Saudi Arabia E-Waste Recycling Market Size, Share, Trends and Forecast by Material, Source, and Region, 2025-2033

Saudi Arabia E-Waste Recycling Market Size and Share:

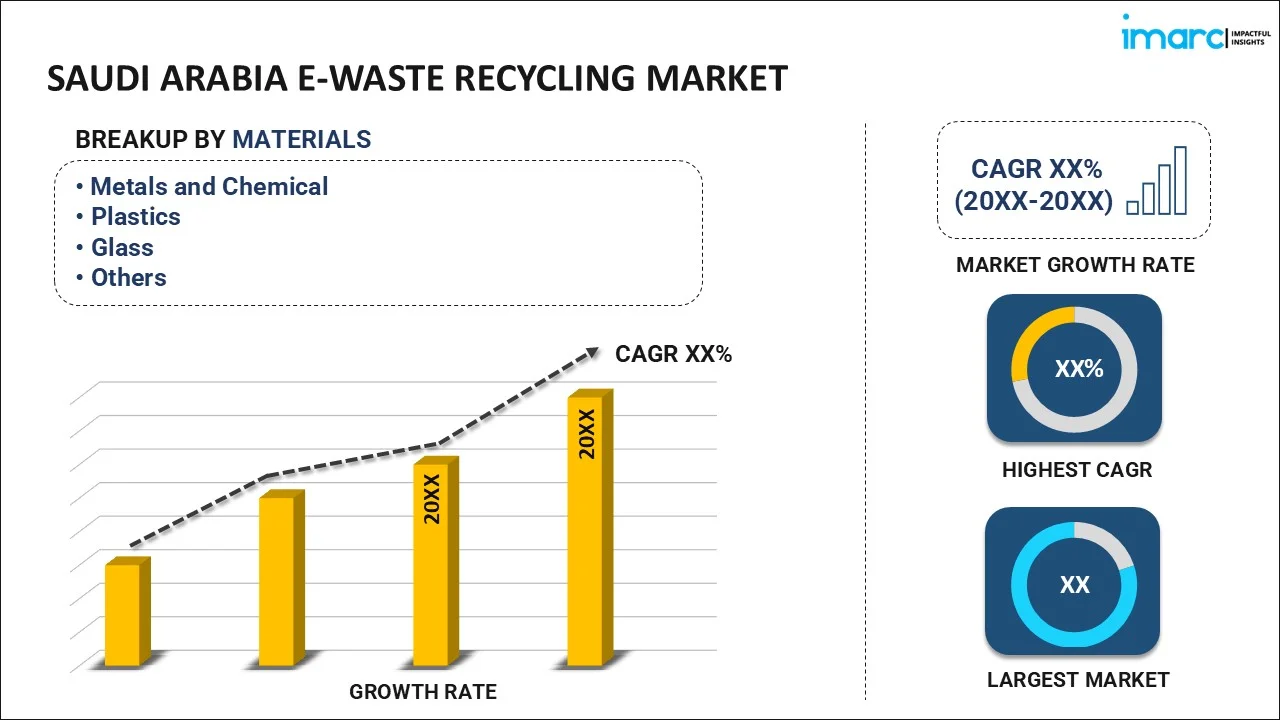

The Saudi Arabia e-waste recycling market size reached USD 0.29 Billion in 2024. Looking forward, IMARC Group expects the market to reach USD 1.70 Billion by 2033, exhibiting a growth rate (CAGR) of 19.20% during 2025-2033. The market is growing due to the rising demand for efficient waste management solutions, rapid electronic consumption, the implementation of various government policies, and rising awareness of environmental sustainability, are the key factors propelling the market growth.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 0.29 Billion |

| Market Forecast in 2033 | USD 1.70 Billion |

| Market Growth Rate (2025-2033) | 19.20% |

Saudi Arabia E-Waste Recycling Market Trends:

