Saudi Arabia Feed Additives Market Size, Share, Trends and Forecast by Type, Animal Type, and Region, 2026-2034

Saudi Arabia Feed Additives Market Size and Share:

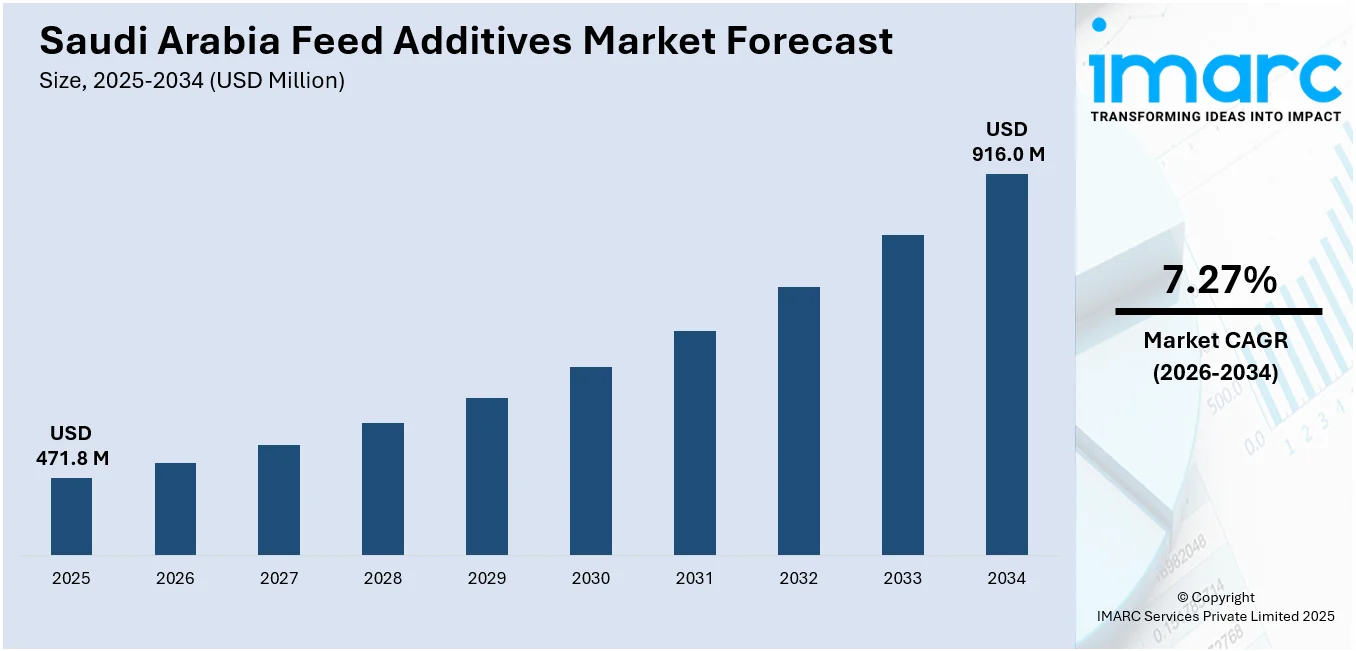

The Saudi Arabia feed additives market size was valued at USD 471.8 Million in 2025. Looking forward, IMARC Group estimates the market to reach USD 916.0 Million by 2034, exhibiting a CAGR of 7.27% from 2026-2034. The market is experiencing significant growth mainly due to increasing livestock production and demand for nutrient-dense animal protein. Rising investments in poultry and aquaculture sectors along with a growing focus on enhancing animal health and feed efficiency are driving market expansion. Technological advancements further boost industry development.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2025 |

|

Forecast Years

|

2026-2034

|

|

Historical Years

|

2020-2025

|

| Market Size in 2025 | USD 471.8 Million |

| Market Forecast in 2034 | USD 916.0 Million |

| Market Growth Rate (2026-2034) | 7.27% |

The feed additives market in Saudi Arabia is experiencing notable growth driven by the increasing demand for high-quality animal protein. A rising population and shifting dietary habits are leading to a greater need for efficient livestock production. As per industry reports, Saudi Arabia produced a record 558,000 metric tons of poultry meat in the first half of 2024 marking a 9% rise compared to the previous year. The government is aspiring for self-sufficiency in poultry as part of Vision 2023, to produce 16 million birds or 12,000 metric tons of pigeon meat each year. Various feed additives including amino acids, vitamins, and enzymes are significantly improving animal health and productivity resulting in enhanced meat and dairy production. Government support for the livestock sector and strict quality standards are encouraging producers to adopt advanced feed additives to satisfy the rising domestic market needs.

