Saudi Arabia Drilling Services Market Report by Service (Directional Drilling, Non-Directional Drilling), Application (Onshore, Offshore), End User (Oil and Gas, Mining, Water Exploration, and Others), and Region 2026-2034

Market Overview:

Saudi Arabia drilling services market size reached USD 226.6 Million in 2025. Looking forward, IMARC Group expects the market to reach USD 328.7 Million by 2034, exhibiting a growth rate (CAGR) of 4.22% during 2026-2034. The increasing advances in drilling technologies, such as horizontal drilling, hydraulic fracturing (fracking), and deepwater drilling, which can open up new opportunities for exploration and production, are driving the market.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2025 |

|

Forecast Years

|

2026-2034

|

|

Historical Years

|

2020-2025

|

| Market Size in 2025 | USD 226.6 Million |

| Market Forecast in 2034 | USD 328.7 Million |

| Market Growth Rate (2026-2034) | 4.22% |

Drilling services encompass a range of specialized techniques and equipment used in the extraction of valuable resources or the creation of boreholes for various purposes. These services are critical in industries such as oil and gas exploration, mining, construction, and environmental assessment. In the context of gas and oil, drilling services involve drilling wells deep into the Earth's crust to access hydrocarbon reserves. This process includes activities like drilling rig operation, wellbore construction, and reservoir evaluation. Mining drilling services are essential for extracting minerals and ores from the Earth's subsurface. Additionally, drilling services are vital in civil engineering and construction projects to create foundations, tunnels, and geotechnical investigations. Environmental drilling services aid in soil and groundwater sampling for environmental assessments. These services require specialized machinery, experienced personnel, and adherence to safety and environmental regulations. They play a crucial role in resource extraction, infrastructure development, and environmental protection.

Saudi Arabia Drilling Services Market Trends:

The drilling services market in Saudi Arabia is currently being propelled by several key drivers. Firstly, the regional demand for energy continues to rise, driving the exploration and production of oil and natural gas. This surge in energy needs is prompting increased drilling activities in Saudi Arabia, boosting the demand for drilling services. Furthermore, technological advancements in drilling techniques and equipment are enhancing the efficiency and cost-effectiveness of drilling operations. Automation, data analytics, and remote monitoring are becoming integral components of drilling services, allowing companies to optimize their operations and reduce downtime. Apart from this, environmental regulations and sustainability concerns are also driving the market. Companies are increasingly focusing on eco-friendly drilling practices, including minimizing environmental impact and reducing emissions, which in turn is boosting the demand for drilling services that can meet these stringent requirements. Additionally, the growing need for unconventional resources, such as shale gas and tight oil, that often require specialized drilling techniques is expected to drive the market in Saudi Arabia during the forecast period.

Saudi Arabia Drilling Services Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country level for 2026-2034. Our report has categorized the market based on service, application, and end user.

Service Insights:

- Directional Drilling

- Measurement-while-Drilling

- Logging-while-Drilling

- Rotary Steerable Systems and Others

- Non-Directional Drilling

A detailed breakup and analysis of the market based on the service have also been provided in the report. This includes directional drilling (measurement-while-drilling, logging-while-drilling, and rotary steerable systems and others) and non-directional drilling.

Application Insights:

- Onshore

- Offshore

The report has provided a detailed breakup and analysis of the market based on the application. This includes onshore and offshore.

End User Insights:

- Oil and Gas

- Mining

- Water Exploration

- Others

A detailed breakup and analysis of the market based on the end user have also been provided in the report. This includes oil and gas, mining, water exploration, and others.

