Saudi Arabia Foreign Exchange Market Report by Counterparty (Reporting Dealers, Non-Financial Customers, Others), Type (Currency Swap, Outright Forward and FX Swaps, FX Options), and Region 2026-2034

Market Overview:

Saudi Arabia foreign exchange market size reached USD 6.5 Billion in 2025. Looking forward, IMARC Group expects the market to reach USD 10.4 Billion by 2034, exhibiting a growth rate (CAGR) of 5.35% during 2026-2034. The growing advancements in technology, such as automation and algorithmic trading, rising use of trading robots, and increasing implementation of a series of regulatory reforms represent some of the key factors driving the market.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2025

|

|

Forecast Years

|

2026-2034

|

|

Historical Years

|

2020-2025

|

|

Market Size in 2025

|

USD 6.5 Billion |

|

Market Forecast in 2034

|

USD 10.4 Billion |

| Market Growth Rate 2026-2034 | 5.35% |

Foreign exchange (Forex) is the process of exchanging the currency of one country for another at an agreed-upon exchange rate. It serves as the backbone of international trade and investment and comprises a wide range of participants, ranging from central banks and financial institutions to individual investors. It is created through a global network of computers and brokers and facilitates currency transactions. It is categorized into spot, forward, futures, and options markets, offering different instruments for hedging, investing, and speculating. It is crucial for global economic stability, providing a mechanism for countries to adjust their currency values as per trade balances and economic conditions. It also acts as a barometer for global economic health, with exchange rates reflecting economic sentiments and policy decisions. It offers opportunities for diversification in investment portfolios, allows for risk management through hedging strategies, and provides a platform for arbitrage. It provides liquidity to the financial system, allowing businesses and investors to access capital and manage risk effectively.

Saudi Arabia Foreign Exchange Market Trends:

Oil Price Volatility

Saudi Arabia is highly reliant on oil exports, and the volatility of oil prices globally is constantly affecting its foreign exchange market. Being the world's largest exporter of oil, any shift in the price of crude oil is affecting the foreign exchange reserves and trade balances of the country directly. Saudi Arabia, the largest oil exporter globally, announced its plans to increase its August crude oil prices for Asian buyers to the highest level in four months, following a rise in spot prices due to the Iran-Israel conflict and strong summer fuel demand, according to trade sources When oil prices are increasing, Saudi Arabia is experiencing an improvement in revenues, which is rising the value of the Riyal, since foreign investors are pouring into the currency. When oil prices are decreasing, however, foreign exchange reserves of the country are being depleted, and the Riyal is depreciating. This consistent dependence on oil exports implies that trends in international oil prices are constantly influencing the foreign exchange environment of the country, affecting both short-run and long-run market conditions. The government closely keeps checking these trends to maintain currency stability.

Government Fiscal Policies

The Saudi government is adopting several fiscal policies which are constantly having an impact on its foreign exchange market. The Vision 2030 of the Kingdom is moving the economy off oil, and the policies that promote this transition are having an impact on the direction of foreign investment into the nation. Since the government is heavily investing in infrastructure, technology, and non-oil sectors, the foreign exchange market is responding to both the confidence investors have in these initiatives and to the fiscal well-being of the nation. In 2025, Saudi Arabia unveiled a new regulation that permits foreign investors to have restricted access to the real estate market in Mecca and Medina as part of its Vision 2030 initiative. This decision enables foreign investors to engage in real estate investments in these two cities via publicly traded companies. These policies are directly impacting the currency value. When the government is in surplus, there is additional liquidity flowing into the market that makes the currency stronger. Deficits or unforeseen fiscal difficulties have a devaluation effect on the currency when confidence in the market declines.

Monetary Policy and Interest Rates

The Saudi Central Bank (SAMA) is modifying interest rates based on domestic economic conditions as well as on factors outside the kingdom such as global trends of inflation. Since SAMA is controlling monetary policy, it is constantly influencing liquidity in the foreign exchange market. For example, when interest rates are increased to curb inflation, foreign investors are drawn toward the increased return and hence more demand for the Riyal rises. On the other hand, reduced interest rates can push investors away, resulting in less foreign exchange inflow. The foreign exchange market is always reacting to these changes since they influence investor sentiment, capital inflows, and the general appeal of Saudi Arabia's assets. As per an article by Arab News published in 2024, Saudi banks were set for a notable rise in profit margins in early 2025, fueled by expected interest rate reductions that should enhance their competitive edge over Gulf rivals.

