Saudi Arabia Fire Fighting Chemicals Market Size, Share, Trends and Forecast by Type, Chemicals, Application, and Region, 2026-2034

Saudi Arabia Fire Fighting Chemicals Market Overview:

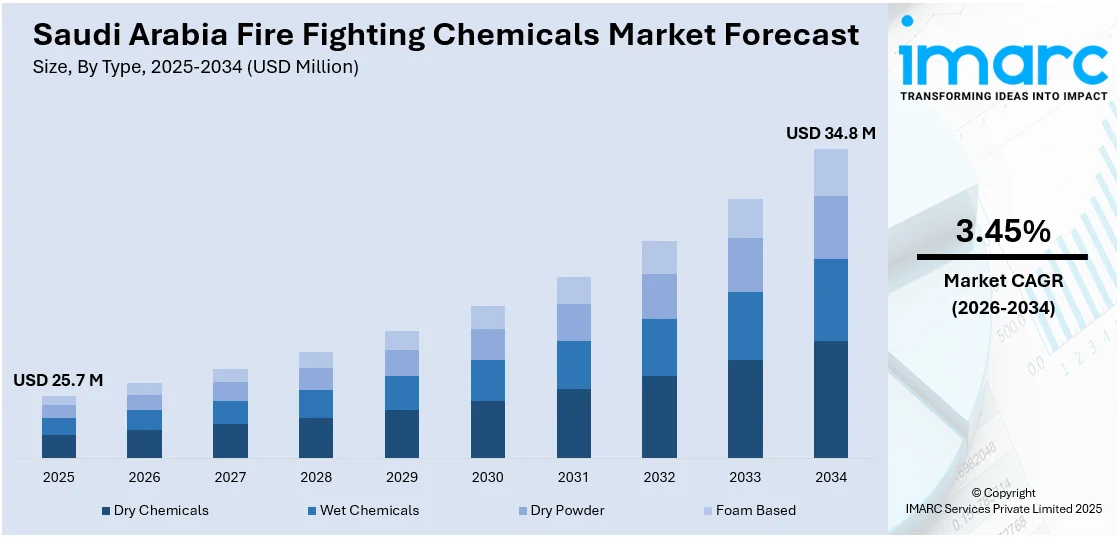

The Saudi Arabia fire fighting chemicals market size reached USD 25.7 Million in 2025. Looking forward, IMARC Group expects the market to reach USD 34.8 Million by 2034, exhibiting a growth rate (CAGR) of 3.45% during 2026-2034. The market is driven by the growing improvements in industrial and infrastructure development, enforcement of strict codes and inspection protocols for residential, commercial, and industrial premises, and increasing focus on workplace safety and proactive risk management in Saudi Arabia.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2025 |

|

Forecast Years

|

2026-2034

|

|

Historical Years

|

2020-2025

|

| Market Size in 2025 | USD 25.7 Million |

| Market Forecast in 2034 | USD 34.8 Million |

| Market Growth Rate 2026-2034 | 3.45% |

Saudi Arabia Fire Fighting Chemicals Market Trends:

Improvements in Industrial and Infrastructure Development

The swift industrialization and infrastructure development in Saudi Arabia, fueled by Vision 2030 and mega-scale development projects like NEOM and the Red Sea Project, are driving the demand for fire safety systems, including fire fighting chemicals. The Saudi government approved a major 2025 budget of SR1.3tn ($342.7bn) in November 2024 to innovate the construction sector. Latest figures from the Investment Ministry showed that 3,800 building licenses were granted in 2024, demonstrating a significant upward trend in sector activity. These ambitious steps include the development of smart cities, airports, petrochemical plants, power plants, and commercial centers, all of which need to meet strict safety standards. Fire fighting chemicals are also helping in controlling fire dangers, particularly in those areas with flammable material susceptibilities like oil and gas installations and extensive building construction sites. Chemical agents involved in the process of extinguishing fires like dry powders, foams, and clean agents are essential in these high-end safety systems.

To get more information on this market Request Sample

Growing Stringency of Fire Safety Regulations

The government of Saudi Arabia is implementing progressively tighter fire safety rules to keep pace with global standards and safeguard lives and property. Regulatory bodies like the Saudi Civil Defense have enforced strict codes and inspection protocols for residential, commercial, and industrial premises. Adherence to these regulations requires the installation and regular servicing of fire suppression systems, which in turn necessitate the use of fire fighting chemicals. These practices are especially essential in high-risk environments such as oil refineries, petrochemical facilities, and airports. Moreover, insurance providers frequently require certified fire protection systems as a condition of coverage, further encouraging companies to invest in effective fire suppression solutions. Such regulatory pressure provides a stabilized baseline level demand for fire fighting chemicals like Aqueous Film Forming Foam (AFFF), dry chemical powder, and CO₂-based suppressants that develops replacement and new installation markets in differing industries. In Intersec Saudi Arabia 2024 various strategies to maintain fire safety were discussed to avoid any dangerous situation in the country. The event had a discussion panel conducted by Neil Odin, Chief Fire Officer from the UK National Fire Chiefs Council.

