Saudi Arabia Hemodialysis Market Report by Segment (Hemodialysis Product, Hemodialysis Service), Modality (Conventional Hemodialysis, Short Daily Hemodialysis, Nocturnal Hemodialysis), End User (Hospitals, Independent Dialysis Centers, and Others), and Region 2026-2034

Market Overview:

The Saudi Arabia hemodialysis market size reached USD 877.4 Million in 2025. Looking forward, IMARC Group expects the market to reach USD 1,247.7 Million by 2034, exhibiting a growth rate (CAGR) of 3.99% during 2026-2034. The market is driven by the rising prevalence of chronic kidney diseases, government investment in healthcare infrastructure, and increasing private sector involvement. Expanded health insurance coverage, digital health technologies, and a focus on patient-centered care and quality standards further contribute to the expansion of the Saudi Arabia hemodialysis market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2025 |

|

Forecast Years

|

2026-2034

|

|

Historical Years

|

2020-2025

|

| Market Size in 2025 | USD 877.4 Million |

| Market Forecast in 2034 | USD 1,247.7 Million |

| Market Growth Rate (2026-2034) | 3.99% |

Hemodialysis is a medical procedure used to treat individuals with kidney failure, a condition where the kidneys are unable to adequately filter waste products and excess fluids from the blood. This procedure helps maintain the body's internal balance of electrolytes, fluids, and waste products when the kidneys are not functioning properly. During hemodialysis, a patient's blood is removed from their body and passed through a dialysis machine, which acts as an artificial kidney. Within this machine, blood flows through a filter (dialyzer) that removes waste products and excess fluids. Hemodialysis is typically performed three times a week, with each session lasting several hours. The frequency and duration depend on the individual's kidney function and overall health. Besides, patients undergoing hemodialysis are closely monitored during the procedure to ensure that their vital signs, electrolyte levels, and fluid balance are maintained within safe limits. Hemodialysis is a critical and life-saving procedure for people with advanced kidney disease. It helps alleviate symptoms of kidney failure, such as fatigue, fluid retention, and toxin buildup, and it allows individuals to maintain a relatively normal lifestyle while managing their condition.

Saudi Arabia Hemodialysis Market Trends:

Rising Prevalence of Chronic Kidney Diseases and Aging Population

The growing prevalence of chronic kidney diseases (CKD) and the increase in the elderly population in Saudi Arabia is a crucial factor influencing the hemodialysis market. The increasing amount of people impacted by lifestyle-related health issues like hypertension and diabetes are resulting in a greater need for renal replacement therapies, such as hemodialysis. Due to enhanced diagnostic abilities and rising awareness regarding the early identification of kidney disorders, the number of individuals pursuing ongoing treatment is growing. The healthcare system in the Kingdom is focusing more on preventive screenings and consistent monitoring, aiding in early intervention and sustained treatment compliance. The increase in elderly individuals, who are more susceptible to kidney issues, is catalyzing the demand for enhanced dialysis services and tailored care initiatives. This demographic and health trend is anticipated to sustain steady demand for hemodialysis services, strengthening Saudi Arabia’s commitment to enhancing renal care infrastructure and elevating clinical outcomes.

Government Investment and Expansion of Healthcare Infrastructure

The rising number of healthcare advancement plans, which focus on boosting infrastructure and enhancing patient care services, is impelling the market growth. Significant funds are being directed towards enhancing hospital infrastructure, increasing dialysis centers, and updating medical technology to improve treatment availability across the Kingdom. For example, in 2024, the Makkah Health Cluster established a collaboration with the Mutlaq bin Saleh Al-Hanaki National Foundation to build a 150-bed dialysis facility at Al-Noor Hospital in Makkah, highlighting the Kingdom’s dedication to increasing specialized healthcare resources. These efforts align with Saudi Arabia’s goals to guarantee fair access to high-quality kidney care in both urban and rural regions. Furthermore, public-private partnerships (PPP) are being promoted to improve operational efficiency, stimulate innovation, and reduce patient waiting times. Additionally, the creation of enhanced training programs for healthcare workers is elevating the quality of clinical services. By implementing extensive healthcare reforms and ongoing infrastructure development, Saudi Arabia is solidifying its role as a regional leader in top-notch, patient-focused dialysis services.

Growing Private Sector Participation and Strategic Partnerships

Private healthcare companies are partnering with government agencies to broaden dialysis networks, enhance operational management, and implement patient-focused treatment approaches. These collaborations are enhancing the accessibility of sophisticated medical devices and qualified healthcare experts, guaranteeing wider availability of top-notch renal services. Investment from private entities is further encouraging the establishment of specialized dialysis centers that are outfitted with advanced technology and efficient patient monitoring systems. These initiatives alleviate pressure on public resources while ensuring consistency in treatment protocols throughout various regions. Aligning private investment with national healthcare goals is encouraging innovation, increasing operational flexibility, and enhancing patient satisfaction. The growing collaboration between public and private sectors is positively influencing the market, ensuring that dialysis services stay accessible, affordable, and technologically advanced within the evolving healthcare landscape of Saudi Arabia.

