Saudi Arabia Geopolymer Market Size, Share, Trends and Forecast by Application, End-Use Industry, and Region, 2026-2034

Saudi Arabia Geopolymer Market Overview:

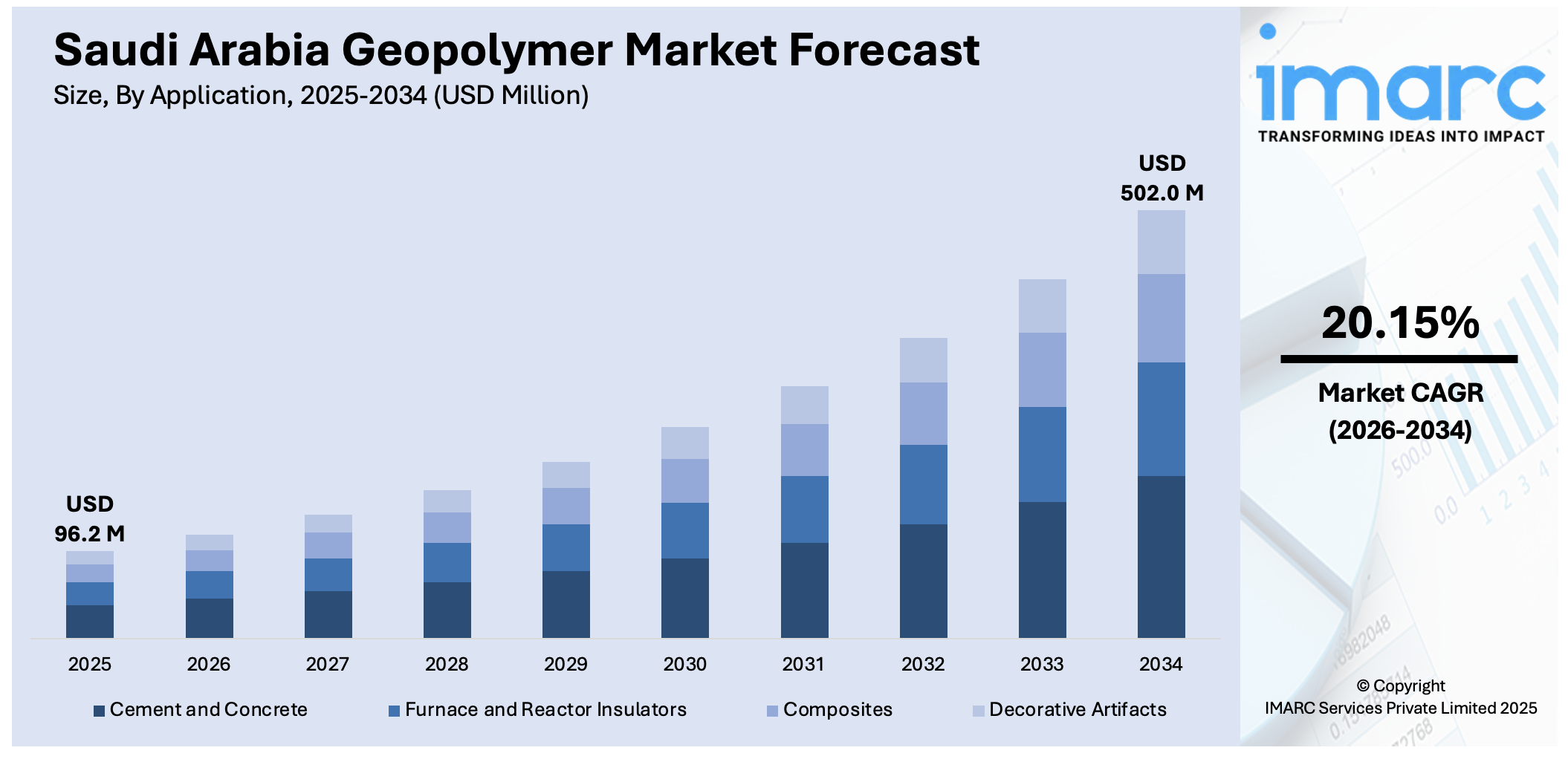

The Saudi Arabia geopolymer market size reached USD 96.2 Million in 2025. Looking forward, IMARC Group expects the market to reach USD 502.0 Million by 2034, exhibiting a growth rate (CAGR) of 20.15% during 2026-2034. The market is gaining momentum due to growing interest in sustainable construction materials. Demand is rising with infrastructure expansion, environmental regulations, and the shift towards low-carbon alternatives, especially in cement and concrete applications across the public and private sectors.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2025 |

|

Forecast Years

|

2026-2034

|

|

Historical Years

|

2020-2025

|

| Market Size in 2025 | USD 96.2 Million |

| Market Forecast in 2034 | USD 502.0 Million |

| Market Growth Rate 2026-2034 | 20.15% |

Saudi Arabia Geopolymer Market Trends:

