Saudi Arabia General Surgical Devices Market Report by Product (Handheld Devices, Laparoscopic Devices, Electro Surgical Devices, Wound Closure Devices, Trocars and Access Devices, and Others), Application (Gynecology and Urology, Cardiology, Orthopaedic, Neurology, and Others), and Region 2025-2033

Market Overview:

Saudi Arabia general surgical devices market size reached USD 162.4 Million in 2024. Looking forward, the market is expected to reach USD 231.0 Million by 2033, exhibiting a growth rate (CAGR) of 4.0% during 2025-2033. Healthcare investments, demographic changes, technological advancements, infection control measures, and stringent regulatory standards by government bodies represent some of the key factors expanding the Saudi Arabia general surgical devices market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

|

Market Size in 2024

|

USD 162.4 Million |

|

Market Forecast in 2033

|

USD 231.0 Million |

| Market Growth Rate 2025-2033 | 4.0% |

General surgical devices refer to a wide range of medical instruments, tools, and equipment utilized by healthcare professionals in surgical procedures that are not limited to a specific medical specialty. They are designed to assist surgeons and medical personnel in performing various surgical interventions, from routine procedures to more complex surgeries. General surgical devices encompass a diverse array of tools such as scalpels, forceps, scissors, retractors, and needle holders, among others. They are instrumental in tasks like tissue cutting, suturing, tissue manipulation, and wound closure. These devices are critical components of any surgical setting, ensuring precision, efficiency, and safety during surgical interventions. General surgical devices are essential in a multitude of medical disciplines, making them a fundamental part of healthcare infrastructure and enabling medical professionals to provide effective surgical care to patients across a broad spectrum of medical conditions.

Saudi Arabia General Surgical Devices Market Trends:

Spending on Healthcare and Development of Infrastructure

Saudi Arabia is spending heavily on its healthcare infrastructure, with a specific interest in developing infrastructure and increasing medical facilities. The government healthcare expenditure has consistently risen with the Ministry of Finance designating SAR260 billion ($69 billion) for ‘Health and Social Development’ in its official budget for 2025, maintaining the same amount as in 2024. Moreover, the government is constructing and upgrading hospitals, clinics, and surgery centers, and this is creating a demand for general surgical equipment. All these are intended to enhance healthcare accessibility and quality throughout the country. Increased healthcare investments are creating a favorable atmosphere for the expansion of the surgical device market. Partnerships between the public and private sectors are hastening the evolution of sophisticated medical devices, such as surgical devices, propelling the market growth. This is in line with the Vision 2030 plan to diversify the economy and minimize reliance on oil exports, targeting industries such as healthcare and technology.

Increased Aging Population and Chronic Diseases

Saudi Arabia is witnessing a demographic shift due to an aging population, leading to the prevalence of chronic conditions. As per Population Pyramids, in 2025, elderly population recorded in the country is 1,056,619. With an aging population, demand for surgeries, including general surgical procedures, is rising. Chronic diseases like diabetes, cardiovascular diseases, and obesity are increasingly prevalent, which are driving the need for surgical procedures. The elderly population is generating strong demand for surgical devices to manage these conditions in an effective manner. Healthcare professionals are increasingly augmenting their facilities to handle the escalated demand for chronic illnesses, and surgical devices, which have a pivotal role in this process. Hospitals and clinics are preparing themselves with cutting-edge general surgical equipment to meet the increasing demand for surgeries of these conditions. This pattern is likely to be followed as the aging population increases, thus propelling the market for surgical equipment.

Technological Innovation in Surgical Equipment

Saudi Arabia is focussing on technological innovation in medical devices, such as general surgical equipment. The nation is experiencing an accelerating shift towards minimally invasive surgical (MIS) procedures that necessitate specialized surgical equipment. These innovations, including robotic surgery and enhanced imaging modalities, are having a profound influence on the need for advanced surgical devices. Clinics and hospitals are adopting these cutting-edge solutions to enhance surgical results and minimize recovery time for patients. The ongoing development in surgical devices is resulting in more accurate, efficient, and safer equipment, which are in great demand. The growing use of robotic surgery, combined with improved visualization systems, is persuading healthcare professionals to invest in advanced devices to remain competitive. This technological transformation is taking the leading role in the increasing market for general surgical devices in Saudi Arabia. In preparation for the forthcoming 1446H Hajj season, the Minister of Health, H.E. Fahad bin Abdulrahman AlJalajel, launched the Robotic Surgical System and examined the advanced PET-CT Scanning technology during a visit to King Abdullah Medical City, an essential facility in the Makkah Health Cluster.