To get more information on this market Request Sample

The increasing focus on sustainable farming practices and animal welfare is also boosting the market. Many producers are opting for natural additives like probiotics and phytogenics to enhance feed efficiency and lessen the use of antibiotics. Substantial investments in agriculture and animal husbandry in the country are encouraging innovation in feed additive formulations. For instance, in February 2024, NEOM launched an aquaculture joint venture Topian Aquaculture with Tabuk Fisheries Company aiming to produce 600,000 tons of fish annually by 2030. The initiative includes a major hatchery and a partnership with Pure Salmon to create a regionally pioneering facility for local salmon production enhancing food security in Saudi Arabia. With continuous technological progress and a move towards ecofriendly solutions, the market is set for consistent growth in the years ahead.

Saudi Arabia Feed Additives Market Trends:

Rising Demand for Animal Protein

The increasing demand for animal protein in Saudi Arabia is driving the need for feed additives. With an expanding population, urban growth, and evolving dietary habits there is a significant rise in the consumption of poultry, beef, and dairy products. According to industry reports, in 2024, Saudi Arabia's population stands at 34,239,771 with an estimated mid-year figure of 33,962,757. Comprising 0.42% of the global population. The country has a density of 16 people per Km² with 92.3% living in urban areas. Livestock producers are using feed additives to enhance feed efficiency, improve growth rates, and promote better health outcomes. Additives like amino acids, probiotics, and vitamins are essential in fulfilling production requirements while upholding high-quality standards. This trend is further intensified by Saudi Arabia's initiatives to enhance local food production ensuring a stable supply of animal protein to satisfy consumer demands.

Government Initiatives for Food Security

The Saudi government is actively prioritizing food security by investing in the livestock sector to reduce dependency on imports and achieve self-sufficiency. Through initiatives like Vision 2030 significant funding is being directed toward modernizing agricultural practices and improving livestock productivity. For example, in October 2024, the Ministry of Environment, Water and Agriculture in Saudi Arabia obtained SAR 37 billion ($9.8 billion) in private investments to enhance its agricultural and food industries. The initiatives aligned with Vision 2030 focus on enhanced crop production, livestock, fisheries, and necessary infrastructure supported by various investor incentives. Feed additives play a crucial role in these efforts enhancing animal nutrition, health, and growth efficiency. By encouraging the use of vitamins, minerals, and probiotics the government aims to support sustainable production while meeting rising consumer demand for animal protein.

Growth in the Poultry Sector

Saudi Arabia’s poultry industry is experiencing significant expansion due to a rising need for affordable and high quality animal protein. This growth is fueled by population increases and shifting dietary preferences prompting the sector to enhance production to satisfy local demands. For instance, in November 2024, Brazilian food company BRF announced its partnership with Saudi Arabia's Halal Products Development Company to invest $84.3 million in Addoha Poultry enhancing local poultry production. This initiative supports Saudi Vision 2030 objectives aiming to meet the growing demand for halal foods and strengthen BRF's presence in the regional market. To enhance efficiency and ensure healthy poultry farmers are increasingly utilizing feed additives such as probiotics, prebiotics, and acidifiers. These additives improve feed conversion rates, strengthen bird immunity, and lower the reliance on antibiotics in line with global standards. The swift industrial development of poultry farming backed by governmental support and investments further propels the demand for advanced nutritional solutions ensuring sustainable production and better bird health.

Saudi Arabia Feed Additives Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the Saudi Arabia feed additives market, along with forecasts at the regional and country levels from 2026-2034. The market has been categorized based on type, animal type.

Analysis by Type:

- Acidifier

- Amino Acids

- Antibiotics

- Antioxidants

- Feed Binders

- Enzymes

- Flavors and Sweeteners

- Minerals

- Mycotoxin Detoxifiers

- Pigments

- Prebiotics

- Probiotics

- Vitamins

In the Saudi Arabian feed additives market acidifiers are becoming popular due to their enhancement of gut health and improving feed efficiency. Acidifiers decrease the pH of the digestive system which makes it a less favorable environment for harmful bacteria. The need for antibiotics may also be reduced by acidifiers. This trend goes in tandem with the increased importance of natural solutions and animal welfare. Furthermore, acidifiers boost nutrient absorption leading to improved growth performance in livestock which is vital for addressing the increasing demand for high quality meat and dairy products.

