Saudi Arabia Electric Car Market Size, Share, Trends and Forecast by Type, Vehicle Class, Drive Type, and Region 2026-2034

Saudi Arabia Electric Car Market Summary:

The Saudi Arabia electric car market size was valued at USD 1.81 Billion in 2025 and is projected to reach USD 5.52 Billion by 2034, growing at a compound annual growth rate of 13.18% from 2026-2034.

The Saudi Arabia electric car market growth is primarily driven by government support for clean mobility, rising investment in charging infrastructure, and national sustainability targets aligned with Vision 2030. Policy incentives, the growing environmental awareness, and diversification away from fossil fuels are encouraging electric car adoption. Increasing availability of electric models, partnerships with global manufacturers, and expansion of urban charging networks further support the market development and user acceptance across major cities.

Key Takeaways and Insights:

- By Type: Battery electric vehicle dominates the market with a share of 57.9% in 2025, driven by the growing availability of charging infrastructure in major urban centers, declining battery costs enabling competitive pricing, and strong government incentives promoting zero-emission transportation solutions aligned with national sustainability objectives.

- By Vehicle Class: Mid-priced leads the market with a share of 66.95% in 2025, owing to the expanding model availability from international manufacturers offering affordable electric alternatives, increasing user preference for value-oriented vehicles, and enhanced accessibility through competitive financing options.

- By Drive Type: Front wheel drive represents the largest segment with a market share of 49.9% in 2025. This dominance is influenced by the inherent cost-effectiveness of front-wheel configurations, superior energy efficiency characteristics, and alignment with consumer preferences for practical urban commuting solutions.

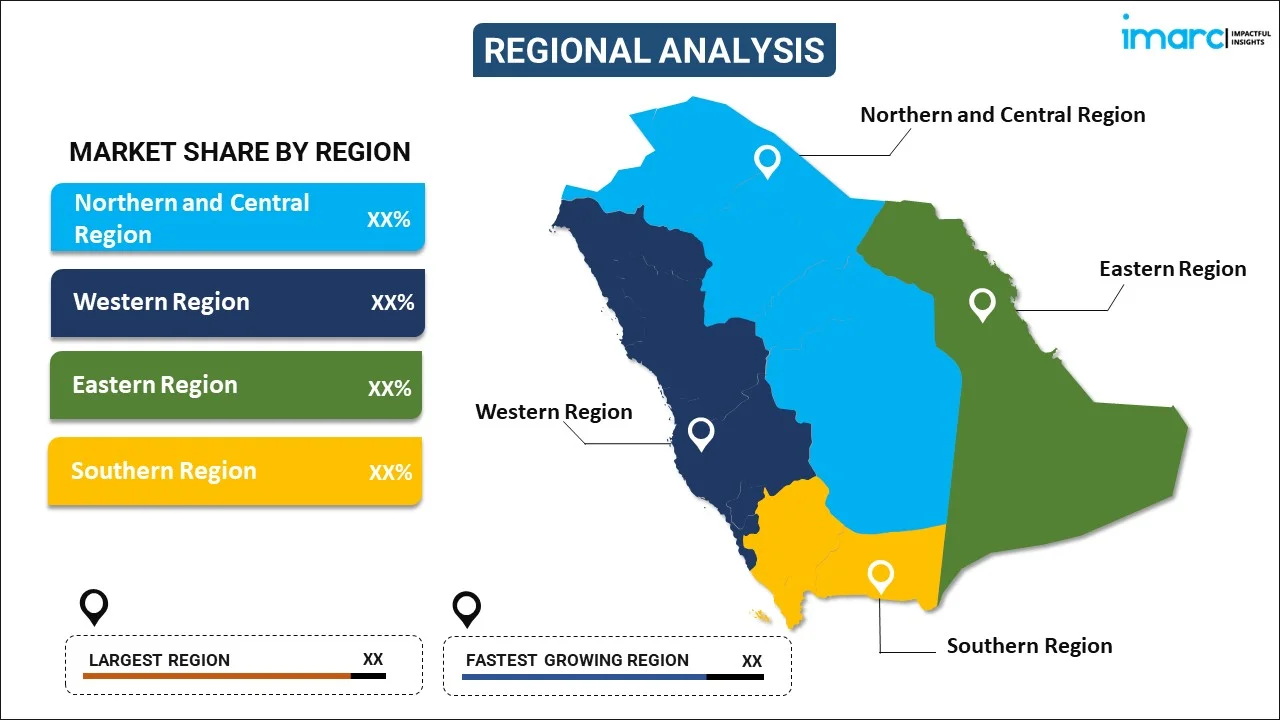

- By Region: Northern and Central Region dominate the market with a share of 28% in 2025, supported by concentrated population density in Riyadh metropolitan area, superior charging infrastructure development, and ambitious municipal fleet electrification initiatives.