Saudi Arabia General Surgical Devices Market Growth Drivers:

Government Aid and Healthcare Reforms

Saudi Arabia is in the process of actively restructuring its healthcare industry to enhance efficiency and quality of care. The healthcare reforms are focused on increasing access and the affordability of healthcare services, which are propelling the demand for surgical devices. The government is introducing policies to aid the healthcare sector, including subsidizing medical equipment costs, offering tax relief, and facilitating private players' entry into the healthcare sector. These initiatives are generating a conducive business climate for the overall general surgical device market, both attracting foreign and local producers. Furthermore, the government is emphasizing the importance of specialized surgical procedures, resulting in an increased need for advanced devices. As the healthcare system evolves, demand for the latest surgical tools is growing, and manufacturers are responding by introducing a wider range of products tailored to meet the country's needs.

Growing Awareness and Patient Expectations

Saudi Arabia's increasing awareness about patient outcomes and healthcare quality is positively influencing the market. Patients are becoming increasingly educated about their treatment choices and are demanding more minimally invasive surgery. Changing patient expectations are driving the demand for sophisticated surgical instruments as patients demand procedures that provide faster recovery times, fewer complications, and better cosmetic outcomes. Healthcare professionals are meeting this demand by investing in new, high-tech surgical technology and providing more comprehensive services. Surgeons and medical professionals also become increasingly skilled in advanced techniques, further driving the demand for specialized general surgical devices.

Rise in Medical Tourism

Saudi Arabia is becoming a regional center for medical tourism in the Middle East, drawing patients from across the region and beyond who are searching for high-standard surgical procedures. The country is highlighting its world-class healthcare infrastructure and trained medical practitioners to gain a bigger market share in global medical tourism. This international patient influx is increasing the demand for general surgical devices since these patients demand sophisticated surgical solutions. Clinics and hospitals are also modernizing their surgical equipment to international standards to treat an ethnically diverse pool of patients. As per the Saudi Arabia general surgical devices market report, the government's initiatives to increase medical tourism through incentives and infrastructure improvement are catalyzing the demand for general surgical devices.

Saudi Arabia General Surgical Devices Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country level for 2025-2033. Our report has categorized the market based on product and application.

Product Insights:

- Handheld Devices

- Laparoscopic Devices

- Electro Surgical Devices

- Wound Closure Devices

- Trocars and Access Devices

- Others

The report has provided a detailed breakup and analysis of the market based on the product. This includes handheld devices, laparoscopic devices, electro surgical devices, wound closure devices, trocars and access devices, and others.

Application Insights:

- Gynecology and Urology

- Cardiology

- Orthopaedic

- Neurology

- Others

A detailed breakup and analysis of the market based on the application have also been provided in the report. This includes gynecology and urology, cardiology, orthopaedic, neurology, and others.

