Saudi Arabia Extruded Snack Food Market Size, Share, Trends and Forecast by Type, Distribution Channel, and Region, 2026-2034

Saudi Arabia Extruded Snack Food Market Summary:

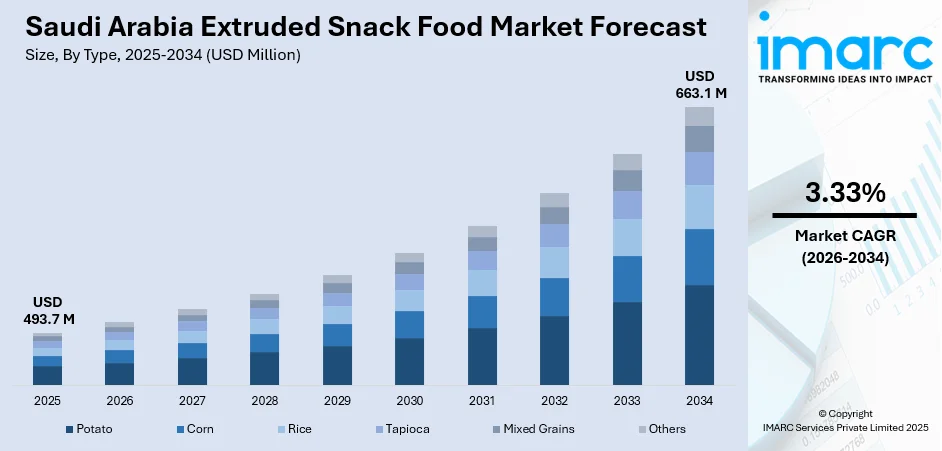

The Saudi Arabia extruded snack food market size was valued at USD 493.7 Million in 2025 and is projected to reach USD 663.1 Million by 2034, growing at a compound annual growth rate of 3.33% from 2026-2034.

The Saudi Arabia extruded snack food market is experiencing steady expansion, driven by evolving consumer lifestyles and increasing demand for convenient ready-to-eat (RTE) options. Rising urbanization across major cities is reshaping snacking habits, with consumers increasingly seeking portable and flavorful snack alternatives. Growing health consciousness is encouraging product reformulations towards cleaner ingredients. Modern retail expansion and digital commerce penetration are enhancing product accessibility, while cultural preferences for local flavors continue to influence product innovations.

Key Takeaways and Insights:

- By Type: Potato dominates the market with a share of 36% in 2025, owing to its widespread consumer acceptance, versatile flavor adaptations, and established manufacturing infrastructure. Rising demand for traditional and locally inspired seasonings continues to strengthen potato-based snack preferences among Saudi consumers.

