Saudi Arabia Hardware in the Loop Market Report by Type (Open Loop, Closed Loop), Vertical (Automobile, Aerospace, Research and Education, Defense, Power Electronics, and Others), and Region 2026-2034

Market Overview:

Saudi Arabia hardware in the loop market size reached USD 8.2 Million in 2025. Looking forward, IMARC Group expects the market to reach USD 19.1 Million by 2034, exhibiting a growth rate (CAGR) of 9.88% during 2026-2034. The growing trend towards ADAS and autonomous vehicles, which demands rigorous testing to ensure the reliability and safety of the embedded systems, is driving the market.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2025 |

|

Forecast Years

|

2026-2034

|

|

Historical Years

|

2020-2025

|

| Market Size in 2025 | USD 8.2 Million |

| Market Forecast in 2034 | USD 19.1 Million |

| Market Growth Rate (2026-2034) | 9.88% |

Hardware in the loop (HIL) is a testing methodology used in the development and validation of complex systems, particularly in the automotive and aerospace industries. It involves integrating real hardware components, such as electronic control units or sensors, into a simulated environment. This simulation mimics the operational conditions and interactions the hardware would encounter in the actual system. By connecting physical components to a simulation, engineers can assess how the hardware responds to various scenarios, enabling comprehensive testing without the need for a complete physical prototype. HIL testing enhances efficiency, reduces development costs, and ensures that the hardware functions as intended in a controlled and repeatable manner, ultimately contributing to the overall reliability and performance of the final product.

Saudi Arabia Hardware in the Loop Market Trends:

The hardware in the loop (HIL) technology is experiencing a surge in demand, driven by several key factors. Firstly, the relentless advancements in the automotive and aerospace industries are pushing for more sophisticated and reliable testing methodologies. In this context, HIL provides a crucial bridge between virtual simulations and real-world scenarios, offering a cost-effective and efficient means of validating complex systems. Moreover, the growing complexity of electronic control units (ECUs) in vehicles and aircraft necessitates rigorous testing, fueling the adoption of HIL solutions. Additionally, the rise of autonomous vehicles and the Internet of Things (IoT) is propelling the HIL market forward. As these technologies become more pervasive, the need for comprehensive testing environments becomes paramount, with HIL systems offering a reliable platform for validating intricate control algorithms and communication protocols. Furthermore, stringent regulatory requirements and safety standards in various industries contribute to the increasing reliance on HIL testing to ensure compliance and mitigate risks. The regional push toward sustainable energy solutions is also a significant driver for the HIL market. With the development of smart grids, renewable energy systems, and electric vehicles, there is a heightened demand for HIL testing to guarantee the reliability and efficiency of these innovative technologies. In essence, the regional market is propelled by a confluence of technological advancements, regulatory imperatives, and the evolving landscape of modern industries.

Saudi Arabia Hardware in the Loop Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country level for 2026-2034. Our report has categorized the market based on type and vertical.

Type Insights:

To get more information on this market, Request Sample

- Open Loop

- Closed Loop

The report has provided a detailed breakup and analysis of the market based on the type. This includes open loop and closed loop.

Vertical Insights:

- Automobile

- Aerospace

- Research and Education

- Defense

- Power Electronics

- Others

A detailed breakup and analysis of the market based on the vertical have also been provided in the report. This includes automobile, aerospace, research and education, defense, power electronics, and others.

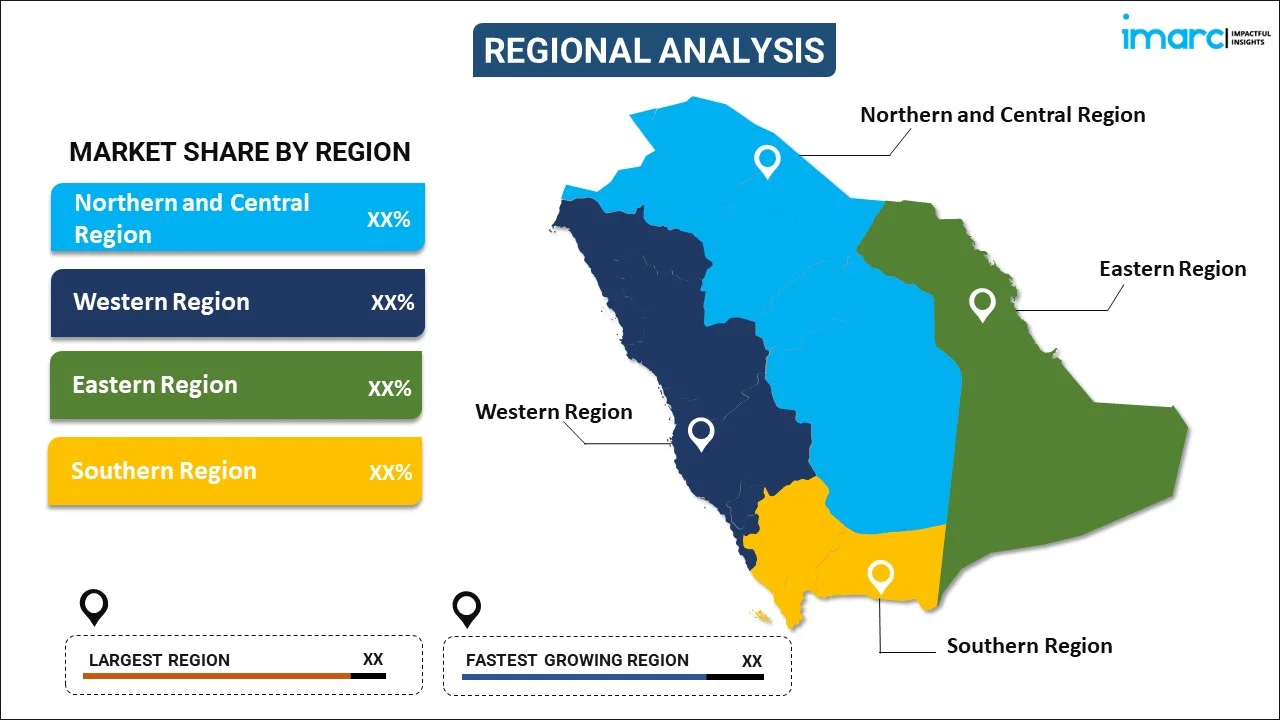

Regional Insights:

- Northern and Central Region

- Western Region

- Eastern Region

- Southern Region

The report has also provided a comprehensive analysis of all the major regional markets, which include Northern and Central Region, Western Region, Eastern Region, and Southern Region.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape in the market. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Saudi Arabia Hardware in the Loop Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Million USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered | Open Loop, Closed Loop |

| Verticals Covered | Automobile, Aerospace, Research and Education, Defense, Power Electronics, Others |

| Regions Covered | Northern and Central Region, Western Region, Eastern Region, Southern Region |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Saudi Arabia hardware in the loop market performed so far and how will it perform in the coming years?

- What is the breakup of the Saudi Arabia hardware in the loop market on the basis of type?

- What is the breakup of the Saudi Arabia hardware in the loop market on the basis of vertical?

- What are the various stages in the value chain of the Saudi Arabia hardware in the loop market?

- What are the key driving factors and challenges in the Saudi Arabia hardware in the loop?

- What is the structure of the Saudi Arabia hardware in the loop market and who are the key players?

- What is the degree of competition in the Saudi Arabia hardware in the loop market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Saudi Arabia hardware in the loop market from 2020-2034.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Saudi Arabia hardware in the loop market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Saudi Arabia hardware in the loop industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)