Saudi Arabia Elevator and Escalator Market Size, Share, Trends and Forecast by Type, Service, End Use, and Region, 2025-2033

Saudi Arabia Elevator and Escalator Market Overview:

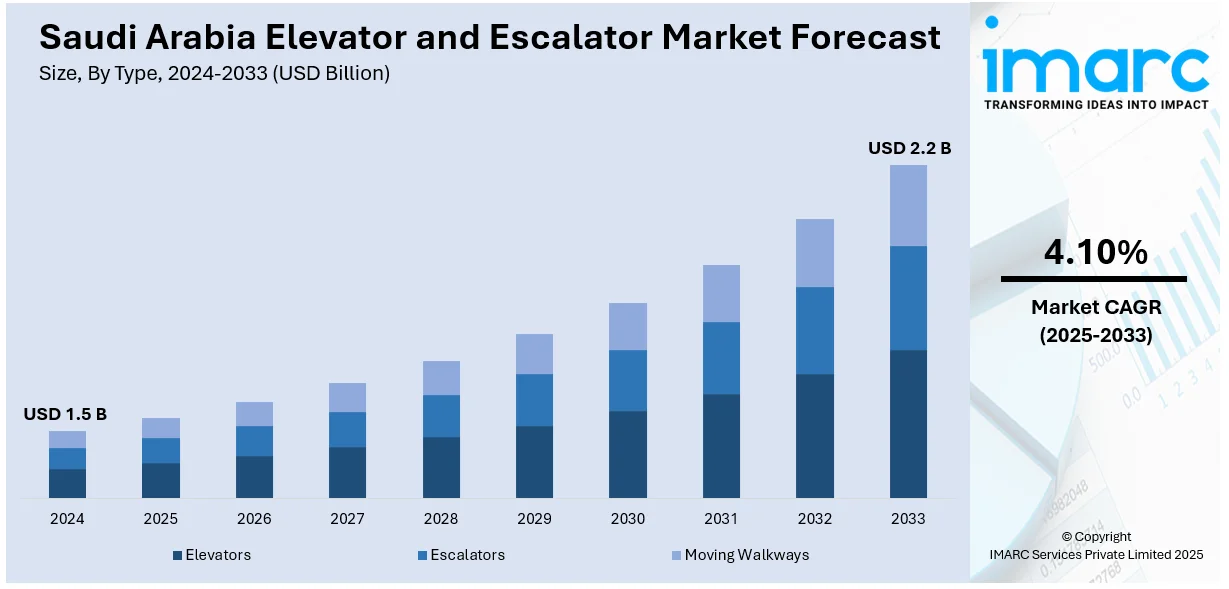

The Saudi Arabia elevator and escalator market size reached USD 1.5 Billion in 2024. Looking forward, IMARC Group expects the market to reach USD 2.2 Billion by 2033, exhibiting a growth rate (CAGR) of 4.10% during 2025-2033. The market is witnessing significant growth mainly driven by Vision 2030-led infrastructure projects, high-rise construction, and smart city developments. Moreover, demand is rising for energy-efficient, IoT-enabled systems across residential, commercial, and public sectors, driving strong growth momentum across Saudi Arabia.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 1.5 Billion |

| Market Forecast in 2033 | USD 2.2 Billion |

| Market Growth Rate 2025-2033 | 4.10% |

Saudi Arabia Elevator and Escalator Market Trends:

Modernization of Aging Equipment

Aging elevator and escalator system modernization is gaining momentum in Saudi Arabia as building owners highly value enhanced safety, efficiency, and adherence to new building codes. This is the trend widely prevalent in old malls, hotels, airports, and government buildings. High demand for retrofitting is fueling the growth of the Saudi Arabia elevator and escalator market share as modernization is being found cost-effective in comparison to complete replacement. For instance, in November 2024, KONE Corporation secured a contract to modernize Saudi Arabia’s King Fahd International Airport enhancing travel for over 11 million annual passengers. The project includes installing 30 elevators and upgrading escalators, aiming for environmental efficiency. This initiative supports Saudi Arabia's goal of achieving 330 million passengers by 2030. Modern systems comprise features like energy-saving motors, advanced braking systems, enhanced cabin design, and real-time fault diagnostics. Since many buildings constructed in the early 2000s or before require upgrading to accommodate changing safety standards, manufacturers and service firms are witnessing heightened requests for tailor-made modernization packages. This trend is creating long-term business opportunities in cities. Greater focus on retrofitting will continue to drive the Saudi Arabia elevator and escalator market outlook throughout the forecast period.

Shift Toward Smart Elevator Systems

The shift toward smart elevator systems in Saudi Arabia reflects a growing emphasis on safety, efficiency, and convenience in urban infrastructure. Building developers and facility managers are increasingly integrating AI-powered dispatching, IoT-enabled monitoring, and destination control systems to optimize passenger flow and reduce wait times. These technologies enable real-time diagnostics, predictive maintenance, and remote performance tracking, which significantly lower operational disruptions. High-rise commercial towers, airports, and luxury hotels are leading adopters of these solutions as they seek to deliver seamless and premium user experiences. Integration with mobile apps and touchless panels is also gaining traction, especially in response to hygiene concerns. Government-backed smart city projects such as NEOM and King Abdullah Economic City are accelerating deployment of such advanced systems. These innovations are expected to play a major role in driving Saudi Arabia elevator and escalator market growth over the coming years.

