Saudi Arabia Geospatial Analytics Market Report by Type (Surface Analysis, Network Analysis, Geovisualization), End Use Vertical (Agriculture, Utility and Communication, Defense and Intelligence, Government, Mining and Natural Resources, Automotive and Transportation, Healthcare, Real Estate and Construction, and Others), and Region 2025-2033

Market Overview:

Saudi Arabia geospatial analytics market size reached USD 3.6 Million in 2024. Looking forward, the market is projected to reach USD 7.7 Million by 2033, exhibiting a growth rate (CAGR) of 8.15% during 2025-2033. The growing need for improving situational awareness, along with the increasing adoption of smart cities, is primarily augmenting the market growth.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 3.6 Million |

| Market Forecast in 2033 | USD 7.7 Million |

| Market Growth Rate (2025-2033) | 8.15% |

Geospatial analytics encompasses the examination of geological information extracted from maps, charts, data sets, and cartograms to depict Earth's surface features or entities. This field utilizes a range of technologies, including the global positioning system (GPS), 3D scanners, geotagging, location sensors, social media platforms, mobile devices, and satellite imagery solutions to analyze surfaces, network structures, and visualize geographical data. Geospatial analytics enhances geospatial data with precise temporal and spatial references, offering valuable insights through visual patterns and imagery. It also plays a pivotal role in geographic information systems (GIS), employed for tasks, such as weather modeling, population projection, and monitoring retail sales trends. Consequently, it finds wide-ranging applications in disaster management, urban planning and development, and the exploration of natural resources.

Saudi Arabia Geospatial Analytics Market Trends:

Government Programs and Investment in Infrastructure

The government of Saudi Arabia is progressively facilitating the development of the market for geospatial analytics through substantial investments in the creation of smart cities and infrastructure development projects. The newly authorized SR1.3tn ($342.7bn) budget for 2025 directs substantial resources towards infrastructure, transport, and housing, bolstering Saudi Arabia’s dedication to extensive development. Programs such as Vision 2030 are promoting the infusion of cutting-edge technologies, including geospatial analytics, in the planning of cities, transportation networks, and public services. Through the integration of these technologies, the government is making decision-making more effective, streamlining resource allocation, and facilitating better mobility in cities. Furthermore, the public sector is encouraging digitalization initiatives in different industries, wherein geospatial information is being utilized to aid city growth, environmental monitoring, and disaster mitigation. All these investments are generating an increasing need for geospatial analytics solutions, thereby fueling the growth of the market.

Increasing Demand for Smart Cities and Urban Planning

Saudi Arabia is increasingly emphasizing the construction of smart cities where geospatial analytics is assuming a significant role. The cities are leveraging geospatial information to optimize urban planning, track infrastructure, traffic management, and environmental sustainability. Tools such as geographic information system (GIS) and remote sensing are being utilized for collecting data, analyzing the spatial relationship between data, and making informed decisions on urban developments. Moreover, as per GMI, during May the population of the country is recorded to be 36.96 million. The increasing population and urban developments are driving the demand for sophisticated solutions that can effectively maintain resources, forecast future growth trends, and minimize the living environment. Consequently, demand for geospatial analytics tools that enable smart city projects is growing strongly.

Growth in E-commerce and Logistics Industries

The speedy growth of e-commerce and logistics industries in Saudi Arabia is driving the use of geospatial analytics. Companies are increasingly turning to geospatial data to streamline supply chains, monitor shipments, and enhance last-mile delivery effectiveness. With the help of GIS tools, businesses are able to examine spatial patterns, review traffic situations, and identify the most optimal routes for delivery. Geospatial analytics also allows for improved warehouse management and logistics planning by giving insights regarding customer locations and regional demand patterns. With e-commerce gaining momentum in Saudi Arabia, increased demand for sophisticated geospatial solutions for optimizing logistics operations is building up further, driving the market demand. The IMARC Group predicts that the Saudi Arabia e-commerce market is anticipated to reach USD 708.7 Billion by 2033.

Saudi Arabia Geospatial Analytics Market Growth Drivers:

Growth of Use of Geospatial Data in Natural Resource Management

The Saudi Arabian economy is also resource-based and heavily reliant upon natural resources such as oil, gas, and minerals. Geospatial analytics is being applied more frequently in optimizing the exploration and extraction of these resources, as well as in their management. More specifically, geospatial information aids in the discovery of new reserves, environmental assessment, and regulatory compliance. As there is greater emphasis on sustainable management of resources, companies are implementing geospatial technologies to make better decisions. Additionally, the capacity for monitoring and controlling resources in real-time with satellite imagery, remote sensing, and GIS is making operations more efficient. This is likely to be a continuing trend, making geospatial analytics an indispensable tool for natural resource management.

