Saudi Arabia Low Voltage Electric Motor Market Size, Share, Trends and Forecast by Efficiency, Application, End-Use Industry, and Region, 2026-2034

Saudi Arabia Low Voltage Electric Motor Market Overview:

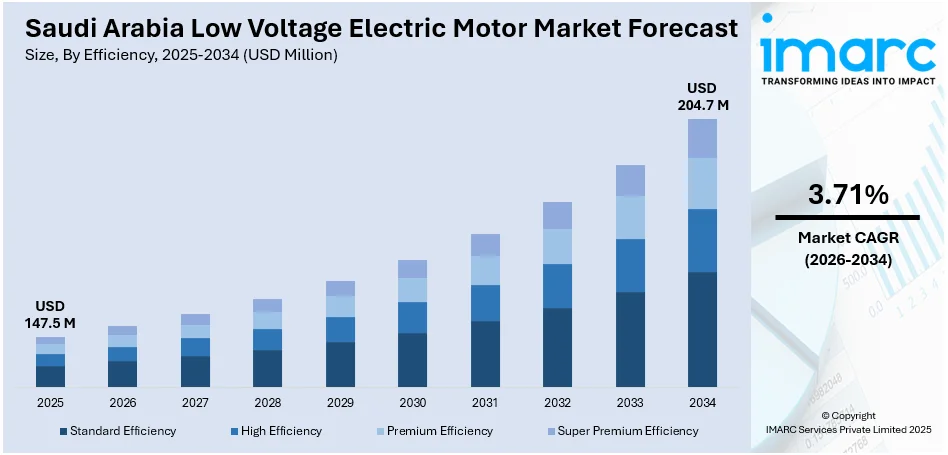

The Saudi Arabia low voltage electric motor market size reached USD 147.5 Million in 2025. Looking forward, IMARC Group expects the market to reach USD 204.7 Million by 2034, exhibiting a growth rate (CAGR) of 3.71% during 2026-2034. The market share is expanding, driven by the increasing urbanization activities, which are creating the need for efficient water supply and waste management systems, along with the rising expenditure on advanced electric vehicle (EV) infrastructure.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2025

|

|

Forecast Years

|

2026-2034

|

|

Historical Years

|

2020-2025

|

| Market Size in 2025 | USD 147.5 Million |

| Market Forecast in 2034 | USD 204.7 Million |

| Market Growth Rate 2026-2034 | 3.71% |

Saudi Arabia Low Voltage Electric Motor Market Trends:

Rising urbanization activities

The increasing urbanization activities are offering a favorable Saudi Arabia low voltage electric motor market outlook. As the country’s population continues to grow and shift towards urban centers, the demand for infrastructure, housing, and modern utilities rises. As per the DataReportal, the population of Saudi Arabia reached 37.21 Million in January 2024. This broadening is creating the need for a wide range of machinery and systems that rely on low voltage electric motors, such as heating, ventilation, and air conditioning (HVAC) systems, water pumps, elevators, and other residential and commercial appliances. Cities are expanding, new buildings are being established, and industrial zones are developing fast, all of which require motor-oriented equipment. Urban areas also need better water supply and waste management systems, where low voltage electric motors play a crucial role. In addition, smart city projects are promoting the use of efficient and automated electric motor systems in different fields, ranging from public transportation to smart home technology. As construction spending rises in both the residential and industrial sectors, the demand for long-lasting motors increases. Developers and engineers seek solutions that reduce energy while keeping excellent performance, catalyzing the demand for new low voltage electric motors.

To get more information on this market Request Sample

Growing utilization of EVs

The increasing adoption of EVs, including electric cars and trucks, is fueling the Saudi Arabia low voltage electric motor market growth. According to the IMARC Group, the Saudi Arabia electric car market size reached USD 500 Million in 2024. As more people and businesses are shifting towards electric mobility, the demand for low voltage electric motors is increasing because they are essential components in EVs. They are used in various systems like power steering, air conditioning, window operations, and the main drivetrain in smaller vehicles. With Saudi Arabia focusing more on reducing its carbon footprint and supporting green transportation, EV employment is rising, which is creating the need for efficient, reliable, and compact motor solutions. The government's encouragement through Vision 2030 to diversify the economy and promote clean energy technologies adds to this trend. As international manufacturers bring more EV options into the regional market, there is a growing requirement for local supply chains and motor manufacturing support. This also leads to more research, innovations, and domestic production opportunities around motor technologies. Moreover, as public and private sectors are investing in EV infrastructure, such as charging stations, low voltage motors are also being needed for auxiliary systems in these setups.

