Saudi Arabia Eggs Market Size, Share, Trends and Forecast by Production Method, End-User, and Region, 2025-2033

Saudi Arabia Eggs Market Size and Share:

The Saudi Arabia eggs market size was valued at 356.06 Thousand Tons in 2024. Looking forward, IMARC Group estimates the market to reach 498.08 Thousand Tons by 2033, exhibiting a CAGR of 3.50% from 2025-2033. The rising consumer demand for protein-rich diets, increasing poultry farming investments, government support for food security, and the growing popularity of organic and specialty eggs is increasing the Saudi Arabia eggs market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | 356.06 Thousand Tons |

| Market Forecast in 2033 | 498.08 Thousand Tons |

| Market Growth Rate (2025-2033) | 3.50% |

The Saudi Arabia eggs market is growing on account of the nation's rapidly growing population, which largely contributes to the increasing demand for eggs as a staple protein source. The demand for affordable and nutritious food options continues to grow with the increasing population, with eggs being one of the cheapest sources of protein. Another significant reason for driving the demand of this market is healthy and well-balanced diet. Now, people of Saudi Arabia have been becoming conscious regarding the health aspects of eggs which include the availability of protein, vitamins, and minerals, quite vital for the health at large. Consequently, such an adjustment in preference led to the increment of egg's consumption either in terms of their serving as the only breakfast dish or accompanied in other kinds of meals.

.webp)

Moreover, the expansion of poultry production in the country has also greatly increased egg supplies. According to the IMARC Group, the Saudi Arabia poultry market is expected to reach USD 26.6 Billion by 2033. Saudi Arabia has found it imperative to invest heavily in local production to displace imported eggs in a bid by the government to attain food security and, generally, become self-sufficient. The increased production resulted in more competitive prices and increased the accessibility of eggs to more segments of the population. Moreover, Advances in agricultural and poultry sectors in Saudi Arabia also are important factors of the growth in this market. Due to farming technology advancements, automation, and improvements in breeding, poultry farms can increase their efficiency in the production of eggs while decreasing costs, enhancing product quality, and producing a more stable supply with fewer price volatilities.

Saudi Arabia Eggs Market Trends:

Increasing consumer preference for convenience and processed egg products

As the urbanization of populations in Saudi Arabia continues to shift and lifestyles quicken, demands for convenient ready-to-eat foods are increasing. According to the IMARC Group, the Saudi Arabia ready meals market has reached USD 1,935.2 Million in 2024. Convenience is another factor driving this market, with processed egg products like liquid eggs, powdered eggs, and even ready-to-eat egg items. These represent busy shoppers trying to find food that is also nutritious and filled with protein to prepare, hence not taking more time to be prepared. The growth of supermarkets, hypermarkets, and online grocery service has increased the convenience aspect, and the processed egg products have been able to reach a much larger market. The food service sectors such as restaurants, cafes, and catering companies in Saudi Arabia are also slowly adopting processed eggs due to their quality and convenience. All these factors are creating a positive Saudi Arabia eggs market outlook.

Government policies and support for poultry farming

According to Saudi Arabia eggs market forecast, different policies and subsidies on domestic poultry have been developed to support this agriculture, since eggs are vital in the poultry products market in the growth of this product. Aiming at having proper food security in place and reduced imports, Vision 2030 is giving focus to enhancing a local industry; thus, big investments in enhancing this poultry local sector take place. This includes funding for the improvement of poultry farms, feed subsidy, and introducing high-tech farming techniques to boost production efficiency while reducing costs. Sustainable farming practices in terms of conserving water and waste management are improving the long-term viability of poultry farms in the region as well. With these supportive policies, local producers are better equipped to meet increasing demand for eggs, ensuring that there is a stable and growing domestic market consistent with the goals of self-sufficiency by the country, further increasing the Saudi Arabia eggs market growth.

Increased adoption of animal welfare standards and organic eggs

As global trends for ethical consumption and sustainability rise, Saudi consumers have become increasingly sensitive to the animal welfare aspect, and hence an interest in organic and free-range egg products. Such a change opens up new markets for better-standards animal welfare-produced eggs. Numerous Saudi poultry producers have taken up more humane and sustainable practices of farming. For instance, they are providing chickens with ample space and access to natural environments. They also use organic feed that is free from synthetic additives. Organic eggs are in high demand, especially on account of their identified health benefits, including increased levels of omega-3 fatty acids and fewer chemicals used in the production process. This is further increasing the Saudi Arabia eggs market demand.