Amino acids are critical elements in the Saudi Arabian feed additive market as they support animal growth and enhance protein synthesis. The increasing demand to enhance feed efficiency has made the employment of amino acids such as lysine, methionine and threonine to maximize nutritional levels for animals. These have reduced the cost of feeds in the diets by enhancing the utilization of the available proteins. Rising concerns with sustainable animal production practices encourage the use of amino acids since they reduce the excretion of nitrogen and therefore minimal environmental impact.

Antibiotics remain a significant part of the Saudi Arabian feed additives market because of their contribution to animal health and productivity. They are used extensively to prevent diseases boost feed conversion rates and ensure higher output in poultry, cattle, and aquaculture. However, the increasing regulatory attention on minimizing antibiotic overuse is leading manufacturers to create alternatives. This transition is promoting innovation in natural feed additives such as probiotics and acidifiers while still sustaining efficiency and productivity in livestock farming.

Antioxidants play a vital role in animal feed by preventing the oxidation of fats and other nutrients thus preserving feed quality and extending its shelf life. The expanding livestock sector in Saudi Arabia is increasing the need for antioxidants to guarantee stable nutrient-dense feed. By protecting animals from oxidative stress, antioxidants enhance immune functions, growth rates and reproductive performance. The increased understanding of animal health and nutritional requirements is encouraging farmers to embrace both natural and synthetic antioxidants which guarantee optimal performance and productivity in livestock agriculture.

Feed additives feed binders are necessary for improving pellet durability and decreasing feed waste in the Saudi Arabian feed additives market. With a growing emphasis on efficient livestock production and binders play a role in feed stability during storage and transportation. Natural binders such as clay, lignosulfonates, and starch are common binders that enhance feed uniformity, thus promoting animal consumption and digestion. The market is witnessing an increase in the use of natural binders because they are non-toxic and fit with the trend toward safer and more sustainable animal nutrition practices.

Enzymes are being increasingly used in the Saudi Arabian feed additives market to increase feed digestibility as well as nutrient absorption in animals. Enzymes help improve feed conversion efficiency, as they break down complex feed constituents, such as fibers and proteins, which helps save on farmer's costs. Along with this, the demand for sustainable livestock farming has risen. Enzymes aid in diminishing feed waste and environmental impacts associated with livestock farming. More prominent supporting improved animal health and production performance are important enzyme categories such as protease, phytase, and carbohydrase.

Flavors and sweeteners are essential feed additives in the Saudi Arabian market enhancing feed palatability and intake, particularly for younger animals and those under stress. By disguising unpleasant feed odors or flavors these additives promote regular consumption and ensure adequate nutrition. The demand for premium feed solutions in the region is on the increase and thus drives innovation of natural sweeteners and flavors. Their role in feed efficiency and animal performance becomes ever so critical as the region's livestock and pet food markets expand.

Minerals are crucial feed additives in Saudi Arabia's livestock sector to ensure the adequate growth of animals, their bone development, and their metabolism. Mineral supplements of calcium, phosphorus, zinc, and magnesium reduce nutritional deficiencies and enhance the productivity of the animals altogether. Rising demand for healthier high-quality meat and dairy products puts the requirement of mineral supplements essential for supporting health as well as reproductive performance in animals. Furthermore, chelated minerals are also increasingly applied with their higher bioavailability, resulting in improved feed efficiency and performance.

Myco-toxin detoxifiers are gaining greater importance in the Saudi Arabian feed additives market with the increased focus on feed safety and animal welfare. These additives neutralize harmful mycotoxins present in contaminated feed preventing adverse effects like decreased productivity, immune suppression, and organ damage. As the country's livestock sector is expanding, feed quality has become a priority.

In Saudi Arabia pigments are used in feed additives mainly for the pigmentation of animal products like egg yolk, broiler skin and fish. Both natural and synthetic pigments including carotenoids are used for enhancing the aesthetic appeal of products by consumer demands for visually appealing food. As high-quality poultry and aquaculture products gain market demand pigments become necessary to differentiate the premium products. An added impulse in the growing interest toward natural additives is propelling demand for plant-derived pigments that are in pace with the movement toward sustainable livestock practice.

Prebiotics find a considerable increase within the Saudi Arabian market of feed additives enhancing gut health and activating immuno-responsiveness in the case of animals. The stimulating nature of prebiotics about helpful bacteria growth enhances nutrient consumption thus bettering feed efficiency generally. Prebiotics are a good natural substitute for the increasing need to reduce antibiotic use in animal farming. They improve livestock performance while meeting consumer expectations for antibiotic-free animal products in alignment with both global and regional movements toward healthier, more sustainable livestock practices.