Sustainable Materials in Construction

Construction companies in Saudi Arabia are increasingly adopting geopolymers as substitutes for traditional cement. National sustainability targets and the desire are encouraging this shift to reduce carbon emissions in building materials. Government-led infrastructure projects are focusing on green solutions, especially in transport and housing developments. Geopolymers offer durability and resistance to chemical and thermal stress, making them suitable for harsh environments common in the region. Engineers and developers are now exploring these materials for structural applications like bridges, pavements, and precast elements. In the latter part of this trend, manufacturers have begun introducing new binder blends using industrial by-products like fly ash and slag, aligning with waste-to-value strategies. Some local players are also working on customizing geopolymer mixes for extreme temperatures and saline conditions. These innovations are helping improve performance while lowering environmental impact. With rising pressure to meet Vision 2030 goals, the Demand for eco-efficient construction materials is expected to grow, solidifying the role of geopolymers in future developments.

To get more information on this market Request Sample

Industrial Waste Conversion Gaining Traction

The need to manage industrial waste more efficiently is contributing to the adoption of geopolymer technology in Saudi Arabia. Industries generating fly ash, red mud, and blast furnace slag are looking for practical reuse options to avoid landfill dependency. Using these materials in geopolymer production not only reduces waste but also provides cost-effective alternatives to cement. This approach supports circular economy practices, which are gaining policy support under national environmental initiatives. In the lower half of this trend, companies have started pilot projects to test geopolymer use in oil and gas sector infrastructure, including well linings and pipeline coatings, due to their corrosion resistance. Universities and research centers are also participating in studies on optimizing mix design and curing methods to match local conditions. These technical developments are helping expand the range of viable applications. Overall, as industries focus more on sustainable practices and cost reduction, the market for geopolymer products derived from industrial by-products is likely to see a steady rise.

Saudi Arabia Geopolymer Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the region/country level for 2026-2034. Our report has categorized the market based on application and end-use industry.

Application Insights:

- Cement and Concrete

- Furnace and Reactor Insulators

- Composites

- Decorative Artifacts

The report has provided a detailed breakup and analysis of the market based on the application. This includes cement and concrete, furnace and reactor insulators, composites, and decorative artifacts .

End-Use Industry Insights:

Access the comprehensive market breakdown Request Sample

- Building Construction

- Infrastructure

- Industrial

- Art and Decoration

- Others

A detailed breakup and analysis of the market based on the end-use industry have also been provided in the report. This includes building construction, infrastructure, industrial, art and decoration, and others.

Regional Insights:

- Northern and Central Region

- Western Region

- Eastern Region

- Southern Region

The report has also provided a comprehensive analysis of all the major regional markets, which include Northern and Central region, Western region, Eastern region, and Southern region.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Saudi Arabia Geopolymer Market News:

- September 2024: AlKifah Ready Mix & Blocks advanced Saudi Arabia’s green construction efforts by promoting ultra-sustainable products like ConGreen and BloGreen. These eco-friendly concrete and block solutions, aligned with giga projects, boosted demand for low-carbon materials and strengthened local adoption of geopolymer alternatives.

- March 2024: Spherical Block and Geopolymer International engaged with Saudi stakeholders to introduce geopolymer-based construction materials. They developed high-strength blocks and GP-based mortar, offering reduced CO₂ emissions and superior durability. This advanced technology strengthened Saudi Arabia’s sustainable construction drive and market innovation potential.

Saudi Arabia Geopolymer Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Applications Covered | Cement and Concrete, Furnace and Reactor Insulators, Composites, Decorative Artifacts |

| End-Use Industries Covered | Building Construction, Infrastructure, Industrial, Art and Decoration, Others |

| Regions Covered | Northern and Central Region, Western Region, Eastern Region, Southern Region |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Saudi Arabia geopolymer market performed so far and how will it perform in the coming years?

- What is the breakup of the Saudi Arabia geopolymer market on the basis of application?

- What is the breakup of the Saudi Arabia geopolymer market on the basis of end-use industry?

- What are the various stages in the value chain of the Saudi Arabia geopolymer market?

- What are the key driving factors and challenges in the Saudi Arabia geopolymer market?

- What is the structure of the Saudi Arabia geopolymer market and who are the key players?

- What is the degree of competition in the Saudi Arabia geopolymer market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Saudi Arabia geopolymer market from 2020-2034.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Saudi Arabia geopolymer market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Saudi Arabia geopolymer industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)