Saudi Arabia Eggs Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the Saudi Arabia eggs market, along with forecasts at the country and regional levels from 2025-2033. The market has been categorized based on production type and end-user.

Analysis by Production Type:

- Conventional Eggs

- Organic Eggs

- Free-Range Eggs

- Enriched Cage Eggs

Frozen ready meals form the bulk of the Saudi Arabian ready meal market since the shelf life is higher and the nutrient value is more likely to be preserved. These are pre-cooked, packed, and frozen, making them more of a ready-to-go choice from a consumer's point of view. Frozen ready meals have been in high demand as nuclear families and expatriates, in particular, are too busy to cook, but they do not sacrifice taste or nutrient value while choosing their meals.

Chilled ready meals are becoming highly in demand among consumers in Saudi Arabia, especially from the consumers that highly value fresh and high-quality food with few preservatives. Usually, chilled meals are kept under refrigerated temperatures; however, frozen meals have longer shelf lives compared to chilled, hence appealing health-conscious consumers with preference for lesser additive meals. Chilled ready meals meet the increasing needs for fresh and highly convenient meal preparation in urban areas where supermarkets and specialty food stores provide a wide range of locally produced and imported chilled meals.

Ambient ready-to-cook foods have gained increased attention in Saudi Arabian markets since the shelf life and convenience are a great feature that these meals are characterized by. Food preservation technologies in the form of advanced vacuum sealing, retort processing, and aseptic packaging enable meals to be kept for a long period of time without the need for refrigeration. This makes them particularly appealing to consumers who seek shelf-stable meal options, including those in remote or rural areas where refrigeration may not be as widely available.

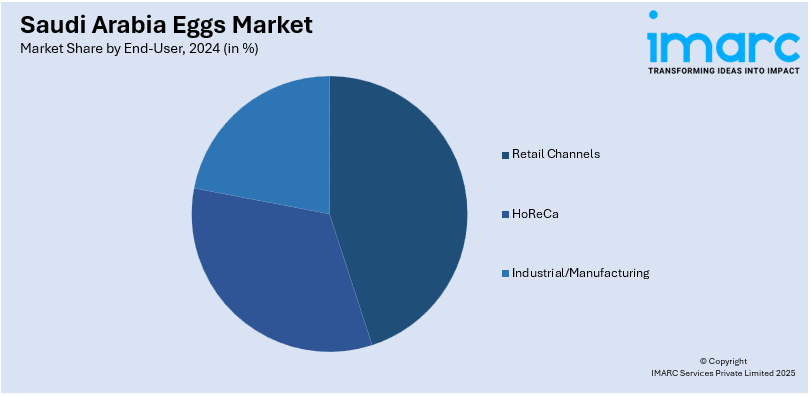

Analysis by End-User:

- Retail Channels

- HoReCa

- Industrial/Manufacturing

Retail is one of the most important places where eggs are sold in Saudi Arabia because households purchase their daily foodstuffs from supermarkets and hypermarkets and online grocery platforms. Supermarkets and hypermarkets such as Panda, Lulu Hypermarket, and Carrefour are primary distribution centers for the sale of fresh eggs in the country. They offer a wide variety of different eggs, such as conventional, organic, free-range, and fortified eggs. With increasing consumer demands for organic and specialty eggs, retailers now carry more varied offerings, in the pursuit of reaching the health-conscious market.

The HoReCa sector forms one of the essential segments in the Saudi Arabia eggs market, mainly because of rapid hospitality industry expansion and growth in tourism in addition to shifting consumer dining patterns. Hotels, restaurants, cafes, and catering services form some of the primary users of eggs for baking, preparing breakfast dishes, making sauces, and desserts. The increasing popularity of international cuisine, especially Western-style breakfast menus, has contributed to higher egg consumption in this segment.

