Saudi Arabia Foodservice Market Size, Share, Trends and Forecast by Foodservice Type, Outlet, Location, and Region, 2025-2033

Saudi Arabia Foodservice Market Size and Share:

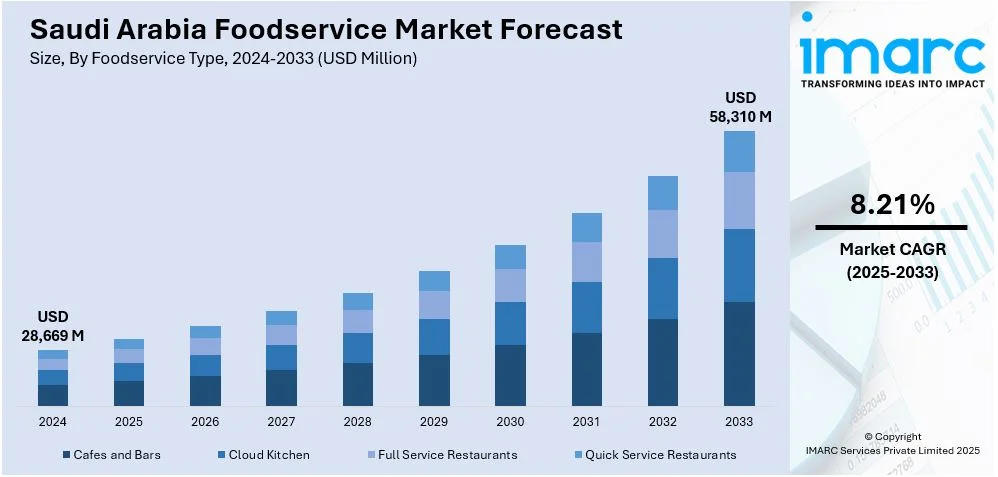

The Saudi Arabia foodservice market size was valued at USD 28,669 Million in 2024. Looking forward, IMARC Group estimates the market to reach USD 58,310 Million by 2033, exhibiting a CAGR of 8.21% from 2025-2033. The market is driven by a rising number of restaurants and demographic shifts, such as growth in urban population, income shifts, and lifestyle changes that propel new restaurant openings.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 28,669 Million |

| Market Forecast in 2033 | USD 58,310 Million |

| Market Growth Rate (2025-2033) | 8.21% |

The Saudi food service market share is growing remarkably due to urbanization, changing consumer preferences, and government-led initiatives. Urbanization is a critical driver since more than 80% of the population is expected to be living in cities by 2030, as per TCS Sustainathon. The demographic shift brings economic activities and modern lifestyles to cities, thus creating fertile ground for food service expansion. Urban centers with their changing demographics and heightened accessibility are hubs for innovation in the experience of dining. For young consumers in these cities , wide-ranging options in culinary experiences range from quick meals and casual dining to international fare, particularly premium international offerings. Other than this, the Saudi Government's Vision 2030 program, which focuses on tourism, entertainment, and cultural development, has stimulated the setting up of new food service outlets. These local restaurants cater to locals and accommodate international tourists increasing day by day.

Another influential result of urbanization has been major changes in the way of living, which directly and consequently affect food habits, thereby increasing the Saudi Arabia food service demand. Increasing two-income family size and higher professionalism have caused hectic schedules, thereby forcing individuals to opt for quicker food service . This has opened numerous opportunities for quick-service restaurants and takeaways. Besides this, the integration of technology has brought about an important change in consumer experience, mainly with food delivery applications and ordering platforms, hence facilitating the increase of food service in urban locations.

Saudi Arabia Foodservice Market Trends:

Rise of online food delivery platforms

The rapid increase in online food delivery services due to growing smartphone penetration, urbanization, and changing lifestyles, is one of the major factor driving Saudi Arabia food service market growth. HungerStation, Jahez, and UberEats have become part of the dining experience, providing convenience and variety. The trend is still going on post-pandemic, fueled by contactless delivery preferences and innovative apps offering seamless ordering and payment options. Restaurants are adapting by enhancing their digital presence and even partnering with delivery services. Cloud kitchens are further driving the momentum of the Saudi Arabia foodservice market by offering the food product just for delivery purposes, as this reduces overhead costs.. This trend indicates a shift from the food service industry to tech-enabled convenience.