- Key Players: The Saudi Arabia electric car market exhibits intensifying competitive dynamics, with multinational automotive manufacturers competing alongside emerging domestic brands across diverse price segments and technology platforms, supported by strategic government partnerships.

The Saudi Arabia electric car market is driven by strong commitment to decarbonization, technology diversification, and long-term transformation of the transportation sector under national sustainability objectives. Policy alignment with Vision 2030, investment in clean mobility, and emphasis on reducing transport-related emissions are strengthening the shift toward electric vehicles (EVs). Integration of complementary zero-emission technologies reinforces confidence in the broader transition ecosystem. In line with this, in 2025, King Abdullah University of Science and Technology, Abdul Latif Jameel Motors, and Toyota Motor Corporation initiated a collaborative partnership to advance hydrogen fuel cell research in Saudi Arabia, supporting decarbonization across transportation and related sectors. Such initiatives demonstrate sustained institutional backing for clean mobility innovation and progress toward the national target of achieving net zero greenhouse gas emissions by 2060. Alongside expanding charging infrastructure, rising manufacturer participation, and the growing user awareness, these technology-led collaborations are creating a supportive environment for EV adoption, strengthening market depth, and contributing to the market growth across the Kingdom.

Saudi Arabia Electric Car Market Trends:

Vision 2030 and National Decarbonization Objectives

Saudi Arabia’s electric car market is driven by Vision 2030, which emphasizes carbon reduction, energy diversification, and sustainable urban mobility. EVs support national objectives to lower transport emissions and reduce reliance on fossil fuels, while regulatory alignment with global climate commitments ensures long-term policy continuity. Reflecting this trend, in 2025, Ford Motors announced its entry into the Saudi EV market with the launch of the Mustang Mach-E, planning an initial rollout of 500 to 1,000 units. Such developments highlight the growing manufacturer confidence, encourage technology transfer, and reinforce investor interest, positioning electric cars as a strategic pillar within the Kingdom’s evolving transportation framework.

Expansion of Charging Infrastructure

Rapid expansion of charging infrastructure is strengthening user confidence in electric cars by improving accessibility and reducing concerns related to driving range. Public charging stations, residential solutions, and workplace installations are making electric mobility more practical for daily commuting and fleet use. Reflecting this progress, in 2025, Jeddah’s charging network aimed to expand through a partnership between Jeddah Transport Co. and Petromin’s Electromin to assess, design, install, and operate new charging stations. Such initiatives enhance urban charging coverage, support Vision 2030 mobility goals, and encourage higher adoption rates by improving convenience, reliability, and readiness for electric vehicle ownership across major cities.

Localization of EV Manufacturing and Assembly

Saudi Arabia’s emphasis on developing domestic EV manufacturing and assembly capabilities is strengthening the long-term market growth by reducing import reliance and improving supply chain resilience. Localization also enables vehicle designs suited to regional climate and driving conditions while supporting cost optimization over time. Reflecting this strategy, in 2025, Ceer, the Kingdom’s first EV manufacturer, announced plans to launch its initial models in Q4 2026, with production beginning in late 2025. Backed by the Public Investment Fund and partnerships with BMW and Foxconn, this initiative supported job creation, skills development, technology transfer, and greater commercial viability of electric cars across the local market.

How Vision 2030 is Transforming the Saudi Arabia Electric Car Market:

Vision 2030 is reshaping the Saudi Arabia electric car market by positioning clean mobility as a strategic priority within national economic diversification and environmental objectives. The program promotes reduced carbon emissions, lower fuel dependence, and development of a domestic EV ecosystem. Government-led investments in charging infrastructure, regulatory support for EV imports, and partnerships with global manufacturers are improving market readiness. Vision 2030 also encourages local assembly, technology transfer, and private sector participation across the automotive value chain. Urban sustainability initiatives and smart city projects are integrating electric mobility into transport planning. Together, these measures are accelerating adoption, improving user confidence, and establishing a structured foundation for long-term electric car market growth across the Kingdom.

Market Outlook 2026-2034:

The Saudi Arabia electric car market demonstrates robust revenue growth potential throughout the forecast period, underpinned by irreversible policy commitments, infrastructure investment, and broad-based economic transformation aligned with sustainability objectives. Government incentives, charging network expansion, and rising consumer acceptance are strengthening market fundamentals and long-term adoption prospects. The market generated a revenue of USD 1.81 Billion in 2025 and is projected to reach a revenue of USD 5.52 Billion by 2034, growing at a compound annual growth rate of 13.18% from 2026-2034.