The industrial portion of the industry, which features bakeries and confectionary and food processors, is important in the kingdom's eggs business. Eggs represent a major item in the confectionery goods, bakery item cakes, bread, cookies, and pastries, as well as in manufactured foods. The bakery and confectionery business is growing by leaps and bounds in Saudi Arabia, with higher urbanization coupled with Western influences in diet making eggs a main ingredient.

Regional Insights:

- Northern and Central Region

- Western Region

- Eastern Region

- Southern Region

Northern and Central Region, Saudi Arabia. This region holds the major cities of Riyadh and is a highly populated and economic region. Thus, it constitutes a significant market for eggs, with Riyadh itself being the capital and largest city, having an increased demand for eggs due to urbanization, a growing middle class, and more consumers spending on food products. The market has several big supermarket chains, hypermarkets, and food service businesses that further incite the market because the described shops stock a variety of egg products, including organic and free-range eggs.

The Western Region, which comprises cities like Jeddah, Mecca, and Medina, has a specific demand for eggs, not only due to the diversity of its population but also because of its significant tourism industry. Jeddah, which is a major commercial centre, has a well-established retail sector where eggs are sold in supermarkets, convenience shops, and online platforms. During the religious pilgrimages to Mecca and Medina, the region sees a seasonal boom in demand due to millions of visitors requiring egg-based meal food services.

The Eastern Region, including Dammam, Al Khobar, and Dhahran cities, is very important for the Saudi eggs market because of the strong economic base in the region due to the oil and gas industry. This high-income population has increased the demand for premium and organic egg products. There is also an increasing expatriate community, thereby increasing the demand for diverse egg-based products in retail and food service industries.

Competitive Landscape:

The Saudi Arabia eggs market has several key players working through various strategies to increase market presence and stimulate growth. Major poultry companies, including Al-Watania Poultry and Al-Fakieh Poultry Farms, are installing the best available farming technologies, ensuring enhanced efficiency in production, quality of eggs, and food safety. Companies are embracing automation during egg collection, sorting, and packaging to minimize labor costs and ensure consistency in supply. As per Saudi Arabia eggs market analysis, another aspect through which the market leaders are extending their distribution channels is by partnering with large supermarket chains, hypermarkets, and e-commerce platforms in order to increase access to consumers. As a result of a change in preference, companies have diversified their offerings by organic, free-range, and omega-3-enriched eggs and are targeting premium and health-conscious segments.

The report provides a comprehensive analysis of the competitive landscape in the Saudi Arabia eggs market with detailed profiles of all major companies.

Latest News and Developments:

- January 2024: Tanmiah Food Company secured a 450 million riyal credit facility to support its strategic expansion plans. The company's revenue increased by 21.5% in the first nine months of 2023, driven by fresh poultry sales and its food franchise business.

- October 2024: Almarai and Algharbia Farms signed an MoU to produce egg powder locally in Saudi Arabia. The initiative aims to enhance food security and meet local demand for diverse products through modern technologies and innovation. Egg powder production aligns with Saudi Arabia's Vision 2030 goals of economic diversification and supporting local content.

- March 2024: MHP, Ukraine's largest poultry processor, took permission to build a poultry farm in Saudi Arabia as partners with local firm DHV. Ukrainian poultry farmers are seeking foreign business diversification due to potential export restrictions to Europe.

Saudi Arabia Eggs Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Thousand Tons |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Production Methods Covered | Conventional Eggs, Organic Eggs, Free-Range Eggs, Enriched Cage Eggs |

| End-Users Covered | Retail Channels, HoReCa, Industrial/Manufacturing |

| Regions Covered | Northern and Central Region, Western Region, Eastern Region, Southern Region |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Saudi Arabia eggs market from 2019-2033.

- The research study provides the latest information on the market drivers, challenges, and opportunities in the Saudi Arabia eggs market.

- Porter's Five Forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Saudi Arabia eggs industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The Saudi Arabia eggs market in the region was valued at 356.06 Thousand Tons in 2024.

The market for eggs in Saudi Arabia is fueled by population increases, heightened health awareness, government backing for poultry agriculture, growing demand for convenient and processed egg items, and a rising inclination towards organic and free-range eggs.

The Saudi Arabia eggs market is projected to exhibit a CAGR of 3.50% during 2025-2033, reaching a value of 498.08 Thousand Tons by2033.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)