Saudi Arabia Heat Pump Market Report by Rated Capacity (Up to 10 kW, 10–20 kW, 20–30 kW, Above 30 kW), Product Type (Air Source Heat Pump, Ground Source Heat Pump, Water Source Heat Pump, Exhaust Air Heat Pump, and Others), End Use Sector (Residential, Commercial, Hospitality, Retail, Education, Food and Beverage, Paper and Pulp, Chemicals and Petrochemicals, and Others), and Region 2026-2034

Market Overview:

The Saudi Arabia heat pump market size reached USD 484.3 Million in 2025. Looking forward, IMARC Group expects the market to reach USD 856.1 Million by 2034, exhibiting a growth rate (CAGR) of 6.53% during 2026-2034. The increased efforts to reduce energy consumption and promote sustainability, the increasing demand for electricity in Saudi Arabia, and ongoing advancements in heat pump technology, including variable-speed compressors and improved heat exchange systems represent some of the key factors driving the market.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2025

|

|

Forecast Years

|

2026-2034

|

|

Historical Years

|

2020-2025

|

|

Market Size in 2025

|

USD 484.3 Million |

|

Market Forecast in 2034

|

USD 856.1 Million |

| Market Growth Rate 2026-2034 | 6.53% |

A heat pump is a heating, ventilation, and air conditioning (HVAC) system that is used to transfer heat from one location to another. It is a highly efficient technology that can provide both heating and cooling for residential and commercial buildings. Heat pumps work by extracting heat from a source, such as the air, ground, or water, and transferring it to another location where it is needed. The heat pump transfers the compressed and heated refrigerant into the building's indoor space. Inside the building, a fan or blower system distributes the heat throughout the living or working areas. Heat pumps are reversible, which means they can operate in cooling mode as well. In cooling mode, the heat pump works like an air conditioner, removing heat from the indoor air and expelling it outside. Heat pumps are known for their energy efficiency and environmental benefits, as they can provide heating and cooling with lower energy consumption compared to traditional heating and cooling systems like furnaces and air conditioners. They are often considered a sustainable and eco-friendly HVAC solution. Heat pumps are commonly used in regions with moderate climates, but they can be effective in various climate conditions with proper design and sizing.

Saudi Arabia Heat Pump Market Trends:

As part of Saudi Arabia's efforts to reduce energy consumption and promote sustainability, there is a growing emphasis on energy-efficient heating and cooling solutions. Heat pumps are known for their high energy efficiency and are seen as an eco-friendly alternative to traditional heating and cooling systems. In addition, the Saudi Arabian government has introduced initiatives and policies to encourage the adoption of energy-efficient technologies, including heat pumps. Incentives such as subsidies, rebates, and regulations promoting energy-efficient HVAC systems drive market growth. Besides, the increasing demand for electricity in Saudi Arabia, particularly for cooling during hot summers, has led to a focus on more efficient cooling solutions. Heat pumps offer an energy-efficient alternative to air conditioning systems. Moreover, with the growth of construction and real estate development in Saudi Arabia, there is a trend toward sustainable building practices. Heat pumps are favored for their contribution to green building certifications and compliance with sustainability standards. Additionally, ongoing advancements in heat pump technology, including variable-speed compressors and improved heat exchange systems, have increased the efficiency and performance of these systems, making them more attractive to consumers. Furthermore, there is a growing awareness of environmental issues and a desire to reduce carbon emissions. Heat pumps produce lower greenhouse gas emissions compared to traditional heating methods, aligning with environmental goals.

Saudi Arabia Heat Pump Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country level for 2026-2034. Our report has categorized the market based on rated capacity, product type, and end use sector.

Rated Capacity Insights:

- Up to 10 kW

- 10–20 kW

- 20–30 kW

- Above 30 kW

The report has provided a detailed breakup and analysis of the market based on the rated capacity. This includes up to 10 kw, 10–20 kw, 20–30 kw, and above 30 kw.

Product Type Insights:

- Air Source Heat Pump

- Ground Source Heat Pump

- Water Source Heat Pump

- Exhaust Air Heat Pump

- Others

A detailed breakup and analysis of the market based on the product type have also been provided in the report. This includes air source heat pump, ground source heat pump, water source heat pump, exhaust air heat pump, and others.

End Use Sector Insights:

- Residential

- Commercial

- Hospitality

- Retail

- Education

- Food and Beverage

- Paper and Pulp

- Chemicals and Petrochemicals

- Others

The report has provided a detailed breakup and analysis of the market based on the end use sector. This includes residential, commercial, hospitality, retail, education, food and beverage, paper and pulp, chemicals and petrochemicals, and others.