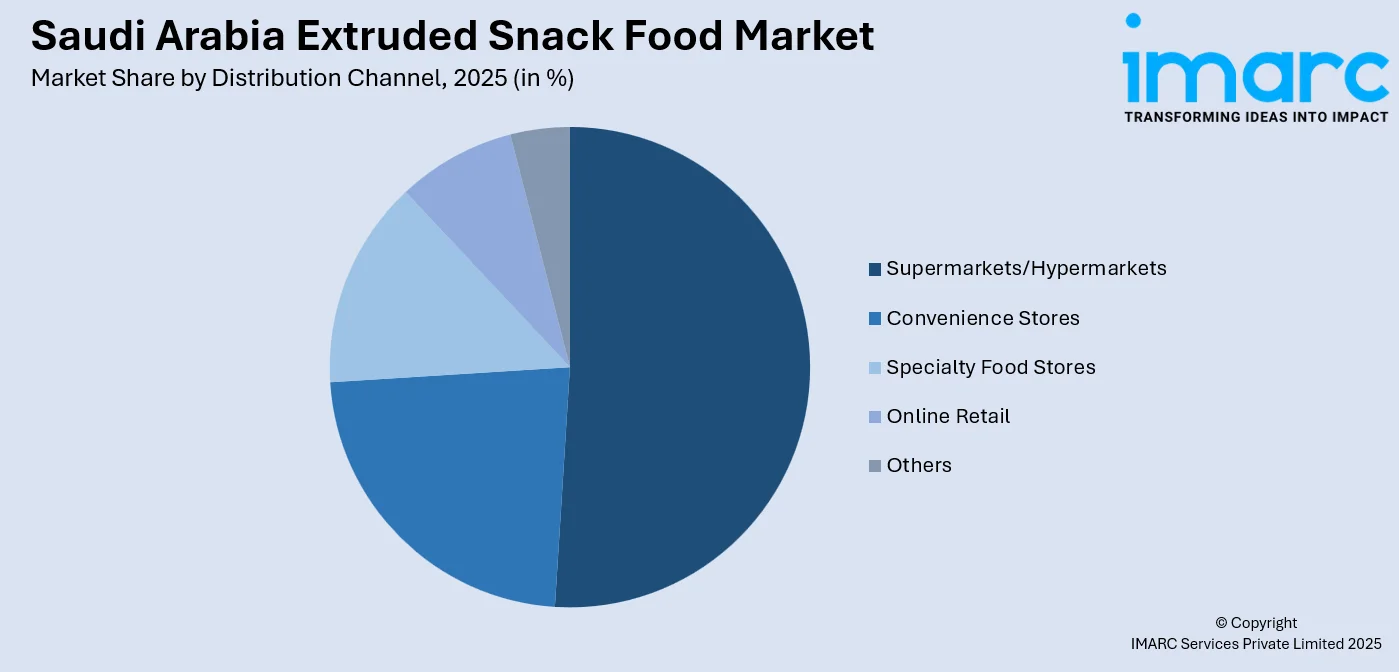

- By Distribution Channel: Supermarkets/hypermarkets lead the market with a share of 51% in 2025. This dominance is driven by extensive product assortments, promotional pricing strategies, and one-stop shopping convenience that appeals to Saudi families seeking variety and value during regular grocery purchases.

- By Region: Northern and Central Region comprises the largest region with 40% share in 2025, driven by the concentration of population in Riyadh metropolitan area, higher consumer spending capacity, robust retail infrastructure development, and presence of major distribution networks serving urban consumers.

- Key Players: Key players drive the Saudi Arabia extruded snack food market by expanding product portfolios, introducing innovative flavors, and strengthening nationwide distribution networks. Their investments in local manufacturing facilities, sustainable packaging solutions, and marketing campaigns targeting younger demographics boost awareness and accelerate adoption across diverse consumer segments.

To get more information on this market Request Sample

The Saudi Arabia extruded snack food market is witnessing robust growth, as consumer preferences shift towards convenient and flavorful snacking options suited to modern lifestyles. Increasing urbanization across major metropolitan areas is driving demand for RTE products that accommodate busy schedules of working professionals and students. In 2024, the urban population in Saudi Arabia was noted to be 85.17% of the total population, according to the World Bank collection of development indicators. The expanding middle-class population with rising disposable incomes is contributing to premiumization trends within the snacking category. Cultural emphasis on hospitality and social gatherings creates consistent demand for shareable snack formats during family events and celebrations. Younger demographics, particularly millennials and Generation Z consumers, are demonstrating strong appetite for innovative flavors and globally inspired taste profiles.

Saudi Arabia Extruded Snack Food Market Trends:

Rising Demand for Healthier Snacking Alternatives

Saudi consumers are increasingly gravitating towards snack products featuring reduced sodium content, baked alternatives, and cleaner ingredient labels. This shift reflects heightened health and wellness consciousness among urban populations seeking permissible indulgence without compromising nutritional values. As per IMARC Group, the Saudi Arabia health and wellness market size reached USD 38,747.7 Million in 2025. Manufacturers are responding by introducing air-fried variants, incorporating whole grain ingredients, and eliminating artificial additives from product formulations. The growing awareness about obesity-related health concerns is prompting families to seek better-for-you snacking options that align with government wellness initiatives promoting balanced dietary choices throughout the Kingdom.

Localization of Flavors and Regional Taste Preferences

Product innovations increasingly center on incorporating traditional Saudi and Middle Eastern flavor profiles into extruded snack food offerings. Brands are capitalizing on consumer nostalgia by introducing seasonings inspired by regional spices, such as za'atar, kabsa blends, and chili-lime combinations. This localization strategy resonates strongly with domestic consumers who appreciate familiar taste experiences in convenient snack formats. The emphasis on halal-certified ingredients and culturally appropriate product positioning further strengthens brand loyalty among Saudi households seeking authentic flavor connections in their snacking choices.

