Saudi Arabia Offshore Wind Energy Market Size, Share, Trends and Forecast by Component, Foundation Type, Capacity, Location, and Region, 2026-2034

Saudi Arabia Offshore Wind Energy Market Size and Share:

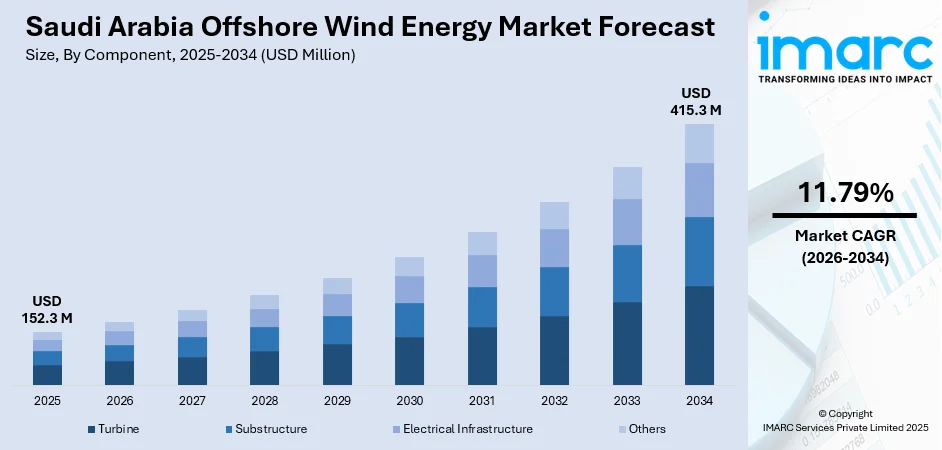

The Saudi Arabia offshore wind energy market size reached USD 152.3 Million in 2025. Looking forward, IMARC Group expects the market to reach USD 415.3 Million by 2034, exhibiting a growth rate (CAGR) of 11.79% during 2026-2034. The market is growing rapidly due to the national energy diversification goals, increasing investments in renewable infrastructure, and rapid technological advancements. Consequently, these drivers reflect Saudi Arabia’s commitment to sustainable energy, economic diversification, and innovation, laying a robust foundation for Saudi Arabia offshore wind energy market growth.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2025

|

|

Forecast Years

|

2026-2034

|

|

Historical Years

|

2020-2025

|

| Market Size in 2025 | USD 152.3 Million |

| Market Forecast in 2034 | USD 415.3 Million |

| Market Growth Rate (2026-2034) | 11.79% |

Saudi Arabia Offshore Wind Energy Market Trends:

Growing Focus on Energy Diversification

Saudi Arabia’s Vision 2030 aims to reduce reliance on oil by focusing on renewable energy as a key part of its economic plans. Offshore wind energy supports this goal, offering a renewable option that works well with the Kingdom’s solar and onshore wind efforts. For instance, in 2025, Saudi Arabia signed 1,100MW wind power agreements with a Marubeni-led Japanese consortium at record-low rates, supporting its Vision 2030 renewable energy targets. These projects will supply power to 257,000 homes, reinforcing the Kingdom’s sustainability goals. This strategy is particularly significant as the Kingdom aims to increase its renewable energy share in electricity generation, reducing reliance on fossil fuels and enhancing long-term energy security.

To get more information on this market, Request Sample

Increasing Investments in Renewable Infrastructure

Saudi government invests heavily in renewable energy projects, most notably offshore wind farms, in an effort to provide its citizens with a reliable and varied energy grid. Such massive projects, supported by strong governmental backing, particularly from the Public Investment Fund (PIF) and partnerships with international renewable energy companies, are being financed, which is evident at the offshore wind sector. Such investment encourages research and infrastructure progress solidifies Saudi Arabia as a regional leader in a dominant market sector, and concurrently attracts foreign experience and technology. For instance, in 2023, in a significant move towards renewable energy, Egypt signed a USD 4 Billion agreement with Saudi Arabia’s ACWA Power to initiate a green hydrogen project, targeting an annual production capacity of 600,000 tons of green ammonia in its first phase. Additionally, these renewable energy projects aim to create jobs and stimulate local economies, aligning with Vision 2030’s goals of fostering economic growth beyond the oil sector. As Saudi Arabia strengthens its renewable energy infrastructure, offshore wind installations will become more viable, contributing to a balanced energy mix and improved grid stability. Thus, this is positively influencing Saudi Arabia offshore wind energy market share.

Rapid Technological Advancements

Advancements in offshore wind technology are resulting in lower costs and higher energy production, making this option more financially attractive for Saudi Arabia. It is the major breakthroughs of turbine design, energy storage systems, and grid connection that help maximize the productivity of offshore wind farms, especially in the harsher environments of the Red Sea and Arabian Gulf. Enhanced turbine capacity and floating wind technology address the limitations of traditional fixed-bottom turbines in deep waters, increasing the geographic range of feasible wind farm locations. Thus, this is further creating a positive Saudi Arabia offshore wind energy market outlook. For instance, in 2023, Saudi Arabia’s ACWA Power installed Central Asia’s largest wind turbine, a 6.5 MW unit by Envision, in Uzbekistan’s Bukhara region, marking the start of its 500 MW Bash wind farm and showcasing the latest advancements in turbine technology that enable greater energy output and efficiency in diverse geographic conditions. These advancements improve the efficiency and cost-effectiveness of offshore wind projects, attracting investors who seek high returns on long-term renewable energy investments.

