Saudi Arabia On-Demand Delivery Market Size, Share, Trends and Forecast by Product, End-User, and Region, 2025-2033

Saudi Arabia On-Demand Delivery Market Overview:

The Saudi Arabia on-demand delivery market size reached USD 205.25 Million in 2024. Looking forward, IMARC Group expects the market to reach USD 917.37 Million by 2033, exhibiting a growth rate (CAGR) of 16.80% during 2025-2033. The market is thriving due to the increasing digital and e-commerce adoption, evolving consumer preferences and urbanization, rapid technological advancements, imposition of supportive government policies, and strategic investments in logistics technology.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 205.25 Million |

| Market Forecast in 2033 | USD 917.37 Million |

| Market Growth Rate (2025-2033) | 16.80% |

Saudi Arabia On-Demand Delivery Market Trends:

Growing Digital Adoption and E-commerce Expansion

The swift increase in digital technology adoption and e-commerce in Saudi Arabia, fueled by widespread smartphone use and a tech-savvy youthful demographic, is a key element propelling the market expansion. Furthermore, the rising rate of internet accessibility that enables entry to digital services and establishes an ideal environment for on-demand delivery services is driving market expansion. For example, in January 2024, the country had 36.84 million internet users, with an internet penetration rate of 99.0 percent of the overall population. Moreover, the implementation of government initiatives under Vision 2030 significantly contributes to promoting a digital economy, motivating both domestic and international entities to invest in logistics and delivery platforms. Additionally, the increasing use of e-payment systems and digital wallets that streamline the transaction process for users is boosting the growth of the on-demand delivery market.

Changing Consumer Preferences and Lifestyle Shifts

The changing consumer habits and lifestyle transformations in Saudi Arabia are fueling the growth of the on-demand delivery market. Growing urbanization is driving the demand for convenience-oriented services like food delivery, groceries, and household items available via mobile applications. The desire for quick and dependable solutions is intensified by extended work hours and hectic routines, leading consumers to focus on time-saving alternatives. This pattern is especially noticeable within the younger population, who are progressively depending on digital options for quick satisfaction of their requirements. Acknowledging this change, Meituan, the biggest food delivery platform in China, ventured into Saudi Arabia in 2024 under its brand Keeta. To meet the increasing demand for rapid commerce, Meituan introduced its 1P dark stores, Xiaoxiang Supermarket, capitalizing on the Middle East’s advantageous market environment and Saudi Arabia’s receptiveness to Chinese technology firms. This action demonstrates the wider transition towards digital-first, on-demand offerings that correspond with evolving consumer tastes in the area.

Rapid Advancements in Technology and Logistics Solutions

The increasing focus of companies on integrating advanced logistics and tracking solutions to enhance their operational efficiency and offer seamless delivery experiences is another major factor positively influencing the market. Along with this, the introduction of real-time tracking features powered by global positioning systems (GPS) and the Internet of Things (IoT), which provide consumers with the ability to monitor their orders at every stage, is fueling the market growth. Furthermore, drone technology and autonomous vehicles are also being explored as future solutions to improve last-mile delivery, especially in less accessible or highly congested areas. Apart from this, the burgeoning deployment of artificial intelligence (AI) and data analytics to optimize delivery routes, manage inventory, reduce operational costs, and ensure timely deliveries is fostering the expansion of the industry. In 2024, Laundryheap, a worldwide frontrunner in on-demand laundry and dry-cleaning services, has debuted in Saudi Arabia, providing same-day pickup and complimentary next-day delivery in Riyadh and Jeddah. The service targeted the delivery of more dependable, technology-based laundry solutions with improved ease for clients.

Saudi Arabia On-Demand Delivery Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the regional level for 2025-2033. Our report has categorized the market based on product and end-user.

Product Insights:

- Websites

- Mobile Applications

- Others

The report has provided a detailed breakup and analysis of the market based on the product. This includes websites, mobile applications, and others.

End-User Insights:

- Apparel

- Food

- Grocery

- Others

A detailed breakup and analysis of the market based on the end-user have also been provided in the report. This includes apparel, food, grocery, and others.