Digital Commerce Transformation in Snack Distribution

Online grocery platforms and food delivery applications are emerging as significant distribution channels for extruded snack food items in Saudi Arabia. The convenience of doorstep delivery, personalized recommendations, and promotional offers through digital platforms appeals to tech-savvy consumers managing busy lifestyles. Quick commerce services promising rapid delivery times are gaining traction among urban populations. This digital transformation enables manufacturers to reach broader consumer segments while collecting valuable data insights for targeted marketing strategies that support the Saudi Arabia extruded snack food market growth.

How Vision 2030 is Transforming the Saudi Arabia Extruded Snack Food Market:

Vision 2030 is transforming the Saudi Arabia extruded snack food market by reshaping consumer lifestyles, boosting local manufacturing, and encouraging healthier food choices. Economic diversification and investments in domestic food processing are strengthening local snack production, reducing import dependence, and improving supply chain resilience. Rising urbanization, higher workforce participation, and busier lifestyles are increasing demand for convenient, RTE extruded snacks across households. Vision 2030’s focus on health and wellness is also influencing product innovation, with manufacturers reformulating snacks using baked processes, whole grains, and reduced oil or salt content. Support for small and medium enterprises (SMEs) is enabling local brands to enter the market with regionally inspired flavors tailored to Saudi tastes.

Market Outlook 2026-2034:

The Saudi Arabia extruded snack food market outlook remains positive, as economic diversification initiatives under Vision 2030 continue to foster consumer spending growth across retail sectors. Expanding modern trade infrastructure, including new hypermarket openings and convenience store networks, will enhance product distribution reach throughout the Kingdom. The market generated a revenue of USD 493.7 Million in 2025 and is projected to reach a revenue of USD 663.1 Million by 2034, growing at a compound annual growth rate of 3.33% from 2026-2034. Rising tourism influx driven by mega entertainment projects and cultural events presents additional consumption opportunities. Product premiumization trends, coupled with growing demand for innovative flavor experiences, will support value growth. Manufacturers investing in sustainable packaging solutions and locally sourced ingredients will gain competitive advantages as environmental consciousness rises among younger consumer demographics.

Saudi Arabia Extruded Snack Food Market Report Segmentation:

|

Segment Category |

Leading Segment |

Market Share |

|

Type |

Potato |

36% |

|

Distribution Channel |

Supermarkets/Hypermarkets |

51% |

|

Region |

Northern and Central Region |

40% |

Type Insights:

- Potato

- Corn

- Rice

- Tapioca

- Mixed Grains

- Others

Potato dominates with a market share of 36% of the total Saudi Arabia extruded snack food market in 2025.

Potato maintains its dominant position in the market due to widespread consumer familiarity and versatile flavor adaptation capabilities. The category benefits from established manufacturing infrastructure that enables efficient production scaling to meet growing demand. Consumer preferences for crispy textures and savory taste profiles drive consistent purchasing patterns across demographic segments. Local flavor innovations incorporating regional spices continue to attract younger consumers seeking authentic taste experiences in convenient formats.

The potato segment demonstrates resilience through continuous product innovations, addressing evolving consumer preferences. Manufacturers are introducing baked alternatives and reduced-sodium variants to capture health-conscious consumer segments without sacrificing taste appeal. Premium positioning through artisanal production techniques and specialty ingredients is supporting value growth. People are becoming more mindful of their snacking habits and portion sizes. This behavioral shift creates opportunities for differentiated potato-based products featuring cleaner labels, transparent sourcing, and portion-controlled packaging formats that align with emerging wellness priorities.

Distribution Channel Insights:

Access the comprehensive market breakdown Request Sample

- Supermarkets/Hypermarkets

- Convenience Stores

- Specialty Food Stores

- Online Retail

- Others

Supermarkets/hypermarkets lead with a share of 51% of the total Saudi Arabia extruded snack food market in 2025.

