Saudi Arabia Off-the-Road Tire Market Size, Share, Trends and Forecast by Vehicle Type, Tire Type, Distribution Channel, Rim Size, End-Use, and Region, 2026-2034

Saudi Arabia Off-the-Road Tire Market Overview:

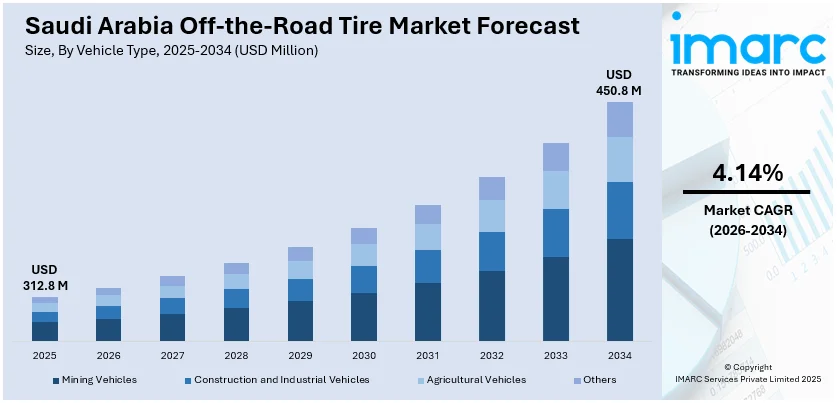

The Saudi Arabia off-the-road tire market size reached USD 312.8 Million in 2025. Looking forward, IMARC Group expects the market to reach USD 450.8 Million by 2034, exhibiting a growth rate (CAGR) of 4.14% during 2026-2034. Rising construction activities, expanding mining and agriculture sectors, and increased government infrastructure investments are some of the factors propelling the growth of the market. Growing demand for durable, heavy-duty tires in harsh environments and ongoing industrial development further support market growth across key off-road vehicle applications.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2025

|

|

Forecast Years

|

2026-2034

|

|

Historical Years

|

2020-2025

|

| Market Size in 2025 | USD 312.8 Million |

| Market Forecast in 2034 | USD 450.8 Million |

| Market Growth Rate 2026-2034 | 4.14% |

Saudi Arabia Off-the-Road Tire Market Trends:

Rising Local Manufacturing Push in High-End Tire Segment

Saudi Arabia is witnessing a growing focus on local tire production backed by strategic foreign partnerships. A new manufacturing facility is slated to begin operations in 2026, targeting premium off-the-road and passenger vehicle tire segments. The setup will cater to both domestic demand and regional export opportunities, supported by a blend of advanced international know-how and localized branding. This shift aligns with national industrialization goals, promising enhanced self-sufficiency, job creation, and reduced import reliance. The facility will operate under dual branding, one global and one tailored to regional needs, positioning the country as a significant hub for quality tire production in the Middle East. The move also reflects growing interest in technology-driven local manufacturing ventures. For example, the Public Investment Fund (PIF) and Pirelli Tyre S.P.A. announced a joint venture to establish a tire manufacturing facility in Saudi Arabia. PIF would hold a 75% stake, while Pirelli would hold 25% and act as a strategic technology partner. The plant would produce high-quality tires for passenger vehicles under the Pirelli brand and a new local brand targeting domestic and regional markets. Production is expected to start in 2026.

To get more information on this market Request Sample

Focus on Innovation and Sustainability in Tire Manufacturing

The off-the-road tire sector in Saudi Arabia is experiencing a shift toward advanced technologies and eco-conscious manufacturing. Global recognition of sustainable production practices and performance-enhancing innovations signals a growing benchmark for excellence. Manufacturers are investing in proprietary technologies designed to reduce environmental impact while enhancing tire durability, efficiency, and performance under harsh conditions. This approach aligns with regional demands for long-lasting, resilient tires suited for industrial and construction-heavy applications. At the same time, environmental considerations, ranging from lower emissions at production sites to reduced raw material consumption, are becoming key differentiators. As innovation gains prominence, local players are expected to adapt by integrating similar high-performance and green manufacturing principles to remain competitive in the evolving market landscape. For instance, in April 2024, Bridgestone was named 'Tire Manufacturer of the Year' at the Tire Technology International Awards for Innovation and Excellence 2024. The award recognized Bridgestone's efforts in innovation and sustainability within the tire industry, including the introduction of ENLITEN Technology and environmental actions at its production sites.

Saudi Arabia Off-the-Road Tire Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the region/country level for 2026-2034. Our report has categorized the market based on vehicle type, tire type, distribution channel, rim size, and end-use.