Increasing demand for health-conscious dining

Health and wellness trends are transforming the Saudi food service landscape. Increasing awareness of lifestyle-related diseases has made consumers more conscious of their meal choices, prompting a focus on nutritious, organic, and low-calorie food options.. Restaurants have responded to this trend by providing healthier menus that include gluten-free, vegan, and keto-friendly dishes for the diverse tastes of consumers. Support from Vision 2030 through healthy eating initiatives urges restaurants to adopt national health objectives. Other growing popular trends include juice bars and salad-focused restaurants. This shows a growing demand for balanced eating, which in itself is a reflection of a cultural shift toward health-consciousness and provides opportunities for innovation in menu offerings.

Rise in tourism-driven food experiences

With tourism as the core thrust of Saudi Arabia's Vision 2030, the food service demand is evolving beyond recognition. Tourist traffic from around the world is providing an impetus for a wide variety of gastronomic experiences, from luxurious meals to local flavors. According to the Ministry of Tourism, 4.2 million tourists visited the country for vacations and entertainment in the first seven months of 2024, making it one of the most appealing destinations in the world. High-end restaurants, food festivals, and cultural dining events that cater to global palates are sprouting in tourist hotspots like Riyadh and Jeddah. Initiatives such as Riyadh Season and AlUla's Winter at Tantora Festival have been promoting traditional dishes alongside innovative interpretations, attracting food enthusiasts from around the world. Experiential dining can also be embraced by desert feasts and heritage village meals, where international tourists are immersed in Saudi culture.

Saudi Arabia Foodservice Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the Saudi Arabia foodservice market, along with forecasts at the country and regional levels from 2025-2033. The market has been categorized based on foodservice type, outlet, and location.

Analysis by Foodservice Type:

- Cafes and Bars

- By Cuisine

- Cafes

- Juice/Smoothie/Desserts Bars

- Specialist Coffee and Tea Shops

- By Cuisine

- Cloud Kitchen

- Full Service Restaurants

- By Cuisine

- Asian

- European

- Latin American

- Middle Eastern

- North American

- Others

- By Cuisine

- Quick Service Restaurants

- By Cuisine

- Bakeries

- Burger

- Ice Cream

- Meat-based Cuisines

- Pizza

- Others

- By Cuisine

Cafes and bars are diverse establishments that cater to Saudi Arabia's social and leisure culture. Cafes are popular for their cozy ambiance and offerings such as coffee, tea, and light snacks, making them social hubs for young adults and professionals. Juice/smoothie/dessert bars appeal to health-conscious consumers and families with refreshing beverages and indulgent sweets. Specialized coffee and tea stores focus on upscale markets and focus on high-end, artisanal brewing experiences.

Cloud kitchens represent a flexible delivery-only model, driven by increasing orders placed online with the growth in delivery apps and digital platforms. These virtual kitchens can save operators money as they do not need dine-in space while still providing extensive menus. The Saudi Arabia food service market analysis reveals that these trends align with evolving consumer demands, showcasing the sector's adaptability and growth potential across various segments.

Full-service restaurants offer an immersive dining experience, from Asian, with its bold flavors and spices, to European, offering classic and contemporary dishes. Latin American, known for vibrant and hearty meals. Middle Eastern, reflecting traditional Saudi and regional dishes. North American, featuring comfort food and fast-casual concepts.

Quick service restaurants (QSRs) are categorized into bakeries, which serve fresh bread, pastries, and desserts such as kunafa. Burger outlets appeal to young, urban consumers with fast, customizable meals. Ice cream parlors provide refreshing treats in a wide range of flavors. Meat-based cuisines offer favorites such as shawarma, kebabs, and barbecue. Pizza outlets are popular for their customizable menus and group dining appeal.