Saudi Arabia Electric Car Market Report Segmentation:

|

Segment Category |

Leading Segment |

Market Share |

|

Type |

Battery Electric Vehicle |

57.9% |

|

Vehicle Class |

Mid-Priced |

66.95% |

|

Drive Type |

Front Wheel Drive |

49.9% |

|

Region |

Northern and Central Region |

28% |

Type Insights:

To get detailed segment analysis of this market, Request Sample

- Battery Electric Vehicle

- Plug-In Hybrid Electric Vehicle

- Fuel Cell Electric Vehicle

Battery electric vehicle dominates with a market share of 57.9% of the total Saudi Arabia electric car market in 2025.

Battery electric vehicle represents the largest segment because of zero tailpipe emissions, lower operating costs, and alignment with national sustainability goals. Strong government support and expanding charging infrastructure further enhance its attractiveness to users.

This segment also offers simpler powertrain design and improving driving range, increasing user confidence. Greater model availability and reduced maintenance requirements support wider adoption compared to hybrid alternatives across urban and fleet applications.

Vehicle Class Insights:

- Mid-Priced

- Luxury

Mid-priced leads with a market share of 66.95% of the total Saudi Arabia electric car market in 2025.

Mid-priced dominates the market, as it offers a balance of affordability with advanced features and driving range. This segment appeals to middle-income consumers seeking electric mobility without premium pricing constraints.

Vehicles in this segment offers adequate performance, modern safety features, and acceptable charging capabilities. Government incentives and expanding charging infrastructure further support adoption, making mid-priced electric cars the preferred choice for practical and cost-conscious buyers.

Drive Type Insights:

- Front Wheel Drive

- Rear Wheel Drive

- All-Wheel Drive

Front wheel drive exhibits a clear dominance with a 49.9% share of the total Saudi Arabia electric car market in 2025.

Front wheel drive leads the market owing to its cost efficiency, simpler drivetrain design, and suitability for urban driving conditions. This configuration supports lower vehicle weight, improved energy efficiency, and competitive pricing for mass-market electric models.

It also provides adequate performance for daily commuting and city traffic. Better interior space utilization and ease of maintenance make this drive type attractive to both manufacturers and consumers seeking practical electric mobility solutions.

Regional Insights:

To get detailed regional analysis of this market, Request Sample

- Northern and Central Region

- Western Region

- Eastern Region

- Southern Region

Northern and Central Region dominates with a market share of 28% of the total Saudi Arabia electric car market in 2025.

Northern and Central Region hold the biggest market share due to dense population, higher income levels, and concentrated commercial activity in cities like Riyadh. Strong purchasing power and urban lifestyles support faster adoption of electric cars among individual buyers and corporate users.

Better charging availability, dealership networks, and urban mobility programs further contribute to the market dominance. This momentum was evident at the EV Auto Show Riyadh 2025, featuring 120 exhibitors from 35 countries, highlighting new EVs, local manufacturing efforts, and skills development initiatives nationwide.

Market Dynamics:

Growth Drivers:

Why is the Saudi Arabia Electric Car Market Growing?

Growth of Automotive Financing and Leasing Options

Improved access to flexible financing and subscription-based mobility solutions is reducing affordability barriers in the market. Leasing, installment plans, and usage-based models make EV ownership more attainable for middle-income consumers and corporate fleets. Reflecting this shift, in 2025, E-FILL launched the Kingdom’s first subscription-based EV charging model, offering Basic, Standard, and Business plans with predictable pricing across its fast-charging network. Such initiatives complement vehicle financing by lowering ongoing ownership costs and improving cost transparency. Together, flexible payment structures and subscription services enhance user confidence, address affordability constraints, and support wider EV adoption in alignment with Vision 2030 sustainability objectives.

Autonomous Mobility and AI-Enabled Vehicle Capabilities

Advances in autonomous driving technologies and artificial intelligence (AI) are influencing the Saudi Arabia electric car market by redefining vehicle performance, safety, and mobility efficiency. Integration of high-level autonomy enhances driving convenience, supports intelligent transport systems, and positions EVs as future-ready solutions. A key development occurred in 2025, when Saudi-backed Lucid Group partnered with Nvidia to develop EVs featuring Level 4 autonomy using Nvidia’s Drive AV platform. These models were designed to compete with global leaders by enabling near-total autonomous operation. Such progress strengthens Saudi Arabia’s smart mobility ambitions, elevates user interest in advanced EVs, and reinforces alignment with Vision 2030 objectives for technology-driven transportation transformation.