Saudi Arabia Low Voltage Electric Motor Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the regional level for 2026-2034. Our report has categorized the market based on efficiency, application, and end-use industry.

Efficiency Insights:

- Standard Efficiency

- High Efficiency

- Premium Efficiency

- Super Premium Efficiency

The report has provided a detailed breakup and analysis of the market based on the efficiency. This includes standard efficiency, high efficiency, premium efficiency, and super premium efficiency.

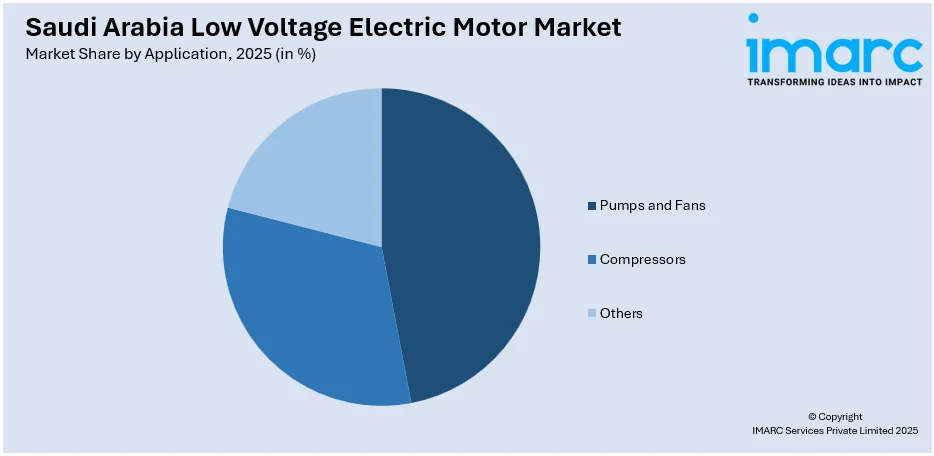

Application Insights:

Access the comprehensive market breakdown Request Sample

- Pumps and Fans

- Compressors

- Others

A detailed breakup and analysis of the market based on the application have also been provided in the report. This includes pumps and fans, compressors, and others.

End-Use Industry Insights:

- Commercial HVAC Industry

- Food, Beverage and Tobacco Industry

- Mining Industry

- Utilities

- Others

The report has provided a detailed breakup and analysis of the market based on the end-use industry. This includes commercial HVAC industry, food, beverage and tobacco industry, mining industry, utilities, and others.

Regional Insights:

- Northern and Central Region

- Western Region

- Eastern Region

- Southern Region

The report has also provided a comprehensive analysis of all the major regional markets, which include Northern and Central Region, Western Region, Eastern Region, and Southern Region.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Saudi Arabia Low Voltage Electric Motor Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Efficiencies Covered | Standard Efficiency, High Efficiency, Premium Efficiency, Super Premium Efficiency |

| Applications Covered | Pumps and Fans, Compressors, Others |

| End-Use Industries Covered | Commercial HVAC Industry, Food, Beverage and Tobacco Industry, Mining Industry, Utilities, Others |

| Regions Covered | Northern and Central Region, Western Region, Eastern Region, Southern Region |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Saudi Arabia low voltage electric motor market performed so far and how will it perform in the coming years?

- What is the breakup of the Saudi Arabia low voltage electric motor market on the basis of efficiency?

- What is the breakup of the Saudi Arabia low voltage electric motor market on the basis of application?

- What is the breakup of the Saudi Arabia low voltage electric motor market on the basis of end-use industry?

- What is the breakup of the Saudi Arabia low voltage electric motor market on the basis of region?

- What are the various stages in the value chain of the Saudi Arabia low voltage electric motor?

- What are the key driving factors and challenges in the Saudi Arabia low voltage electric motor market?

- What is the structure of the Saudi Arabia low voltage electric motor market and who are the key players?

- What is the degree of competition in the Saudi Arabia low voltage electric motor market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Saudi Arabia low voltage electric motor market from 2020-2034.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Saudi Arabia low voltage electric motor market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Saudi Arabia low voltage electric motor industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)