Saudi Arabia Food Processing Machinery Market Size, Share, Trends and Forecast by Type, Application, and Region, 2026-2034

Saudi Arabia Food Processing Machinery Market Overview:

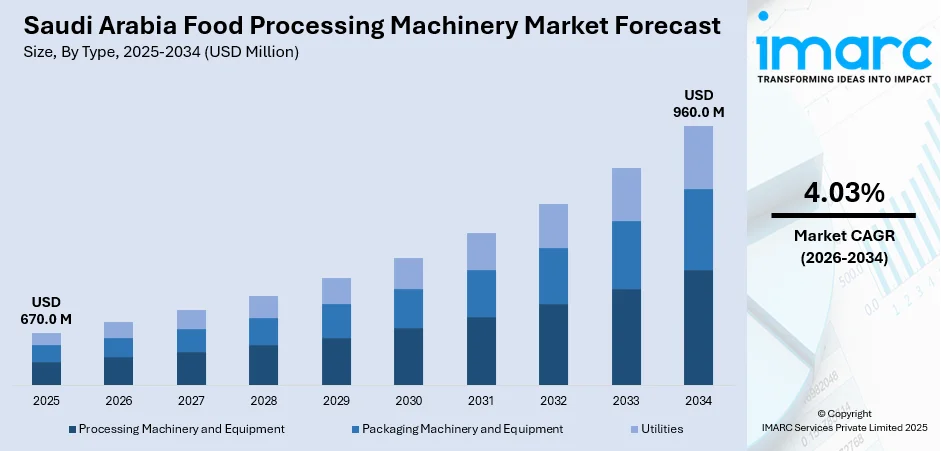

The Saudi Arabia food processing machinery market size reached USD 670.0 Million in 2025. Looking forward, IMARC Group expects the market to reach USD 960.0 Million by 2034, exhibiting a growth rate (CAGR) of 4.03% during 2026-2034. The market is driven by rising demand for processed foods, ongoing technological advancements in machinery, increasing need for health-conscious products, supportive government initiatives, and expanding export opportunities for processed goods.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2025 |

|

Forecast Years

|

2026-2034

|

|

Historical Years

|

2020-2025

|

| Market Size in 2025 | USD 670.0 Million |

| Market Forecast in 2034 | USD 960.0 Million |

| Market Growth Rate (2026-2034) | 4.03% |

Saudi Arabia Food Processing Machinery Market Trends:

Rising Demand for Processed and Packaged Foods

The growing demand for processed and packaged foods in Saudi Arabia is fueling the food processing machinery market. As per industry reports, the kingdom of Saudi Arabia is an active importer of U.S. processed foods, the top market in the GCC-6 bringing in around USD 533.8 Million in 2022, an increase of 16% from the prior year. Urbanization and a fast-paced lifestyle have led to a shift in consumer preferences toward convenient food options, such as ready-to-eat meals and frozen foods. This transition has encouraged manufacturers to adopt advanced machinery that can streamline processes, increase production capacity, and ensure quality control, all of which are critical in meeting higher consumer expectations. With this, the influx of immigrants who are expatriates with varying food requirements has increased the demand for additional products in the product line of processed foods, providing another avenue for the machines that are used to process these various food lines in the bakery, dairy among others. Tourism growth also increases this consumption of processed foods by individuals, and this supports growth in the infrastructure of the food processing industries.

To get more information on this market, Request Sample

Government Support and Initiatives to Enhance Domestic Production

The Saudi government’s Vision 2030 program plays a significant role in the growth of the food processing machinery market. As part of its goal to diversify the economy, the government has prioritized food security and sustainability, which includes a robust domestic food production sector. The government has taken these domestic production initiatives in various areas. This support has led to increased investments in advanced machinery to improve production efficiency and meet domestic demand. On 30th January 2025, Simplex successfully obtained USD 13 Million in funding to establish a CNC manufacturing facility spanning 20,000 square meters in Riyadh. This initiative aligns with Saudi Arabia's Vision 2030 and its goals for industrial growth. Scheduled to commence operations in 2026, the factory is designed to increase the production of CNC machines and strengthen the company's presence in the global market. As more local companies invest in automation and specialized machinery, they contribute to the sector's growth, aligning with the government’s broader economic objectives of reducing reliance on imports and building a self-sufficient food industry.