Development of Domestic Innovation Infrastructure and Talent Ecosystems

Expansion of localized research and innovation infrastructure is bolstering the Saudi Arabia electric car market growth by building long-term technological self-reliance and industry capability. Investment in dedicated innovation centers supports advancements in battery systems, vehicle engineering, and connected mobility while cultivating skilled local talent. In 2025, King Abdulaziz City for Science and Technology and Lucid Group launched the Middle East’s first Electric Vehicle Innovation Center in Saudi Arabia, focused on EV technologies and smart mobility solutions. This initiative strengthens collaboration between academia and industry, encourages technology transfer, and supports Vision 2030 goals by anchoring EV innovation within the Kingdom’s growing technology ecosystem.

Market Restraints:

What Challenges the Saudi Arabia Electric Car Market is Facing?

High Vehicle Acquisition Costs Limiting Mass Market Adoption

Electric car purchase prices remain significantly higher than those of conventional vehicles, limiting affordability for price-sensitive buyers. Elevated upfront costs continue to restrict adoption among middle-income households, which represent a large potential user base. Limited availability of competitively priced electric models suitable for family use further constrains broader market penetration.

Limited Charging Infrastructure Coverage in Remote Areas

Despite continued expansion efforts, charging infrastructure remains heavily concentrated in major metropolitan areas, creating significant geographic gaps. Limited availability of charging stations along intercity and desert highway routes restricts long-distance travel feasibility. These constraints heighten range anxiety among prospective buyers and discourage electric car adoption due to concerns over charging access and travel convenience.

Extreme Climate Conditions Affecting Battery Performance

Saudi Arabia’s extreme desert climate, with temperatures often exceeding fifty degrees Celsius, poses significant challenges for electric car battery performance and durability. High thermal loads increase energy demand for cooling systems, reducing effective driving range. Prolonged exposure to extreme heat may also accelerate battery degradation, raising maintenance requirements and overall operating costs.

Competitive Landscape:

The Saudi Arabia electric car market exhibits intensifying competitive dynamics characterized by the convergence of established multinational automotive manufacturers and emerging domestic brands competing across diverse technology platforms and price segments. Market positioning increasingly reflects strategic alignment with Vision 2030 localization objectives, with manufacturers pursuing local production capabilities to capture government procurement preferences and reduce import dependencies. Competition is driven by investments in charging infrastructure partnerships, expanded model availability spanning entry-level to luxury segments, and enhanced aftersales support networks that improve customer confidence and ownership experience. The competitive landscape continues evolving as domestic brands prepare market entry, creating opportunities for differentiation through technology innovation, pricing strategies, and brand positioning.

Recent Developments:

- January 2026: Tesla introduced its most affordable electric vehicle, the Model 3 Standard, in Saudi Arabia. Priced at SAR 154,990, it offers impressive range, efficiency, and advanced technology. Deliveries will begin in June 2026, making electric mobility more accessible to a broader audience.

- December 2025: GAC Motors launched its Aion and Hyptec electric vehicle series at the Riyadh Motor Show, marking its debut in Saudi Arabia's growing new energy vehicle market. The new models, including Aion V, Aion ES, and Hyptec HT, aligned with Saudi Arabia's Vision 2030. GAC also committed to offering strong warranties and reliable parts supply to boost EV adoption in the region.

Saudi Arabia Electric Car Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Billion USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered | Battery Electric Vehicle, Plug-In Hybrid Electric Vehicle, Fuel Cell Electric Vehicle |

| Vehicle Classes Covered | Mid-Priced, Luxury |

| Drive Types Covered | Front Wheel Drive, Rear Wheel Drive, All-Wheel Drive |

| Regions Covered | Northern and Central Region, Western Region, Eastern Region, Southern Region |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report

The Saudi Arabia electric car market size was valued at USD 1.81 Billion in 2025.

The Saudi Arabia electric car market is expected to grow at a compound annual growth rate of 13.18% from 2026-2034 to reach USD 5.52 Billion by 2034.

Battery electric vehicle dominates the market with 57.9% market share in 2025, driven by expanding charging infrastructure, declining battery costs, and strong government incentives promoting zero-emission transportation.

Key factors driving the Saudi Arabia electric car market include rapid expansion of charging infrastructure, supportive urban mobility policies, and Vision 2030 initiatives, highlighted by the 2025 partnership between Jeddah Transport Company and Electromin to develop new charging stations, improving accessibility and reducing range concerns.

Major challenges include high upfront vehicle costs, limited charging infrastructure in remote areas, extreme climate conditions affecting battery performance, generous fuel subsidies reducing conventional vehicle operating costs, and limited model availability across price segments.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)