Increasing Electronic Consumption and Rapid Technological Advancements

One of the primary drivers in the Saudi Arabia e-waste recycling market growth is the increasing consumption of electronic devices, spurred by rapid technological advancements. The digitalization of education, healthcare, finance, and retail businesses has resulted in significant growth of electronic item usage which includes smartphones and computers alongside home appliances. Moreover, the accelerated generation of e-waste occurs because ongoing technological updates and innovations force users to replace their older devices with newer models. The increased speed of electronic replacement patterns has enabled the emergence of a strong market demand for better recycling systems that process increasing amounts of discarded electronic products. According to reports, in 2024, the Kingdom achieved electronic device recycling of more than 100,000 units through its digital sustainability and resource optimization plan. Besides this, the increase in smart city programs and IoT technology spread across the world drives the rapid growth of e-waste production. Furthermore, the increasing number of advanced devices in the market leads to projected expansion in e-waste volumes thus creating an urgent need for a structured recycling industry in Saudi Arabia.

Government Initiatives and Policy Support

Government initiatives are playing a critical role in e-waste management which is boosting the Saudi Arabia e-waste recycling market share. The Saudi Vision 2030 framework focuses on sustainable practices and environmental preservation which incorporates e-waste recycling into its agendas. Policies are also introduced to standardize electronic waste disposal and recycling which is encouraging the companies to follow more eco-friendly strategies. For instance, the Communications, Space and Technology Commission started the "Development of Electronic Waste Management Regulations" in October 2023. The initiative establishes a worldwide approach to e-waste management while pursuing circular economy principles and developing creative solutions to decrease electronic waste. Moreover, regulatory bodies are actively motivating Extended Producer Responsibility (EPR) programs, making the producers and importers take responsibility for the end-of-life disposal of their products. The regulations are forcing the companies to recycle either directly or through partnerships with e-waste recycling specialists, which is contributing to the market growth. This is further fostered with incentives and investment in the development of recycling facilities supporting the development of formal e-waste management infrastructure. Apart from this, improved environmental compliance enforcement and constant monitoring are making recycling a bankable business venture aligned with the country's vision of a circular economy.

Rising Awareness of Environmental Sustainability

The growing consciousness of environmental sustainability among the audience and institutions of the region is enhancing the Saudi Arabia e-waste recycling market outlook. Consumers and corporate houses are highly becoming conscious of the ecological effects posed by improperly disposed e-waste, which can release hazardous pollutants entering soil and water systems. Additionally, media campaigns, educational programs, and community actions are collaborating and driving a social shift in waste disposal which is particularly concerning electronic goods. Besides this, amplifying numbers of businesses and audiences are assuming greater responsibility for the most environmentally effective methods of waste elimination. Individuals are also increasingly utilizing designated recycling centers to dispose of electronics, thus preventing these items from entering traditional waste streams. Moreover, corporations that now include environmental, social, and corporate governance goals are seeking to include e-waste recycling into their sustainability initiatives to reduce their carbon footprint and improve their goodwill. For example, in 2024, Zain KSA partnered with Ertiqa to launch the second phase of an e-waste recycling campaign, targeting the recycling of over 5,000 electronic devices to reduce carbon emissions and enhance economic efficiency, thus contributing to the market expansion.

Saudi Arabia E-Waste Recycling Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the region level for 2025-2033. Our report has categorized the market based on material and source.

Material Insights:

- Metals and Chemical

- Plastics

- Glass

- Others

The report has provided a detailed breakup and analysis of the market based on the material. This includes metals and chemical, plastics, glass, and others.

Source Insights:

- Household Appliances

- Entertainment & Consumer Electronics

- IT & Telecommunication

- Medical Equipment

- Others

A detailed breakup and analysis of the market based on the source have also been provided in the report. This includes household appliances, entertainment & consumer electronics, IT & telecommunication, medical equipment, and others.