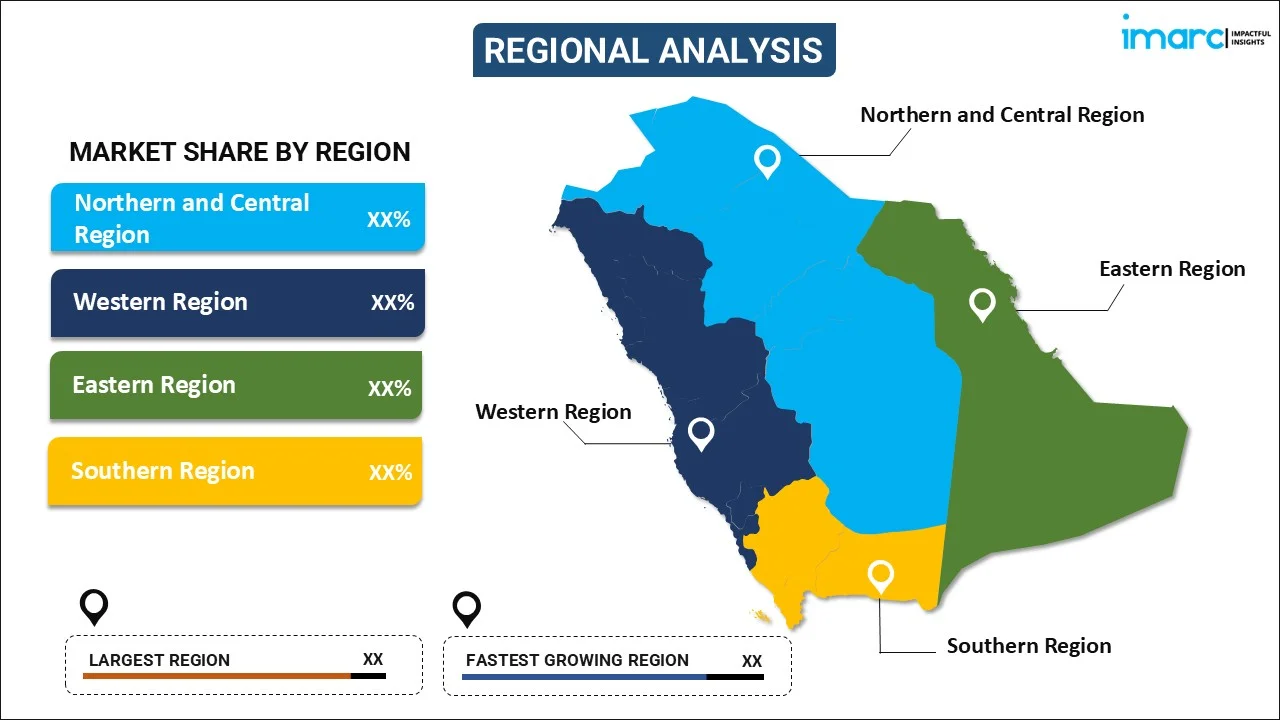

Regional Insights:

- Northern and Central Region

- Western Region

- Eastern Region

- Southern Region

The report has also provided a comprehensive analysis of all the major regional markets, which include Northern and Central Region, Western Region, Eastern Region, and Southern Region.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Saudi Arabia On-Demand Delivery Market News:

- In October 2024, Keeta, an international on-demand food delivery platform, announced its expansion into Riyadh, Saudi Arabia. The company had invested SR1 billion ($266.6 million) in the Kingdom to facilitate the growth of Keeta’s operations and contribute to the local job market and overall economy.

- In May 2023, Careem, the region’s leading multi-service app, launched the healthiest on-demand food delivery service in Riyadh and Jeddah. It gave consumers the access to delicious and healthy food without subscription. The company’s redesigned application offers complete curated dish collections, nutritional labels, educational health content, and monthly health challenges.

Saudi Arabia On-Demand Delivery Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Products Covered | Websites, Mobile Applications, Others |

| End-Users Covered | Apparel, Food, Grocery, Others |

| Regions Covered | Northern and Central Region, Western Region, Eastern Region, Southern Region |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Saudi Arabia on-demand delivery market performed so far and how will it perform in the coming years?

- What is the breakup of the Saudi Arabia on-demand delivery market on the basis of product?

- What is the breakup of the Saudi Arabia on-demand delivery market on the basis of end-user?

- What is the breakup of the Saudi Arabia on-demand delivery market on the basis of region?

- What are the various stages in the value chain of the Saudi Arabia on-demand delivery market?

- What are the key driving factors and challenges in the Saudi Arabia on-demand delivery market?

- What is the structure of the Saudi Arabia on-demand delivery market and who are the key players?

- What is the degree of competition in the Saudi Arabia on-demand delivery market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Saudi Arabia on-demand delivery market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Saudi Arabia on-demand delivery market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Saudi Arabia on-demand delivery industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)