Supermarkets/hypermarkets maintain their leadership position through extensive product assortments, competitive pricing strategies, and convenient one-stop shopping experiences that resonate with Saudi families. These modern trade formats offer dedicated snack aisles, featuring both domestic and international brands, enabling consumers to compare options and discover new products during regular shopping trips. Strategic shelf placement, promotional activities, and loyalty programs further strengthen the channel's ability to drive impulse purchases and build brand awareness.

The continued expansion of hypermarket chains across secondary cities is broadening consumer access to diverse extruded snack offerings beyond traditional metropolitan centers. Major retail operators are investing in enhanced store formats featuring improved shopping experiences and expanded product selections. According to the Saudi Central Bank, electronic payments represented 79% of total retail payments in 2024, reflecting growing digital payment adoption within modern retail environments. This payment infrastructure modernization supports seamless checkout experiences and enables retailers to implement sophisticated loyalty programs that encourage repeat purchases and data-driven personalization strategies across their extruded snack food category offerings.

Regional Insights:

- Northern and Central Region

- Western Region

- Eastern Region

- Southern Region

Northern and Central Region exhibits a clear dominance with a 40% share of the total Saudi Arabia extruded snack food market in 2025.

Northern and Central Region dominates the Saudi extruded snack food market primarily due to Riyadh's significant population concentration and economic activity levels. As the Kingdom's capital and largest metropolitan area, Riyadh hosts extensive modern retail infrastructure supporting diverse snack product distribution. The strong presence of supermarkets, convenience stores, and foodservice outlets enhances product accessibility, brand visibility, and impulse consumption across residential, commercial, and transit-oriented locations across the region.

The region benefits from higher average household incomes enabling premium product purchases and greater openness to innovative snack offerings. Concentration of corporate offices, educational institutions, and entertainment venues creates consistent demand for on-the-go snacking solutions throughout the day. Riyadh prepares for the spectacular launch of the entertainment venue, Seven Al-Hamra, in the second half of 2026. Government mega-projects concentrated in the capital region are driving workforce expansion and supporting commercial activities.

Market Dynamics:

Growth Drivers:

Why is the Saudi Arabia Extruded Snack Food Market Growing?

Rapid Urbanization and Changing Consumer Lifestyles

The accelerating pace of urbanization across Saudi Arabia is fundamentally reshaping consumer snacking behaviors and driving demand for convenient RTE products. As more Saudi citizens migrate to major metropolitan centers for employment and educational opportunities, traditional meal patterns are evolving to accommodate busier schedules and longer commuting times. Dual-income households, where both partners participate in the workforce, have less time available for traditional home cooking, creating sustained demand for quick and satisfying snack alternatives. Working professionals increasingly rely on portable snack options during office hours and between meetings, while students seek affordable and tasty products during breaks. The expansion of entertainment venues, shopping centers, and recreational facilities provides additional consumption occasions outside the home environment. Urban consumers demonstrate greater exposure to global food trends and international brands, fostering acceptance of diverse snack formats and innovative flavor profiles. This lifestyle transformation continues to strengthen the market growth trajectory as urbanization trends show no signs of slowing across the Kingdom.

Expansion of Modern Retail Infrastructure

The continued proliferation of modern retail formats, including hypermarkets, supermarkets, and convenience stores, is significantly enhancing consumer access to extruded snack foods across Saudi Arabia. Major retail operators are expanding their footprints beyond traditional urban centers into secondary cities and suburban communities, bringing diverse product assortments to previously underserved populations. Modern trade environments offer superior shopping experiences featuring organized displays, air-conditioned comfort, and promotional activities that encourage product discovery and impulse purchases. Retailers invest in sophisticated category management strategies that optimize shelf space allocation and enhance brand visibility within competitive snack aisles. The development of neighborhood convenience stores and petrol station forecourts extends distribution reach to capture immediate consumption occasions throughout the day. Strategic partnerships between manufacturers and retailers enable exclusive product launches, customized promotional campaigns, and collaborative merchandising efforts that drive category growth.

