Saudi Arabia Motor Insurance Market Size, Share, Trends and Forecast by Insurance Type, Distribution Channel, and Region, 2025-2033

Saudi Arabia Motor Insurance Market Size and Share:

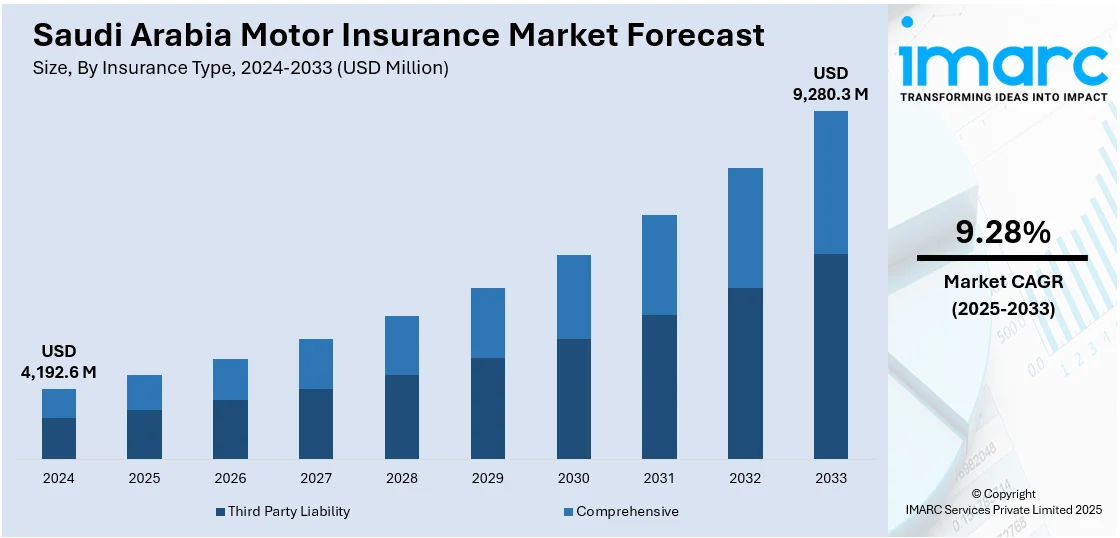

The Saudi Arabia motor insurance market size was valued at USD 4,192.6 Million in 2024. Looking forward, IMARC Group estimates the market to reach USD 9,280.3 Million by 2033, exhibiting a CAGR of 9.28% from 2025-2033. The market is driven by mandatory insurance regulations, increasing vehicle ownership, urbanization, and economic growth. Rising awareness of insurance benefits, advancements in digital platforms, widespread telematics adoption, and government initiatives like Vision 2030 further fuel market growth.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 4,192.6 Million |

| Market Forecast in 2033 | USD 9,280.3 Million |

| Market Growth Rate (2025-2033) | 9.28% |

The Saudi Arabia motor insurance market is primarily driven by the government’s enforcement of mandatory motor insurance regulations, which significantly boosts the demand. These laws require all vehicle owners to have at least third-party liability insurance, ensuring compliance and widespread adoption. For instance, in July 2024, The Najm Repair Network Service was introduced by Najm for Insurance Services Company to secure cars that have been in collisions and belong to third-party insurance clients. This is the first of its kind in the Saudi insurance industry, and aims to improve road safety by guaranteeing vehicle safety and lessening the financial burden on individuals impacted by traffic accidents. By having their cars fixed at facilities approved by the Saudi Standards, Metrology, and Quality Organization, it caters to customers with third-party insurance. Based on this step, Najm seeks to offer a quick, excellent repair service that adheres to the highest standards.