Probiotics are becoming indispensable in Saudi Arabia's feed additives sector as natural solutions for enhancing animal health and productivity. These beneficial microorganisms balance gut flora, improve digestion, and strengthen immunity, thereby reducing the dependence on antibiotics. The increasing concern over antibiotic resistance has accelerated the adoption of probiotics, particularly in the poultry and dairy industries. Sustainable livestock practices emphasize feed efficiency and productivity to produce high-quality meat and dairy for the growing domestic and regional markets.

Vitamins constitute the important additives in Saudi Arabia's feeding which promote adequate growth, reproduction as well and immune functions in domestic animals. The upsurge in livestock production and animals' nutrient supplementation ensures a healthy life. The production of these essential vitamins such as A, D, E, and B complex groups increases productivity and performance. The market is seeing greater demand for both synthetic and natural vitamins, as producers seek to improve the quality of feed and general animal health.

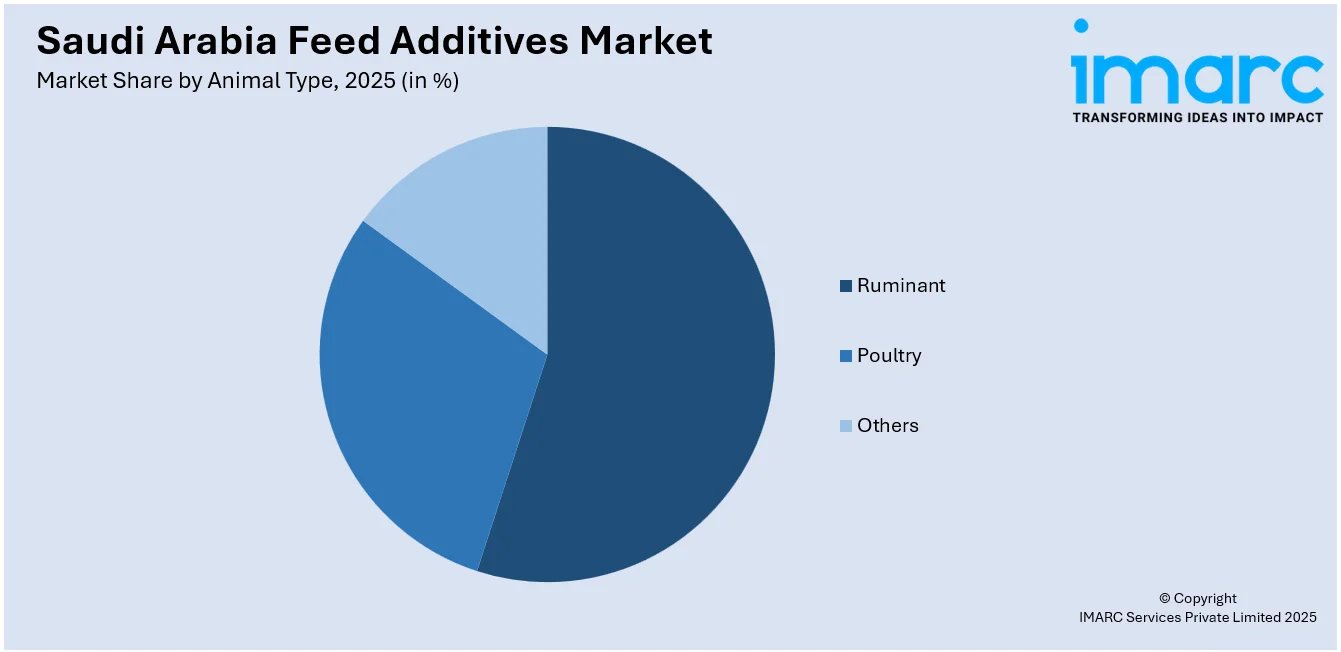

Analysis by Animal Type:

Access the comprehensive market breakdown Request Sample

- Ruminant

- Poultry

- Others

The ruminant sector within the Saudi Arabia feed additives market is expanding due to rising demand for premium dairy and beef products. Additives like vitamins, minerals, amino acids and enzymes enhance digestion, optimize feed utilization, and improve both milk production and meat quality. As investments in the livestock industry increase farmers are increasingly focusing on additives that promote overall animal wellness and productivity.

The poultry segment plays a crucial role in the Saudi Arabia feed additives market spurred by a growing demand for poultry meat and eggs in the country. Feed additives such as amino acids, enzymes, probiotics, and pigments are vital for boosting feed efficiency, enhancing growth rates and improving egg production. The increasing consumer preference for high-quality protein sources drives the demand for additives that foster healthier birds and better product yields.