Young Demographic Profile and Evolving Taste Preferences

Saudi Arabia's youthful population structure creates a substantial and growing consumer base with strong affinity for snack food products. According to the 2024 Saudi Family Statistics Report released by GASTAT, approximately 71% of the population in Saudi Arabia was aged below 35. Younger generations demonstrate higher snacking frequency compared to older demographics, viewing between-meal consumption as integral to their daily routines rather than occasional indulgences. This demographic cohort shows greater willingness to experiment with novel flavors, textures, and formats, driving manufacturer innovation cycles and product portfolio expansion. Social media influence and digital connectivity expose young Saudi consumers to global snacking trends, creating demand for internationally inspired products alongside traditional local favorites. Peer recommendations and influencer endorsements significantly impact purchase decisions within this demographic, making social platforms crucial marketing channels. The growing presence of women in the workforce expands the working professional segment seeking convenient snacking solutions. Educational institutions, from schools through universities, represent significant consumption venues where young consumers develop brand preferences and purchasing habits that persist into adulthood.

Market Restraints:

What Challenges the Saudi Arabia Extruded Snack Food Market is Facing?

Raw Material Price Volatility and Supply Chain Pressures

Saudi Arabia's significant reliance on imported raw materials for food manufacturing exposes extruded snack food producers to international commodity price fluctuations and supply chain disruptions. Variations in global potato, corn, and vegetable oil prices directly impact production costs and margin sustainability. Currency exchange rate movements affecting import expenses create pricing pressures that may necessitate consumer price increases, potentially dampening demand growth particularly among price-sensitive consumer segments.

Competition from Alternative Snacking Categories

Extruded snack food products face intensifying competition from alternative snacking options, including fresh fruits, nuts, energy bars, and protein-based snacks that position themselves as healthier alternatives. The proliferation of better-for-you snack options at retail provides consumers with expanded choices that may divert spending away from traditional extruded categories. Quick service restaurant expansion and RTE meal convenience also compete for share of consumer snacking occasions and expenditure.

Regulatory Compliance and Labeling Requirements

Evolving food safety regulations and labeling standards present operational challenges for extruded snack food producers. Compliance with stricter guidelines related to nutritional disclosures, ingredient transparency, and shelf-life validation increases administrative and production complexity. Smaller manufacturers may struggle to absorb compliance-related costs, while frequent regulatory updates require continuous monitoring and process adjustments. These factors can slow product launches, limit innovation speed, and raise overall operational expenses across the industry.

Competitive Landscape:

The Saudi Arabia extruded snack food market features a dynamic competitive environment, characterized by the presence of established international players alongside emerging domestic manufacturers. Market participants compete across multiple dimensions, including product innovations, flavor diversification, pricing strategies, and distribution network expansion. Leading manufacturers leverage strong brand equity, manufacturing scale economies, and extensive trade relationships to maintain competitive positions. Investments in local production facilities enable cost efficiencies while demonstrating commitment to Kingdom's economic development objectives. Marketing strategies increasingly emphasize digital engagement, social media presence, and influencer partnerships to connect with younger consumer demographics. Product innovations focus on introducing healthier variants, locally inspired flavors, and convenient packaging formats addressing evolving consumer preferences. Retail partnerships and promotional collaborations remain critical for securing favorable shelf positioning and driving consumer trial.

Saudi Arabia Extruded Snack Food Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Million USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered | Potato, Corn, Rice, Tapioca, Mixed Grains, Others |

| Distribution Channels Covered | Supermarkets/Hypermarkets, Convenience Stores, Specialty Food Stores, Online Retail, Others |

| Regions Covered | Northern and Central Region, Western Region, Eastern Region, Southern Region |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report

The Saudi Arabia extruded snack food market size was valued at USD 493.7 Million in 2025.

The Saudi Arabia extruded snack food market is expected to grow at a compound annual growth rate of 3.33% from 2026-2034 to reach USD 663.1 Million by 2034.

Potato dominated the market with a share of 36%, driven by widespread consumer acceptance, versatile flavor adaptation capabilities, and established manufacturing infrastructure supporting efficient production scaling across the Kingdom.

Key factors driving the Saudi Arabia extruded snack food market include rapid urbanization, expanding modern retail infrastructure, young demographic profile with evolving taste preferences, rising disposable incomes, and growing demand for convenient on-the-go snacking options.

Major challenges include rising health consciousness affecting consumer preferences, raw material price volatility impacting production costs, supply chain pressures from import dependency, competition from healthier snacking alternatives, and evolving regulatory requirements regarding nutritional labeling and content restrictions.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)