Government initiatives like Vision 2030, aimed at diversifying the economy and improving infrastructure, also play a crucial role. These initiatives encourage investments in the automotive and insurance sectors, fostering market expansion. For instance, in December 2024, The Insurance Authority announced the automation of several vehicle insurance services and traffic accident follow-ups in a pioneering step towards the future, as part of its ongoing efforts to improve the experience of beneficiaries of the insurance sector beneficiaries. This will help to increase the efficiency of the sector system's services. This initiative was started by Najm as part of the Authority's aim to grow the insurance industry while keeping up with technology advancements, simplifying the process for beneficiaries, and accomplishing the objectives of Vision 2030 in terms of digital transformation.

Saudi Arabia Motor Insurance Market Trends:

Mandatory Insurance Regulations

The Saudi government mandates motor insurance for all vehicle owners, ensuring compliance with legal requirements. This regulation boosts demand for third-party liability and comprehensive policies. Regular updates to insurance laws and strict enforcement drive market expansion while fostering a culture of accountability and financial protection among vehicle owners. For instance, in August 2024, a industry reports highlight Saudi Arabia’s pivotal role in the expansion of Islamic insurance within the Gulf Cooperation Council. With Saudi Arabia playing a major role, revenues are predicted to surpass $20 billion in 2024 and climb by 15 to 20% the following year. In line with this, Saudi authorities are attempting to expand insurance coverage through the implementation of new mandatory medical insurance regulations and the handling of uninsured automobiles.

Significant Technological Advancements

The adoption of telematics, usage-based insurance, and digital platforms has transformed the motor insurance market. These innovations optimize premium calculations, improve claims processing, and enhance customer experiences, making insurance products more appealing and accessible to a broader audience. For instance, in July 2024, a Saudi-based supplier of all-inclusive insurance solutions, Najm for Insurance Services Company, unveiled a new telematics project designed to increase road safety throughout the kingdom. This project was started in collaboration with AiGeNiX, a prominent regional pioneer in AI-based analytics, and Cambridge Mobile Telematics (CMT), renowned for their AI-powered DriveWell Fusion platform. In keeping with Saudi Arabia's Vision 2030 goals, the project aims to improve overall road safety and lower accident rates by gathering and analyzing driving data.

Government Initiatives and Vision 2030

The government's Vision 2030 initiatives seek to improve infrastructure and diversify the economy, influencing the motor insurance market growth. While the development of financial literacy raises awareness of insurance benefits, technological investments and alliances between insurers and automakers facilitate market expansion. For instance, in October 2024, under the supervision of the Insurance Authority and in cooperation with the Executive Committee of Insurance Companies, Vehicle Insurance Sub-committee, and other organizations involved in the vehicle insurance industry, Najm for Insurance Services initiated the third "Insure and Be Safe" campaign. This campaign is a nationwide effort to increase road safety, improve quality of life, increase awareness of insurance, and help achieve Saudi Vision 2030's goals.

Saudi Arabia Motor Insurance Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the Saudi Arabia motor insurance market, along with forecasts at the country and regional levels from 2025-2033. The market has been categorized based on insurance type, and distribution channel.

Analysis by Insurance Type:

- Third Party Liability

- Comprehensive

Third-party liability insurance is a required coverage that covers bodily harm and property damage as well as other damages or injuries that the covered vehicle may cause to a third party. It guarantees compliance and financial security for car owners and is mandated by law. Personal injuries and the insured's own car are not covered by this policy. It is commonly used because traffic laws are strictly enforced, encouraging accountability and lowering financial risks for drivers and other impacted parties.

Comprehensive insurance provides extensive coverage, protecting against third-party liabilities and damages to the insured vehicle. It includes coverage for accidents, theft, fire, natural disasters, and vandalism, offering greater financial security than basic third-party policies. Popular among vehicle owners seeking complete protection, especially for new or high-value cars, comprehensive insurance appeals to those wanting peace of mind. Its flexibility and robust coverage make it a preferred choice in a growing and competitive market.