Saudi Arabia Hemodialysis Market Growth Drivers:

Health Insurance Coverage and Financial Accessibility

Increasing health insurance coverage significantly contributes to the enhancement of the hemodialysis market in Saudi Arabia by fostering financial access and ensuring consistent care for patients. The expanded coverage of kidney treatments in public and private insurance plans is alleviating the financial burden on those with chronic kidney diseases, guaranteeing reliable access to essential therapies. In 2025, Bupa Arabia launched the Kingdom’s first health insurance program with “No Pre-Approvals,” allowing members to access outpatient services without needing prior authorization. This initiative, rolled out in over seven hospitals across three regions, has positively impacted over 200,000 members, showcasing Saudi Arabia’s growing emphasis on healthcare inclusiveness and patient ease. These reforms increase affordability and promote consistent treatment adherence, resulting in better clinical results and lower rates of hospitalization. Furthermore, enhanced cooperation between insurers and healthcare providers is improving reimbursement processes and simplifying patient management.

Digital Transformation and Data-Driven Healthcare Systems

Healthcare institutions nationwide are progressively implementing electronic health records (EHRs), telehealth systems, and real-time patient monitoring technologies to enhance operational precision and clinical results. Recent statistics from the IMARC Group indicate that Saudi Arabia’s telemedicine sector attained USD 842.1 Million in 2024, showcasing the Kingdom’s robust dedication to incorporating digital health technologies into its healthcare framework. Utilizing artificial intelligence (AI) and predictive analytics allows healthcare professionals to foresee complications, tailor dialysis procedures, and improve patient safety via data-informed decisions. The digitization of dialysis facilities is enhancing communication among healthcare teams, minimizing administrative inefficiencies, and boosting coordination of care. Centralized data systems also aid in national health planning and policy formulation concerning renal care. With the Kingdom's ongoing expansion of its digital healthcare ecosystem, the incorporation of technology, automation, and analytics is enhancing treatment accuracy, efficiency, and the overall patient experience.

Emphasis on Patient-Centered Care and Quality Standards

The growing emphasis on patient-focused care and compliance with global quality benchmarks are major factors influencing the hemodialysis market in Saudi Arabia. Healthcare providers are concentrating on enhancing the overall patient experience by implementing individualized treatment methods, ongoing support, and increased comfort during dialysis treatments. The establishment of uniform procedures for hygiene, infection management, and equipment upkeep guarantees safe and dependable care provision. Accreditation of dialysis facilities through established international standards are enhancing service quality and accountability. Patient feedback systems and outcome-focused assessments are now essential to healthcare administration, enabling ongoing enhancements in care methods. Furthermore, the incorporation of psychosocial support services targets the emotional and mental health of patients on long-term dialysis, aiding in comprehensive recovery. This growing dedication to patient contentment and clinical quality is raising healthcare benchmarks throughout Saudi Arabia, cultivating confidence in dialysis services, and promoting the growth of advanced renal care framework.

Saudi Arabia Hemodialysis Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country level for 2026-2034. Our report has categorized the market based on segment, modality, and end user.

Segment Insights:

- Hemodialysis Product

- Machines

- Dialyzers

- Others

- Hemodialysis Service

- In-centre Services

- Home Services

The report has provided a detailed breakup and analysis of the market based on the segment. This includes hemodialysis product (machines, dialyzers, and others) and hemodialysis service (in-center services and home services).

Modality Insights:

- Conventional Hemodialysis

- Short Daily Hemodialysis

- Nocturnal Hemodialysis

A detailed breakup and analysis of the market based on the modality have also been provided in the report. This includes conventional hemodialysis, short daily hemodialysis, and nocturnal hemodialysis.

End User Insights:

- Hospitals

- Independent Dialysis Centers

- Others

The report has provided a detailed breakup and analysis of the market based on the end user. This includes hospitals, independent dialysis centers, and others.