Infrastructure Expansion Under Vision 2030

Saudi Arabia’s Vision 2030 is fueling a large-scale transformation of the country’s infrastructure, significantly impacting elevator and escalator demand. The launch of mega-projects such as NEOM, Red Sea Global, and Qiddiya involves extensive development of commercial, residential, hospitality, and mixed-use spaces all requiring modern vertical transportation systems. These projects aim to create futuristic urban environments with smart technologies, sustainability features, and world-class public amenities. As a result, the demand for high-capacity, energy-efficient, and technologically advanced elevators and escalators is growing. In addition to new installations, developers are emphasizing integrated systems for better traffic flow and safety in high-density zones. This infrastructure boom is positioning Saudi Arabia as a major growth hub for global elevator and escalator manufacturers and suppliers.

Saudi Arabia Elevator and Escalator Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the regional level for 2025-2033. Our report has categorized the market based on type, service, and end use.

Type Insights:

- Elevators

- Escalators

- Moving Walkways

The report has provided a detailed breakup and analysis of the market based on the type. This includes elevators, escalators, and moving walkways.

Service Insights:

- New Installation

- Maintenance and Repair

- Modernization

A detailed breakup and analysis of the market based on the service have also been provided in the report. This includes new installation, maintenance and repair, and modernization.

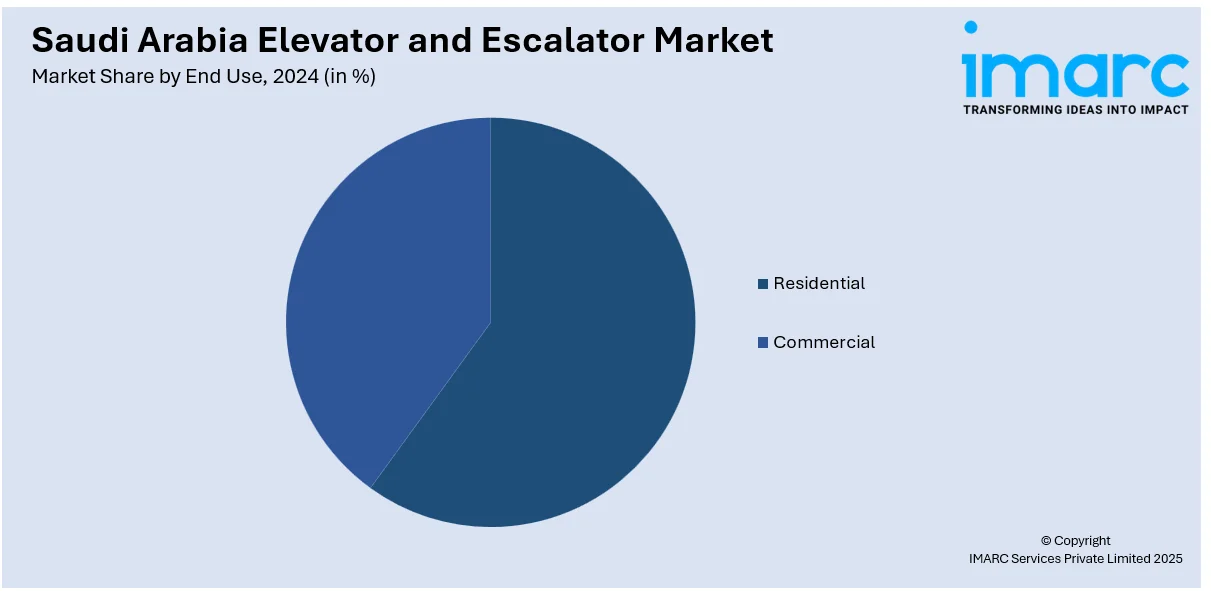

End Use Insights:

- Residential

- Commercial

- Offices

- Hospitality

- Mixed Block

- Others

A detailed breakup and analysis of the market based on the end use have also been provided in the report. This includes residential and commercial (offices, hospitality, mixed block, and others).

Regional Insights:

- Northern and Central Region

- Western Region

- Eastern Region

- Southern Region

The report has also provided a comprehensive analysis of all the major regional markets, which include Northern and Central Region, Western Region, Eastern Region, and Southern Region.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Saudi Arabia Elevator and Escalator Market News:

- In February 2025, TK Elevator and Alat announced a €160 million joint venture to produce elevator and escalator solutions in Saudi Arabia, supporting local manufacturing and economic diversification. Alat will acquire a 15% stake in TKE, enhancing its growth potential and aligning with the Kingdom's Vision 2030 objectives.

- In September 2023, Jeddah hosted the Lift City Expo 2023, focusing on elevator and escalator technologies. This event came as Saudi Arabia’s elevator market was expected to grow, driven by over $1.34 trillion in ongoing giga-projects and offering opportunities for global manufacturers and industry professionals.

Saudi Arabia Elevator and Escalator Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered | Elevators, Escalators, Moving Walkways |

| Services Covered | New Installation, Maintenance and Repair, Modernization |

| End Uses Covered |

|

| Regions Covered | Northern and Central Region, Western Region, Eastern Region, Southern Region |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Saudi Arabia elevator and escalator market performed so far and how will it perform in the coming years?

- What is the breakup of the Saudi Arabia elevator and escalator market on the basis of type?

- What is the breakup of the Saudi Arabia elevator and escalator market on the basis of service?

- What is the breakup of the Saudi Arabia elevator and escalator market on the basis of end use?

- What is the breakup of the Saudi Arabia elevator and escalator market on the basis of region?

- What are the various stages in the value chain of the Saudi Arabia elevator and escalator market?

- What are the key driving factors and challenges in the Saudi Arabia elevator and escalator market?

- What is the structure of the Saudi Arabia elevator and escalator market and who are the key players?

- What is the degree of competition in the Saudi Arabia elevator and escalator market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Saudi Arabia elevator and escalator market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Saudi Arabia elevator and escalator market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Saudi Arabia elevator and escalator industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)