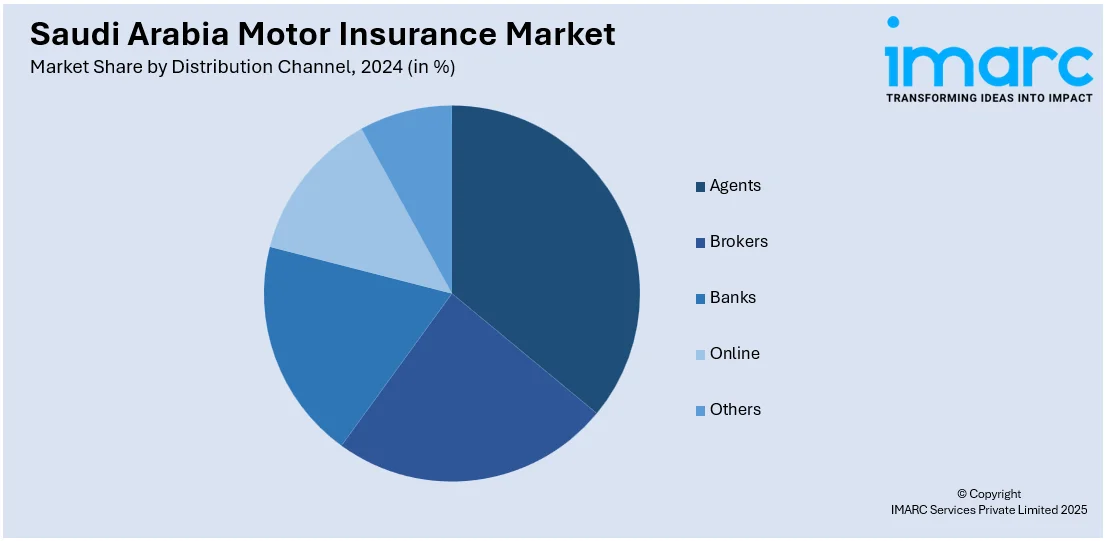

Analysis by Distribution Channel:

- Agents

- Brokers

- Banks

- Online

- Others

Insurance agents dominate the Saudi Arabia motor insurance market because of their ability to provide individualized service and navigate complicated policies. Agents serve as a liaison between clients and insurers, providing customized guidance on prices and coverage options. They are a popular option for many customers looking for advice on the best policy to meet their needs because of their in-depth knowledge of client demands and solid connections with insurance companies.

Brokers hold a significant market share due to their capacity to provide a large selection of insurance products from numerous insurers. Brokers give customers better value and more specialized coverage by comparing various policies and prices. They can act as trusted consultants and assist clients in making well-informed decisions because of their independence. Brokers also contribute significantly to the simplification of the insurance purchasing procedure, which boosts their standing in the cutthroat Saudi market.

Banks have a major role in the motor insurance market by providing insurance products through bancassurance agreements. When buying or financing a car, they give customers quick access to auto insurance. Banks can cross-sell insurance in addition to loans and other financial services because of their well-established ease and confidence. Additionally, banks encourage the uptake of insurance, particularly among consumers looking for comprehensive or bundled coverage choices, by utilizing their large customer base and digital platforms.

Regional Analysis:

- Northern and Central Region

- Western Region

- Eastern Region

- Southern Region

The Northern and Central regions of Saudi Arabia are driven by economic growth, increased urbanization, and rising vehicle ownership. These regions host major cities like Riyadh, which has a large population and a growing demand for both third-party and comprehensive insurance. Government projects under Vision 2030 also boost infrastructure development, further fueling the need for motor insurance. Additionally, the rise in disposable incomes, along with mandatory insurance regulations, supports the market in these areas.

The Western region, including cities like Jeddah and Mecca, is influenced by significant religious tourism, leading to higher vehicle ownership. Because of the high investments in the large number of commercial vehicles involved in the tourism, transport, and trade businesses, motor insurance is in high demand. Additionally, the increasing middle class, economic growth, and the region's business hub status raise the need for a comprehensive motor insurance policy. The increasing awareness about the significance of financial protection induces demand for the market within the region.