Saudi Arabia Foreign Exchange Market Growth Drivers:

Global Economic Conditions

Saudi Arabia's foreign exchange market is persistently affected by general global economic trends. Such events as financial crises, global geopolitical tensions, and global inflationary trends continuously affect the trade flows and foreign investment of the country. When the world economy is uncertain, foreign investors will opt for safer assets, and it may either create more robust demand for Riyal or push the government to intervene in the market to stabilize the currency. Global economic trends also influence the demand for oil, which is constantly pushing Saudi Arabia's foreign exchange market. For instance, in times of global recessions, demand for oil goes down, and thus the foreign exchange reserves are reduced. On the other hand, global economic prosperity may lead to increased demand for oil, which increases the nation's reserves and strengthens the Riyal.

Geopolitical Risks and Regional Stability

Middle East geopolitical conditions are constantly influencing the foreign exchange market of Saudi Arabia. The Kingdom is keeping a close eye on tensions in the region, specifically with its immediate neighbors such as Iran, Iraq, and Yemen. Increased conflict or political tensions in the region can lead to drastic swings in investor sentiment, which can drive demand for safe-haven assets as well as possible fluctuations in the foreign exchange market. The foreign exchange market of Saudi Arabia is also influenced by its relationships with other world powers. Shifts in these diplomatic relations, either through trade or sanctions, are constantly altering the flow of capital in or out of the nation and thus influencing the demand for the Riyal.

Foreign Direct Investment (FDI) Inflows

Saudi Arabia is prioritizing the attraction of foreign direct investment under the economic diversification strategy of its Vision 2030. Saudi Arabia is constantly launching reforms to make the business environment more appealing, including regulatory reforms, tax credits, and work to simplify business operations. These initiatives are constantly affecting the foreign exchange market as they are constantly contributing to an increase in capital inflows. When international investors are more optimistic about the economy of the Kingdom and its long-term growth, they are more inclined to invest in the country, thereby increasing the demand for the Riyal. In turn, with a deceleration of FDI, the foreign exchange market can face liquidity deficiencies or decreased investor appetite, resulting in downward pressure on the currency.

Saudi Arabia Foreign Exchange Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country level for 2026-2034. Our report has categorized the market based on counterparty and type.

Counterparty Insights:

To get more information on this market, Request Sample

- Reporting Dealers

- Non-financial Customers

- Others

The report has provided a detailed breakup and analysis of the market based on the counterparty. This includes reporting dealers, non-financial customers, and others.

Type Insights:

- Currency Swap

- Outright Forward and FX Swaps

- FX Options

A detailed breakup and analysis of the market based on the type have also been provided in the report. This includes currency swap, outright forward and FX swaps, and FX options.