Emergence of Satellite and Remote Sensing Technologies

Technological innovations in satellite and remote sensing technologies are playing a major role in driving the Saudi Arabian geospatial analytics market. With the growing availability of high-resolution satellite imagery and real-time data, government agencies and businesses are acquiring improved capabilities to monitor and analyze vast geographies at high accuracy. These technologies are enabling a large number of applications, ranging from environmental monitoring to disaster management and defense. With the advancement of satellite technology, the need for geospatial analytics solutions that can process and analyze such an enormous volume of spatial data is increasing. This growth is leading to more extensive and accurate geospatial analytics, which will benefit various industries throughout Saudi Arabia.

Increasing Need for Geospatial Solutions in Disaster Management

Saudi Arabia is investing in sophisticated geospatial analytics to enhance disaster management capabilities. Natural disasters like floods, earthquakes, and sandstorms are more frequently occurring phenomena, and there is a resultant necessity for improved preparedness and response measures through geospatial analytics. Real-time monitoring of disasters, assessment of risks, and planning of emergency responses are increasingly being facilitated by technologies like geospatial analytics. Through geo-analysis, for instance, government agencies are determining zones of vulnerability, mapping evacuation routes, and undertaking effective resource allocation in times of distress. The growing prevalence of these incidents, combined with the spread of geospatial technologies, is driving the demand for converged geospatial analytics solutions for disaster management.

Saudi Arabia Geospatial Analytics Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country level for 2025-2033. Our report has categorized the market based on type and end use vertical.

Type Insights:

- Surface Analysis

- Network Analysis

- Geovisualization

The report has provided a detailed breakup and analysis of the market based on the type. This includes surface analysis, network analysis, and geovisualization.

End Use Vertical Insights:

- Agriculture

- Utility and Communication

- Defense and Intelligence

- Government

- Mining and Natural Resources

- Automotive and Transportation

- Healthcare

- Real Estate and Construction

- Others

A detailed breakup and analysis of the market based on the end use vertical have also been provided in the report. This includes agriculture, utility and communication, defense and intelligence, government, mining and natural resources, automotive and transportation, healthcare, real estate and construction, and others.

