Saudi Arabia Laptop Market Size, Share, Trends and Forecast by Type, Screen Size, Price, End Use, and Region, 2026-2034

Saudi Arabia Laptop Market Summary:

The Saudi Arabia laptop market size was valued at USD 1.37 Billion in 2025 and is projected to reach USD 2.72 Billion by 2034, growing at a compound annual growth rate of 7.87% from 2026-2034.

The Saudi Arabia laptop market is experiencing stable growth, driven by the Kingdom's comprehensive digital transformation initiatives under Vision 2030 and expanding technology infrastructure. Rising demand for portable computing solutions across educational institutions, corporate enterprises, and individual consumers continues to fuel market expansion. The proliferation of remote work arrangements, accelerated e-learning adoption, and growing gaming culture among the youthful population are reshaping consumption patterns throughout the Saudi Arabia laptop market share.

Key Takeaways and Insights:

- By Type: Traditional laptop dominates the market with a share of 72% in 2025, owing to its superior processing capabilities, extensive storage options, and suitability for professional and academic applications. Growing demand from corporate sectors and educational institutions continues to strengthen market position.

- By Screen Size: 15.0" to 16.9" leads the market with a share of 37% in 2025, reflecting consumer preference for balanced portability and visual comfort. This screen category offers optimal viewing experience for productivity tasks and multimedia consumption without compromising mobility.

- By Price: USD 501 to USD 1000 represents the biggest segment with a market share of 41% in 2025, driven by consumer preference for mid-range devices offering balanced performance and affordability. Rising disposable incomes enable broader access to quality computing solutions across diverse demographic segments.

- By End Use: Personal dominates the market with a share of 59% in 2025, reflecting strong individual demand for computing devices supporting education, entertainment, and remote work activities. Digital literacy initiatives and expanding internet accessibility continue to accelerate personal laptop adoption.

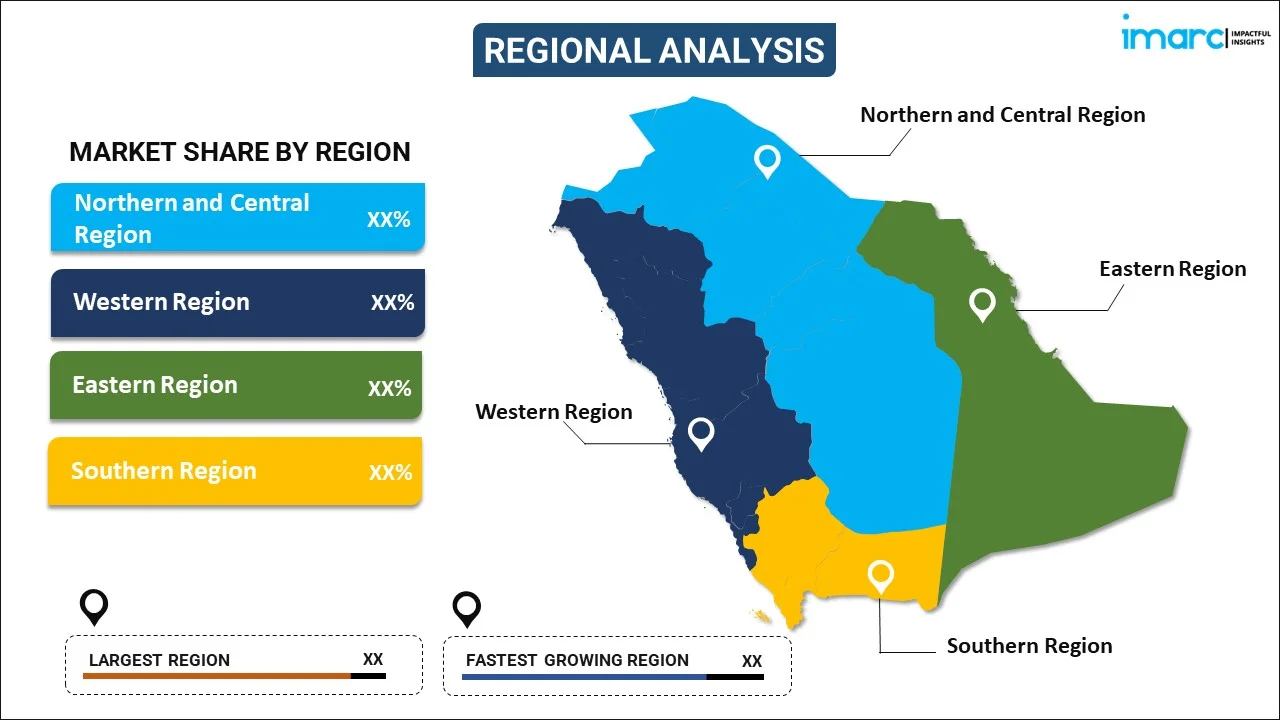

- By Region: Northern and Central Region is the largest region with 49% share in 2025, driven by Riyadh's position as the Kingdom's economic and technological hub. Concentration of corporate headquarters, educational institutions, and government entities fuels sustained demand.