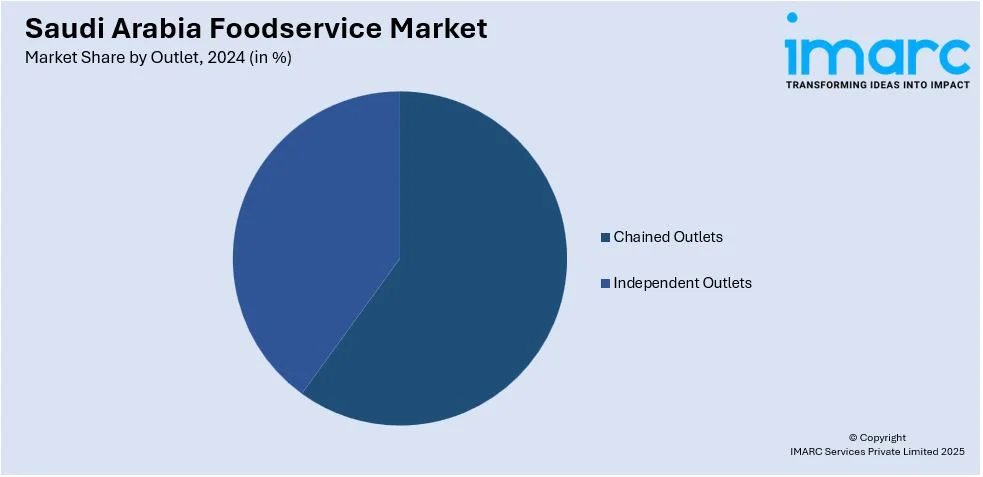

Analysis by Outlet:

- Chained Outlets

- Independent Outlets

Chained food service outlets, such as international franchises and regional brands, hold a significant market share in urban areas due to superior quality, efficient service, and brand recognition. All these food service outlets cater to a diverse clientele spectrum, which includes locals, expats, and tourists, and offer standardized menus and promotional offers. They are mostly used in shopping malls, entertainment centers, and travel hubs.

The independent outlets are crucial in the preservation of Saudi Arabia's culinary heritage. These standalone businesses are usually family-owned and rely on authentic recipes, personalized service, and a unique dining experience. They are highly favored in smaller towns and among consumers who want to have a sense of exclusivity and cultural authenticity. Independent outlets have niche menus from traditional Saudi dishes to innovative fusion concepts, making it a valuable niche in areas not saturated by the big chains. It emphasizes sustainability, sourcing from the local environment, and community eating. Besides those tactics, such as seasonal menus and loyalty schemes, independent retailers can even prosper in an otherwise very competitive urban environment, like Riyadh.

Analysis by Location:

- Leisure

- Lodging

- Retail

- Standalone

- Travel

Leisure locations, including amusement centers, theme parks, and cultural festivals, have gained immense popularity for food service outlets as they cater to different kinds of consumers like family groups, tourists, and youngsters through diversified offerings.

Lodging locations, which include hotels and resorts, center on upscale dining experiences, serving local and international cuisines to business travelers and tourists looking for convenience and luxury.

Retail locations in malls and shopping centers are vital food service hubs, with quick-service outlets, full-service restaurants, and everything in between, giving shoppers a variety of fast and leisurely dining options.

Standalone locations, often situated in high-traffic areas or scenic spots, provide unique dining atmospheres, with traditional decor and innovative menus drawing in both locals and visitors. Travel destinations, like airports, train stations, and highway stops, are fast food destinations that serve travelers with quick and easy access to recognizable global brands and quick-service options. Such places benefit immensely from increased mobility and international tourism, ensuring a steady flow of foot traffic and constant demand for efficient service.

Regional Analysis:

- Northern and Central Region

- Western Region

- Eastern Region

- Southern Region

The Northern and Central region, anchored by Riyadh, is a major hub for business and tourism, offering a thriving market for diverse dining options. High disposable incomes and urbanization boost the growth of cafes, full-service restaurants, and cloud kitchens.