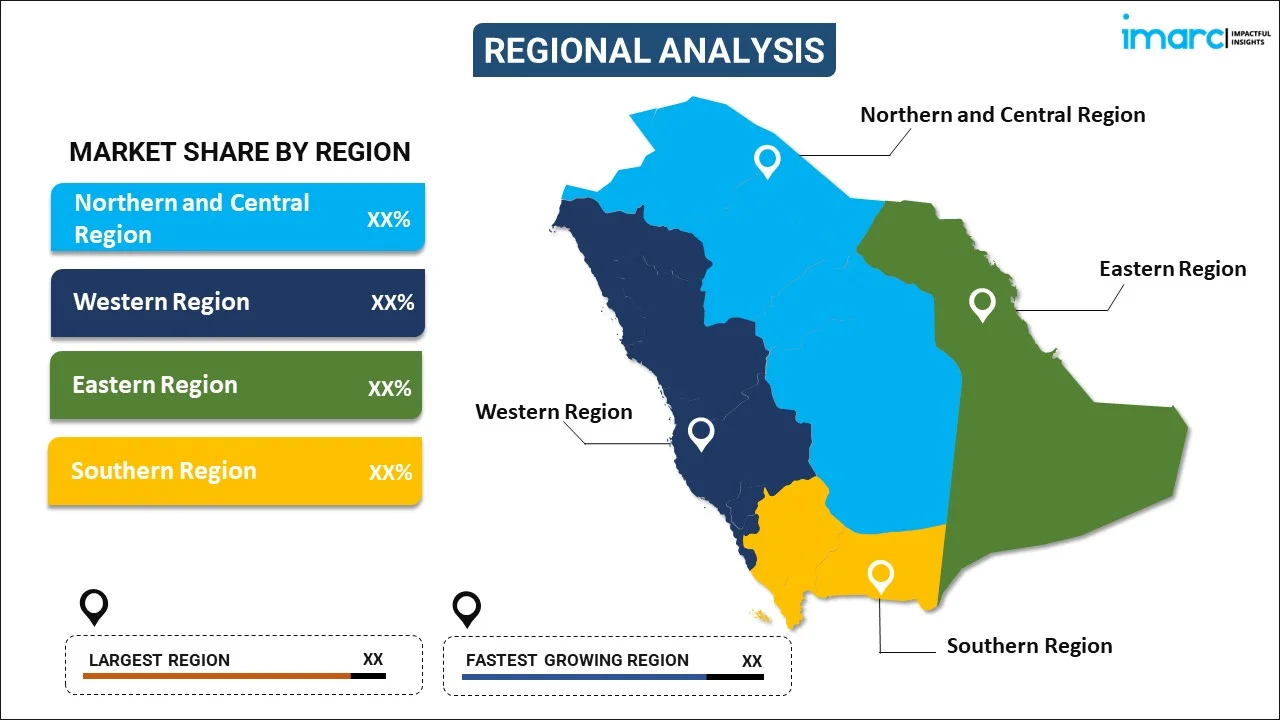

Regional Insights:

- Northern and Central Region

- Western Region

- Eastern Region

- Southern Region

The report has also provided a comprehensive analysis of all the major regional markets, which include Northern and Central Region, Western Region, Eastern Region, and Southern Region.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape in the market. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Saudi Arabia Geospatial Analytics Market News:

- April 2025: Saudi Arabia has moved to ninth rank in the 2025 Geospatial Knowledge Infrastructure Readiness Index, from 32nd rank in 2022, a sign of consistent development in its spatial sciences industry. Led by the General Authority for Survey and Geospatial Information, the Kingdom was first in the Middle East and Arab world, and sixth among the G20 countries, in the index.

- January 2025: Esri signed a Memorandum of Understanding (MoU) with Neo Space Group (NSG), a Saudi public investment fund company and the leading commercial space services provider in Saudi Arabia. The historic agreement was sealed during the Esri Saudi User Conference 2025, which was conducted in Riyadh. CEO of Neo Space Group Martijn Blanken and founder and president of Esri Jack Dangermond signed the MoU. This partnership is observed as a major step towards the solidification the geospatial sector in Saudi Arabia.

- March 2025: Saudi Arabia's geospatial industry is ready to take off as Neo Space Group aligns with SuperMap Software to spur technological development and bolster the Kingdom's Vision 2030 initiatives. NSG, a space and satellite company owned by Saudi Arabia's sovereign wealth fund, has aligned with SuperMap based in Beijing to enhance geographic information system services. This alliance will bolster the development of the Kingdom’s geospatial sector.

- June 2025: Space42 is Abu Dhabi-based, ADX-listed space tech with a focus on delivering geospatial analytics and satellite communications driven by artificial intelligence (AI). Backed by significant shareholders like G42, Mubadala and International Holding Company (IHC) with a global presence, Space42 plans to provide sustainable growth and long-term value to investors.

- January 2025: Kidana, a top Saudi-based real estate developer and building company, revealed its partnership with iSolution and Google Cloud at the Hajj and Umrah Conference & Exhibition 2025. With Kidana becoming one of the region's first organizations to adopt Cloud GPUs (Graphics Processing Units) on Google Cloud. This innovation opens doors to new powerful capabilities for the processing of complex geospatial data and high-performance computing. In addition to this, supporting Saudi Arabia's vision for cloud-first and digital innovation.

Saudi Arabia Geospatial Analytics Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered | Surface Analysis, Network Analysis, Geovisualization |

| End Use Verticals Covered | Agriculture, Utility and Communication, Defense and Intelligence, Government, Mining and Natural Resources, Automotive and Transportation, Healthcare, Real Estate and Construction, Others |

| Regions Covered | Northern and Central Region, Western Region, Eastern Region, Southern Region |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Saudi Arabia geospatial analytics market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Saudi Arabia geospatial analytics market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Saudi Arabia geospatial analytics industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

Geospatial analytics is the process of analyzing geographical data obtained from various sources like maps, satellite imagery, and mobile devices. It involves the use of technologies such as GIS, GPS, remote sensing, and 3D scanning to examine spatial relationships and visualize geographic patterns for insights in applications like urban planning, disaster management, and resource exploration.

The Saudi Arabia geospatial analytics market was valued at USD 3.6 Million in 2024.

The Saudi Arabia geospatial analytics market is projected to exhibit a CAGR of 8.15% during 2025-2033, reaching a value of USD 7.7 Million by 2033.

The key drivers include government investments in infrastructure, the rise of smart city initiatives, increasing demand for urban planning solutions, advancements in satellite and remote sensing technologies, and the growing need for efficient natural resource management and disaster response solutions.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)