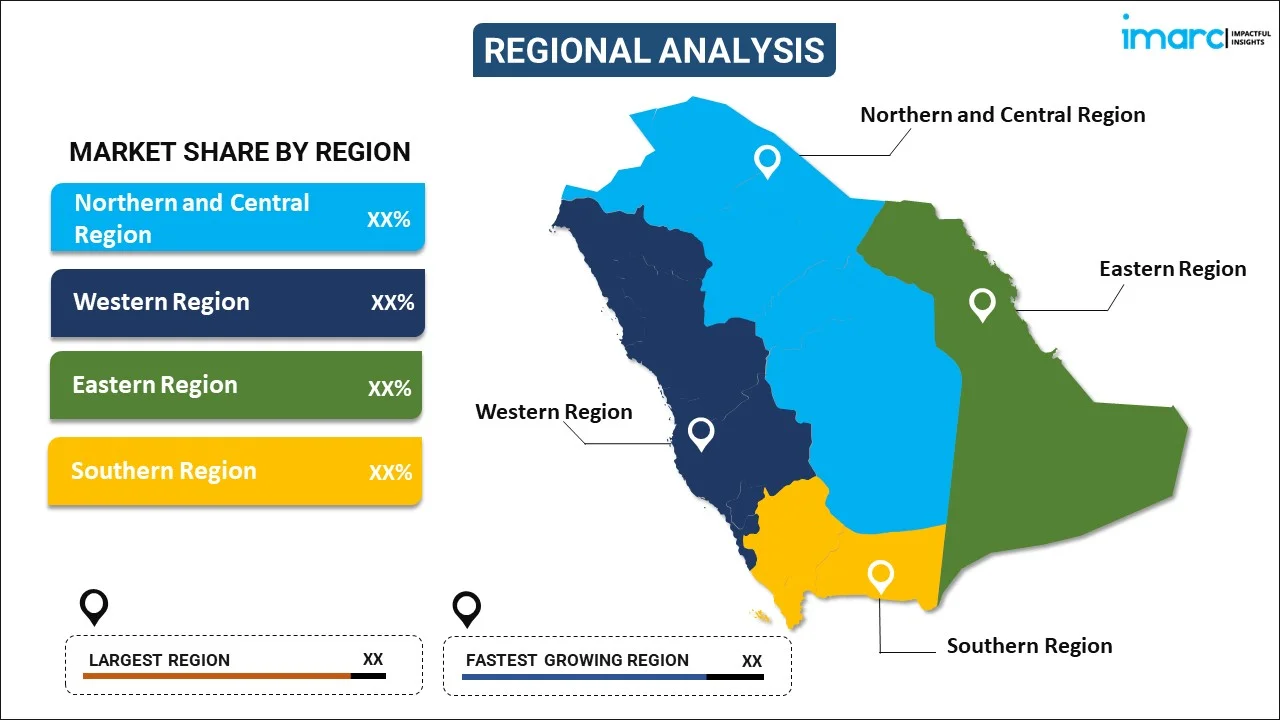

Regional Insights:

- Northern and Central Region

- Western Region

- Eastern Region

- Southern Region

The report has also provided a comprehensive analysis of all the major regional markets, which include Northern and Central Region, Western Region, Eastern Region, and Southern Region.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape in the market. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided. Some of the key players include:

- ADES Holding Company

- Arabian Drilling Company

- Baker Hughes Company

- Burgan Drilling Company

- Halliburton Company

- Noble Corporation plc

- NOV Inc.

- Saipem S.p.A. (Eni S.p.A.)

- SLB

- Weatherford International plc

(Please note that this is only a partial list of the key players, and the complete list is provided in the report.)

Saudi Arabia Drilling Services Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Million USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Services Covered |

|

| Applications Covered | Onshore, Offshore |

| End Users Covered | Oil and Gas, Mining, Water Exploration, Others |

| Regions Covered | Northern and Central Region, Western Region, Eastern Region, Southern Region |

| Companies Covered | ADES Holding Company, Arabian Drilling Company, Baker Hughes Company, Burgan Drilling Company, Halliburton Company, Noble Corporation plc, NOV Inc., Saipem S.p.A. (Eni S.p.A.), SLB, Weatherford International plc, etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Saudi Arabia drilling services market performed so far and how will it perform in the coming years?

- What has been the impact of COVID-19 on the Saudi Arabia drilling services market?

- What is the breakup of the Saudi Arabia drilling services market on the basis of service?

- What is the breakup of the Saudi Arabia drilling services market on the basis of application?

- What is the breakup of the Saudi Arabia drilling services market on the basis of end user?

- What are the various stages in the value chain of the Saudi Arabia drilling services market?

- What are the key driving factors and challenges in the Saudi Arabia drilling services?

- What is the structure of the Saudi Arabia drilling services market and who are the key players?

- What is the degree of competition in the Saudi Arabia drilling services market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Saudi Arabia drilling services market from 2020-2034.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Saudi Arabia drilling services market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Saudi Arabia drilling services industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)