Regional Analysis:

- Northern and Central Region

- Western Region

- Eastern Region

- Southern Region

The Northern and Central Region of Saudi Arabia is an important market for feed additives as it is highly involved in livestock farming and dairy production. With a high number of ruminant farms, there is a continued demand for vitamins, minerals, and enzymes to enhance feed efficiency and milk production. Further support to the growth of the market is given by the rising investment in modern farming practices and improvement in feed quality.

The Western Region is rapidly growing into an important market for feed additives as the increase in poultry farming and consumer demand for protein-based food products creates a great market for feed additives around cities such as Jeddah and Mecca. With amino acids, probiotics, and enzymes being key drivers of growth improvements and the optimization of poultry meat and egg production, the large urban population and strong food industry in the region create a steady demand for livestock products. In addition, there is a trend toward natural feed additives that are in line with consumer demand for safer, antibiotic-free animal products.

In the Eastern Region, there is a consistent demand for feed additives primarily driven by extensive poultry and aquaculture farming practices. There is an increasing emphasis on improving feed efficiency and livestock health which has led to a rise in the use of amino acids, minerals, and antioxidants. The region’s proximity to Gulf countries also opens export opportunities for high-quality meat and dairy products. Technological innovation in feed formulations and investments in sustainable farming practices are promoting the uptake of innovative additives thereby ensuring optimized livestock productivity and economic advancement in the area.

The Southern Region of Saudi Arabia represents an expanding market for feed additives mainly due to the growth of small and medium-scale livestock farming operations. Farmers in this area are progressively adopting feed solutions such as acidifiers, probiotics, and enzymes to enhance feed utilization and improve overall animal health. The increasing demand for dairy and poultry products is propelling the uptake of performance-enhancing additives. Moreover, governmental initiatives to modernize agricultural practices are fostering the use of advanced feed additives supporting the sustainability of livestock production in the region.

Competitive Landscape:

The Saudi Arabian feed additives market is a highly competitive field with the presence of both local and international companies emphasizing innovation, quality, and cost-effective solutions. Companies are investing heavily in research and development to introduce high-value feed additives that ensure healthy livestock, increase productivity, and meet the evolving regulatory standards. Local companies are capitalizing on their proximity to significant agricultural centers to enhance supply chains and offer tailored solutions to farmers. Global players are broadening their presence by establishing partnerships and distribution agreements with local entities.

The report provides a comprehensive analysis of the competitive landscape in the Saudi Arabia feed additives market with detailed profiles of all major companies.

Latest News and Developments:

- In December 2024, UTRIX achieved HALAL certification for its feed additives and mycotoxin binders from Dar El Fatwa. This certification enhances their market access in the Middle East. Established in 2009 UTRIX focuses on sustainable animal production delivering innovative solutions backed by international expertise and high quality production standards.

- In November 2024, Delicious Food Factory (DFF) announced its plans to construct the largest pet food plant in the Middle East, located in Saudi Arabia. Spanning 55000 square meters the facility will manufacture 60000 tons of dry food and 40000 tons of wet food each year boosting the local economy and catering to increasing pet food demand in the region.

Saudi Arabia Feed Additives Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered | Acidifier, Amino Acids, Antibiotics, Antioxidants, Feed Binders, Enzymes, Flavors and Sweeteners, Minerals, Mycotoxin Detoxifiers, Pigments, Prebiotics, Probiotics, Vitamins |

| Animal Types Covered | Ruminant, Poultry, Others |

| Regions Covered | Northern and Central Region, Western Region, Eastern Region, Southern Region |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Saudi Arabia feed additives market from 2020-2034.

- The research study provides the latest information on the market drivers, challenges, and opportunities in the Saudi Arabia feed additives market.

- Porter's Five Forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Saudi Arabia feed additives industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

Feed additives are substances added to animal feed to improve its nutritional value, promote growth, and enhance livestock health. They include amino acids, vitamins, minerals, enzymes, and probiotics, which optimize digestion, boost immunity, and support higher-quality meat and dairy production.

The Saudi Arabia feed additives market was valued at USD 471.8 Million in 2025.

IMARC estimates the Saudi Arabia feed additives market to exhibit a CAGR of 7.27% during 2026-2034.

The market is driven by rising livestock production, increasing demand for high-quality animal protein, government food security initiatives, and technological advancements in animal nutrition and sustainable farming practices.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)