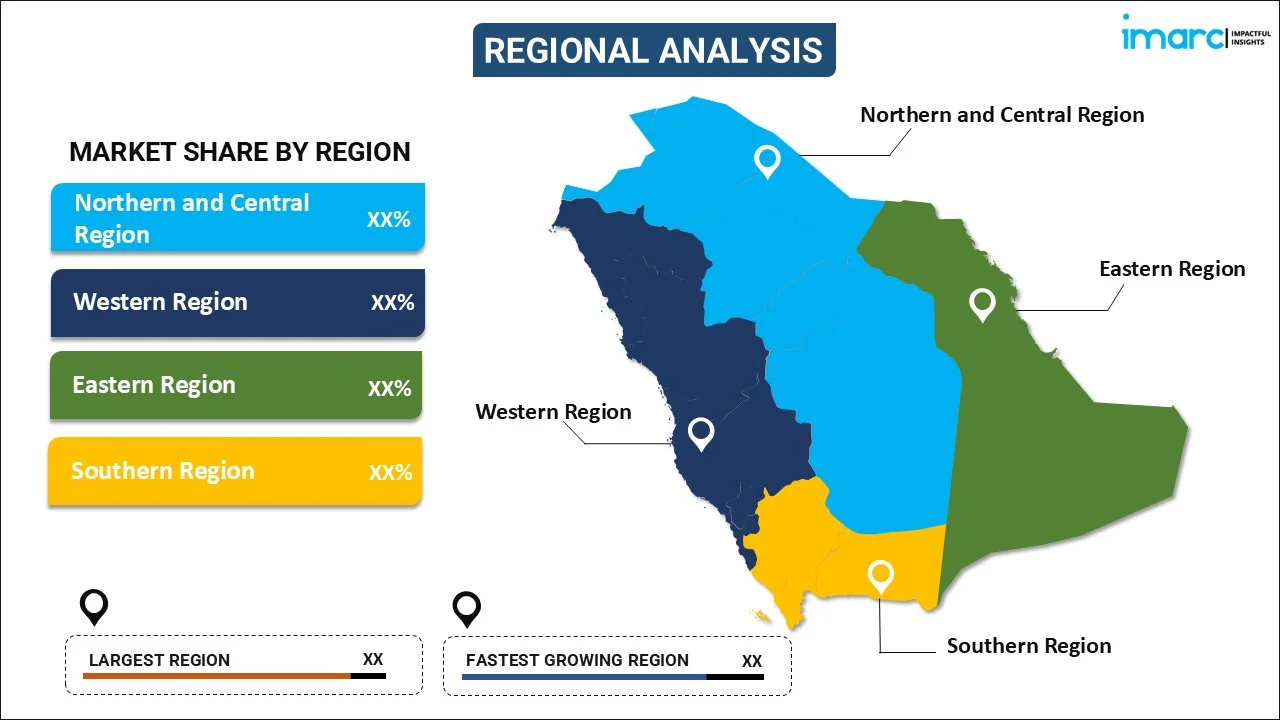

Regional Insights:

- Northern and Central Region

- Western Region

- Eastern Region

- Southern Region

The report has also provided a comprehensive analysis of all the major regional markets, which include Northern and Central Region, Western Region, Eastern Region, and Southern Region.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Saudi Arabia E-Waste Recycling Market News:

- In December 2023, the Saudi Investment Recycling Company (SIRC), a Public Investment Fund subsidiary, signed a Memorandum of Understanding with the Alliance to End Plastic Waste. The partnership aims to address plastic waste in the Kingdom and aligns with the objectives of Saudi Arabia's Vision 2030.

- In December 2023, during COP28, CST announced the commencement of the "Developing E-Waste Management Regulations" initiative, reinforcing Saudi Arabia's commitment to digital sustainability and the promotion of a circular economy.

Saudi Arabia E-Waste Recycling Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Materials Covered | Metals and Chemical, Plastics, Glass, Others |

| Sources Covered | Household Appliances, Entertainment & Consumer Electronics, IT & Telecommunication, Medical Equipment, Others |

| Regions Covered | Northern and Central Region, Western Region, Eastern Region, Southern Region |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Saudi Arabia e-waste recycling market performed so far and how will it perform in the coming years?

- What is the breakup of the Saudi Arabia e-waste recycling market on the basis of material?

- What is the breakup of the Saudi Arabia e-waste recycling market on the basis of source?

- What is the breakup of the Saudi Arabia e-waste recycling market on the basis of region?

- What are the various stages in the value chain of the Saudi Arabia e-waste recycling market?

- What are the key driving factors and challenges in the Saudi Arabia e-waste recycling?

- What is the structure of the Saudi Arabia e-waste recycling market and who are the key players?

- What is the degree of competition in the Saudi Arabia e-waste recycling market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Saudi Arabia e-waste recycling market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Saudi Arabia e-waste recycling market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Saudi Arabia e-waste recycling industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)