The Eastern region, home to key oil-producing areas like Dhahran and Dammam, benefits from strong economic activity and a large expatriate workforce. Ownership of both personal and commercial vehicles is fueled by the oil and gas sector, which raises the demand for auto insurance. Customers are choosing both comprehensive and third-party insurance due to increased disposable income and increased knowledge of insurance advantages. Furthermore, infrastructural development is encouraged by the region's economic significance, which raises the demand for trustworthy and affordable insurance services.

The Southern region sees steady growth in motor insurance driven by increased vehicle ownership, particularly among families and businesses. Economic development, improved connectivity, and infrastructure projects contribute to market growth, as consumers seek financial protection for both personal and commercial vehicles. Additionally, the region’s proximity to neighboring countries influences trade and transport activities, further boosting the demand for motor insurance. The growing awareness of the importance of vehicle protection, combined with government regulations, supports market expansion in this region.

Competitive Landscape:

The Saudi Arabia motor insurance market is highly competitive, with numerous local and international insurers vying for market share. Bupa Arabia, Malath Insurance, Walaa Cooperative Insurance, and Tawuniya are major players. These companies set themselves apart with cutting-edge goods, client-focused services, and online platforms for managing policies. Laws requiring auto insurance and regulatory frameworks encouraging fair competition drive the market's competitiveness. Telematics and artificial intelligence are two examples of the technologies that insurers are using more and more to streamline the underwriting and claims procedures. Furthermore, collaborations with automakers and lenders expand market penetration, and changing consumer tastes and price sensitivity spur product development.

Latest News and Developments:

- In August 2024, Malath Cooperative Insurance Company and Liva Insurance Company signed a non-binding agreement of intent to discuss the possibility of a merger. With SAR 522 million (USD 139 million) in gross written premiums (GWP) last year, Liva KSA, which is primarily owned by Liva Insurance BSC, a division of Liva Group, offers a range of best-in-class insurance services to clients throughout the Kingdom of Saudi Arabia.

- In April 2024, Abu Dhabi National Insurance Company (ADNIC) completed the strategic acquisition of a 51 percent share in Allianz Saudi Fransi Cooperative Insurance Company all over Saudi Arabia. Through the acquisition, ADNIC solidified its position as a top insurer in the Gulf by becoming one of Saudi Arabia's Tier-1 listed insurers. ADNIC has been aggressively pursuing possibilities and broadening its global reach as part of its strategic expansion plan.

Saudi Arabia Motor Insurance Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Insurance Types Covered | Third Party Liability, Comprehensive |

| Distribution Channels Covered | Agents, Brokers, Banks, Online, Others |

| Regions Covered | Northern and Central Region, Western Region, Eastern Region, Southern Region |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Saudi Arabia motor insurance market from 2019-2033.

- The research study provides the latest information on the market drivers, challenges, and opportunities in the Saudi Arabia motor insurance market.

- Porter's Five Forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Saudi Arabia motor insurance industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

Motor insurance is a policy that provides financial protection against losses or damages to vehicles due to accidents, theft, natural disasters, or third-party liabilities. It covers repair costs, medical expenses, and legal liabilities, ensuring compliance with legal requirements and safeguarding the policyholder's financial interests while driving.

The Saudi Arabia motor insurance market was valued at USD 4,192.6 Million in 2024.

IMARC estimates the Saudi Arabia motor insurance market to exhibit a CAGR of 9.28% during 2025-2033.

The Saudi Arabia motor insurance market is driven by mandatory insurance laws, increasing vehicle ownership, rising awareness of financial protection, and government initiatives like Vision 2030. Technological advancements, such as telematics and digital platforms, and growing demand for comprehensive coverage also contribute to the market’s expansion and competitiveness.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)