Saudi Arabia Offshore Wind Energy Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the regional level for 2026-2034. Our report has categorized the market based on component, foundation type, capacity, and location.

Component Insights:

- Turbine

- Substructure

- Electrical Infrastructure

- Others

The report has provided a detailed breakup and analysis of the market based on the component. This includes turbine, substructure, electrical infrastructure, and others.

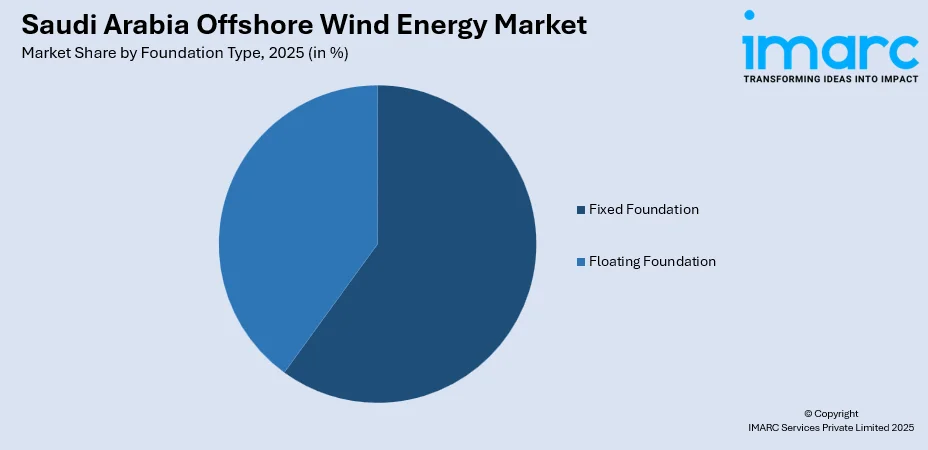

Foundation Type Insights:

- Fixed Foundation

- Floating Foundation

A detailed breakup and analysis of the market based on the foundation type have also been provided in the report. This includes fixed foundation and floating foundation

Capacity Insights:

- Less Than 5 MW

- Greater than or Equal to 5 MW

The report has provided a detailed breakup and analysis of the market based on the capacity. This includes less than 5 MW and greater than or equal to 5 MW.

Location Insights:

- Shallow Water

- Transitional Water

- Deep Water

A detailed breakup and analysis of the market based on the location have also been provided in the report. This includes shallow water, transitional water, and deep water.

Regional Insights:

- Northern and Central Region

- Western Region

- Eastern Region

- Southern Region

The report has also provided a comprehensive analysis of all the major regional markets, which include Northern and Central Region, Western Region, Eastern Region, and Southern Region.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Saudi Arabia Offshore Wind Energy Market News:

- In January 2025, ACWA Power, with its foothold in Saudi Arabia, signed a USD 1.5 Billion agreement with Egypt to develop a 1.1GW wind energy project in the Gulf of Suez and Gulf of Zeit. This initiative will reduce annual CO₂ emissions by 2.4 million tons and supply power to one million Egyptian homes with clean energy.

- In 2025, the NEOM Green Hydrogen Company (NGHC), a joint venture of ACWA Power, Air Products, and NEOM, marked a significant milestone by receiving its first delivery of wind turbines at the Port of NEOM in Northwest Saudi Arabia. Over 250 turbines will power the facility via a dedicated transmission grid, supporting NEOM’s goal of producing carbon-free hydrogen on a large scale.

- In September 2025, Saipem received a USD 2 Billion offshore contract from Saudi Aramco to develop Saudi Arabia’s Marjan field, under their Long-Term Agreement (LTA). This contract complements Saudi Arabia’s offshore energy goals, which include substantial investments in offshore wind infrastructure as part of Vision 2030.

Saudi Arabia Offshore Wind Energy Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Components Covered | Turbine, Substructure, Electrical Infrastructure, Others |

| Foundation Types Covered | Fixed Foundation, Floating Foundation |

| Capacities Covered | Less Than 5 MW, Greater than or Equal to 5 MW |

| Locations Covered | Shallow Water, Transitional Water, Deep Water |

| Regions Covered | Northern and Central Region, Western Region, Eastern Region, Southern Region |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Saudi Arabia offshore wind energy market performed so far and how will it perform in the coming years?

- What is the breakup of the Saudi Arabia offshore wind energy market on the basis of component?

- What is the breakup of the Saudi Arabia offshore wind energy market on the basis of foundation type?

- What is the breakup of the Saudi Arabia offshore wind energy market on the basis of capacity?

- What is the breakup of the Saudi Arabia offshore wind energy market on the basis of location?

- What is the breakup of the Saudi Arabia offshore wind energy market on the basis of region?

- What are the various stages in the value chain of the Saudi Arabia offshore wind energy market?

- What are the key driving factors and challenges in the Saudi Arabia offshore wind energy market?

- What is the structure of the Saudi Arabia offshore wind energy market and who are the key players?

- What is the degree of competition in the Saudi Arabia offshore wind energy market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Saudi Arabia offshore wind energy market from 2020-2034

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Saudi Arabia offshore wind energy market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Saudi Arabia offshore wind energy industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)