The Western region by Jeddah and Makkah benefits from religious tourism as well as local culture in that the traditional Middle Eastern eateries, quick-service restaurants, international dining, and so forth get to service the high influx of pilgrims and tourists. Barn's coffee chain opened a drive-thru location in Jeddah's Town Square, marking a milestone for the brand, which has 700 stores across Saudi Arabia in 2024, as per Qahwa World.

The influence of its industrial and expat-driven population gives the Eastern region, including Dammam and Al-Khobar, the demand for global cuisines, cloud kitchens, and casual dining.

The Southern region reflects a mix of traditional and modern trends, with growing urban centers supporting quick-service and independent food outlets.

Competitive Landscape:

The major market players are indulging in expansion, innovation, and digitization, aligned with the Saudi Vision 2030. The FFCC states that the Saudi Vision 2030 aims to diversify the food service market by raising the number of cafes per million from its current count of 258 to 1,000 per million. International food chains are increasing their footprint and utilizing the new urban population with increasing disposable income. Cloud kitchen models have urged players to deploy more innovative delivery-focused formats that ensure a more efficient model for operations catering to booming online food deliveries. Several of the operators have resorted to technology-backed solutions such as AI-powered ordering systems and mobile apps to maximize customer convenience and loyalty. Sustainability is becoming an important area of focus, where products focus on eco-friendly packaging, avoiding food waste, and health-conscious dining options are popular that emphasize the entry of organic, plant-based, and low-calorie offerings to the menu, in line with changing consumer preferences.

Latest News and Developments:

- In December 2024, Zuma Riyadh, the famous Japanese izakaya, was officially launched within the King Abdullah Financial District with MJS Holding. The two levels of interactive sushi and robata counters also include private dining rooms and a lounge, all designed to offer signature dishes as well as a Riyadh-exclusive dessert.

- In July 2024, Epik Foods opened its first brick-and-mortar restaurant, Healthy & Co, in Riyadh, Saudi Arabia, after launching 13 delivery-only kitchens earlier. Located in Al Sahafah, the 175 sqm restaurant catered to the growing demand for healthy dining. Plans included expanding to Jeddah and Khobar through a partnership with GymNation.

- In August 2024, SUSHISAMBA, a globally popular restaurant that is popular among Dubai's royal family, announced its Riyadh, Saudi Arabia opening at KAFD by the end of August 2024. It serves Japanese, Peruvian, and Brazilian fusion food and boasts iconic decor like a central bar and bamboo lighting.

- On September 2024, Pizza Hut, with Americana Restaurants, has initiated its "Opportunity4All" program, with the country's first restaurant operated by people with special needs. Located in Riyadh, it promotes inclusiveness and aligns with Saudi Vision 2030. The Sa3ee company and the Ministry of Human Resources support the expansion of the initiative across the Middle East.

Saudi Arabia Foodservice Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Foodservice Types Covered |

|

| Outlets Covered | Chained Outlets, Independent Outlets |

| Locations Covered | Leisure, Lodging, Retail, Standalone, Travel |

| Regions Covered | Northern and Central Region, Western Region, Eastern Region, Southern Region |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Saudi Arabia foodservice market from 2019-2033.

- The research study provides the latest information on the market drivers, challenges, and opportunities in the Saudi Arabia foodservice market.

- Porter's Five Forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Saudi Arabia foodservice industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

Foodservice refers to any kind of service outside the home, which delivers food and beverage. It deals with restaurants, cafeterias, catering, and institutional outlets such as schools and hospitals. Its applications include restaurants, catering events, meals in the workplace, and nutritional programs in institutions or schools.

The Saudi Arabia foodservice market was valued at USD 28,669 Million in 2024.

IMARC estimates the Saudi Arabia foodservice market to exhibit a CAGR of 8.21% during 2025-2033.

The market is driven by a rising number of restaurants and demographic shifts, such as growth in urban population, income shifts, and lifestyle changes that cater to new restaurant openings.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)