Vehicle Type Insights:

- Mining Vehicles

- Construction and Industrial Vehicles

- Agricultural Vehicles

- Others

The report has provided a detailed breakup and analysis of the market based on the vehicle type. This includes mining vehicles, construction and industrial vehicles, agricultural vehicles, and others.

Tire Type Insights:

- Radial Tire

- Bias Tire

A detailed breakup and analysis of the market based on the tire type have also been provided in the report. This includes radial tire and bias tire.

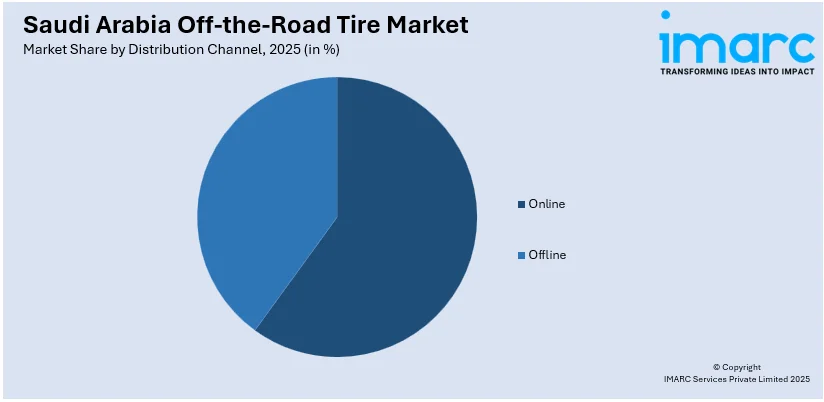

Distribution Channel Insights:

Access the comprehensive market breakdown Request Sample

- Online

- Offline

A detailed breakup and analysis of the market based on the distribution channel have also been provided in the report. This includes online and offline.

Rim Size Insights:

- Below 29 inches

- 29-45 inches

- Above 45 inches

A detailed breakup and analysis of the market based on the rim size have also been provided in the report. This includes below 29 inches, 29-45 inches, and above 45 inches.

End-Use Insights:

- OEM

- Replacement

The report has provided a detailed breakup and analysis of the market based on the end-use. This includes OEM and replacement.

Regional Insights:

- Northern and Central Region

- Western Region

- Eastern Region

- Southern Region

The report has also provided a comprehensive analysis of all the major regional markets, which include Northern and Central Region, Western Region, Eastern Region, and Southern Region.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Saudi Arabia Off-the-Road Tire Market News:

- In February 2025, JAECOO launched its premium off-road SUV, the J8, in Saudi Arabia, signaling rising demand for high-performance tires. Designed for rugged terrains, the vehicle features ARDIS and Torque Vectoring AWD systems. As Saudi consumers embrace luxury off-road vehicles, the market for advanced off-road tires is expected to expand, creating new opportunities for tire manufacturers and suppliers across the Kingdom.

Saudi Arabia Off-the-Road Tire Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Vehicle Types Covered | Mining Vehicles, Construction and Industrial Vehicles, Agricultural Vehicles, Others |

| Tire Types Covered | Radial Tire, Bias Tire |

| Distribution Channels Covered | Online, Offline |

| Rim Sizes Covered | Below 29 inches, 29-45 inches, Above 45 inches |

| End-Uses Covered | OEM, Replacement |

| Regions Covered | Northern and Central Region, Western Region, Eastern Region, Southern Region |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Saudi Arabia off-the-road tire market performed so far and how will it perform in the coming years?

- What is the breakup of the Saudi Arabia off-the-road tire market on the basis of vehicle type?

- What is the breakup of the Saudi Arabia off-the-road tire market on the basis of tire type?

- What is the breakup of the Saudi Arabia off-the-road tire market on the basis of end-use?

- What is the breakup of the Saudi Arabia off-the-road tire market on the basis of distribution channel?

- What is the breakup of the Saudi Arabia off-the-road tire market on the basis of rim size?

- What is the breakup of the Saudi Arabia off-the-road tire market on the basis of region?

- What are the various stages in the value chain of the Saudi Arabia off-the-road tire market?

- What are the key driving factors and challenges in the Saudi Arabia off-the-road tire?

- What is the structure of the Saudi Arabia off-the-road tire market and who are the key players?

- What is the degree of competition in the Saudi Arabia off-the-road tire market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Saudi Arabia off-the-road tire market from 2020-2034.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Saudi Arabia off-the-road tire market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Saudi Arabia off-the-road tire industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)