Growing Emphasis on Health and Wellness Products

Health and wellness are now the central focus of Saudi consumers. As a result, individuals are demanding nutritious and organic food products. This requires a change in the food processing companies to equip themselves with machines that can handle organic ingredients as well as low sugar, low fat, and additives-free products. On 26th November 2025, LT Foods established a new office in Riyadh, Saudi Arabia, committing an investment of SAR 185 Million over the next five years to enhance its presence in the rice and organic food sectors. The company targets a revenue of SAR 435 Million and intends to pursue local manufacturing in collaboration with SALIC as a strategic partner. High pressure processing and cold-press technology, which are developed without any degradation of the ingredients, are gaining more momentum. Moreover, the growing demand for vegan and plant-based products has increased interest in processing equipment that can accommodate alternative ingredients such as plant-based proteins and grains. The food processing equipment that accommodates these products allows food manufacturers to introduce new lines and follow the trend toward healthier food. This is changing the nature of the product line and driving a need for dedicated, health-oriented processing equipment.

Saudi Arabia Food Processing Machinery Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the regional level for 2026-2034. Our report has categorized the market based on type and application.

Type Insights:

- Processing Machinery and Equipment

- Packaging Machinery and Equipment

- Utilities

The report has provided a detailed breakup and analysis of the market based on the type. This includes processing machinery and equipment, packaging machinery and equipment, and utilities.

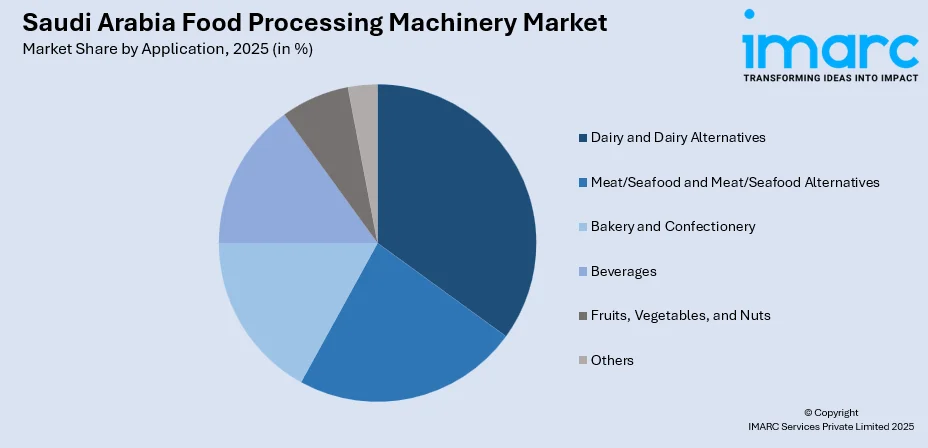

Application Insights:

- Dairy and Dairy Alternatives

- Meat/Seafood and Meat/Seafood Alternatives

- Bakery and Confectionery

- Beverages

- Fruits, Vegetables, and Nuts

- Others

A detailed breakup and analysis of the market based on the application have also been provided in the report. This includes dairy and dairy alternatives, meat/seafood and meat/seafood alternatives, bakery and confectionery, beverages, fruits, vegetables, and nuts, and others.

Regional Insights:

- Northern and Central Region

- Western Region

- Eastern Region

- Southern Region

The report has also provided a comprehensive analysis of all the major regional markets, which include Northern and Central Region, Western Region, Eastern Region, and Southern Region.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Saudi Arabia Food Processing Machinery Market News:

- July 8, 2025: DC Norris, a global leader in food processing equipment manufacturing, announced a new strategic partnership with Zakka Multitec KSA. Zakka Multitec KSA will serve as the agents for DC Norris in Saudi Arabia. This partnership marks a significant milestone for both companies, aiming to expand DC Norris’s presence in the Middle Eastern market and provide advanced food and beverage processing solutions to a wider range of clients in the region.

Saudi Arabia Food Processing Machinery Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered | Processing Machinery and Equipment, Packaging Machinery and Equipment, Utilities |

| Applications Covered | Dairy and Dairy Alternatives, Meat/Seafood and Meat/Seafood Alternatives, Bakery and Confectionery, Beverages, Fruits, Vegetables, and Nuts, Others |

| Regions Covered | Northern and Central Region, Western Region, Eastern Region, Southern Region |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Saudi Arabia food processing machinery market performed so far and how will it perform in the coming years?

- What is the breakup of the Saudi Arabia food processing machinery market on the basis of type?

- What is the breakup of the Saudi Arabia food processing machinery market on the basis of application?

- What is the breakup of the Saudi Arabia food processing machinery market on the basis of region?

- What are the various stages in the value chain of the Saudi Arabia food processing machinery market?

- What are the key driving factors and challenges in the Saudi Arabia food processing machinery market?

- What is the structure of the Saudi Arabia food processing machinery market and who are the key players?

- What is the degree of competition in the Saudi Arabia food processing machinery market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Saudi Arabia food processing machinery market from 2020-2034.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Saudi Arabia food processing machinery market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Saudi Arabia food processing machinery industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)