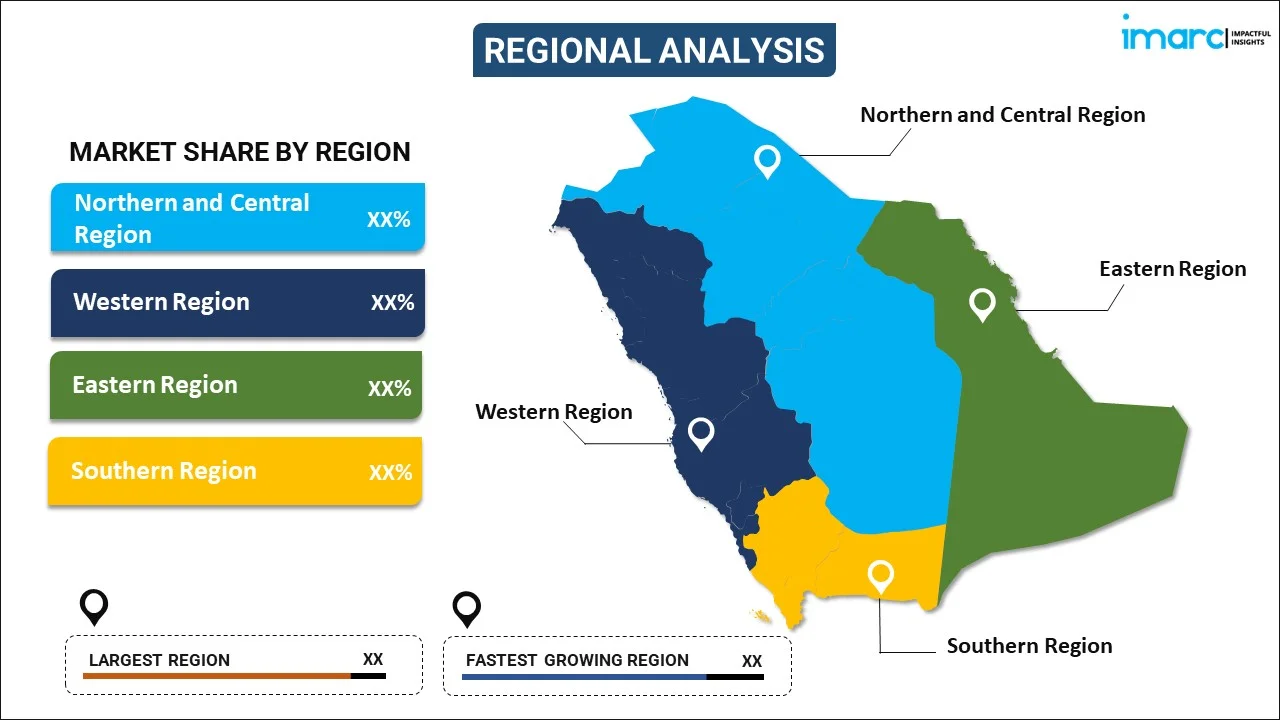

Regional Insights:

- Northern and Central Region

- Western Region

- Eastern Region

- Southern Region

The report has also provided a comprehensive analysis of all the major regional markets, which include Northern and Central Region, Western Region, Eastern Region, and Southern Region.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape in the market. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Saudi Arabia Foreign Exchange Market News:

- September 2025: MoneyGram, a prominent worldwide payment network for individuals, enterprises, and communities, has entered into a Memorandum of Understanding (MoU) with Enjaz Payment Services, one of the biggest remittance-oriented fintech firms in Saudi Arabia. The revelation was disclosed at the first edition of Money20/20 Middle East, the leading platform for the fintech and financial sector.

- August 2025: Saudi Arabia’s stock market has suggested a series of rule modifications designed to expand investor access to its Parallel Market, in an effort that could enhance listings and increase capital market engagement. The Saudi Exchange Co., or Tadawul, announced proposed changes to its exchange regulations for public review, seeking input until Aug. 19, as stated in a release. The suggested reforms focus on redefining “qualified investors,” relaxing listing criteria for the Parallel Market, referred to as Nomu, and aligning current regulations with changes under the new Companies Law.

- May 2025: AstroLabs, the primary business growth platform in the Gulf region, has collaborated with Saudi Awwal Bank “SAB”. This collaboration aims to assist the ambitions of rapidly expanding firms looking to enter and broaden their operations in the Kingdom of Saudi Arabia, while also reinforcing SAB’s dedication to the Kingdom’s objective of enhancing private sector involvement in the economy (targeting a 65% contribution to GDP from the private sector by 2030). SAB is a prominent entity in Saudi Arabia and the region regarding foreign exchange, trade finance, wholesale banking, digital service advancement, and ESG, setting the standard for transformation and excellence.

Saudi Arabia Foreign Exchange Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Billion USD |

| Scope of the Report | Exploration of Historical and Forecast Trends, Industry Catalysts and Challenges, Segment-Wise Historical and Predictive Market Assessment:

|

| Counterparties Covered | Reporting Dealers, Non-Financial Customers, Others |

| Types Covered | Currency Swap, Outright Forward and FX Swaps, FX Options |

| Regions Covered | Northern and Central Region, Western Region, Eastern Region, Southern Region |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Saudi Arabia foreign exchange market from 2020-2034.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Saudi Arabia foreign exchange market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Saudi Arabia foreign exchange industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The foreign exchange market in Saudi Arabia was valued at USD 6.5 Billion in 2025.

The Saudi Arabia foreign exchange market is projected to exhibit a CAGR of 5.35% during 2026-2034, reaching a value of USD 10.4 Billion by 2034.

Key factors driving the Saudi Arabia foreign exchange market include oil price fluctuations, government fiscal policies, interest rates set by the Saudi Central Bank (SAMA), global economic conditions, geopolitical risks, and foreign direct investment inflows. These factors influence demand for the Riyal, investor confidence, and currency stability.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)