- Key Players: Key players drive the Saudi Arabia laptop market by expanding distribution networks, introducing innovative product portfolios, and establishing local manufacturing facilities. Their investments in after-sales services, training programs, and strategic partnerships with retailers strengthen market positioning and customer satisfaction.

The Saudi Arabia laptop market demonstrates significant growth potential, underpinned by comprehensive government initiatives promoting digital transformation and technological advancement across multiple sectors. The Kingdom's commitment to establishing a knowledge-based economy has catalyzed substantial investments in information and communication technology infrastructure, creating favorable conditions for laptop adoption among businesses, educational institutions, and consumers. Saudi Arabia has achieved global recognition for government digital transformation maturity, reflecting the accelerated pace of technological integration throughout the economy. The expansion of remote work arrangements across the private sector continues to drive demand for portable computing solutions as businesses embrace flexible work models. Educational technology investments supporting students through digital learning platforms necessitate reliable laptop devices for effective participation in modern academic programs. Corporate digitalization initiatives aligned with Vision 2030 objectives, gaming industry development attracting youthful demographics, and rising consumer spending power collectively contribute to sustained market momentum. The convergence of institutional procurement requirements and individual consumer demand positions the Saudi Arabia laptop market for continued expansion throughout the forecast period.

Saudi Arabia Laptop Market Trends:

Rising Integration of Artificial Intelligence Features in Laptops

The integration of artificial intelligence capabilities into laptop devices represents a transformative trend reshaping the Saudi Arabia laptop market. Manufacturers are incorporating AI-powered features including enhanced productivity tools, intelligent battery management systems, and advanced security protocols to meet evolving consumer expectations. The growing emphasis on AI-ready computing infrastructure aligns with national initiatives promoting technological innovation and digital advancement across sectors, driving demand for laptops equipped with neural processing units and machine learning capabilities.

Expansion of Gaming Laptop Segment

The gaming laptop segment is experiencing accelerated growth, driven by Saudi Arabia's youthful population and ambitious gaming industry development initiatives. The Kingdom hosts approximately 23.5 Million gaming enthusiasts, representing strong demand for high-performance computing devices capable of delivering immersive gaming experiences. Major manufacturers are introducing gaming-focused laptop models with enhanced graphics capabilities, superior thermal management systems, and high-refresh-rate displays to capture this expanding market opportunity.

Growing Adoption of Convertible and Hybrid Laptop Designs

Convertible and hybrid laptop designs are gaining significant traction among consumers seeking versatile computing solutions that combine traditional laptop functionality with tablet convenience. The increasing adoption of touch-screen interfaces and stylus-enabled devices supports creative professionals, students, and business users requiring flexible input methods. Digital transformation policies promoting interactive learning environments and collaborative work practices continue to accelerate demand for adaptable computing devices offering multiple usage modes.

How Vision 2030 is Transforming the Saudi Arabia Laptop Market:

Vision 2030 serves as the cornerstone of transformation in the Saudi Arabia laptop market, driving unprecedented demand through comprehensive digitalization initiatives spanning government, education, and private sectors. The national framework prioritizes technological advancement and digital literacy as essential pillars for economic diversification, creating substantial institutional requirements for portable computing devices. Government-led programs promoting e-learning adoption, smart classroom implementations, and digital government services necessitate widespread laptop utilization among students, educators, and civil servants. The strategic emphasis on developing a knowledge-based economy encourages businesses to invest in technology infrastructure supporting remote work capabilities and digital operations. Furthermore, Vision 2030's focus on attracting international technology companies to establish regional headquarters and manufacturing facilities strengthens local supply chains and enhances market accessibility for consumers throughout the Kingdom.