Rising Awareness About Occupational Safety and Risk Management

There is an increase in the focus on workplace safety and proactive risk management in Saudi Arabia, mainly in industries, such as oil and gas, construction, manufacturing, and transport. Firms are spending heavily on health, safety, and environment (HSE) programs to safeguard employees, prevent operations disruptions, and ensure both local and international safety regulations. Fire risks are among the highest threats covered in these programs, and this is resulting in the incorporation of sophisticated fire detection and suppression systems. Fire fighting chemicals play a vital role in these systems, providing quick and efficient extinguishing of Class A, B, and C fires. In addition, regular drills, inspections, and maintenance schedules guarantee a recurring need for replenishment and testing of fire fighting chemicals. This shift towards emphasizing safety culture in industries significantly contributes to market growth and technological innovation in fire suppression solutions. Moreover, Saudi Arabia will implement new Saudi Building Code (SBC) and Saudi Fire Code (SFC) regulations in mid-2025 as the construction industry in the country continues to expand. Ahead of the regulatory updates, AESG has grown its Fire & Life Safety business in Saudi Arabia by recruiting fire protection engineers, senior fire protection engineers, and principal fire protection engineers.

Saudi Arabia Fire Fighting Chemicals Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the region level for 2026-2034. Our report has categorized the market based on type, chemicals, and application.

Type Insights:

- Dry Chemicals

- Wet Chemicals

- Dry Powder

- Foam Based

The report has provided a detailed breakup and analysis of the market based on the type. This includes dry chemicals, wet chemicals, dry powder, and foam based.

Chemicals Insights:

- Monoammonium Phosphate

- Halon

- Carbon Dioxide

- Potassium Bicarbonate

- Potassium Citrate

- Sodium Chloride

- Others

A detailed breakup and analysis of the market based on the chemicals have also been provided in the report. This includes monoammonium phosphate, halon, carbon dioxide, potassium bicarbonate, potassium citrate, sodium chloride, and others.

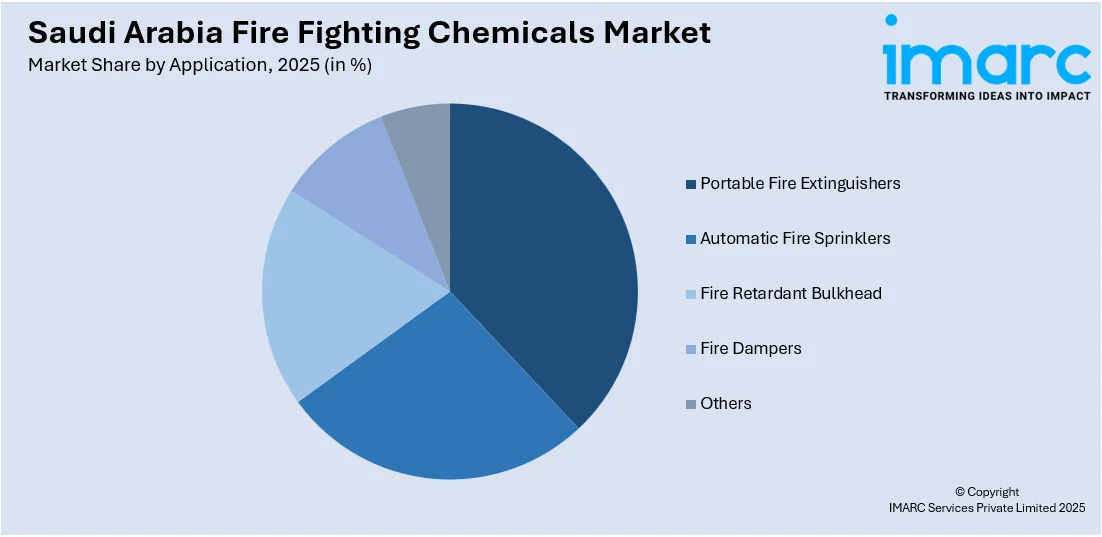

Application Insights:

Access the comprehensive market breakdown Request Sample

- Portable Fire Extinguishers

- Automatic Fire Sprinklers

- Fire Retardant Bulkhead

- Fire Dampers

- Others

A detailed breakup and analysis of the market based on the application have also been provided in the report. This includes portable fire extinguishers, automatic fire sprinklers, fire retardant bulkhead, fire dampers, and others.

Regional Insights:

- Northern and Central Region

- Western Region

- Eastern Region

- Southern Region

The report has also provided a comprehensive analysis of all the major regional markets, which include northern and central region, western region, eastern region, and southern region.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Saudi Arabia Fire Fighting Chemicals Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered | Dry Chemicals, Wet Chemicals, Dry Powder, Foam Based |

| Chemicals Covered | Monoammonium Phosphate, Halon, Carbon Dioxide, Potassium Bicarbonate, Potassium Citrate, Sodium Chloride, Others |

| Applications Covered | Portable Fire Extinguishers, Automatic Fire Sprinklers, Fire Retardant Bulkhead, Fire Dampers, Others |

| Regions Covered | Northern and Central Region, Western Region, Eastern Region, Southern Region |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Saudi Arabia fire fighting chemicals market performed so far and how will it perform in the coming years?

- What is the breakup of the Saudi Arabia fire fighting chemicals market on the basis of type?

- What is the breakup of the Saudi Arabia fire fighting chemicals market on the basis of chemicals?

- What is the breakup of the Saudi Arabia fire fighting chemicals market on the basis of application?

- What are the various stages in the value chain of the Saudi Arabia fire fighting chemicals market?

- What are the key driving factors and challenges in the Saudi Arabia fire fighting chemicals market?

- What is the structure of the Saudi Arabia fire fighting chemicals market and who are the key players?

- What is the degree of competition in the Saudi Arabia fire fighting chemicals market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Saudi Arabia fire fighting chemicals market from 2020-2034.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Saudi Arabia fire fighting chemicals market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Saudi Arabia fire fighting chemicals industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)