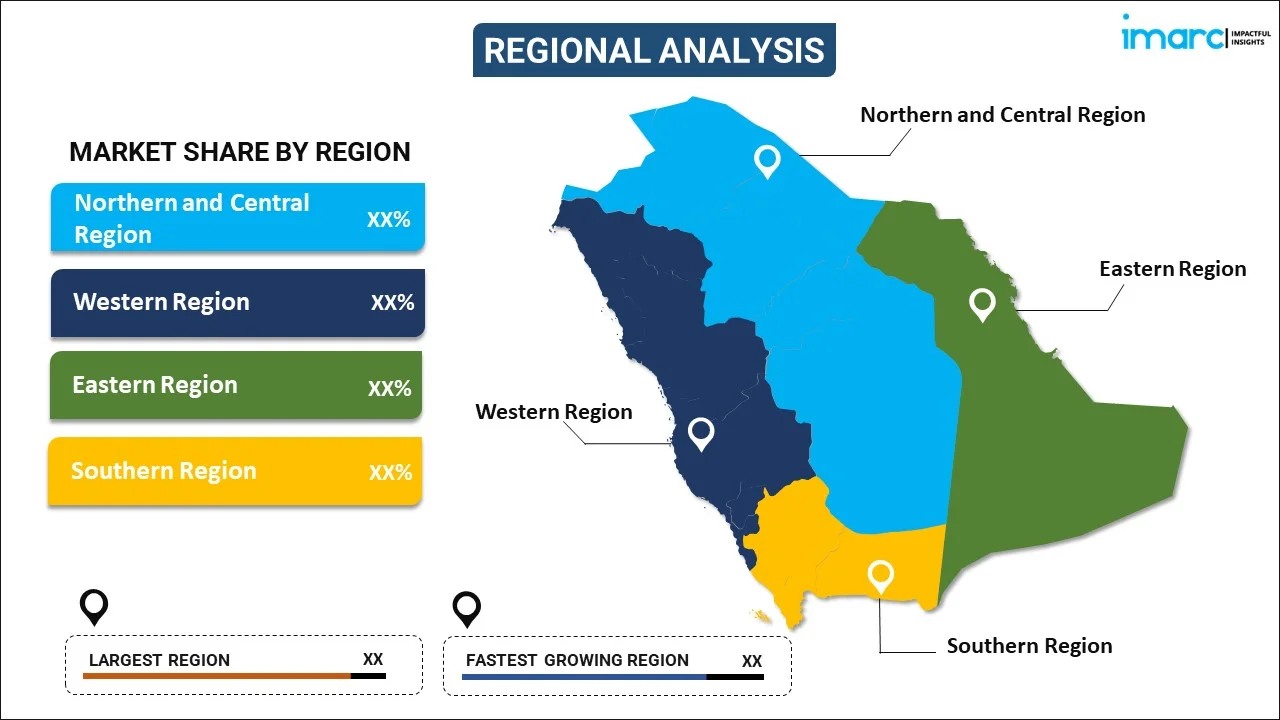

Regional Insights:

- Northern and Central Region

- Western Region

- Eastern Region

- Southern Region

The report has also provided a comprehensive analysis of all the major regional markets, which include Northern and Central Region, Western Region, Eastern Region, and Southern Region.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided. Some of the key players include:

- Almana Group of Hospitals

- DaVita

- Diaverum Al Khobar

(Please note that this is only a partial list of the key players, and the complete list is provided in the report.)

Saudi Arabia Hemodialysis Market News:

- February 2025: NephroPlus announced it will open a dialysis center in Saudi Arabia by December 2025, expanding into its fourth international market. Known for its hemodialysis, peritoneal dialysis, and home dialysis services, NephroPlus operates 500+ clinics across 5 countries. The move strengthens its mission to deliver high-quality, patient-centric kidney care globally.

- April 2024: Cleopatra Hospitals Group announced a partnership with Mumtada Medical Company to open a 200-bed rehabilitation and long-term care facility in Riyadh, Saudi Arabia, by late 2024. The center aimed to feature 17 hemodialysis stations, 27 clinics, and ICU support, addressing a critical care gap in the region.

Saudi Arabia Hemodialysis Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Million USD |

| Scope of the Report | Exploration of Historical and Forecast Trends, Industry Catalysts and Challenges, Segment-Wise Historical and Predictive Market Assessment:

|

| Segments Covered |

|

| Modalities Covered | Conventional Hemodialysis, Short Daily Hemodialysis, Nocturnal Hemodialysis |

| End Users Covered | Hospitals, Independent Dialysis Centers, Others |

| Regions Covered | Northern and Central Region, Western Region, Eastern Region, Southern Region |

| Companies Covered | Almana Group of Hospitals, DaVita, Diaverum Al Khobar, etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Saudi Arabia hemodialysis market from 2020-2034.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Saudi Arabia hemodialysis market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Saudi Arabia hemodialysis industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The hemodialysis market in Saudi Arabia was valued at USD 877.4 Million in 2025.

The Saudi Arabia hemodialysis market is projected to exhibit a CAGR of 3.99% during 2026-2034, reaching a value of USD 1,247.7 Million by 2034.

The Saudi Arabia hemodialysis market is driven by the rising prevalence of kidney-related disorders, improved healthcare infrastructure, and increasing government investment in renal care services. The growing awareness about advanced treatment options, expanding healthcare access, and technological advancements in dialysis equipment are further influencing the market and improving patient outcomes across the Kingdom.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)