Market Outlook 2026-2034:

The Saudi Arabia laptop market outlook remains optimistic throughout the forecast period, supported by sustained government investments in digital infrastructure and technology sector development. The market generated a revenue of USD 1.37 Billion in 2025 and is projected to reach a revenue of USD 2.72 Billion by 2034, growing at a compound annual growth rate of 7.87% from 2026-2034. Strategic initiatives by major technology companies to establish local manufacturing and distribution facilities strengthen supply chain capabilities and market accessibility. The expansion of educational technology programs, corporate digitalization efforts, and consumer electronics retail networks creates multiple growth channels for laptop vendors. Continued investments in high-speed internet connectivity, including 5G network expansion reaching 99% internet penetration, enhance the value proposition of portable computing devices. The convergence of remote work adoption, e-learning expansion, and gaming industry growth positions the market for sustained momentum, while emerging demand from smart city projects and industrial automation applications presents additional opportunities for market expansion.

Saudi Arabia Laptop Market Report Segmentation:

|

Segment Category |

Leading Segment |

Market Share |

|

Type |

Traditional Laptop |

72% |

|

Screen Size |

15.0" to 16.9" |

37% |

|

Price |

USD 501 to USD 1000 |

41% |

|

End Use |

Personal |

59% |

|

Region |

Northern and Central Region |

49% |

Type Insights:

To get more information on this market, Request Sample

- Traditional Laptop

- 2-in-1 Laptop

Traditional laptop dominates with a market share of 72% of the total Saudi Arabia laptop market in 2025.

Traditional laptops maintain overwhelming market dominance due to their superior processing capabilities, extensive storage options, and comprehensive feature sets required for demanding professional and academic applications. Corporate enterprises across Saudi Arabia prefer traditional laptop configurations offering robust performance specifications, enhanced security features, and compatibility with enterprise software solutions. The continued expansion of business operations and government digitalization initiatives sustains strong institutional demand for conventional laptop designs that deliver reliable performance across diverse computing workloads. Major retailers including Jarir Bookstore report consistent sales growth for traditional laptop categories among professional consumers.

The traditional laptop segment benefits from established manufacturing partnerships and supply chain networks supporting competitive pricing and product availability throughout the Kingdom. Educational institutions implementing digital learning frameworks prioritize traditional laptops for their durability, keyboard functionality, and ability to handle resource-intensive educational applications simultaneously. The segment's pricing flexibility across budget and premium categories enables manufacturers to address diverse consumer requirements while maintaining healthy profit margins. Dell Technologies opened its first merge and fulfillment center in Dammam in February 2025, capable of handling up to 600,000 units annually, strengthening traditional laptop supply capabilities across the region.

Screen Size Insights:

- Up to 10.9"

- 11" to 12.9"

- 13" to 14.9"

- 15.0" to 16.9"

- More Than 17"

15.0" to 16.9" leads with a share of 37% of the total Saudi Arabia laptop market in 2025.

The 15.0" to 16.9" screen size category commands market leadership by offering optimal balance between visual comfort and portability that appeals to diverse consumer segments including professionals, students, and entertainment users. This screen dimension provides sufficient display area for productive multitasking, document editing, and multimedia consumption while maintaining reasonable weight and form factor for mobile usage. Corporate users particularly favor this category for presentation capabilities and comfortable extended work sessions. Saudi Arabia's edtech market reached USD 2,322.1 Million in 2024, driving demand for appropriately sized educational devices supporting digital learning environments.

Gaming enthusiasts and content creators within Saudi Arabia's growing digital ecosystem increasingly select 15.0" to 16.9" laptops for their enhanced visual experience without sacrificing thermal performance characteristics essential for sustained gaming sessions. The screen size accommodates higher resolution displays and improved graphics rendering that gaming-focused consumers demand, while offering practical dimensions for transportation between gaming events and personal spaces. Manufacturers continue introducing premium models within this category featuring advanced display technologies including high refresh rates and enhanced color accuracy to capture performance-oriented market segments.

Price Insights:

- Up to USD 500

- USD 501 to USD 1000

- USD 1001 to USD 1500

- USD 1501 to USD 2000

- Above USD 2001

USD 501 to USD 1000 exhibits a clear dominance with 41% share of the total Saudi Arabia laptop market in 2025.

USD 501 to USD 1000 segment captures maximum market share by delivering optimal value proposition combining adequate performance specifications with accessible pricing attractive to mainstream consumers. This price category accommodates working professionals, university students, and household purchasers seeking reliable computing solutions without premium pricing burdens associated with higher-end devices. Rising disposable incomes throughout Saudi Arabia enable broader consumer access to quality mid-range devices. The Kingdom's growing economic prosperity and increasing per capita income levels support enhanced affordability of quality computing devices across diverse consumer segments, positioning the mid-range category as the preferred choice for value-conscious buyers prioritizing balanced performance and cost efficiency.