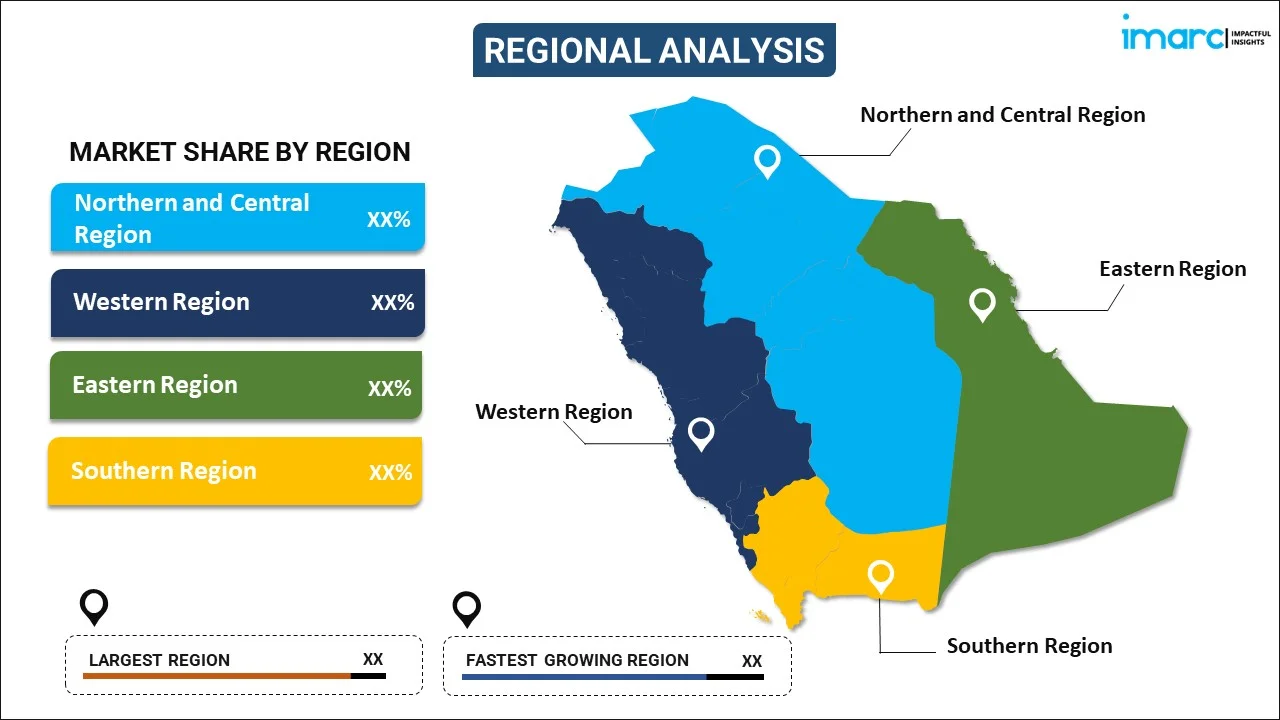

Regional Insights:

- Northern and Central Region

- Western Region

- Eastern Region

- Southern Region

The report has also provided a comprehensive analysis of all the major regional markets, which include Northern and Central Region, Western Region, Eastern Region, and Southern Region.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape in the market. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided. Some of the key players include:

- Atlas Copco Compressors LLC

- Daikin Industries Ltd.

- LG Electronics Inc.

- Saudi Heat Pump

- WIKA Saudi Arabia LLC

(Please note that this is only a partial list of the key players, and the complete list is provided in the report.)

Saudi Arabia Heat Pump Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Million USD |

| Scope of the Report | Exploration of Historical and Forecast Trends, Industry Catalysts and Challenges, Segment-Wise Historical and Predictive Market Assessment:

|

| Rated Capacities Covered | Up to 10 kW, 10–20 kW, 20–30 kW, Above 30 kW |

| Product Types Covered | Air Source Heat Pump, Ground Source Heat Pump, Water Source Heat Pump, Exhaust Air Heat Pump, Others |

| End Use Sectors Covered | Residential, Commercial, Hospitality, Retail, Education, Food and Beverage, Paper and Pulp, Chemicals and Petrochemicals, Others |

| Regions Covered | Northern and Central Region, Western Region, Eastern Region, Southern Region |

| Companies Covered | Atlas Copco Compressors LLC, Daikin Industries Ltd., LG Electronics Inc., Saudi Heat Pump, WIKA Saudi Arabia LLC, etc. (Please note that this is only a partial list of the key players, and the complete list is provided in the report.) |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Saudi Arabia heat pump market performed so far and how will it perform in the coming years?

- What has been the impact of COVID-19 on the Saudi Arabia heat pump market?

- What is the breakup of the Saudi Arabia heat pump market on the basis of rated capacity?

- What is the breakup of the Saudi Arabia heat pump market on the basis of product type?

- What is the breakup of the Saudi Arabia heat pump market on the basis of end use sector?

- What are the various stages in the value chain of the Saudi Arabia heat pump market?

- What are the key driving factors and challenges in the Saudi Arabia heat pump?

- What is the structure of the Saudi Arabia heat pump market and who are the key players?

- What is the degree of competition in the Saudi Arabia heat pump market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Saudi Arabia heat pump market from 2020-2034.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Saudi Arabia heat pump market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Saudi Arabia heat pump industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)