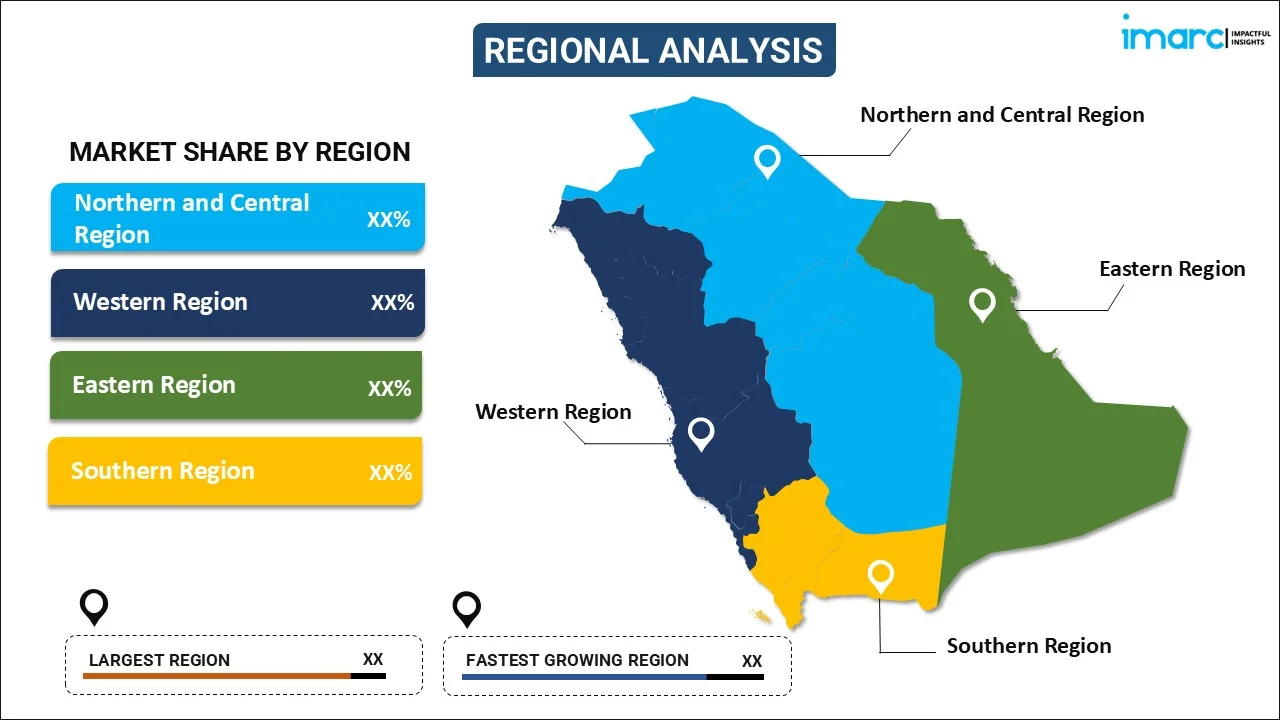

Regional Insights:

- Northern and Central Region

- Western Region

- Eastern Region

- Southern Region

The report has also provided a comprehensive analysis of all the major regional markets, which include Northern and Central Region, Western Region, Eastern Region, and Southern Region.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Saudi Arabia Online Food Delivery Platforms Market News:

- September 2024: Chinese tech giant Meituan introduced its food delivery platform KeeTa in Riyadh, investing SR1 billion (USD 266.6 million) with the goal of securing up to 80% of the Saudi market by 2025.

Saudi Arabia Online Food Delivery Platforms Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Demographics Covered | Age, Gender, Income, Occupation |

| Behavioral Segmentations Covered | Usage Patterns Order, Frequency Order Size, Loyalty |

| Psychographic Divisions Covered | Lifestyle, Attitudes, Values |

| Regions Covered | Northern and Central Region, Western Region, Eastern Region, Southern Region |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Saudi Arabia online food delivery platforms market performed so far and how will it perform in the coming years?

- What is the breakup of the Saudi Arabia online food delivery platforms market on the basis of demographics?

- What is the breakup of the Saudi Arabia online food delivery platforms market on the basis of behavioral segmentation?

- What is the breakup of the Saudi Arabia online food delivery platforms market on the basis of psychographic division?

- What are the various stages in the value chain of the Saudi Arabia online food delivery platforms market?

- What are the key driving factors and challenges in the Saudi Arabia online food delivery platforms market?

- What is the structure of the Saudi Arabia online food delivery platforms market and who are the key players?

- What is the degree of competition in the Saudi Arabia online food delivery platforms market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Saudi Arabia online food delivery platforms market from 2020-2034.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Saudi Arabia online food delivery platforms market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Saudi Arabia online food delivery platforms industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)