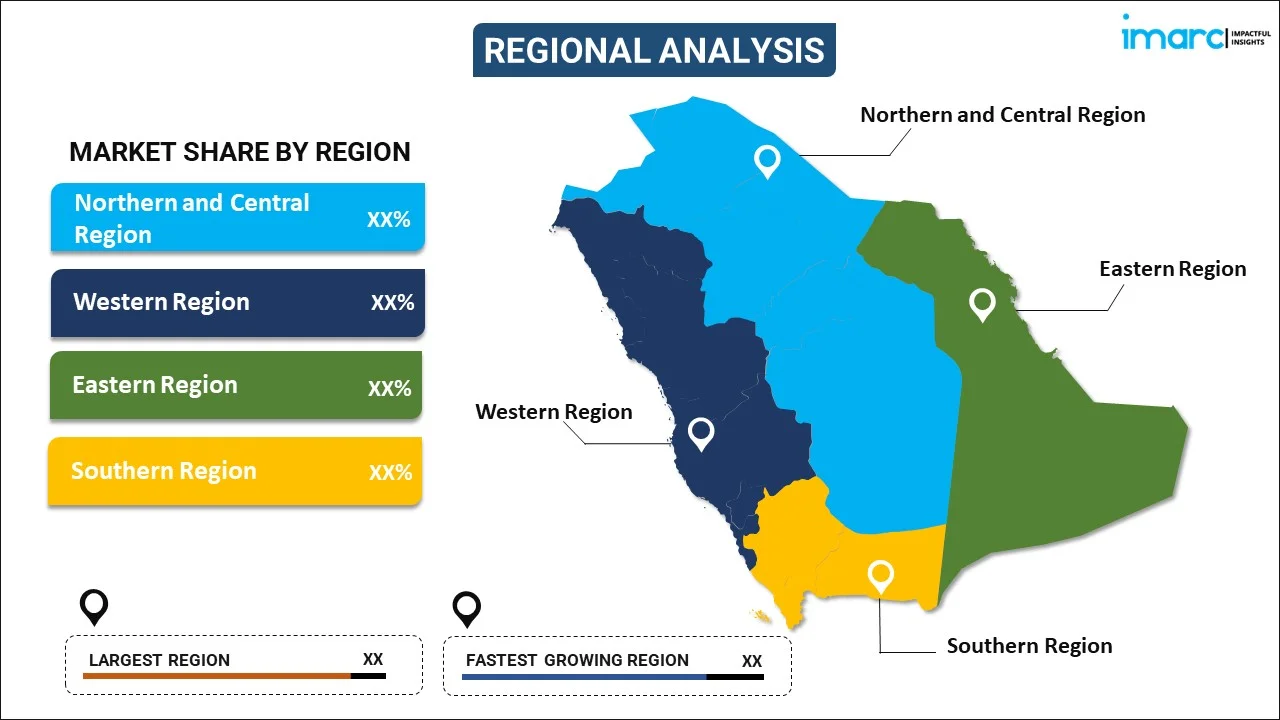

Regional Insights:

- Northern and Central Region

- Western Region

- Eastern Region

- Southern Region

The report has also provided a comprehensive analysis of all the major regional markets, which include Northern and Central Region, Western Region, Eastern Region, and Southern Region.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape in the market. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Saudi Arabia General Surgical Devices News:

- June 2025: King Faisal Specialist Hospital & Research Centre (KFSHRC) and Germfree Laboratories, LLC will be working jointly to develop a fully integrated, modular 'Advanced Therapy Medicinal Product' manufacturing campus in Saudi Arabia. The campus will be housed within KFSHRC's main campus in Riyadh.

- May 2025: Saudi Arabia has made a big stride towards the future of medicine with the opening of the world's first AI clinic, which was created by Chinese medical tech startup Synyi AI, headquartered in Shanghai. As artificial intelligence picks up steam throughout the Kingdom, followed by the tech push by the Public Investment Fund and adding AI studies to high school curricula, this clinic is an important step towards embedding new-age technology into public services.

- May 2025: King Abdullah Medical City in Makkah performed the first accurate robotic thoracic surgery with the Da Vinci Xi system with success. Dr. Adel Tash, CEO of KAMC, informed Arab News that introduction of the service is a major medical achievement, further affirming the city's position as a prominent reference center for advanced specialized medical care, fueled by the most advanced innovations in surgical and medical technology.

- March 2025: Mölnlycke Health Care, a global leader in MedTech, has further developed its commitment to the Middle Eastern operations through increasing its stake from 33.3% to 60% to become the majority shareholder in Tamer Mölnlycke Care - a joint venture with Tamer Group, the Kingdom of Saudi Arabia's market leader in healthcare distribution.

- February 2025: DIH Holding US, Inc., a worldwide supplier of sophisticated robotic devices employed in rehabilitation, which include visual stimulation in an interactive format to allow clinical research and intensified functional rehabilitation and training in patients with walking disabilities, decreased balance and/or compromised arm and hand function, reported the expansion of their strategic partnership with Zahrawi Group (MTC Company), representative and sales partner of DIH, to include Saudi Arabia. Growing from a successful partnership that was initiated in 2019, the alliance now exists across four nations: the United Arab Emirates, Qatar, Bahrain, and Saudi Arabia.

- January 2025: Scientific & Medical Equipment House Company, which deals in the sale, operation, and maintenance of medical equipment via its commercial division, announces signing an exclusive distribution agreement with Haier Germany, an operating room equipment specialist in the sale and distribution worldwide and the Middle East, at the Health exhibition in Dubai on January 31, 2024.

Saudi Arabia General Surgical Devices Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Products Covered | Handheld Devices, Laparoscopic Devices, Electro Surgical Devices, Wound Closure Devices, Trocars and Access Devices, Others |

| Applications Covered | Gynecology and Urology, Cardiology, Orthopaedic, Neurology, Others |

| Regions Covered | Northern and Central Region, Western Region, Eastern Region, Southern Region |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Saudi Arabia general surgical devices market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Saudi Arabia general surgical devices market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Saudi Arabia general surgical devices industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

General surgical devices refer to a broad range of medical instruments and tools used by healthcare professionals during various surgical procedures. These devices assist in tasks such as cutting, suturing, tissue manipulation, and wound closure, ensuring precision and safety in surgeries across multiple medical specialties.

The general surgical devices market in Saudi Arabia was valued at USD 162.4 Million in 2024.

The Saudi Arabia general surgical devices market is projected to exhibit a CAGR of 4.0% during 2025-2033, reaching a value of USD 231.0 Million by 2033.

Key factors driving the Saudi Arabia general surgical devices market include increased healthcare investments, a growing aging population, rising chronic diseases, technological innovations in surgical equipment, government healthcare reforms, growing patient awareness, and the rise of medical tourism in the region.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)