Manufacturers strategically position competitive offerings within this price bracket to capture volume sales opportunities presented by the Kingdom's expanding middle-class consumer base seeking capable everyday computing solutions. The segment benefits from intense brand competition driving continuous improvement in specifications and features available at mid-range price points, enhancing overall value proposition for price-conscious consumers. Educational institutions and small businesses frequently procure devices within this category when implementing technology adoption initiatives requiring multiple units while managing budget constraints effectively.

End Use Insights:

- Personal

- Business

- Gaming

Personal represents the leading segment with 59% share of the total Saudi Arabia laptop market in 2025.

The personal end-use segment maintains substantial market leadership driven by widespread consumer demand for individual computing devices supporting education, entertainment, communication, and remote work activities. Saudi Arabia's youthful demographic profile, with 71% of the population under age 35, creates substantial baseline demand for personal computing devices enabling digital lifestyle participation. Government initiatives promoting digital literacy and technology adoption throughout society strengthen individual consumer purchasing motivations.

The Ministry of Education's Madrasati platform serving millions of students necessitates personal laptop ownership for effective educational participation. Expanding internet connectivity reaching near-universal penetration rates enhances the utility proposition of personal laptops by enabling access to diverse online services, streaming platforms, and social media applications integral to contemporary lifestyle patterns. The growing acceptance of remote work arrangements, with a significant proportion of Saudi workers engaging in remote activities regularly, positions personal laptops as essential household equipment supporting work-from-home productivity requirements. Consumers increasingly view personal laptops as versatile multi-purpose devices capable of addressing education, entertainment, and professional needs within single purchase decisions.

Regional Insights:

To get more information on this market, Request Sample

- Northern and Central Region

- Western Region

- Eastern Region

- Southern Region

Northern and Central Region holds the largest share with 49% of the total Saudi Arabia laptop market in 2025.

The Northern and Central Region commands market leadership anchored by Riyadh's position as the Kingdom's administrative, economic, and technological center concentrating significant corporate headquarters, government institutions, and educational facilities generating sustained laptop demand. The capital city hosts major technology sector investments and serves as primary hub for digital transformation initiatives driving substantial institutional and consumer purchasing activity. Urban population density and higher average income levels within the region support premium product adoption. Alat and Lenovo broke ground on a major new manufacturing facility in Riyadh in February 2025, establishing local production capabilities on a 200,000 square meter campus site.

Strategic investments in technology infrastructure throughout the Northern and Central Region position Riyadh as emerging hub for laptop distribution and manufacturing operations serving broader regional markets. The concentration of universities, research institutions, and training centers generates consistent academic demand for computing devices supporting educational programs and research activities. Growing presence of multinational technology companies establishing regional headquarters operations in the capital creates additional demand channels for business-grade laptop procurement while strengthening after-sales service capabilities throughout the region.

Market Dynamics:

Growth Drivers:

Why is the Saudi Arabia Laptop Market Growing?

Government-Led Digital Transformation Initiatives

The Saudi Arabia laptop market experiences significant growth momentum driven by comprehensive government initiatives promoting digital transformation across economic sectors under the Vision 2030 framework. The Kingdom's commitment to establishing a knowledge-based economy necessitates widespread adoption of computing technologies throughout government operations, educational institutions, and private sector enterprises. Strategic investments in information and communication technology infrastructure create favorable conditions for laptop market expansion by enhancing connectivity and digital service accessibility. The government has invested approximately USD 25 Billion in digital infrastructure development over the past six years, establishing robust foundations for technology adoption nationwide. Digitalization of government services through platforms like Absher and Tawakkalna demonstrates successful technology integration encouraging broader digital device adoption among citizens and residents seeking convenient access to administrative services.

Expansion of Educational Technology Programs

The growth of educational technology initiatives throughout Saudi Arabia creates substantial demand for laptop devices supporting digital learning environments across primary, secondary, and tertiary education levels. The Ministry of Education's implementation of digital learning platforms and smart classroom technologies requires students and educators to possess capable computing devices for effective participation in modern educational programs. Curriculum developments incorporating artificial intelligence, coding, and digital literacy skills further necessitate student access to appropriate laptop hardware supporting practical skill development. The nationwide AI curriculum beginning in the 2025-2026 academic year expects to reach more than six million students, generating significant institutional demand for compatible computing devices. Private education sector expansion, with new private schools opening, amplifies educational laptop demand as institutions invest in technology infrastructure supporting competitive academic programs.

Rising Remote and Hybrid Work Adoption

The increasing adoption of remote and hybrid work arrangements throughout Saudi Arabia's corporate sector drives substantial demand for portable computing solutions enabling productive work activities beyond traditional office environments. Businesses across diverse industries recognize the operational benefits of flexible work models and invest in equipping employees with capable laptop devices supporting secure remote connectivity and collaboration requirements. The shift toward hybrid work arrangements, accelerated by changing workplace preferences, positions laptops as essential business tools rather than optional equipment for modern workforce operations. Approximately 28% of private sector employees in Saudi Arabia now engage in some form of remote work, representing significant increase from previous years and generating sustained corporate laptop procurement.

Market Restraints:

What Challenges the Saudi Arabia Laptop Market is Facing?

High Competition from Mobile Devices and Tablets

The Saudi Arabia laptop market faces competitive pressure from smartphones and tablets that increasingly satisfy consumer computing needs for routine tasks including browsing, social media, and entertainment consumption. Mobile devices offer superior portability, longer battery life, and lower price points that appeal to consumers prioritizing convenience over comprehensive computing capabilities. The proliferation of mobile applications addressing business and educational requirements diminishes the perceived necessity of laptop ownership for certain user segments, potentially constraining market expansion among casual users.

Extended Device Replacement Cycles

Improvements in laptop durability, processing capabilities, and software optimization enable extended device usage periods that potentially limit replacement demand and market growth velocity. Consumers and businesses increasingly retain functional laptops for longer durations when existing devices adequately address computing requirements without compelling reasons for upgrade investment. The trend toward extended replacement cycles, particularly among budget-conscious institutional purchasers, creates challenges for manufacturers seeking to stimulate regular upgrade demand and maintain sales momentum.

Supply Chain and Pricing Volatility

Global supply chain dynamics affecting semiconductor availability, component costs, and logistics expenses create pricing volatility that complicates market planning and potentially constrains consumer purchasing decisions. Fluctuations in currency exchange rates and international trade policies introduce additional uncertainty affecting laptop pricing throughout Saudi Arabia's import-dependent market. Manufacturers face challenges balancing competitive pricing pressures against rising production and logistics costs, potentially limiting promotional activities and value offerings attractive to price-sensitive consumer segments.

Competitive Landscape:

The Saudi Arabia laptop market competitive landscape features prominent global technology manufacturers competing through product innovation, distribution network expansion, and local manufacturing investments to capture growing market opportunities. Leading industry participants pursue strategic partnerships with local retailers, government entities, and educational institutions to strengthen market positioning and brand visibility throughout the Kingdom. Competition intensifies as manufacturers establish local assembly, customization, and fulfillment operations to enhance supply chain efficiency and customer service capabilities. Product differentiation strategies emphasizing artificial intelligence integration, gaming performance, and sustainability features enable competitors to address evolving consumer preferences while commanding premium pricing in targeted market segments.

Saudi Arabia Laptop Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Billion USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered | Traditional Laptop, 2-in-1 Laptop |

| Screen Sizes Covered | Up to 10.9", 11" to 12.9", 13" to 14.9", 15.0" to 16.9", More Than 17" |

| Prices Covered | Up to USD 500, USD 501 to USD 1000, USD 1001 to USD 1500, USD 1501 to USD 2000, Above USD 2001 |

| End Uses Covered | Personal, Business, Gaming |

| Regions Covered | Northern and Central Region, Western Region, Eastern Region, Southern Region |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report

The Saudi Arabia laptop market size was valued at USD 1.37 Billion in 2025.

The Saudi Arabia laptop market is expected to grow at a compound annual growth rate of 7.87% from 2026-2034 to reach USD 2.72 Billion by 2034.

Traditional laptop dominated the market with a share of 72%, driven by superior processing capabilities, extensive storage options, and strong demand from corporate and educational institutions seeking reliable computing solutions.

Key factors driving the Saudi Arabia laptop market include government-led digital transformation initiatives under Vision 2030, expansion of educational technology programs, rising adoption of remote and hybrid work arrangements, and growing gaming industry investments.

Major challenges include high competition from mobile devices and tablets, extended device replacement cycles reducing upgrade demand, supply chain volatility affecting component availability and pricing, and market dependency on imported products creating logistical complexities.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)